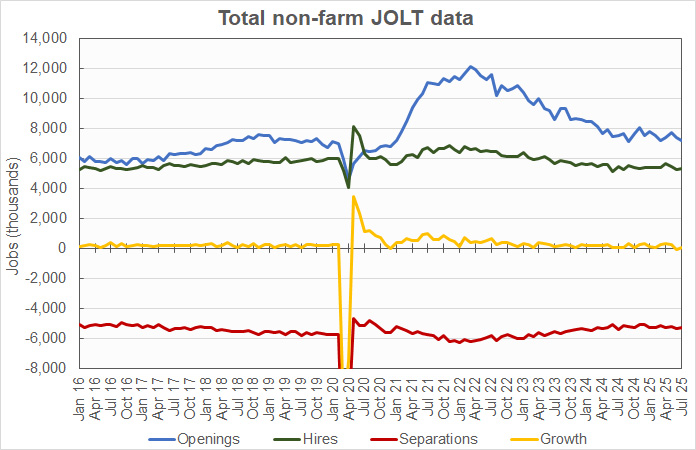

The Job Openings and Labor Turnover (JOLT) report from the Bureau of Labor Statistics (BLS) said that the number of total non-farm job openings in July fell to 7.18 million. Hiring in July was higher for construction jobs but fell for real estate jobs. However, employment was reported to rise in both categories.

Fewer openings but more hiring

Job openings were reported to be down 176,000 openings month-over-month. In addition, the openings figure for June was revised lower by 80,000 openings, so the July openings figure is 256,000 lower than the initial level reported for June last month. Total job openings are down 323,000 openings from their year-ago level.

Hiring was reported to be up by 41,000 jobs from last month’s revised (+63,000) figure for the economy as a whole, rising to a level of 5.31 million hires.

Total separations were reported to fall 52,000 from last month’s greatly revised (+281,000) figure to a level of 5.29 million. Within total separations, quits were reported to fall by 1,000 jobs while layoffs rose by 12,000 jobs. Quits represented 60.7 percent of total separations for the month, slightly below the trailing 12-month average of 61.3 percent.

The July job openings figure represents 4.3 percent of total employment plus job openings. For comparison, the unemployment rate in July was reported to be 4.25 percent and 7.24 million people were unemployed. Another 6.53 million people said that they would like a job but were not counted as being in the labor force since they were not actively seeking employment.

For a discussion of the JOLT report and how it relates to the Employment Situation Report, please see the paragraph at the end of this article.

The excess of hiring over separations in the July JOLT report implies an employment increase of only 19,000 jobs for the month. In addition, revisions to last month’s hiring and separations figures changed last month’s preliminary employment growth from a gain of 144,000 jobs to a loss of 74,000 jobs. That is the first overall job loss indicated by the JOLT data since December 2020.

Of those leaving their jobs in July, 3.21 million quit voluntarily, while 1.81 million people were involuntarily separated from their jobs. The remainder of people leaving their jobs left for other reasons, such as retirements or transfers. The portion of people quitting their jobs remained unchanged from last month’s figure at 2.0 percent of the labor force. The involuntary separations rate was up slightly from last month’s figure at 1.1 percent.

Total non-farm JOLT data since January 2016 is shown in the first chart, below.

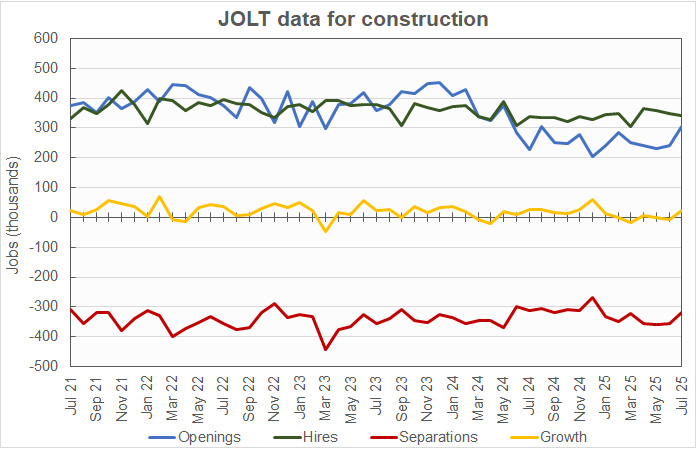

Construction quits hit a multi-year low as layoffs soar

The next chart, below, shows the employment situation for the construction jobs market over the last 49 months. It shows that July saw a net gain of 24,000 construction jobs. However, last month’s preliminary gain of 12,000 construction jobs was revised to a loss of 8,000 jobs based on revisions to the data.

