A new industry report on renter delinquency trends paints a starker picture of the multifamily sector in 2025 than was suggested here last month. Produced by J Turner Research in partnership with TheGuarantors—a firm specializing in risk management for multifamily housing—the 2025 State of Renter Delinquency and Default draws on survey responses from more than 400 professionals across executive, corporate, and onsite roles. It reveals concern over renter defaults, limited confidence in recovery and growing doubt that current strategies will be enough to meet the challenges ahead.

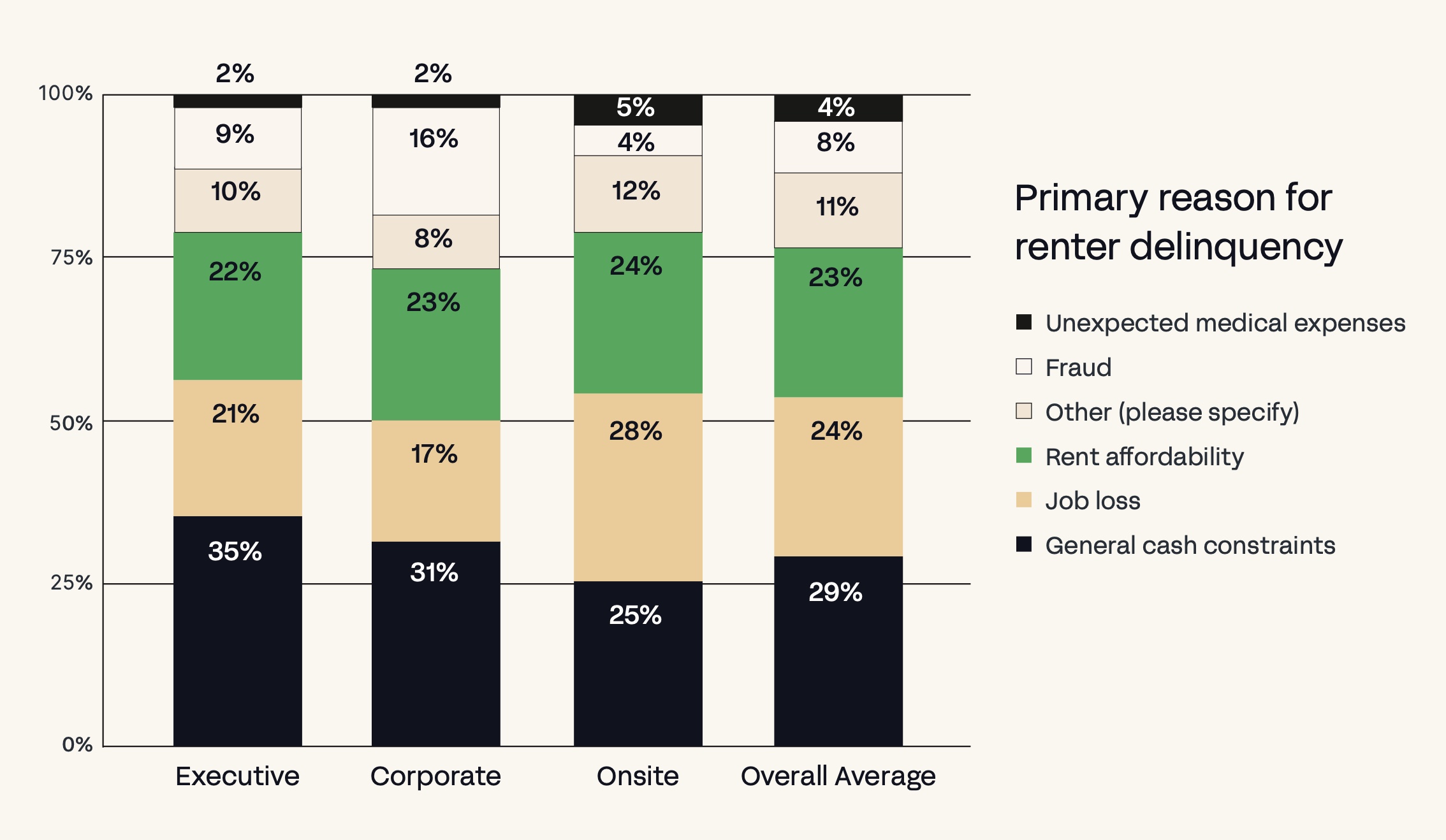

The report reveals entrenched financial stressors as the cause for renter delinquency trends. When asked to identify the primary cause of delinquency, respondents pointed to three interrelated factors: cash constraints (29 percent), job loss (24 percent), and rent affordability (23 percent). Just eight percent cited fraud, despite national data showing it on the rise, suggesting that its impact may be under-recognized at the property level. See chart below.

