The summer 2025 edition of Yardi Matrix’s Affordable Housing podcast and its companion report, Affordable Property Debt: Slow Burn as Market Evolves, offers a data-rich examination of the evolving challenges and opportunities in the affordable housing sector amid tight supply, tight margins. Based on a proprietary database encompassing 3.5 million units across 26,000 fully affordable properties, Yardi’s analysis covers market fundamentals, development bottlenecks, loan maturities and affordability metrics.

A key takeaway: while demand remains strong, delivery of new affordable units is slowing, mirroring the market-rate multifamily sector. Development peaked last year with 94,000 fully affordable units delivered, but completions are now falling due to a trifecta of headwinds: prolonged permitting timelines, rising construction costs and a tough capital market.

Construction starts, defined as projects with poured foundations, have declined sharply for both fully affordable and partially affordable assets. That trend is expected to continue, pushing total new supply below pre-COVID levels.

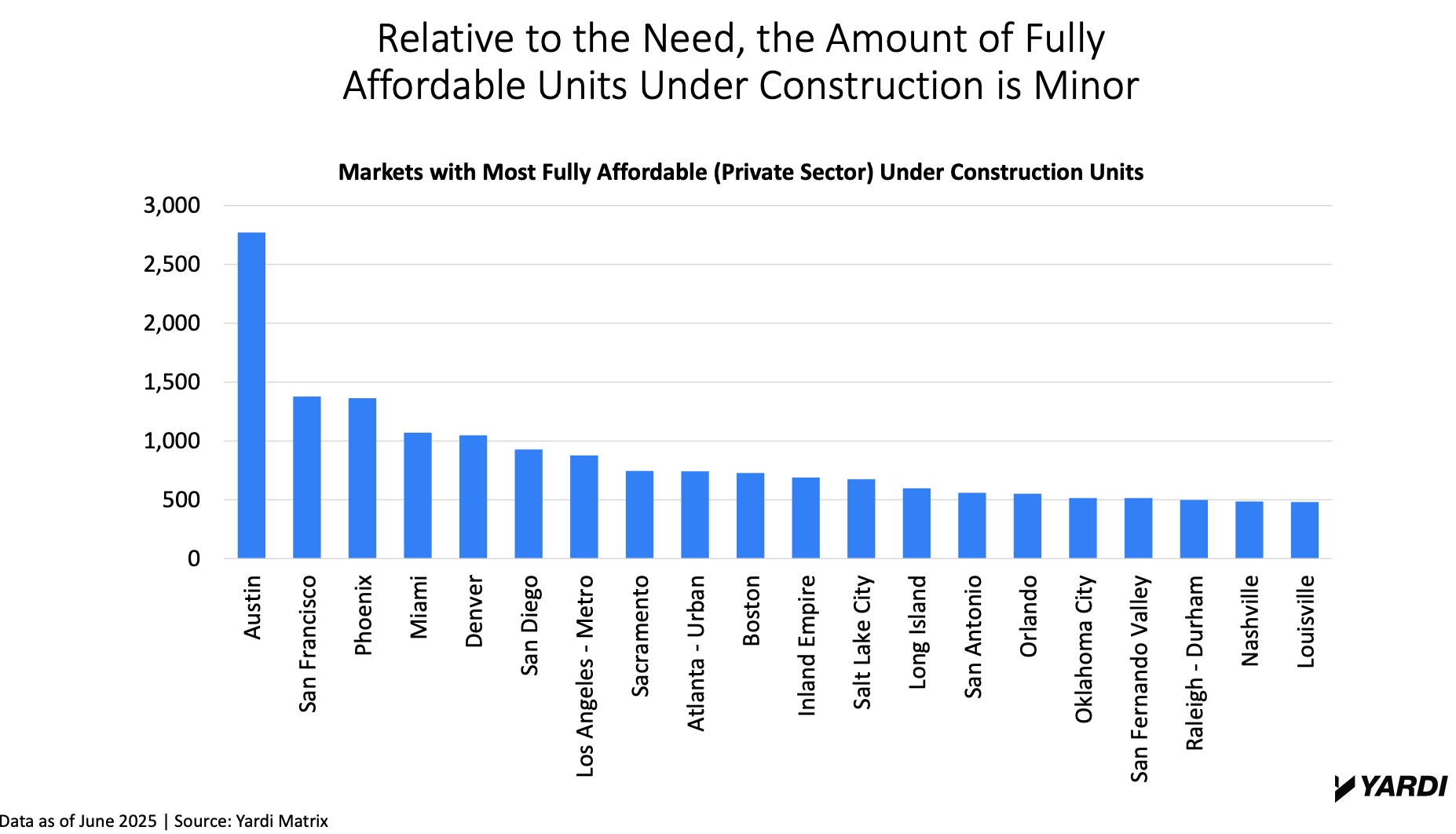

Per the chart above: Austin leads in fully affordable units under construction, but overall numbers remain low across markets, underscoring a mismatch between demand and supply.

Despite high demand, market fundamentals are increasingly complex. Yardi analysts note that rent growth is being driven by “in-place” rents, which remain sticky at about four percent growth annually. This is largely due to tight supply, the high cost of homeownership and higher interest rates that have propped up housing costs broadly. Because housing is the largest component of the CPI basket, it is keeping inflation elevated even as other sectors cool. If housing were excluded, inflation would already be near the Fed’s two percent target.