The preliminary job openings figure for July was reported to be up by 64,000 openings from last month’s revised (-4,000) figure at 306,000 openings. This is the highest number of construction jobs openings reported since August 2024. Openings were reported to be up 33.6 percent from last year’s level and were reported to represent 3.5 percent of construction employment plus job openings.

Hiring was reported to be down by 6,000 jobs in July from the prior month’s revised (-3,000) jobs figure to 342,000 new hires. The number of construction jobs that were filled in July was reported to be up 1.0 percent year-over-year.

Construction jobs total separations were reported to be down by 38,000 jobs from the prior month’s revised (+17,000) figure to 318,000 jobs.

Quits were reported to plunge by 80,000 jobs from June’s revised (-1,000) figure to a level of only 74,000 jobs. This is the lowest level of quits recorded since 2012. Quits represented 23.3 percent of separations for the month, less than half the figure for the economy as-a-whole.

Layoffs were reported to rise by 49,000 from last month’s revised (+20,000) figure to 232,000 jobs. This is the highest level of construction layoffs since March 2023.

“Other separations” which include retirements and transfers, were reported to be down 6,000 at 13,000 jobs.

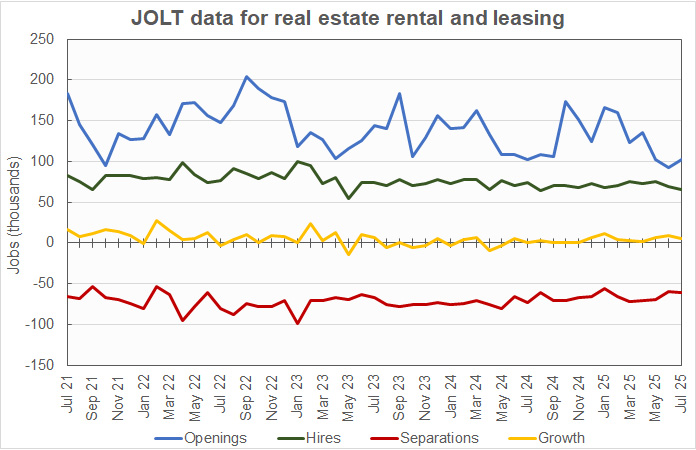

RERL employment higher

The last chart shows the employment situation for the real estate and rental and leasing (RERL) jobs category. Employment in this jobs category was reported to be up 5,000 jobs for the month. RERL employment has risen every month for the past year.

The number of job openings in the RERL category was reported to rise to 102,000 jobs at the end of July. The RERL job openings figure was 9,000 openings higher than the revised (-5,000) level reported for the month before. However, RERL job openings were unchanged from their year-ago level. Job openings in the RERL category represent 3.9 percent of total employment plus job openings, up 0.1 percentage points from the level in last month’s report.

Hiring in July was reported to be down by 3,000 jobs from last month’s revised (+2,000) figure at 66,000 jobs. The hiring figure was down 10.8 percent from the level of the year before.

Total separations in the RERL jobs category in July were up by 1,000 from June’s revised (+3,000) figure at 61,000 jobs.

Quits were reported to be up 6,000 from June’s revised (+4,000) figure at 36,000 jobs. Quits represented 59.0 percent of total separations. Layoffs were reported to be down by 3,000 jobs from June’s revised (-2,000) figure at 23,000 jobs.

The numbers given in the JOLT report are seasonally adjusted and are subject to revision. It is common for adjustments to be made in subsequent reports, particularly to the data for the most recent month. The full current JOLT report can be found here.

Comparing the reports

The US labor market is very dynamic with many people changing jobs in any given month. The JOLT report documents this dynamism by providing details about job openings, hiring and separations. However, it does not break down the jobs market into as fine categories as does the Employment Situation Report, which provides data on total employment and unemployment. For example, while the Employment Situation Report separates residential construction from other construction employment, the JOLT report does not. The Employment Situation Report separates residential property managers from other types of real estate and rental and leasing professionals, but the JOLT report does not. However, the JOLT report provides a look at what is driving the employment gains (or losses) in broad employment categories.