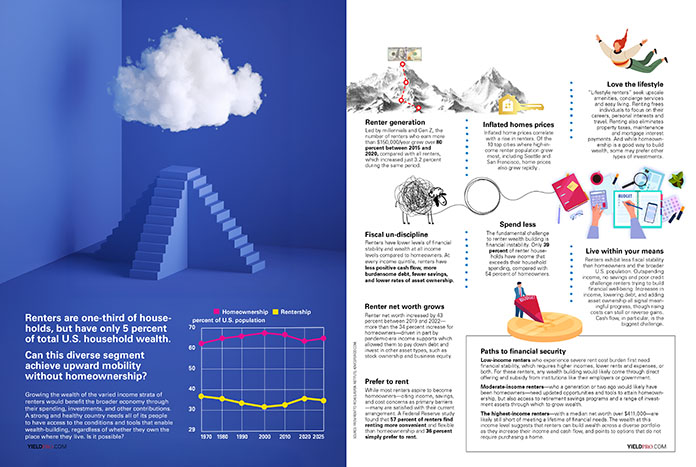

Renters are one-third of households but have only 5 percent of total U.S. household wealth.

Can this diverse segment achieve upward mobility without homeownership?

Growing the wealth of the varied income strata of renters would benefit the broader economy through their spending, investments, and other contributions. A strong and healthy country needs all its people to have access to the conditions and tools that enable wealth-building, regardless of whether they own the place where they live.

