Revisions to Fannie Mae’s August housing forecast raise the number of multifamily starts expected in 2025 and 2026 from those in last month’s forecast. Fannie Mae is now predicting 389,000 starts in 2025 with 392,000 starts in 2026. By contrast, all of the quarterly forecasts for single-family housing starts were lowered in this month’s forecast.

Fed Funds rate outlook again nearly unchanged

Despite making revisions to their predictions for the paths of many of the economic metrics they track, Fannie Mae’s forecasters left their prediction for the trajectory of the Fed Funds rate unchanged for the second forecast in a row. They still predict the Fed Funds rate will see a one-quarter point rate cut from its current level of 4.3 percent to an average of 4.0 percent in Q4 2025. They predict the average Fed Funds rate for Q4 2026 will be 3.4 percent.

As detailed below, Fannie Mae’s forecasts for near-term inflation were raised, which might prompt the Fed to raise rates. However, Fannie Mae’s forecasts for employment growth were lowered, which might prompt the Fed to lower rates. While no explanation was given, it appears that the forecasters expect the Fed to see these factors as offsetting and to keep their interest rate plans unchanged.

The forecast for the for the 10-year Treasury rate was raised slightly. The forecasters raised their predicted interest rate in Q4 2025 by 0.1 percentage points to 4.4 percent and they also raised their predicted rate in Q4 2026 by 0.1 percentage points to 4.5 percent. They now expect the rate to average 4.4 percent in 2025 and to average 4.5 percent in 2026.

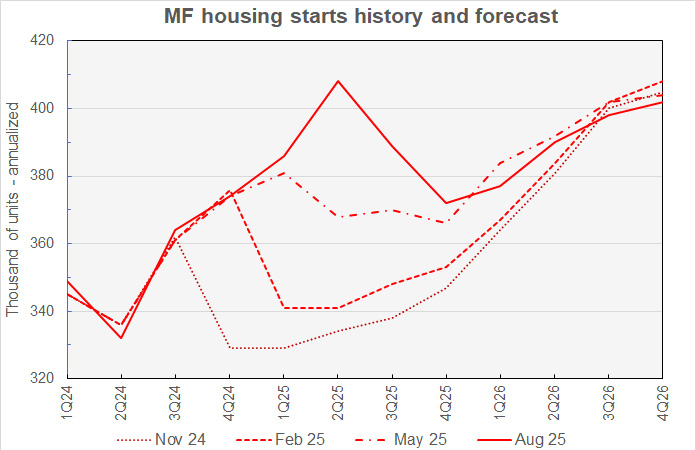

Multifamily starts forecast raised

The current forecast for multifamily housing starts is shown in the first chart, below, along with three other forecasts from the last year. Fannie Mae considers any building containing more than one dwelling unit to be “multifamily”, including both condominiums and rental housing units.

A look at the chart reveals that Fannie Mae’s forecasters have repeatedly expected a slowdown in multifamily starts “soon” only to have to revise their estimates higher as new data comes in.

As sometimes happens, the largest quarterly revision this month was to the quarter just passed. The Q2 estimate was revised 18,000 annualized units higher to 408,000 annualized units, in line with last month’s estimate from the Census Bureau. However, the latest Census Bureau report raises this figure to 422,000 annualized units, so expect to see the Q2 figure revised again next month.

For the third forecast in a row, Q2 2025 is predicted to be the cycle high for multifamily starts. Starts are then predicted to fall through the end of 2025, reaching a low of 372,000 annualized starts in Q4. Multifamily starts are predicted to rise from that point, reaching a rate of 402,000 annualized units in Q4 2026. This is up 9,000 units from last month’s forecast.

Looking at yearly forecasts, the predicted number of multifamily starts for 2025 was revised higher by 8,000 units to 389,000 units. The forecast for multifamily starts in 2026 was revised higher by 12,000 units to 392,000 units.

