Preleasing in the student housing sector has reached a strong level as the 2025–2026 academic year begins. According to the Yardi Matrix Student Housing September 2025 report, preleasing for the Yardi 200 schools stood at 93.7 percent in August. This was 200 basis points higher than in August 2024 and even slightly above the final fall occupancy rate of 2024. While final occupancy is still being tallied, these early results suggest another solid year for student housing performance. However, there are ongoing signs of slowing rent growth and challenges in certain large markets.

One notable trend is that many of the largest student housing markets, including Purdue, Georgia Tech, Arizona, Michigan, and Texas A&M, are leasing more slowly than in 2024. Each of these schools is roughly 3.5 percent behind last year’s pace, with preleasing in the mid-80s to low-90s.

Heavy construction pipelines in these markets have added supply pressures, making it more difficult to fill beds and sustain rent increases. The added competition has led to slower or even negative rent growth in several of these locations.

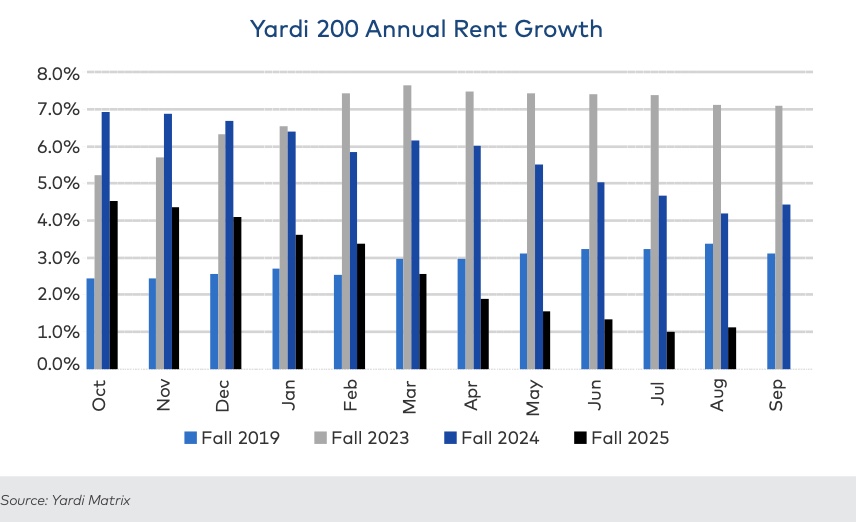

Nationally, rent growth has clearly decelerated compared to prior leasing seasons. Average rents in August 2025 were $903 per bed, up 1.1 percent year-over-year, but down from a peak of $919 in March. For much of the 2022–2024 period, rent growth averaged between five and seven percent. But growth in the past year has slipped to 2.7 percent on average and is trending downward, says the report.

The slowdown is especially pronounced in Tennessee, Arizona, Arkansas, Clemson, and Central Florida, where construction has been heavy. In some cases, early-season rent gains gave way to significant declines by late summer, with Arizona and North Texas both shifting from double-digit increases at the start of the cycle to negative rent growth by August.

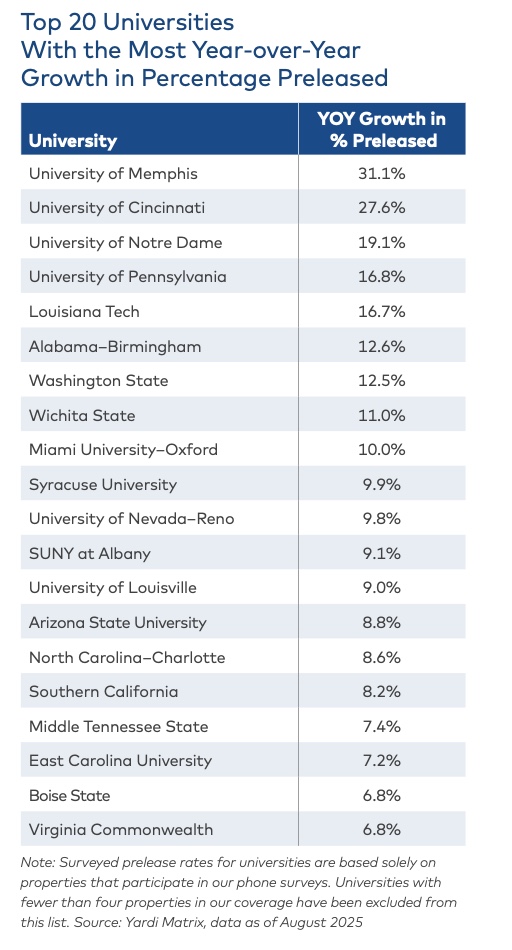

Despite these headwinds, preleasing momentum remains broadly positive. Thirty-six markets were more than 99 percent preleased in August 2025, compared to just 25 markets a year earlier. Furthermore, 91 markets recorded preleasing rates above their final occupancy levels from 2024, with some showing double-digit improvement. For instance, Cincinnati and Drexel/UPenn both outperformed last year’s occupancy by more than 10 percentage points, while San Jose State achieved full occupancy well ahead of schedule. On the flip side, 17 universities lagged by 10 percent or more compared to 2024 levels, often smaller or tertiary markets such as RPI, UT–Arlington, and Cornell.

Investors continue to monitor long-term factors that could reshape student housing demand, including university funding limitations and a projected 30–40 percent decline in international student enrollment over the coming years. While these impacts will take time to materialize, they could eventually influence leasing patterns, particularly at schools heavily dependent on foreign students.

Investors continue to monitor long-term factors that could reshape student housing demand, including university funding limitations and a projected 30–40 percent decline in international student enrollment over the coming years. While these impacts will take time to materialize, they could eventually influence leasing patterns, particularly at schools heavily dependent on foreign students.

In the capital markets, transaction activity has slowed relative to 2024, which was boosted by a large portfolio sale. As of late Summer 2025, fewer large deals have been completed, suggesting that rising interest rates and slower rent growth may be weighing on acquisition appetite.

Overall, the student housing industry enters the 2025–2026 academic year with strong occupancy fundamentals but faces challenges in sustaining rent growth. Markets with heavy new supply are under the most strain, while well-established markets with limited construction continue to post high occupancy and steadier rent performance. This divergence underscores the importance of local market dynamics in shaping student housing investment outcomes.

Access the report here.