1975 63 37

1980 64 36

1985 65 35

1990 66 34

1995 67 33

2000 68 32

2005 69 31

2010 67 33

2015 65 35

2020 64 36

2025 65 35

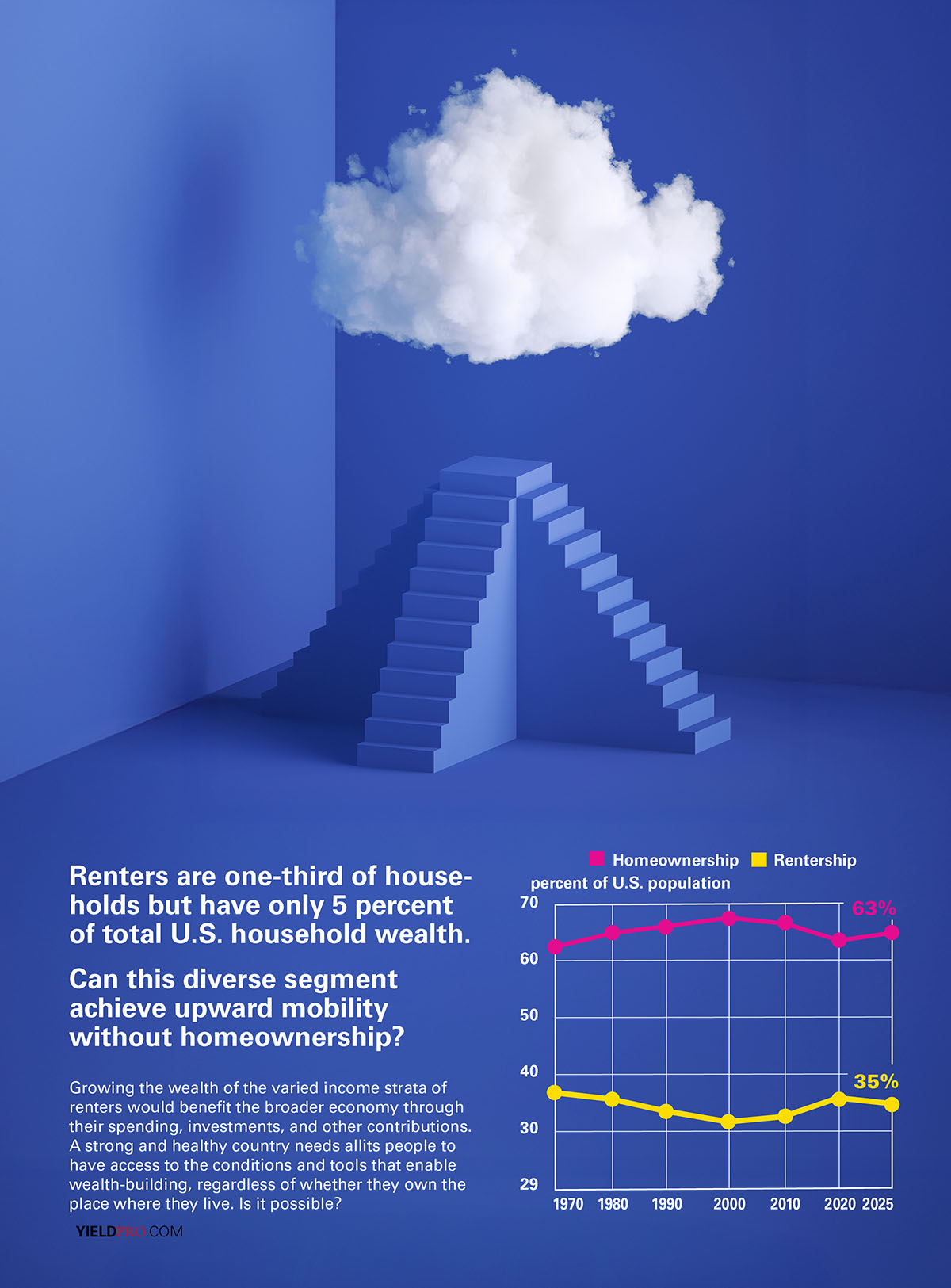

Renter generation

Led by millennials and Gen Z, the number of renters who earn more than $150,000/year grew over 80 percent between 2015 and 2020, compared with all renters, which increased just 3.2 percent during the same period.

Inflated homes prices

Inflated home prices correlate with a rise in renters. Of the 10 top cities where high-income renter population grew most, including Seattle and San Francisco, home prices also grew rapidly.

Love the lifestyle

“Lifestyle renters” seek upscale amenities, concierge services and easy living. Renting frees individuals to focus on their careers, personal interests and travel. Renting also eliminates property taxes, maintenance and mortgage interest payments. And while homeownership is a good way to build wealth, some may prefer other types of investments.

Fiscal un-discipline

Renters have lower levels of financial stability and wealth at all income levels compared to homeowners. At every income quintile, renters have less positive cash flow, more burdensome debt, fewer savings, and lower rates of asset ownership.

Spend less

The fundamental challenge to renter wealth building is financial instability. Only 39 percent of renter households have income that exceeds their household spending, compared with 54 percent of homeowners.

Live within your means

Renters exhibit less fiscal stability than homeowners and the broader U.S. population. Outspending income, no savings and poor credit challenge renters trying to build financial well-being. Increases in income, lowering debt, and adding asset ownership all signal meaningful progress, though rising costs can stall or reverse gains. Cash flow, in particular, is the biggest challenge.

Renter net worth grows

Renter net worth increased by 43 percent between 2019 and 2022—more than the 34 percent increase for homeowners—driven in part by pandemic-era income supports which allowed them to pay down debt and invest in other asset types, such as stock ownership and business equity.

While most renters aspire to become homeowners—citing income, savings, and cost concerns as primary barriers—many are satisfied with their current arrangement. A Federal Reserve study found that 57 percent of renters find renting more convenient and flexible than homeownership and 36 percent simply prefer to rent.

Paths to financial security

Low-income renters who experience severe rent cost burden first need financial stability, which requires higher incomes, lower rents and expenses, or both. For these renters, any wealth building would likely come through direct offering and subsidy from institutions like their employers or government.

Moderate-income renters—who a generation or two ago would likely have been homeowners—need updated opportunities and tools to attain homeownership but also access to retirement savings programs and a range of investment assets through which to grow wealth.

The highest-income renters—with a median net worth over $411,000—are likely still short of meeting a lifetime of financial needs. The wealth at this income level suggests that renters can build wealth across a diverse portfolio as they increase their income and cash flow, and points to options that do not require purchasing a home.

Source: From rent to riches, Aspen Institute; adviceperiod.com