The U.S. Census Bureau’s latest housing starts report is drawing some of the sharpest criticism in recent memory. In July, the agency reported 42,000 multifamily starts — the second-highest July in nearly 40 years. June’s total ranked among the five most active Junes since the late 1980s. To many in the industry, those multifamily start numbers defy belief.

“This does not pass the sniff test,” said rental housing economist Jay Parsons on his podcast The Rent Roll. “If you think there’s even a chance these numbers are true, find an executive from any apartment developer or builder in the country and tell them with a straight face that multifamily starts are rebounding at historically strong levels. See if they don’t laugh at you.”

Parsons isn’t alone. Ryan Davis of Witten Advisors called the July totals “laughable.” Chris Nebenzahl of John Burns Research & Consulting said the Census data “doesn’t represent what we are seeing.” Jay Lybik of Continental Properties agreed: “The numbers don’t make a lot of sense.”

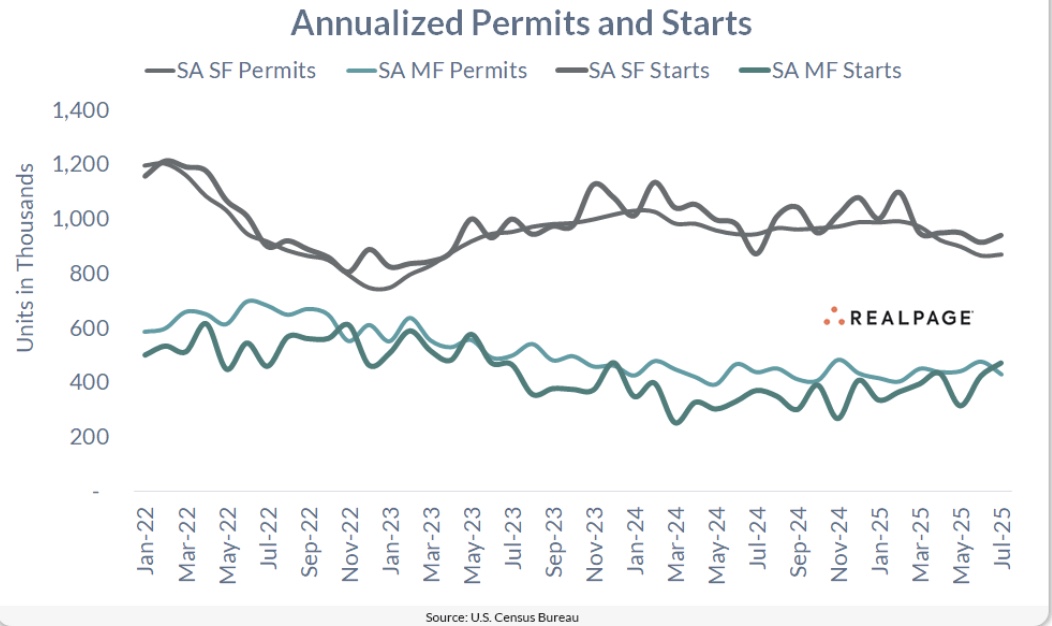

Chart above: Annualized single-family (SF) and multifamily (MF) permits and starts since early 2022. RealPage data shows no evidence of a sudden rebound in multifamily construction activity, despite Census Bureau reports suggesting otherwise.

Private-sector data aligns with the skeptics. Paul Fiorilla, Yardi Associate Director Secondary Research, said Matrix shows 2025 starts roughly level with 2024 and well below historic peaks. Parsons noted that both RealPage and CoStar report apartment starts at their lowest levels in 12 to 13 years, dating back to the post-financial crisis era.

The American Institute of Architects’ Billings Index and the National Multifamily Housing Council’s developer surveys show no sign of a rebound either. “If construction really were ramping up, developers and REITs would be reporting it,” Parsons said. “Instead, MAA Communities and AvalonBay, two of the nation’s largest apartment REITs, both say new starts are significantly below historical averages.”