These economic pressures were consistent across roles. Executives emphasized liquidity, while onsite staff who are closer to residents’ daily lives highlighted job loss.

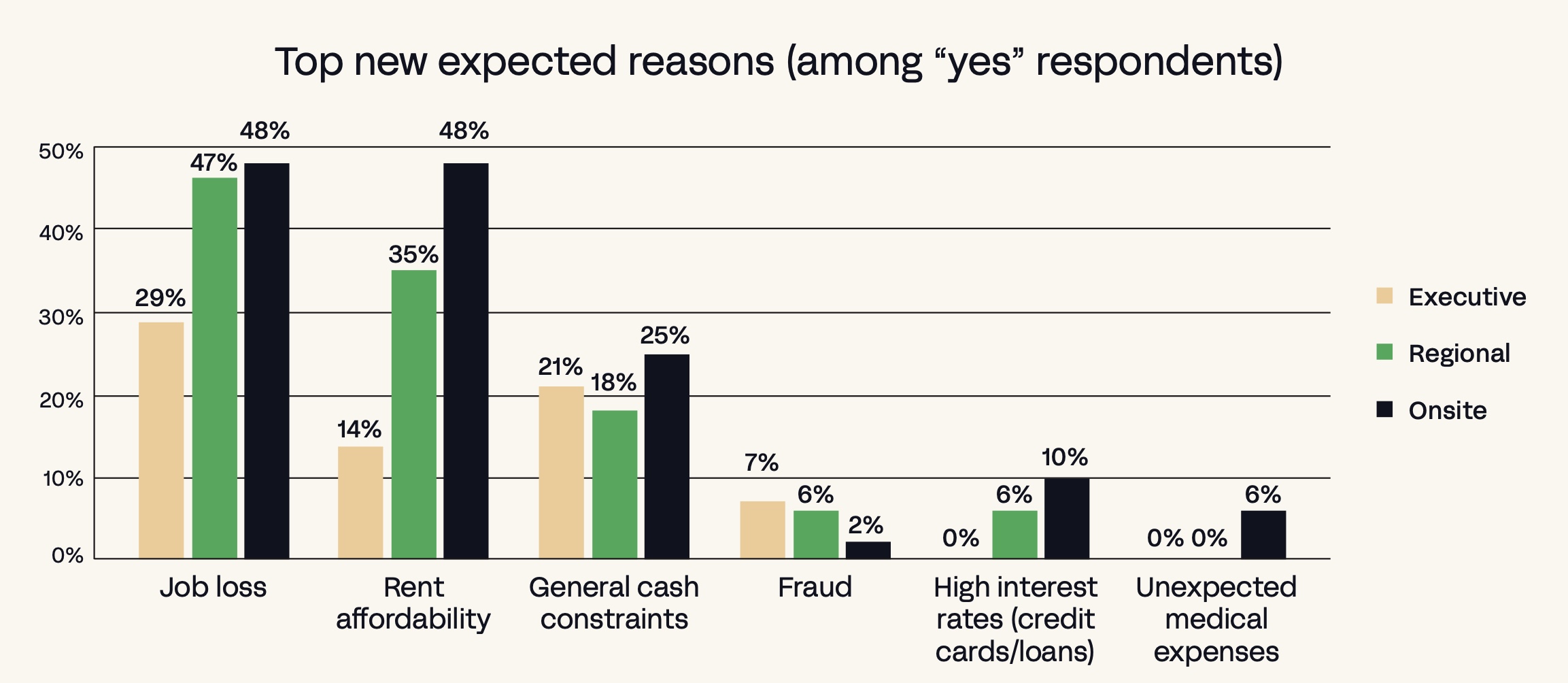

Forecasts remain rooted in the same core issues, even among the 20 percent of respondents who expect the primary cause of delinquency to shift in the coming year.

The chart above showing newly expected reasons shows little change: job instability, unaffordable rents, and limited access to cash continue to dominate. In short, operators expect more of the same. These perceptions are shaping expectations for the remainder of 2025.

