Rental concessions rise again in August while Texas markets dominate discounts.

As new apartment supply continues in select markets, but is expected to peak later this year, rental concessions have become a crucial tool for property owners competing to fill units. From free rent periods to reduced deposits, operators are leaning on discounts to capture demand, particularly in metros where construction has surged.

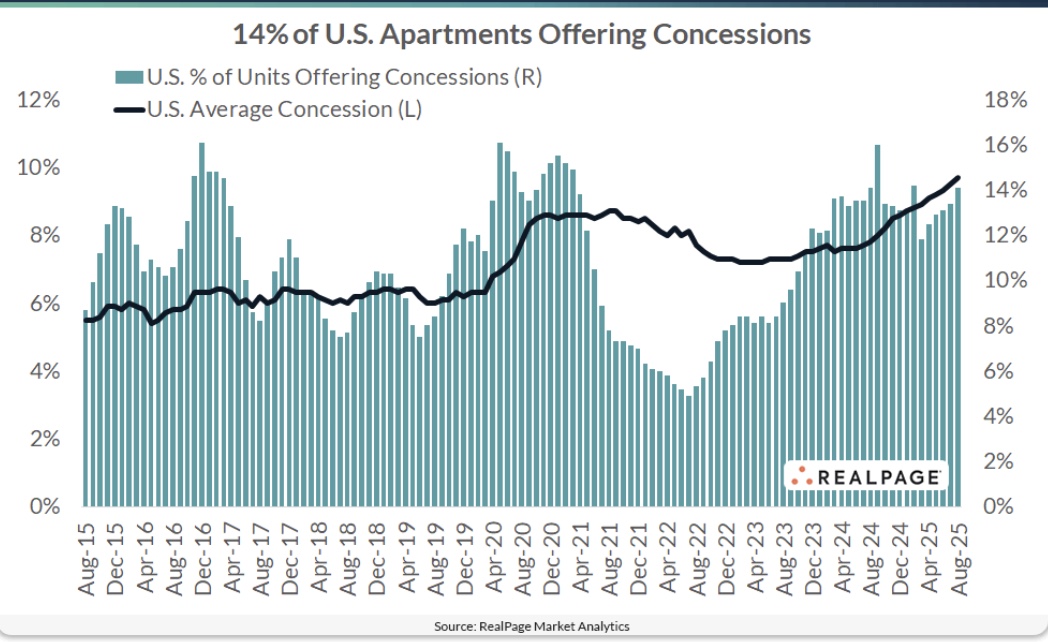

Nationwide, just over 14 percent of apartments offered concessions in August 2025, according to RealPage Market Analytics, with the average discount at 9.7 percent off asking rents. This represents a slight increase from earlier in the summer, when about 12 percent of stabilized conventional units offered discounts averaging 9.3 percent, highlighting a modest uptick in incentives as new supply enters these markets.

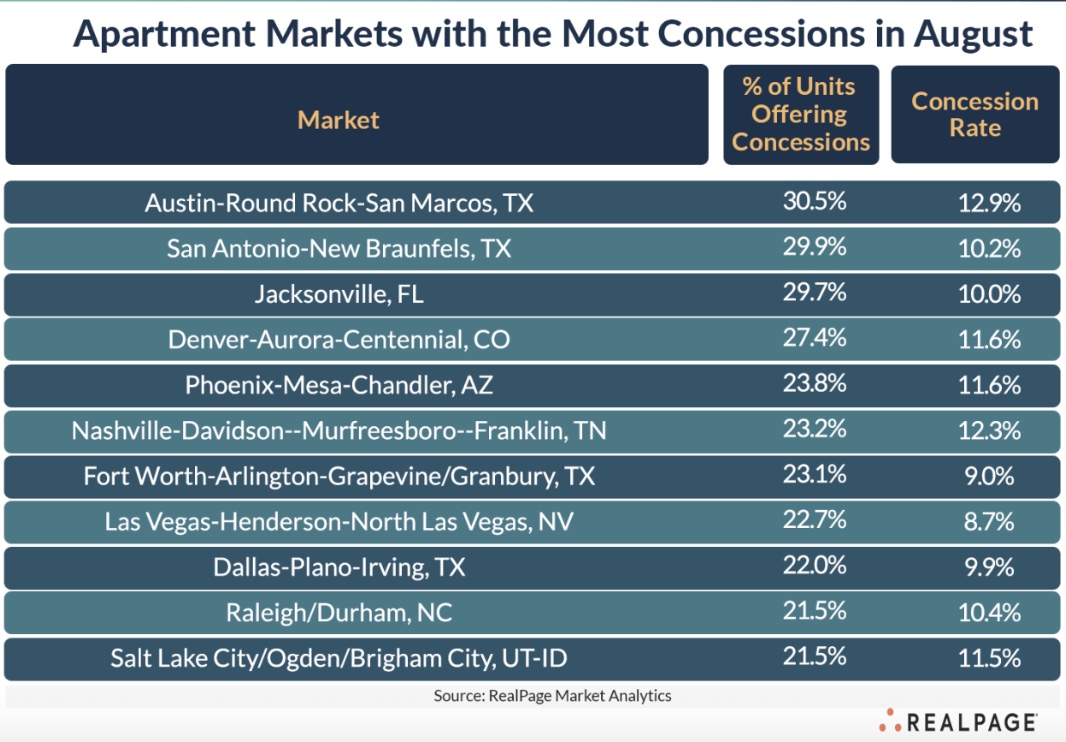

Austin topped the list among the nation’s 50 largest apartment markets, RealPage data shows. In August, 30.5 percent of Austin’s apartments were offering concessions, the highest share nationwide, with average discounts reaching 12.9 percent. Despite these offers, renter demand has remained strong, helping to absorb much of the new supply.

Just an hour south, San Antonio is also seeing heavy concession activity. Nearly 30 percent of its apartment stock offered discounts in August, according to RealPage. Zillow data from late 2024 also indicated that more than half of San Antonio’s rental listings were providing incentives such as free rent, waived fees, or utility discounts, reflecting a highly competitive market fueled by new construction.

Rental concessions rise elsewhere in Texas, as Fort Worth and Dallas follow suit, with roughly 22 to 23 percent of apartments in the Metroplex offering concessions, RealPage reports. Together, these four Texas markets rank among the top 10 nationally for rental discounts, demonstrating the state’s outsized role in the supply-driven concessions trend.

Beyond Texas, several Sun Belt metros are seeing elevated concessions, as well. Jacksonville, Phoenix, and Las Vegas reported higher discount use, likely linked to cooling demand after pandemic-era migration spikes. ApartmentIQ noted that in Q1 2025, about one in four apartment units in some major metros were advertised with a concession, averaging roughly one month of free rent, highlighting the widespread reliance on incentives. These concessions are increasingly used not just to attract new renters but also to retain existing tenants amid rising competition.

These trends illustrate a national pattern. While renters benefit from increased bargaining power, property owners face mounting pressure to balance new supply with stable rent performance. Redfin reported that median U.S. asking rents rose 2.6 percent year-over-year in August 2025, the largest increase since December 2022, underscoring how concessions and rent growth coexist in a competitive market.

In short, concessions remain a key indicator of supply-demand tensions in U.S. apartment markets. With construction pipelines still robust in much of the Sun Belt and operators increasingly turning to creative lease incentives, the use of concessions is expected to continue as a defining feature of apartment leasing strategies well into 2026.