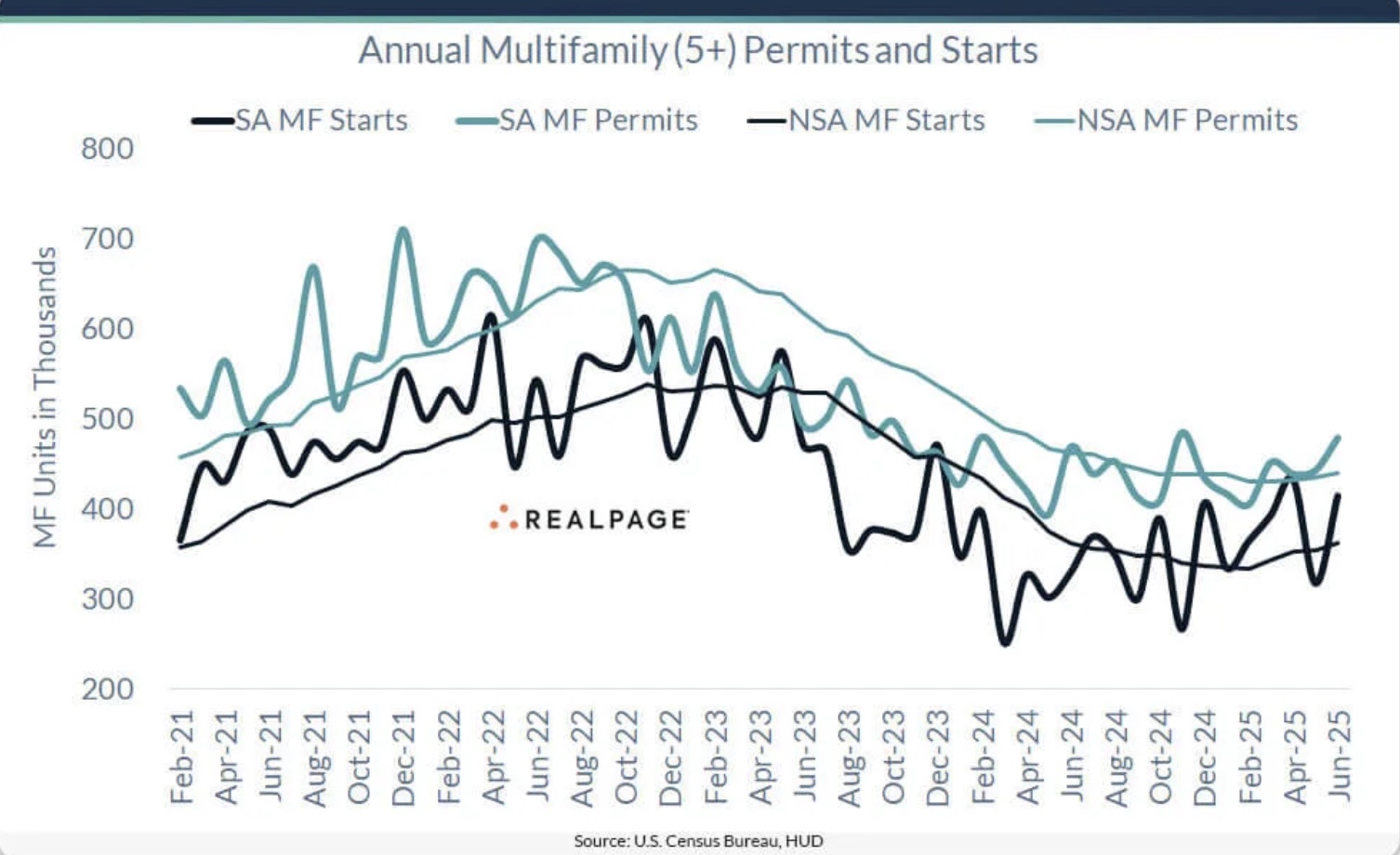

Chart 2 above: Multifamily permits and starts, seasonally adjusted (SA) and not seasonally adjusted (NSA). Both Census/HUD and RealPage show multifamily construction trending down, not up, since mid-2022.

Why the gap? Some macroeconomists chalk it up to volatility, but critics say this goes beyond statistical noise. Parsons warns the stakes are high, “Inflated numbers can give policymakers a false sense of accomplishment and reduce urgency to adopt pro-housing solutions. They might also convince the Fed that high rates aren’t slowing down construction — when we know they are.”

Frustration with Census data isn’t new. “The construction starts series always has been an egregiously bad data set,” said Greg Willett, chief economist at LeaseLock. RealPage chief economist Carl Whitaker worries this could be “the tip of the iceberg for continued degradation of government data sources,” noting chronic underfunding has made timely, accurate data collection increasingly difficult.

Not everyone agrees. National Association of Home Builders chief economist Robert Dietz still calls Census the “gold standard,” suggesting the gains could be concentrated in smaller markets private data sets undercount. But that view remains the exception.

