RealPage Analytic‘s second-quarter multifamily report paints a picture of a market gradually finding its footing. The apartment sector is stabilizing, though unevenly, after a turbulent year marked by interest rate swings and historic delivery volumes. The data points to muted rent growth, deep concessions and resilient demand, even as construction trends send mixed signals and the supply pipeline begins to thin.

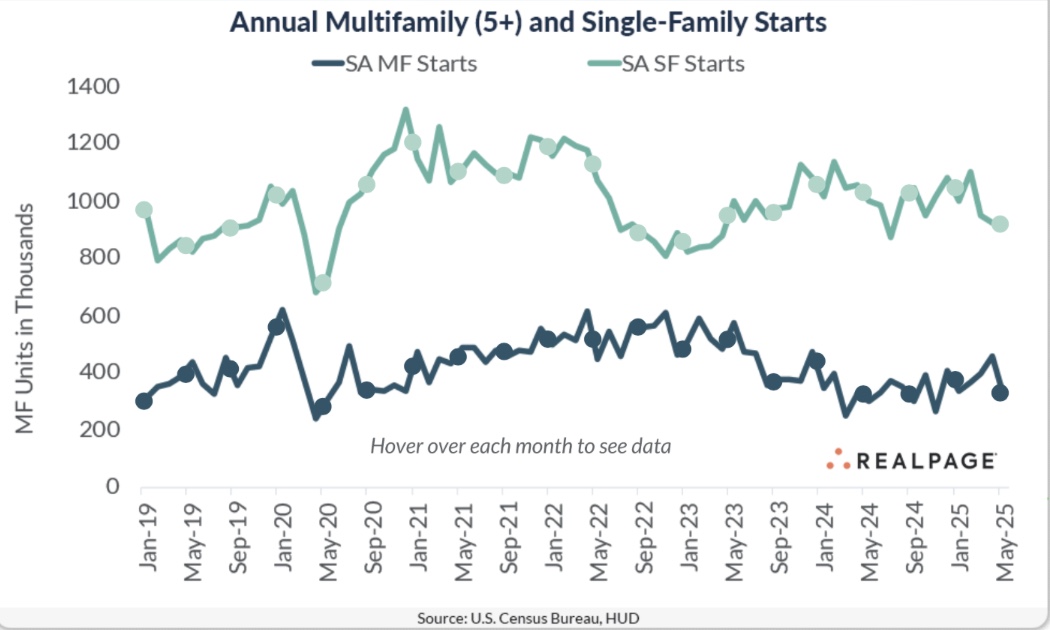

While June’s Census Bureau report pointed to a surprising 30 percent spike in multifamily starts, RealPage analysts say the picture is more nuanced. The discrepancy comes down to methodology. The Census figure is survey-based and subject to significant monthly volatility, especially when it includes units already underway but not yet reported. In contrast, industry sources on the ground track permits and actual construction activity, which has declined on a year-over-year basis.

Despite an increase in multifamily starts compared to last year, the SAAR for multifamily units under construction decreased almost 19 percent from last May and 1.5 percent from April to 733,000 units.

In short: even after adjusting for seasonal patterns, the new development pipeline isn’t accelerating, it’s cooling, and sharply, especially outside of a few deep-pocketed players. While the supply side shows signs of restraint, demand remains firm, particularly for stabilized assets. That strength is evident in the evolving concessions landscape.

Rising concessions value

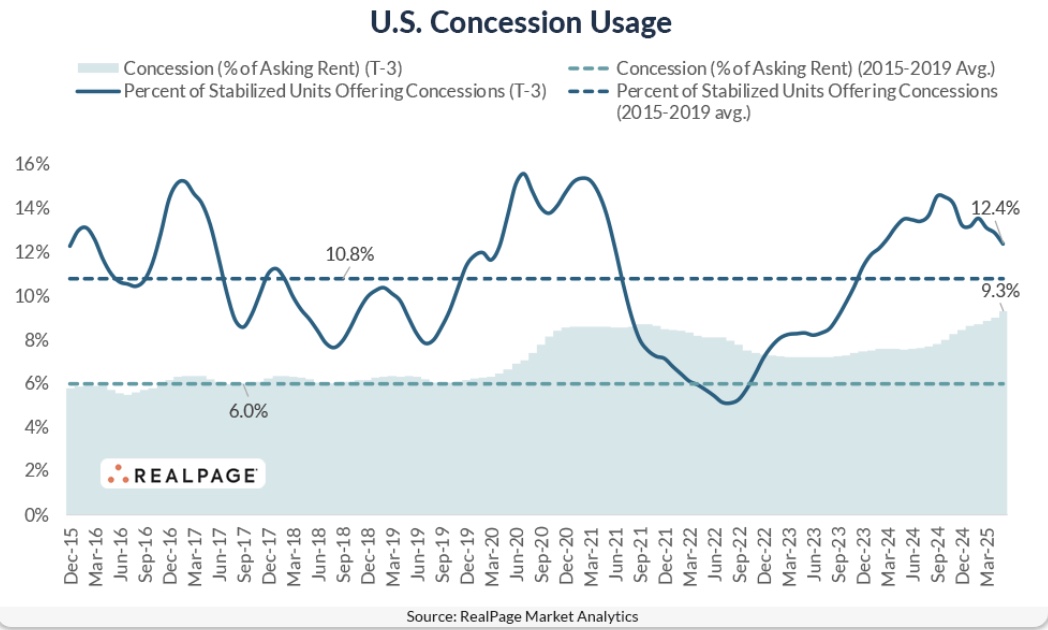

According to RealPage, as of mid-2025, roughly 12 percent of stabilized conventional apartment units are offering concessions, down slightly from a year ago. But the value of those concessions is rising and now averages 9.3 percent of lease value, or about 31 days free — two days more than the typical giveaway seen during the early pandemic leasing cycle.

