The multifamily housing industry is navigating a shifting regulatory landscape as the Trump administration advances sweeping changes to federal energy policy. With the House already passing key parts of what Trump has dubbed his “One Big Beautiful Bill,” apartment owners and investors are facing the real possibility that long-standing programs could be eliminated. Here, we weigh the risks and rewards of Trump’s energy policy overhauls.

While many in the industry support efforts to reduce federal oversight—such as easing appliance standards and reporting requirements—others warn that some rollbacks could create long-term financial and operational challenges, especially for affordable housing providers.

Among the most significant changes is the proposed elimination of the Low-Income Home Energy Assistance Program (LIHEAP), which helps cash-strapped renters pay utility bills, and the ENERGY STAR certification program. ENERGY STAR, long backed by major industry groups like the National Multifamily Housing Council (NMHC), includes the Portfolio Manager tool co-developed with the EPA to help property owners benchmark and manage building energy use.

NMHC Vice President for Construction, Development, Land Use and Counsel Paula Cino noted that Energy Star certification could be replaced with other tools, but losing Portfolio Manager raises real concerns that could either exacerbate compliance and performance tracking issues or provide new opportunities.

Without it, she said, operators could lose a key mechanism to demonstrate and improve building performance along with the significant amount of data they have contributed to the program over the years. Apartment REITs like AvalonBay have echoed those concerns, citing the importance of Portfolio Manager in benchmarking energy performance across large property portfolios.

Meanwhile, LIHEAP’s uncertain future presents its own set of risks. Although NMHC has not issued an official position on the program’s proposed elimination, LIHEAP has long helped low-income tenants stay current on utility bills—a benefit to both residents and property operators. Cuts could increase financial strain on renters and raise default risks for landlords, especially in affordable housing communities where margins are already thin.

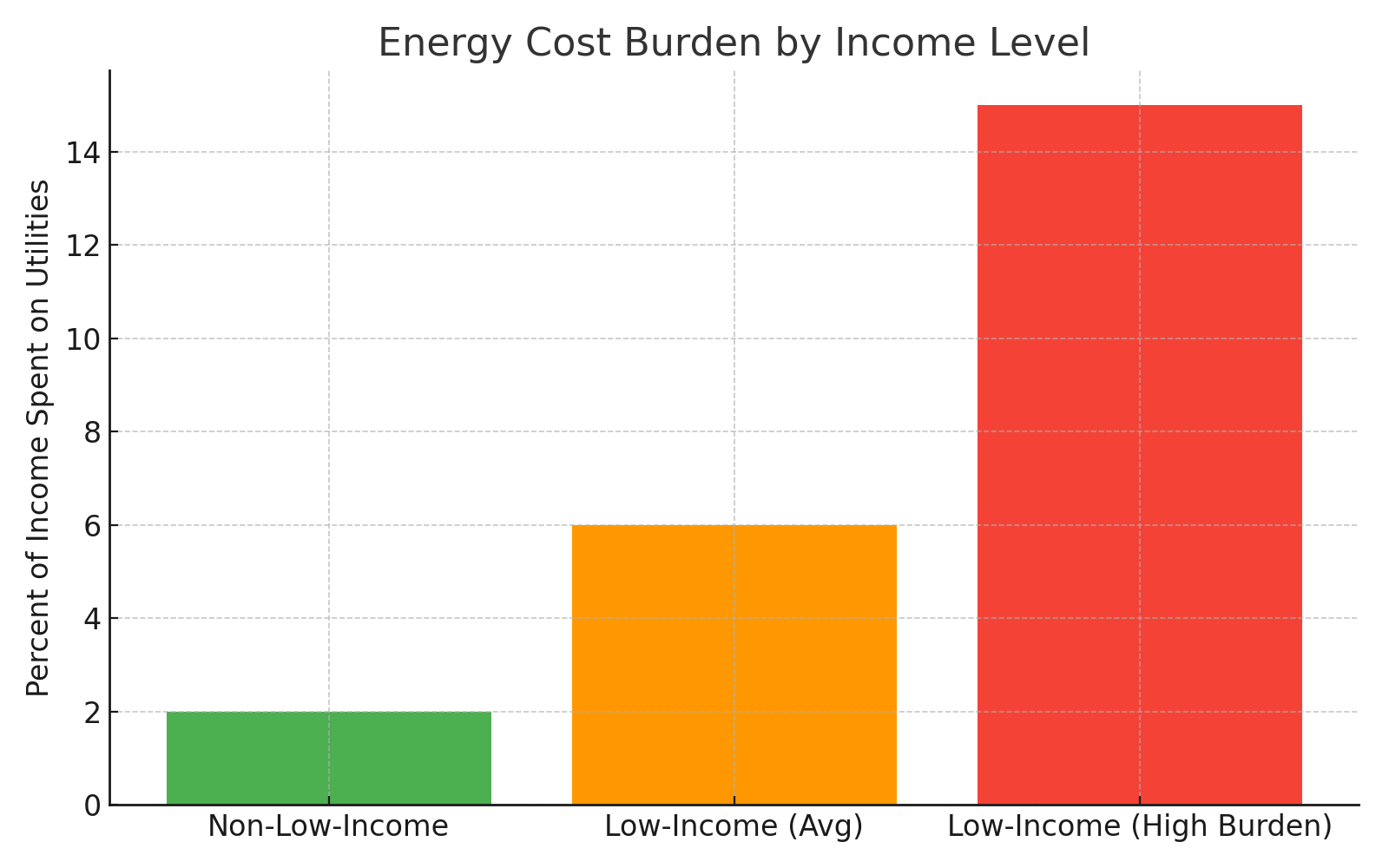

Yield Pro put together the graph below using data from the U.S. Department of Energy’s Low-Income Energy Affordability Data (LEAD) Tool, showing that low-income households spend a significantly higher share of their income on utilities—averaging six percent, compared to just two percent for higher-income households. The most burdened renters can spend 15 percent or more, underscoring the role of programs like LIHEAP in supporting housing stability.