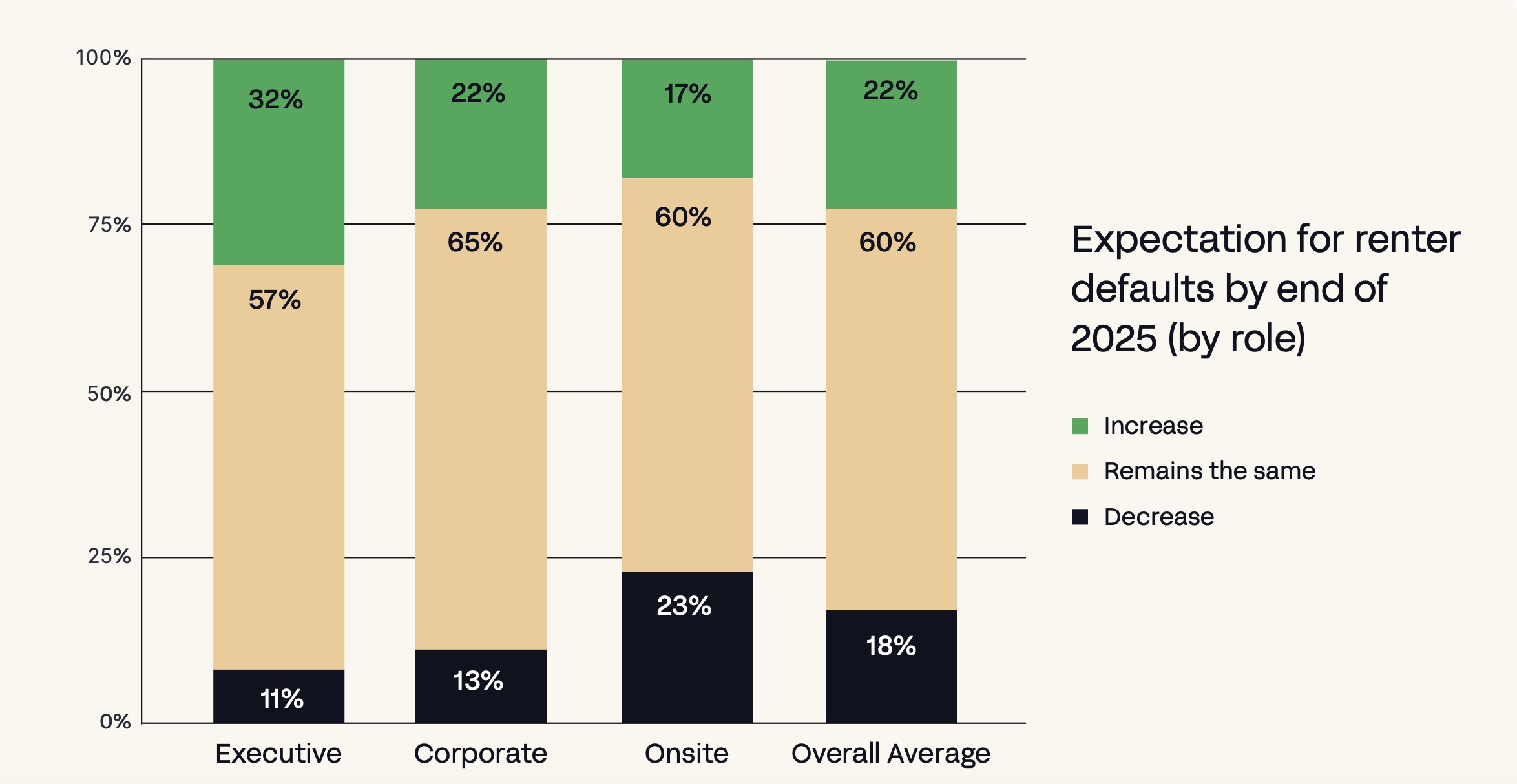

When asked about the trajectory of defaults, 60 percent of respondents predicted they would remain steady. But a significant share, especially executives (32 percent), expected defaults to rise. Meanwhile, 23 percent of onsite staff said they believed defaults would decline, revealing a notable disconnect between leadership and frontline teams.

The on-site optimism may reflect localized successes or informal solutions, but the mismatch points to potential breakdowns in communication and alignment between the boardroom and the property office.

