Private equity investment has become a vital force in modernizing U.S. rental housing infrastructure, with Blackstone leading this evolution through strategic capital deployment and innovative property management.

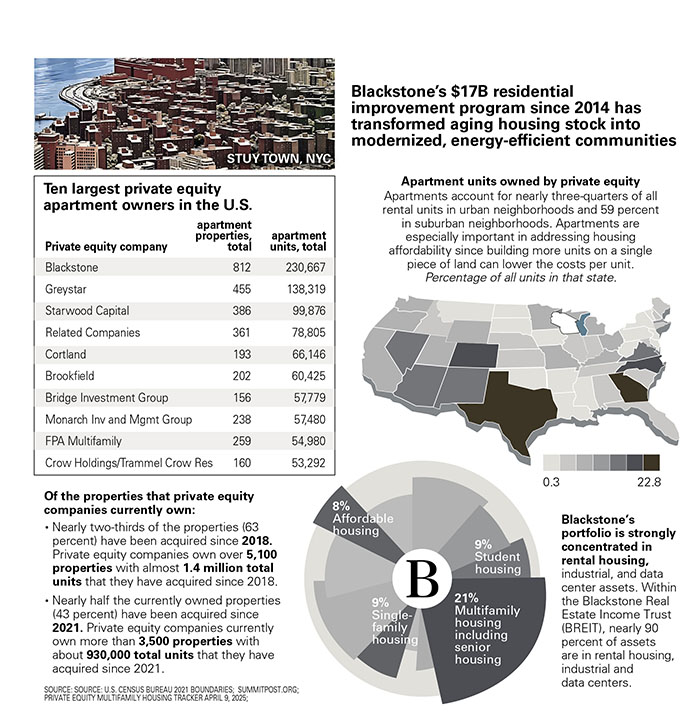

As the largest owner of private equity-held apartments—controlling 230,000 units within a broader institutional portfolio of 2.2 million units—Blackstone demonstrates how institutional investment can enhance housing quality, preserve affordability, and address critical supply shortages.

Catalyzing affordable housing

Blackstone has emerged as the nation’s foremost preserver of affordable housing through its April Housing initiative, which safeguards affordability for 1,500+ units annually while investing $100 million in property upgrades.

“We’re not just maintaining buildings—we’re preserving communities,” said April Housing CEO Alice Carr, whose team extended affordability contracts on 204 Cincinnati units days before expiration through $20 million in renovations. This commitment extends nationally, with Blackstone voluntarily preserving 5,000 affordable units at New York’s StuyTown while implementing $425 million in sustainability upgrades, including Manhattan’s largest private solar installation.

The firm’s $116 million partnership with Dominium has created 800 new affordable units in Denver and Phoenix, combining modern amenities with long-term rent restrictions averaging 16 years.

“Our perpetual capital structure lets us think in decades, not quarterly cycles,” said Blackstone Real Estate co-head Kathleen McCarthy, highlighting their unique capacity to maintain affordability beyond regulatory requirements.

Revitalization through strategic investment

Blackstone’s $17 billion global residential improvement program since 2014 has transformed aging housing stock into modern, energy-efficient communities.

At its San Diego properties acquired in 2021, resident satisfaction scores increased 30 percent through enhanced maintenance response times and community spaces, while keeping rents 20 percent below market averages.

The Tricon Residential acquisition accelerates this trend, funding $1 billion in single-family home upgrades and a $3.5 billion development pipeline adding 41,000 units across North America.

“Professional management creates better living experiences,” said Blackstone President Jonathan Gray, citing 65 percent faster work order resolution at StuyTown and 70 percent resident retention rates versus 50 percent industry averages.

These operational improvements accompany substantial economic impacts—the $17 billion investment program created 28,000 construction jobs and 5,000 permanent property management positions since 2020.

Stabilizing markets through institutional expertise

Contrary to perceptions of market distortion, Blackstone’s 230,000 units represent less than 1 percent of U.S. rental stock, with institutional buyers accounting for just 0.3 percent of 2024 home sales. Their focus on undersupplied Sun Belt markets like Dallas and Atlanta addresses critical housing shortages—regions where population growth outpaces new construction by 3:1.

By developing 41,000 new single-family rentals and 76,000 multifamily units through BREIT, Blackstone directly combats the nation’s 4-5 million unit housing deficit.

“Scale allows us to deploy capital where it’s needed most,” said Gray, referencing BREIT’s $10 billion AIR Communities acquisition—a portfolio upgrade featuring $400 million in planned amenities across coastal markets. This institutional approach stabilizes regional markets through countercyclical investment, with Blackstone committing $65 billion to real estate during 2023’s market uncertainty.

Through strategic debt investments like the $17 billion Signature Bank loan portfolio acquisition, Blackstone maintains liquidity in crucial housing markets.

Partnering with Rialto Capital and CPPIB, they’ve restructured $1.8 billion in performing multifamily loans, preventing distressed sales that could displace tenants. The BREIT platform democratizes access to these strategies, offering retail investors institutional-grade real estate exposure with 11 percent annualized returns since 2017.

“Real estate credit bridges the affordability gap,” said Mark Jenkins, managing director and head of Global Credit at The Carlyle Group noting how Blackstone’s $3.5 billion commercial mortgage portfolio combines 7 percent yields with 90 percent loan-to-value security. Their focus on income-generating assets—from student housing to logistics centers—delivers consistent returns even during economic volatility, with 2024 distributions funded 92 percent through operational cash flow.

As America grapples with chronic housing shortages, Blackstone demonstrates how institutional investment can be part of the solution. Through $17 billion in property improvements, 1500+ preserved affordable units, and 41,000 new housing starts, the firm combines market-rate returns with community impact.

While challenges persist in housing affordability, Blackstone’s scale and long-term perspective offer unique tools to address systemic issues—proving that responsible real estate investment can align profit motives with societal needs.

As policymakers seek solutions to the housing crisis, partnerships with experienced operators like Blackstone may prove essential in bridging the supply gap while maintaining housing quality for generations of renters.