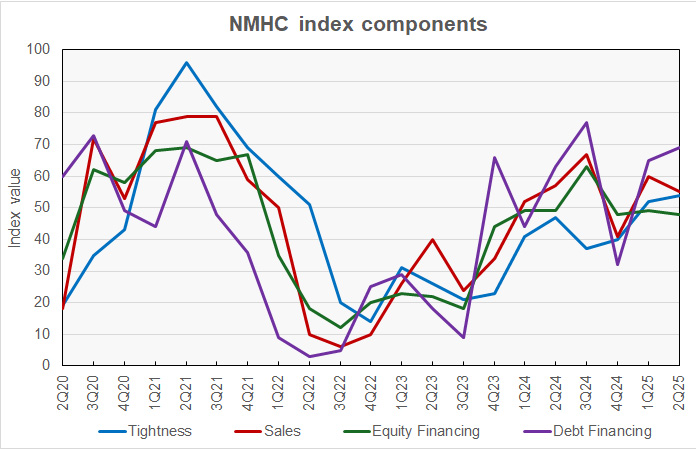

The Market Tightness Index (54), Sales Volume Index (55) and Debt Financing Index (69) all came in above the breakeven level of 50, indicating improved conditions, while the Equity Financing Index remained just below 50 (48). Still, a majority of respondents for each of the four indexes reported unchanged conditions compared to April.

“Rent growth remains low in the South and West amidst a historic overhang of new supply, even though strong demand has kept absorptions high and occupancy stable,” noted NMHC’s Chief Economist and Senior Director of Research, Chris Bruen. “Meanwhile, tighter apartment conditions persist in the more supply-constrained Northeast and Midwest.”

“While high levels of political and economic uncertainty have kept some equity capital on the sidelines, survey respondents did report an uptick in transaction volume for the second consecutive quarter.”

Despite these disparities, conditions largely showed improvements compared to three months ago.

• The Market Tightness Index came in at 54 this quarter – above the breakeven level of 50 – indicating tighter market conditions. Twenty-seven percent of respondents thought market conditions were tighter relative to three months ago, while 18% thought conditions had become looser. Slightly over half (54%) of respondents thought conditions were unchanged from April.

• The Sales Volume Index reading of 55 indicates increasing deal flow over the past three months, continuing a trend of increasing deal flow after April’s reading of 60. While the majority (62%) of respondents thought sales volume went unchanged over the past three months, 22% (down from 34%) thought sales volume was higher than in April. Conversely, 12% of respondents (down from 14%) thought sales volume was lower.

• The Equity Financing Index recorded an index value of 48 (down from 49 in April) reflecting less available equity financing compared to three months ago. Twenty percent of respondents thought equity had become more available (same as in April), 24% thought equity was less available (up from 22%), while half of respondents thought the availability of equity financing went unchanged over the last three months.

• The Debt Financing Index reading of 69 signals better conditions for debt financing compared to three months ago. Fifty-four percent of respondents thought debt financing conditions were unchanged from three months ago. While 41% of respondents reported that now was a better time to borrow than three months ago (down from 45%), only 2% thought it a worse time to borrow (from 14% in April).

The July 2025 Quarterly Survey of Apartment Market Conditions was conducted from July 2 to July 16, 2025. 93 CEOs and other senior executives of apartment-related firms nationwide responded. The full results are available here.