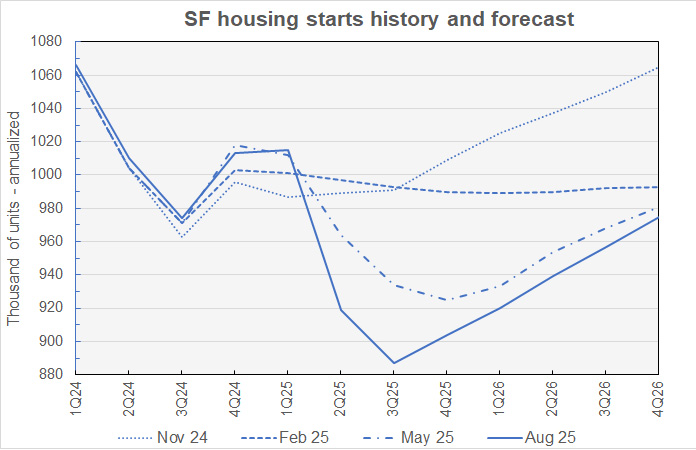

Reduced outlook for single-family starts

The current forecast for single-family housing starts is shown in the next chart, below, along with three other recent forecasts.

All revisions made to the single-family starts quarterly forecasts in this month’s report were to the downside. The largest quarterly revision made was to the Q3 2025 forecast, which was lowered by 45,000 annualized units to 887,000 units. The revisions made to the successive forecasts were progressively smaller, ending with a 14,000 annualized unit lowering of the forecast for Q4 2026.

The low point for single-family starts going forward is now predicted to be Q3 2025. Starts are forecast to rise from that point and are predicted to reach an annualized rate of 975,000 units in Q4 2026.

For reference, the Census Bureau’s new residential construction report put Q2 2025 single-family starts at 937,000 annualized units. The preliminary July figure started Q3 off with a rate of 939,000 annualized starts.

Looking at full-year predictions, Fannie Mae now expects 24,000 fewer single-family starts in 2025 than forecast last month at 931,000 units. Fannie Mae now also expects 24,000 fewer single-family starts in 2026 than forecast last month at 948,000 units.

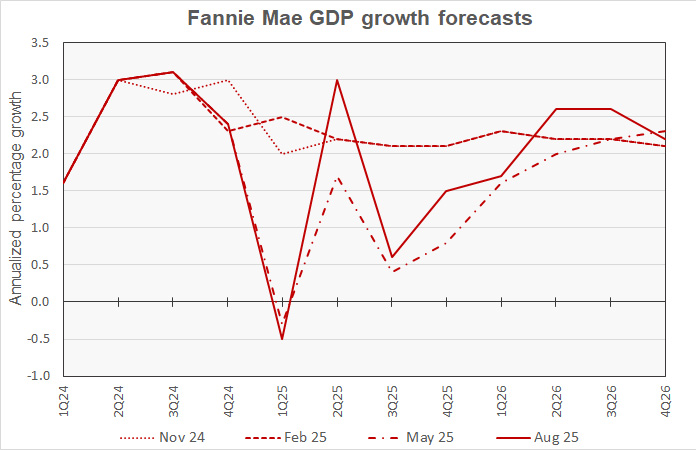

GDP growth forecasts revised lower

The next chart, below, shows Fannie Mae’s current forecast for Gross Domestic Product (GDP) growth, along with other recent forecasts.

After being revised sharply lower in last month’s forecast, the estimate for Q2 2025 GDP growth was revised sharply higher this month, rising 0.6 percentage points to 3.0 percent. This is in line with the Bureau of Economic Analysis’ advance estimate for the quarter.

The Q3 2025 forecast was revised sharply lower, falling 1.1 percentage points to only 0.6 percent. The Q3 growth estimate had been 1.7 percent in each of the last two quarters. Forecasts for Q4 and for Q1 2026 were also lowered by 0.1 and 0.4 percentage points respectively. However, GDP growth forecasts for Q2 and Q3 2026 were raised slightly.

Fannie Mae’s forecasters now expect year-over-year GDP growth to be 1.1 percent in 2025, down 0.2 percentage points from the rate predicted last month. They expect 2.2 percent growth in 2026, down 0.1 percentage point from their last prediction.

For reference, the August 19 release of the GDP Now estimate from the Atlanta Fed indicates that Q3 2025 GDP growth is currently running at 2.3 percent. This is well above their “blue chip consensus” Q3 forecast, which is currently under 1.0 percent.