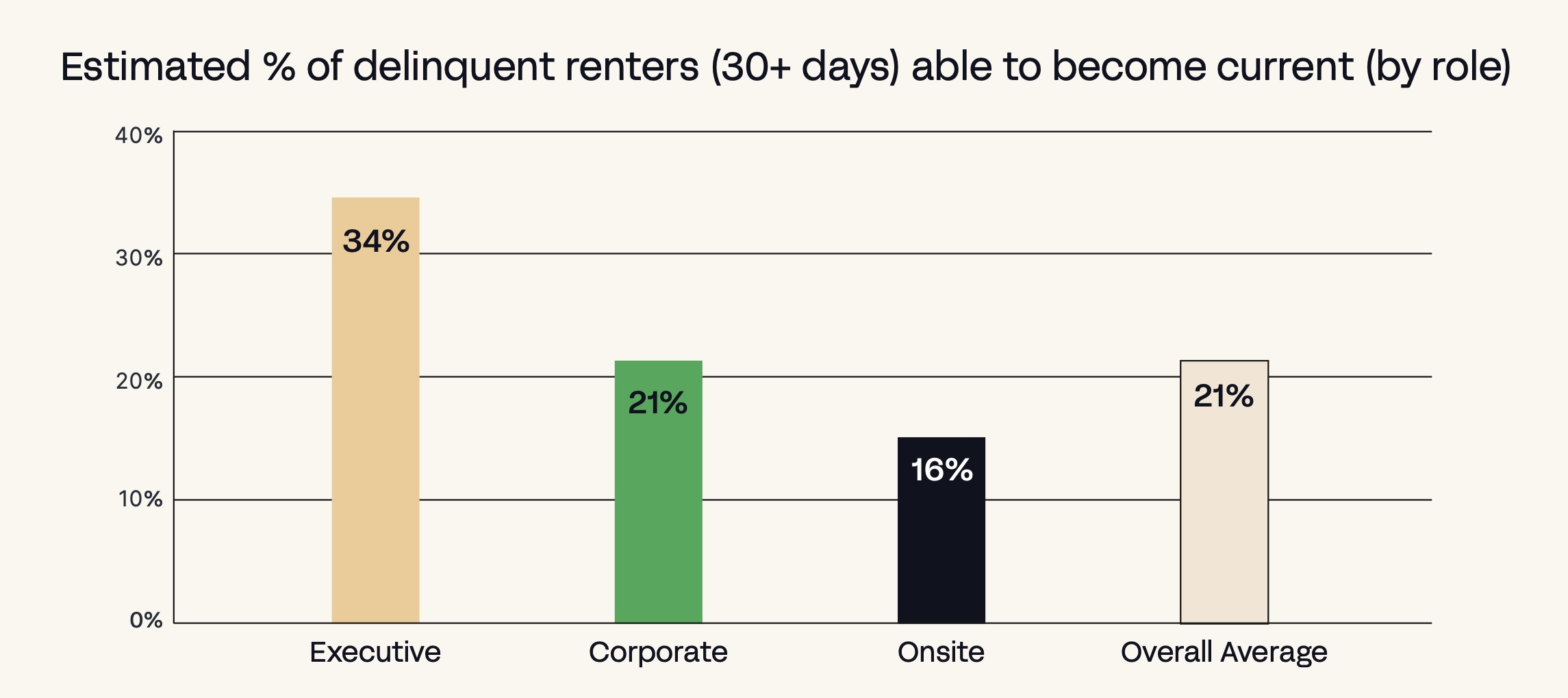

Perhaps the most sobering finding in the report is the industry’s low confidence in renter recovery. When asked how many renters more than 30 days behind on rent would eventually catch up, just 21 percent of respondents believed even a quarter would recover.

Pessimism was more severe among executives—34 percent said fewer than 25 percent of delinquent renters would become current again. That casts doubt on long-term outcomes, not only for renters but also for owners and operators navigating increasingly narrow margins.