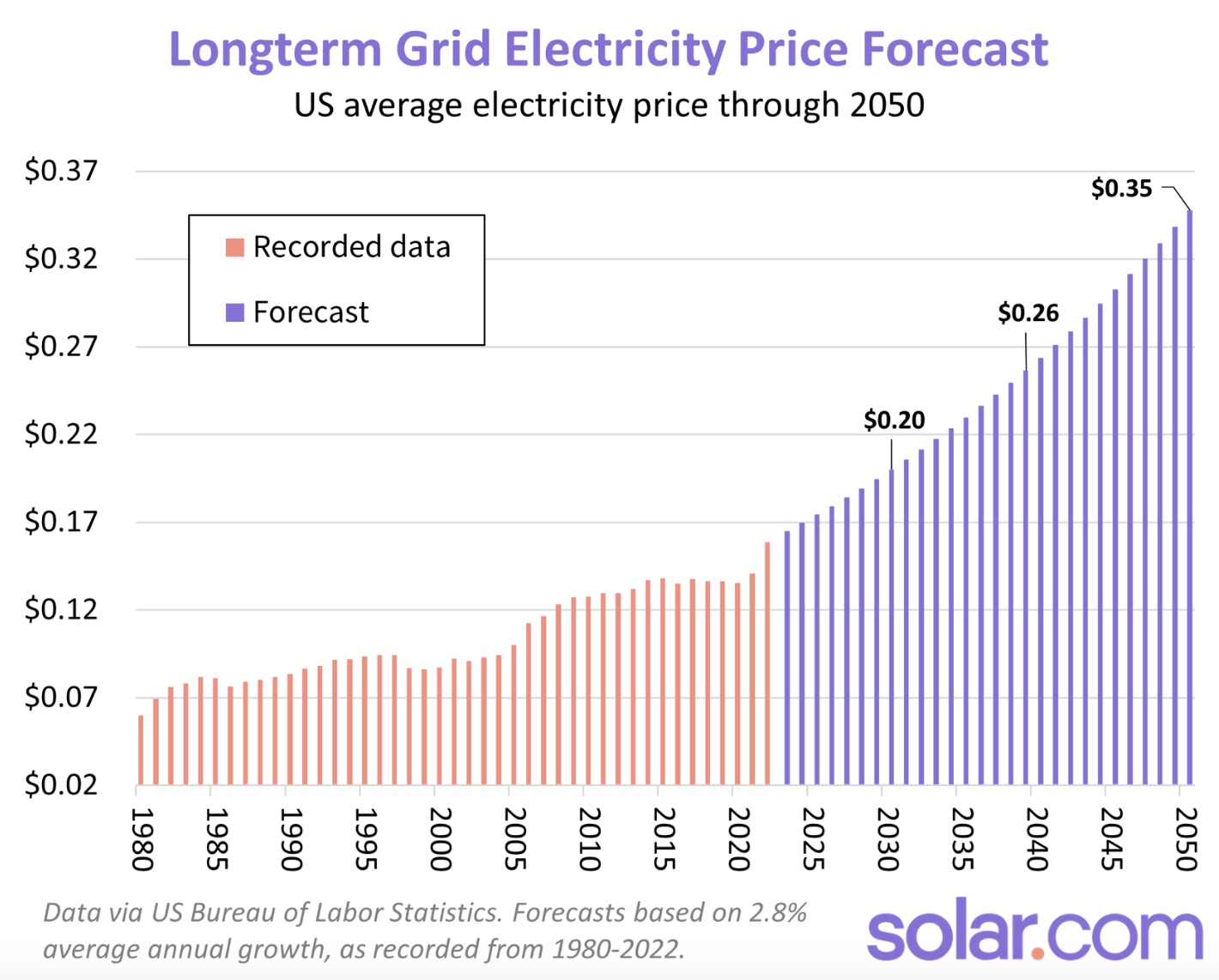

Utility costs for households have been steadily rising. According to the May 2025 Consumer Price Index (CPI), electricity prices are up 4.5 percent, while natural gas service has surged 15.3 percent over the past year. These increases disproportionately affect renters—especially low-income households—whose energy burdens are already significant. If this trend continues, electricity (and other utility) cost increases will remain a critical concern, reinforcing the importance of aid like LIHEAP.

The Trump administration’s review of Biden-era appliance efficiency rules has also stirred debate. The Department of Energy’s standards for furnaces, water heaters, refrigerators, and other appliances were intended to lower energy use and utility bills over time. But some in the multifamily sector argue the rules drive up construction and retrofit costs.

According to Cino, the higher cost of compliant appliances and their necessary infrastructure changes can slow much-needed affordable housing development. She calls for maintaining a delicate balance between promoting energy efficiency and preserving rental housing affordability.

The NMHC and the National Apartment Association (NAA) support the Trump administration’s plans to scale back mandates they see as overly burdensome. Many property owners also prefer voluntary energy efficiency initiatives over federal requirements that may be costly to implement and difficult to scale across diverse portfolios.

With a more sympathetic administration in power, the industry is seizing the moment to push a broader deregulatory agenda. In early 2025, NMHC and NAA sent lawmakers a list of priorities that included rolling back rules they claim hinder housing production. At the same time, they are lobbying for expanded tax credits and regulatory exemptions, particularly for affordable housing development.

Despite their support for certain rollbacks, industry leaders have flagged proposed cuts to HUD programs and Section 8 as “untenable,” highlighting the complex push-and-pull as the industry tries to protect both investor interests and tenant stability.