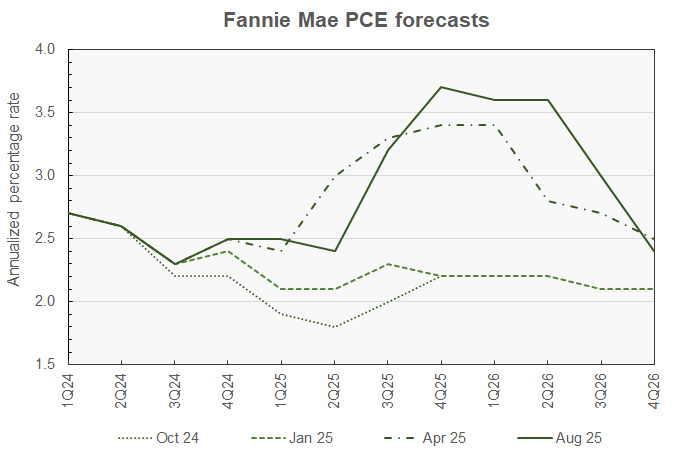

PCE Inflation forecasts also raised

The next chart, below, shows Fannie Mae’s current forecast for the chained personal consumption expenditures (PCE) inflation rate, along with three other recent forecasts.

This month’s revisions to Fannie Mae’s PCE inflation forecasts to upcoming quarters were all to the upside. The updates for Q4 2025 through Q3 2026 were unusually large, averaging 0.5 percentage points. However, by the end of 2026, they still expect inflation to fall to the level they predicted last month. While Fannie Mae’s forecasters do not explain the reasoning behind their revisions, it may be that they expect President Trump’s tariffs to finally be imposed, at least on some trading partners, and to cause a one-time increase in prices.

Fannie Mae’s prediction for the year-over-year inflation rate for Q4 2025 was revised 0.4 percentage points higher to 3.7 percent. Their predicted year-over-year inflation rate for Q4 2026 was left unchanged at 2.4 percentage.

For reference, the Bureau of Economic Analysis estimated that PCE inflation was running at 2.6 percent in June 2025.

Employment growth forecast lowered

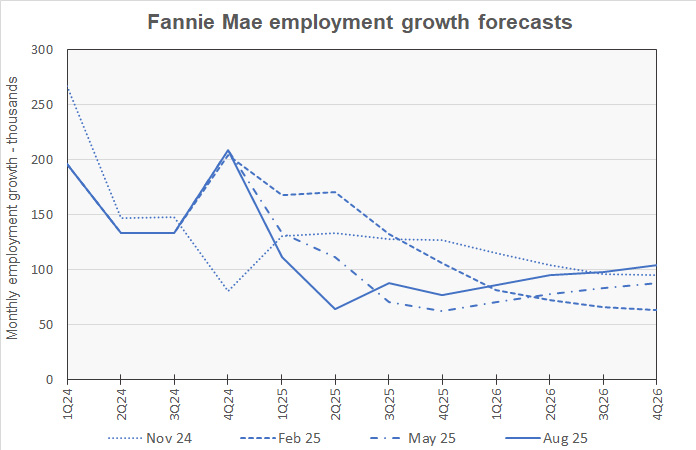

The next chart, below, shows Fannie Mae’s current forecast for employment growth, along with three earlier forecasts. Employment growth is our preferred employment metric since job gains, along with productivity gains, drive economic growth. By contrast, the unemployment rate depends on employment but also on the labor force participation rate. Either rising employment or falling labor force participation can drive the unemployment rate lower, but only the former would contribute to economic growth.

Note that the population estimates upon which the employment data is quoted were updated in January, so the figures from the earlier forecasts may not be directly comparable to those from the more recent forecasts.

After raising their estimates for employment growth higher in the last three forecasts, Fannie Mae’s forecasters reduced their employment growth estimates this month. This was likely in response to the large downward revisions to employment level estimates in the latest Employment Situation Report from the Bureau of Labor Statistics.

The largest revision to the employment growth estimates was for the quarter that has just passed. The Q2 2025 employment growth forecast was revised lower by 86,000 jobs per month to only 64,000 jobs per month. While all employment growth forecasts for upcoming quarters were also revised lower, no other revision exceeded 27,000 jobs per month.

Employment growth in 2025 is expected to be 1,000,000 jobs, down 400,000 jobs from last month’s prediction. Employment growth for 2026 is expected to be 1,100,000 jobs, down 200,000 jobs from last month’s predicted level.

The Fannie Mae August forecast can be found here. There are links on that page to the detailed economic and housing forecasts.