Carl Whitaker, senior analyst at RealPage, noted that while concession frequency has stabilized or even declined slightly (13 pecent of vacant units, down half a percent from 2024), what’s driving the current conversation is the depth of concessions. “One in five units offering a concession is now offering at least one month free,” Whitaker wrote in a recent LinkedIn analysis. “That’s well above normal.”

Notably, this shift is highly regional. While many Gateway markets have moved beyond the aggressive discounting seen in the early 2020s, some metros, particularly in the overbuilt Sun Belt, are still seeing deep concessions offered. Whitaker points to coastal Southwest Florida markets, as well as Austin, San Antonio, Phoenix, Denver, and Salt Lake City, where average discounts exceed 40 days of free rent. In those markets, some operators are offering two months free to stay competitive.

This nuanced picture supports the broader point that today’s concession activity isn’t rooted in weak demand. “We’re not dealing with a demand problem,” says Kim O’Brien of RealPage. “We’re managing the absorption of an unusually high supply pipeline that’s just starting to taper off.”

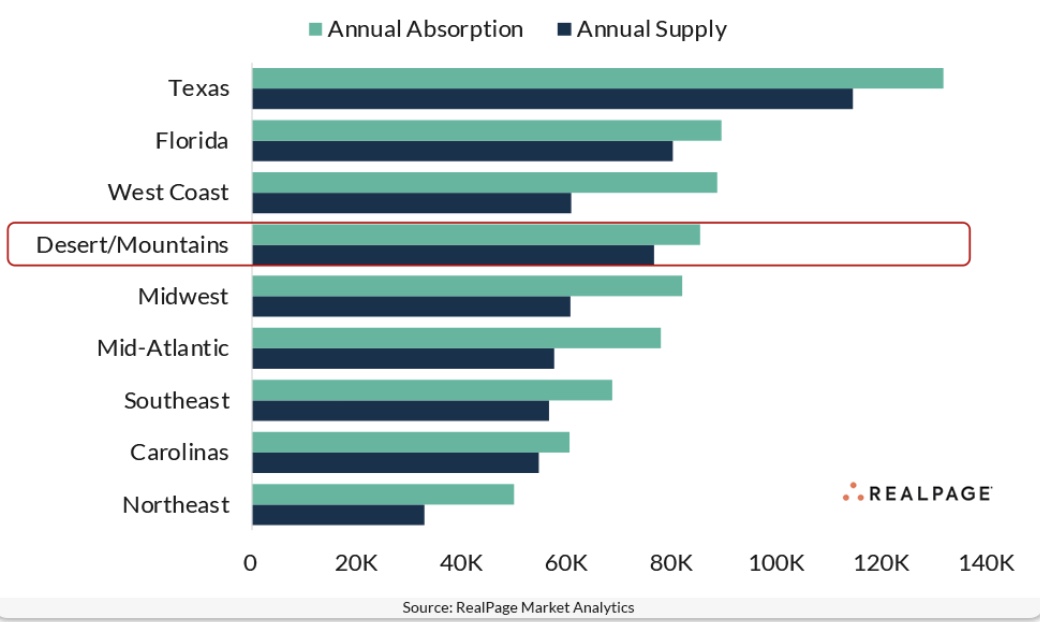

That pipeline is expected to shrink meaningfully. RealPage projects national deliveries will fall 25 percent this year versus 2024, with the steepest pullbacks in high-supply metros. A forecasted slowdown through 2026 could rebalance leasing conditions.

The steepest pullbacks are expected in overbuilt Sun Belt metros like Austin, Atlanta, and Phoenix, where developers had raced to meet COVID-era migration waves. This pause in new supply offers breathing room and opportunities for operators in these markets.

Meanwhile, rental demand is holding steady, buoyed by job growth, easing inflation, and a widening affordability gap between renting and homeownership — especially for first-time buyers facing high mortgage rates.

This demand stability has allowed operators to move away from blanket discounts and instead take a more targeted approach by offering deals on harder-to-lease units or in ultra-competitive submarkets, rather than across the board. In the desert mountain regions, demand outpaced supply by more than ten percent, helping to stabilize regional occupancy.

Seasonality also plays a role. “Fall and winter always bring higher concession activity,” O’Brien adds. “But we’re anticipating a sharper burn-off heading into peak leasing in spring and summer of 2026.”

Looking ahead, the Trump administration’s reduced funding for federal housing programs may increase reliance on the private sector to meet workforce and affordable housing needs. While this could constrain development in some segments, it opens opportunities for investors and operators focused on long-term value and mission-aligned strategies.

The bottom line While construction starts remain below historic norms and incentives persist in selected markets, the structural drivers of rental housing demand remain intact. Rents may grow more moderately, but the apartment sector is not shrinking — it’s adapting. And for operators with discipline and flexibility, that’s a good place to be.