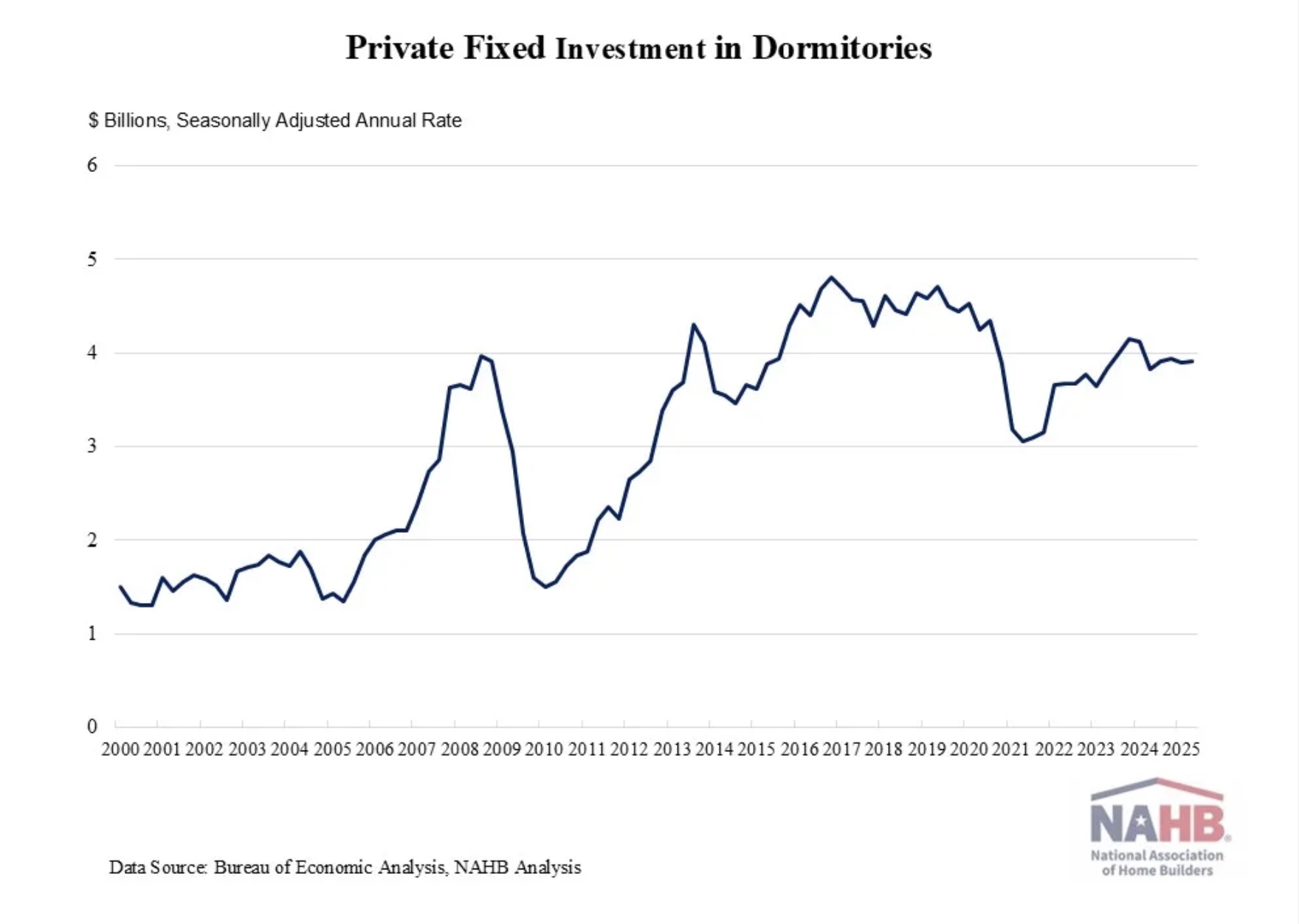

Student housing construction rose in Q2, but demographic and enrollment trends pose challenges, according to a report from National Association of Home Builders (NAHB). Private fixed investment in student dormitories edged up by 0.3 percent in the Q2 2025, reaching a seasonally adjusted annual rate of $3.9 billion. This mild increase follows a 1.1 percent decline in the previous quarter, when elevated interest rates placed pressure on student housing construction. Despite the volatility, investment was 2.1 percent higher than in the same quarter last year, suggesting a slow but ongoing recovery.

Investment in student housing surged after the Great Recession, paralleling a boom in college enrollment, which climbed from 17.2 million in 2006 to 20.4 million in 2011. But during the COVID-19 pandemic, construction dropped significantly from $4.4 billion (SAAR) in Q4 2019 to $3 billion by Q2 2021 as on-campus activity was disrupted. The National Student Clearinghouse Research Center reported enrollment declines of 3.6 percent in 2020 and 3.1 percent in 2021, respectively.

Since then, enrollment has gradually rebounded. Undergraduate enrollment rose again in 2023 and nearly recovered to pre-pandemic levels by 2024, with 15.96 million undergraduates enrolled. Graduate enrollment, meanwhile, has increased steadily since 2019. This recovery in student numbers has supported the recent rebound in student housing investment.

However, longer-term demographic and economic trends point to growing headwinds. College enrollment is projected to increase by only eight percent from 2020 to 2030, compared to a 37 percent jump from 2000 to 2010, according to the National Center for Education Statistics.

This slowdown is linked in part to declining birth rates that followed both the early 1990s recession and the 2007–2009 Great Recession. These demographic dips are now maturing into what analysts call an “enrollment cliff” — a sharp projected decline in the number of traditional college-aged students, particularly after 2025.

Notably, the enrollment cliff disproportionately affects traditional undergraduates (ages 18–24), but nontraditional students, including older and part-time learners, are playing a growing role in higher education. Online programs and flexible formats have enabled more adult learners and graduate students to pursue degrees, potentially offsetting some of the traditional enrollment losses.

The type of institution also matters. Since 2010, the largest enrollment declines have been concentrated in two-year and for-profit colleges. Two-year public colleges lost 38 percent of their enrollment from 2010 to 2022, while two-year private for-profits fell by 59 percent. Meanwhile, four-year private for-profits declined 55 percent. By contrast, four-year public colleges grew their enrollment by 15 percent, and nonprofit four-year institutions by 3.5 percent over the same period.

These shifts suggest that student housing investment will likely cluster around four-year public and nonprofit institutions, where enrollment remains more resilient.

Although the percentage of 18- to 24-year-olds enrolled in college was 39 percent in 2022, near its lowest level since 2006, and only 62 percent of recent high school graduates entered college that year (down from 70 percent in 2009), total college participation is still higher than it was in earlier decades. That said, institutions must now adapt to a structurally changing student population, one that is more diverse in age, educational goals, and modality preferences.

While student housing construction has begun to recover from pandemic-era lows, it now operates in a fundamentally different landscape. Developers and investors will need to account for shifting demographic and enrollment changes, including the anticipated post-2025 enrollment cliff and the growing role of online and hybrid education, especially for nontraditional students.

Student housing growth is expected to be uneven, with investments focusing on campuses and regions that show enrollment stability or diversification.