Levin Johnston of Marcus & Millichap, one of the top brokerage teams in the U.S. specializing in wealth management through commercial real estate investments, announces that it has represented the seller and procured the buyer in the sale of a portfolio comprising three Silicon Valley multifamily properties totaling 33 units.

The Levin Johnston team of Adam Levin, Executive Managing Director; Robert Johnston, Executive Managing Director; and Jessica Tomasetti, Associate Director Investments, completed the transaction.

“The seller held these vintage assets, still largely in their original condition, for several years and was looking to trade into fully remodeled assets,” explains Levin. “We identified an opportune time to take advantage of current market conditions and sell the portfolio amidst rejuvenated interest in the Silicon Valley and San Francisco Bay Area and the region’s unmatched employment, networking, and access to high-quality urban and suburban living.”

According to research from the Brookings Institution, despite some geographical diversification, the Bay Area continues to dominate the next generation of tech, with San Francisco and San Jose unparalleled hubs of AI success. This is just one indicator of revitalized interest and shifting sentiments following pandemic-driven population outflows and the hybrid work landscape, adds Johnston.

“We were able to source a buyer attracted to the upside potential of these assets and their diversified locations within the Silicon Valley,” says Johnston. “Fundamentals are resilient, there is a continued increase in return-to-office mandates, and a resurgence of interest in living in established tech hubs and coastal markets. This is driving net absorption that is on pace with deliveries and positioning Menlo Park, Santa Clara, and Sunnyvale as stable, high-barrier submarkets.”

Levin adds that some multifamily owners are adjusting their portfolios to strategically leverage tax benefits: “Many owners are making moves with growing long-term wealth in mind. For example, the seller in this transaction, a private investor, is consolidating into two larger, more stabilized assets in the Silicon Valley and East Bay, as well as taking advantage of new accelerated depreciation schedules.”

Tomasetti adds: “It was a privilege to represent the sellers and help forge a path for the next generation to carry the family’s legacy forward. We aligned timing, financing, and tax objectives to deliver a smooth portfolio closing, and we look forward to completing their new acquisitions in the coming weeks—more than doubling their unit count.”

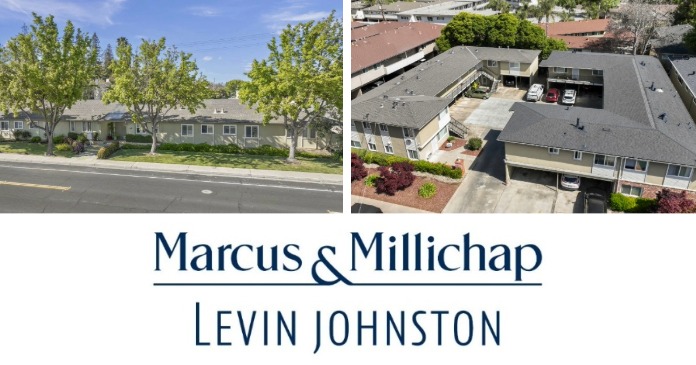

The three multifamily properties in this portfolio include:

- 700 & 710 Coleman Avenue in Menlo Park, California, a 15-unit multifamily community with one- and two-bedroom floorplans, private covered parking, and on-site laundry facilities.

- 3331 Princeton Way in Santa Clara, California, an 8-unit multifamily community with one-bedroom floorplans, a community pool, private covered parking, and on-site laundry facilities.

- 119 Crescent Avenue in Sunnyvale, California, a 10-unit multifamily community with two- and three-bedroom floorplans, private covered parking, and on-site laundry facilities.

“These communities are all uniquely positioned within submarkets of the Bay Area with strong employment fundamentals and low vacancy levels,” says Johnston. “The variety of locations, floorplans, and neighborhood lifestyle amenities appeal to a range of potential residents.”

700 & 710 Coleman Avenue is ideally located between Downtown Menlo Park and Downtown Palo Alto, providing close proximity to employers like Meta and SRI International, which is currently redeveloping its 63-acre headquarters within a mile of the community. 3331 Princeton Way positions residents near Santa Clara’s significant employment, with over 12,000 businesses including many large and renowned companies, such as Applied Materials, Hewlett-Packard, Intel, Nvidia, Oracle, and Ericsson. 119 Crescent Avenue offers excellent access to transportation key highway corridors that intersect Sunnyvale, as well as to the city’s major employers including Intel, LinkedIn, Lockheed Martin, Google, and Intuitive Surgical.

According to Compass data, median home prices in Silicon Valley increased by 30 percent between 1997 and 2000, during the dot-com boom, reaching $500,000 in 2000. During the decade between 2010 and 2020, homes in the Bay Area reached a median price of $1.6 million, with certain submarkets having median home prices that surpass $3.5 million, coinciding with the rise of social media and growth of tech giants like Meta, Google, and Apple. This high barrier to home ownership continues to create significant demand for rental housing in proximity to tech employment in particular.

This portfolio trade comes as the Levin Johnston team of Marcus & Millichap has completed 52 transactions with a total dollar volume of more than $286 million in 2025 to date.

“Activity has picked up due to a continuation of market and economic trends, driving increasing transaction numbers quarter-over-quarter,” says Levin. “Deal volume in Q2 was up 60% over Q1, and with Q3 on track to surpass that, we are well-positioned to grow our team as we continue to advise clients and close deals in the Bay Area, California, and throughout the country. In addition to multifamily, we are focused on retail, self-storage, and other product types that have seen rising demand as populations shift.”