The economic projections released by the Federal Open Market Committee (FOMC) after this week’s meeting indicate that they expect higher GDP growth ahead than in last their forecast. They left their forecasts for the 2025 year-end PCE inflation rate and the unemployment rate unchanged. However, they forecast a lower unemployment rate and a higher inflation rate in 2026 than in their June projection. While an outlook for higher growth, lower unemployment and higher inflation might seem like a call for higher interest rates, the FMOC voted to lower the Fed Funds rate by ¼ point to a range of 4.0 to 4.25 percent. They also forecasted lower Fed Funds rates in 2026 and 2027 than in their last projection in June.

In a prepared statement following the meeting, Fed Chairman Jerome Powell said, “In the near term, risks to inflation are tilted to the upside and risks to employment to the downside—a challenging situation. When our goals are in tension like this, our framework calls for us to balance both sides of our dual mandate. With downside risks to employment having increased, the balance of risks has shifted. Accordingly, we judged it appropriate at this meeting to take another step toward a more neutral policy stance.”

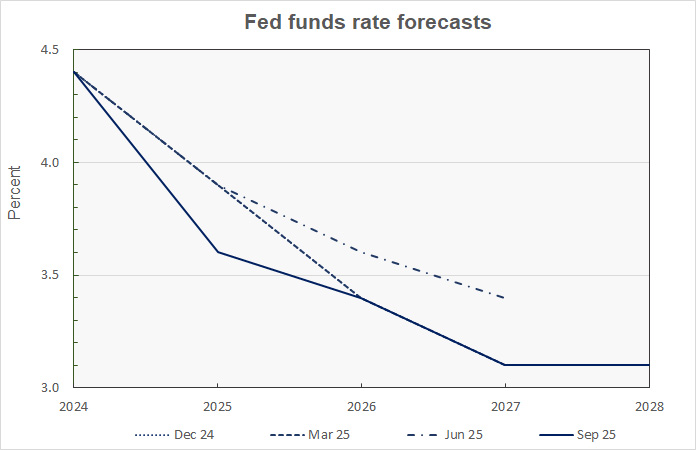

Interest rates to trend lower

In addition to the Fed lowering their current target Federal Funds interest rate, they also lowered their projected year-end 2025 interest rate. They are now projecting a Fed Funds rate of 3.6 percent, down from 3.9 percent in their June projection. This implies that this interest rate will be cut by another 0.5 percentage point by year-end.

The forecast for the Fed Funds rate at year-end 2027 was also lowered from June’s projection. However, the current projection of a Fed Funds rate of 3.1 percent, is the same as was projected by the Fed in both December 2024 and March 2025.

In his statement, Chairman Powell noted, “As is always the case, these individual forecasts are subject to uncertainty, and they are not a Committee plan or decision. Policy is not on a preset course.”

A history of the forecasts for the Federal Funds rate is given in the first chart, below.

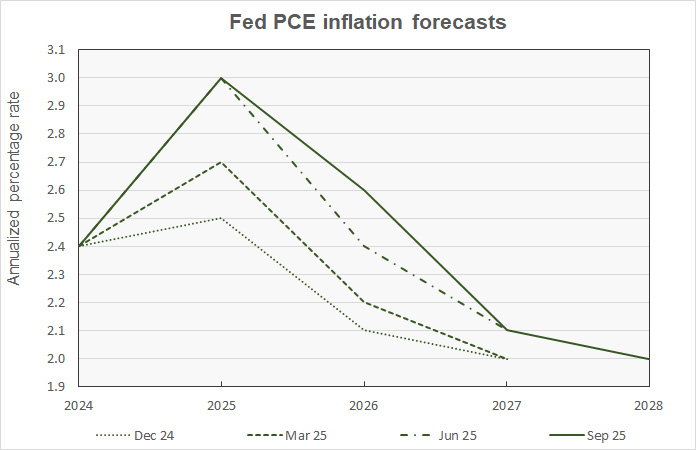

Inflation projection raised again

The Federal Reserve’s preferred inflation measure is based on the Personal Consumption Expenditures (PCE) survey, rather than the more familiar Consumer Price Index (CPI).

While the Fed’s projection for the year-end rate of inflation for 2025 was left unchanged, their projection for year-end inflation in 2026 was raised another 0.2 percentage points to 2.6 percent. This is the fourth consecutive economic projection where the inflation forecast for 2026 has been raised. A year ago, 2026 inflation was projected to come in at 2.0 percent, the Fed’s target rate.