Parsons stresses this isn’t about piling on. He praised Census staff for doing their best with limited resources, but argued the methodology must modernize. “This isn’t new. Back in 2023, Census missed the big decline in starts that private sources picked up months earlier. Policymakers need to work off accurate numbers. Otherwise, bad data can drive bad policy,” he said.

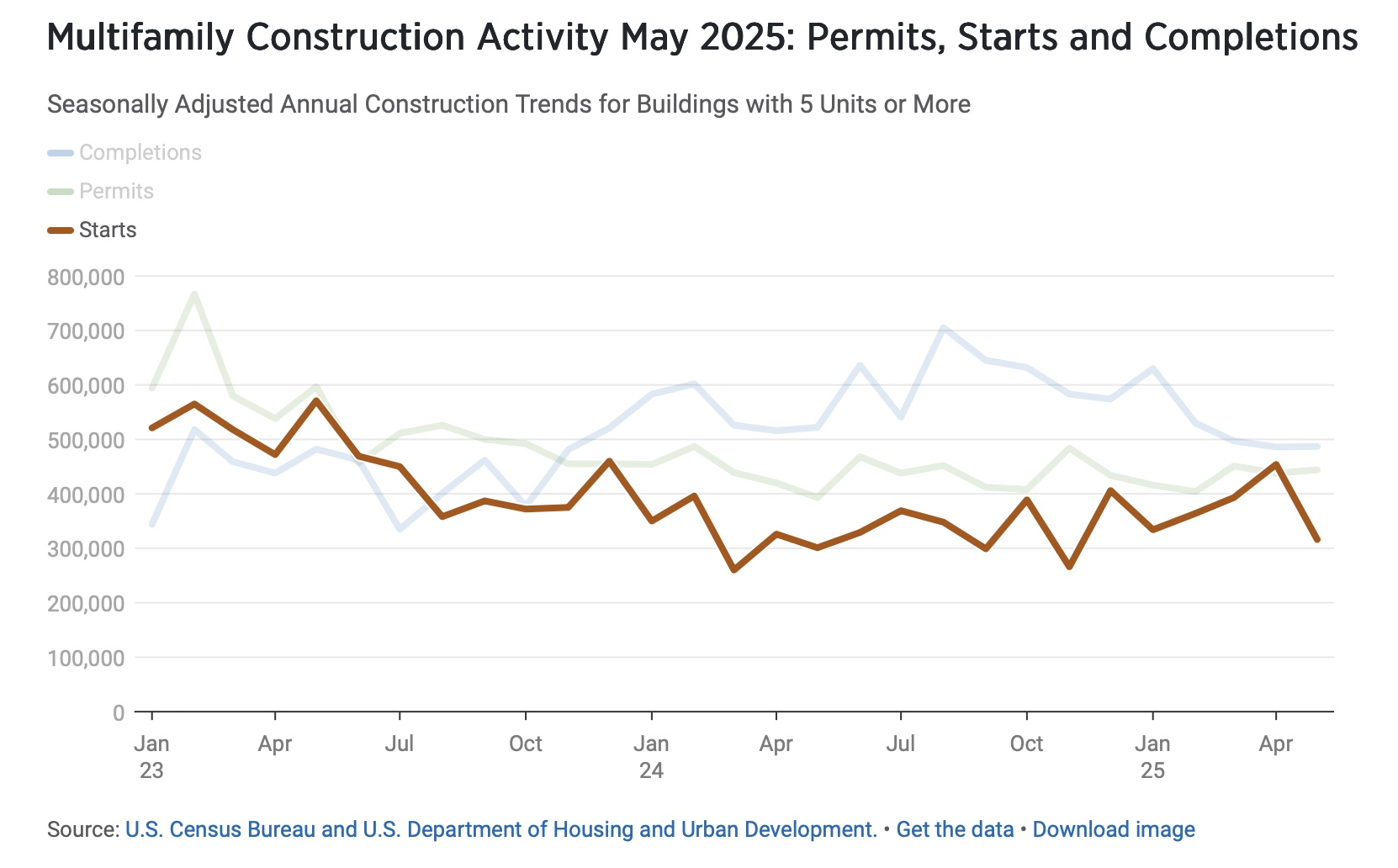

Chart 3 above: Even Census/HUD’s own long-run series on permits, starts, and completions suggests softness, with starts trending near post-COVID lows. The July surge stands out as an anomaly.

With multifamily development already constrained by high costs, tight credit, and soft rents, the last thing the industry can afford is for policymakers to act on a phantom boom.

Correction: The earliest version of this piece misidentified Paul Fiorillo as CoStar Director of Research.