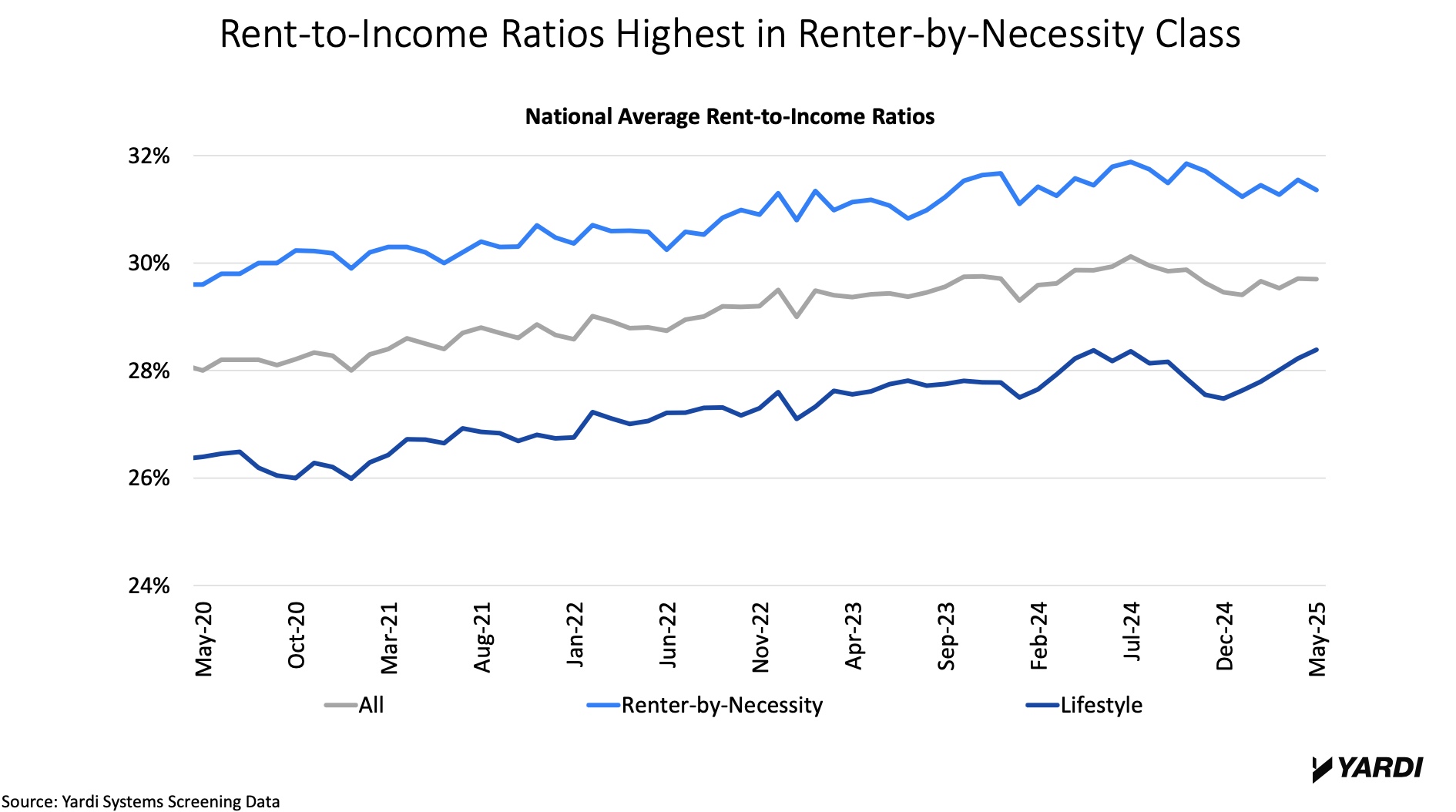

From a competitive standpoint, affordability is deteriorating, particularly in the “renter by necessity” segment. Average rent-to-income ratios have risen from 29 percent to 32 percent nationally for renters screened through Yardi’s system and many metros now exceed the 30 percent affordability threshold. In the typically more affordable B and C properties, rent increases have outpaced both income growth and Area Median Income, exacerbating cost burdens for low-income tenants. See chart below:

The lines between affordable and market-rate housing are blurring in some markets. A surprising insight from the data is that in supply-heavy markets like Austin, as much as 70 percent of market-rate inventory is priced competitively with fully affordable units.

However, in tighter markets like Miami, where new supply is scarce and rents are high relative to income, affordable properties remain distinctly cost-advantaged, showing low turnover, high occupancy and NOI growth.

Yardi’s competitiveness model, which compares the rents of affordable units to nearby market-rate properties, allows developers to assess whether new supply will face leasing headwinds. In markets with a large spread between affordable and market-rate rents, like Los Angeles, New York, and San Diego, affordable projects are likely to enjoy high demand. Conversely, in cities like Austin or Denver, the advantage is less clear and submarket-level analysis becomes essential.

The report provides the first ever detailed breakdown of loan maturities in the affordable sector. Over $10.5 billion in loans on fully affordable properties will mature by 2027, with $21.7 billion maturing by the end of the decade. Loan distress is more visible in the market-rate sector, while affordable properties have mostly avoided large-scale defaults thanks to long loan terms, low vacancy, and subsidized revenue streams.

Still, risk is not absent. The affordable housing sector faces uncertainty from potential changes in HUD funding, GSE policy, and the Trump administration’s proposed shift to block grants for renter subsidies. Rising development costs are also forcing developers to layer in more capital—mezzanine debt, soft funds, and tax credit equity—complicating deals and increasing risk.

One nuance worth noting is that lenders have shown a strong reluctance to foreclose on affordable properties, even when under stress, partly because the regulatory and contractual limitations tied to affordable assets make them unattractive to repossess. In most cases, it’s more prudent for banks or agencies to restructure loans or extend maturities than to manage a distressed property. As one podcast panelist noted, foreclosure can pose more risk to lenders than carrying the loan.

Despite the policy and capital hurdles, investor interest in the space remains high. Some institutional investors are targeting stripped-down, naturally affordable projects—even if they don’t qualify as capital-A Affordable—while others pursue tax relief deals that convert existing market-rate units to income-restricted housing. States like Florida, California, Texas, North Carolina, and Ohio are experimenting with these and other models to increase stock and reduce costs.

The data shows a sector with persistent demand and mounting constraints. Supply isn’t keeping up, financing is increasingly layered and complex, and affordability is slipping, but the need and the opportunity for strategic investment are both very real.