By contrast, the year-end 2027 inflation projection was left unchanged at 2.1 percent while the first projection for the year-end 2028 inflation rate came in at 2.0 percent.

Chairman Powell’s statement said, “Near-term measures of inflation expectations have moved up, on balance, over the course of this year on news about tariffs, as reflected in both market- and survey-based measures. Beyond the next year or so, however, most measures of longer-term expectations remain consistent with our 2 percent inflation goal.”

Recent PCE inflation forecasts are shown in the next chart.

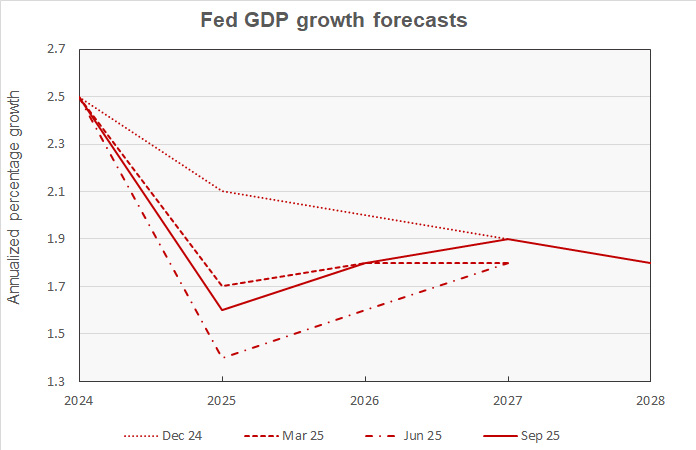

GDP growth higher

The Fed raised its forecasts for GDP growth across the forecast horizon compared to its projections in June. Projected GDP growth rates in 2025 and 2026 were raised by 0.2 percentage points to 1.6 percent and 1.8 percent respectively. GDP growth in 2027 was raised 0.1 percentage point to 1.9 percent.

For reference, the second estimate for GDP growth by the Bureau of Economic Analysis had the economy shrinking by 0.5 percent in Q1 2025 but growing at a rate of 3.3 percent in Q2 as a surge and then fall in imports roiled the results. The Atlanta Fed’s GDP Now estimate for Q3 growth released September 17 came in at 3.3 percent on strong consumer spending.

Recent Fed GDP forecasts are illustrated in the next chart, below.

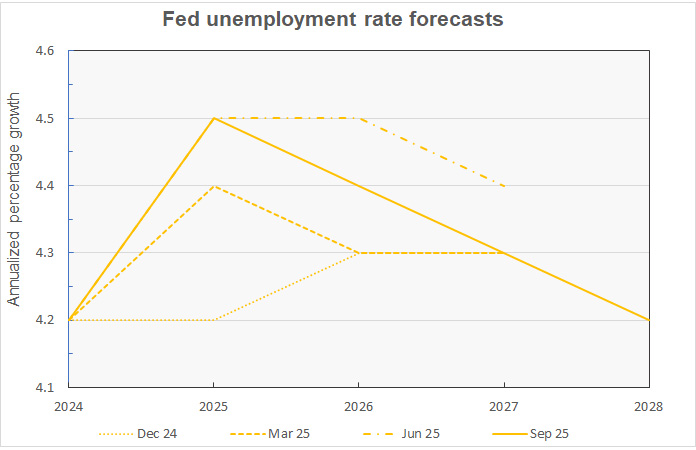

Unemployment higher through 2027

The Fed left its year-end 2025 projection for the unemployment rate unchanged at 4.5 percent. The most recent unemployment rate figure from the Bureau of Labor Statistics was 4.3 percent, although it has been rising in recent months. The unemployment rate projections for both 2026 and 2027 were lowered 0.1 percentage points to 4.4 percent and 4.3 percent respectively.

The history of the Fed’s recent unemployment rate forecasts is shown in the next chart.

The FOMC meets 8 times per year but only releases its Summary of Economic Projections (SEP) at 4 of the meetings. The Fed forecast presents estimates for economic metrics for December of each year, now through 2028, and a “longer run” forecast which reflects their view of the equilibrium state of the economy. The consensus Fed forecast is developed by combining the forecasts of 19 economists. Each of the economists assumes that the Fed will follow “appropriate” monetary policy during the term of the forecast, although their individual ideas of what that policy is may vary.

The next updates to the Federal Reserve’s forecasts for the economy will come after the December 2025 FOMC meeting which concludes December 10.