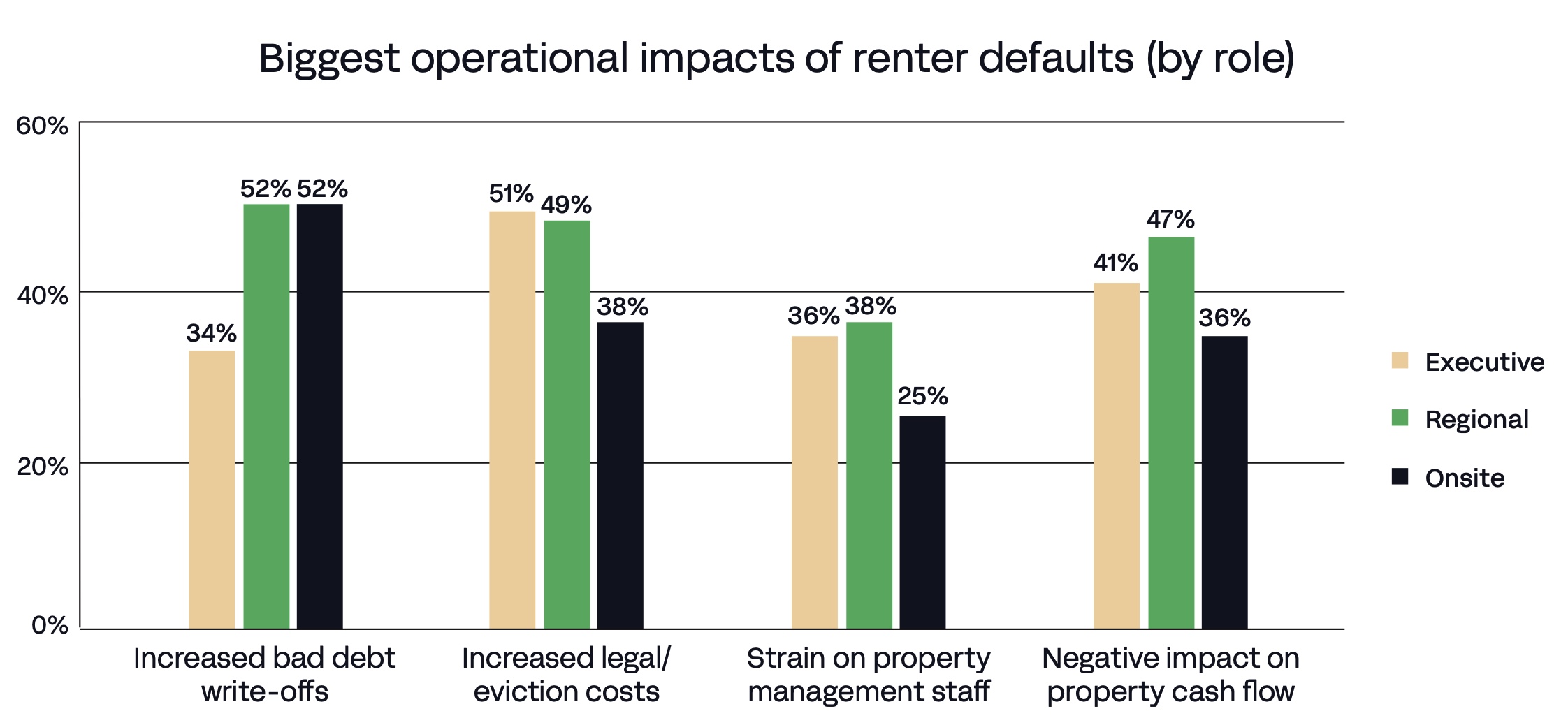

Renter default is straining staff, inflating bad debt, and affecting property cash flows, as revealed in the chart below.

Executives cite rising legal and eviction costs as top concerns, while corporate and onsite staff report mounting stress and administrative burdens.

The report also highlights growing dissatisfaction with current mitigation strategies. These approaches—payment reminders, flexible plans, and screening tools—are widely used but deliver only modest satisfaction. Just 20 percent of respondents said they were “very satisfied” with their current tools, but among executives, that drops to 12 percent. Meanwhile, only 24 percent of respondents are considering new solutions, pointing to a lack of innovation despite widespread concern.

The survey message is that today’s delinquency risk is outpacing the instruments being used to manage it, while internal disconnects between leadership and those on the ground may be compounding the challenge. Solutions suggested include evaluating what’s working, embracing innovation and fostering honest conversations across all roles.

Still, the outlook is not without glimmers of resilience. Nearly half of respondents said delinquency levels have remained stable over the past year, and most expect little change through 2025. Onsite staff, those closest to residents, were especially hopeful, with nearly a quarter predicting a decrease in defaults.

This optimism may reflect successes at the community level that haven’t yet been fully captured by the data.

The full report is available here.