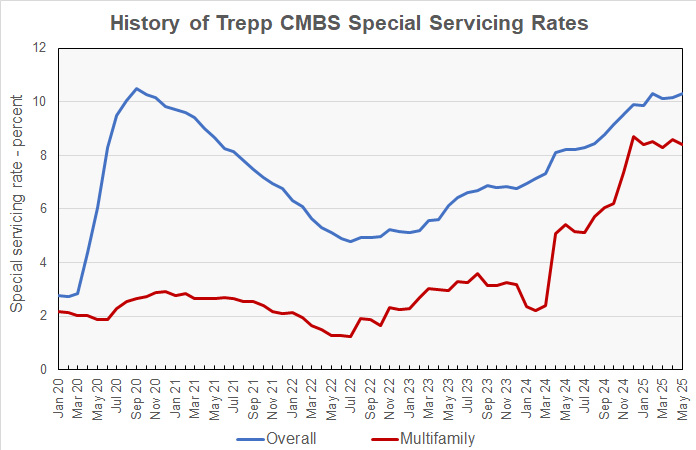

Trepp reported that the special servicing rate for multifamily commercial mortgage-backed securities (CMBS) loans fell in May. It is now back to its level in January. However, the overall CMBS special servicing rate on commercial property rose 13 basis points in the month.

Multifamily CMBS special servicing rate shows no clear direction

The special servicing rate on CMBS loans on multifamily property has been alternately up and down month-by-month this year. It fell in January and March, along with its 17 basis points decline to 8.42 percent in May. However, it rose in December, February and April. It has remained in a 45 basis point range since last December. One year ago, it was 5.1 percent.

The report found that overall CMBS special servicing rate rose to 10.30 percent, up from 10.17 percent the month before and 10.11 percent in March. The current rate is still lower than that of last February.

The recent history of multifamily and overall CMBS special servicing rates are shown in the chart, below.

By far the largest increase in special servicing rates this month was on that for office properties, which was up 85 basis points to 15.76 percent. The majority of the loans transferring to special servicing in May were on office properties.

The special servicing rate on lodging property, which jumped 126 basis points last month, fell by 64 basis points in May, giving up half its gains. It is now at 9.57 percent.

The special servicing rates for the other property types showed minimal movement for the month.

The rate on CMBS loans on industrial properties crept higher this month, increasing 3 basis points to 0.72 percent, a new recent high for this property type.

The special servicing rate on mixed-use properties rose 2 basis points to 12.31 percent. It is up 319 basis points over the last year.

The special servicing rate for retail properties was unchanged for the month and remained at 11.53 percent. It is up 66 basis points year-over-year.

The full Trepp special servicing rate report can be found here.