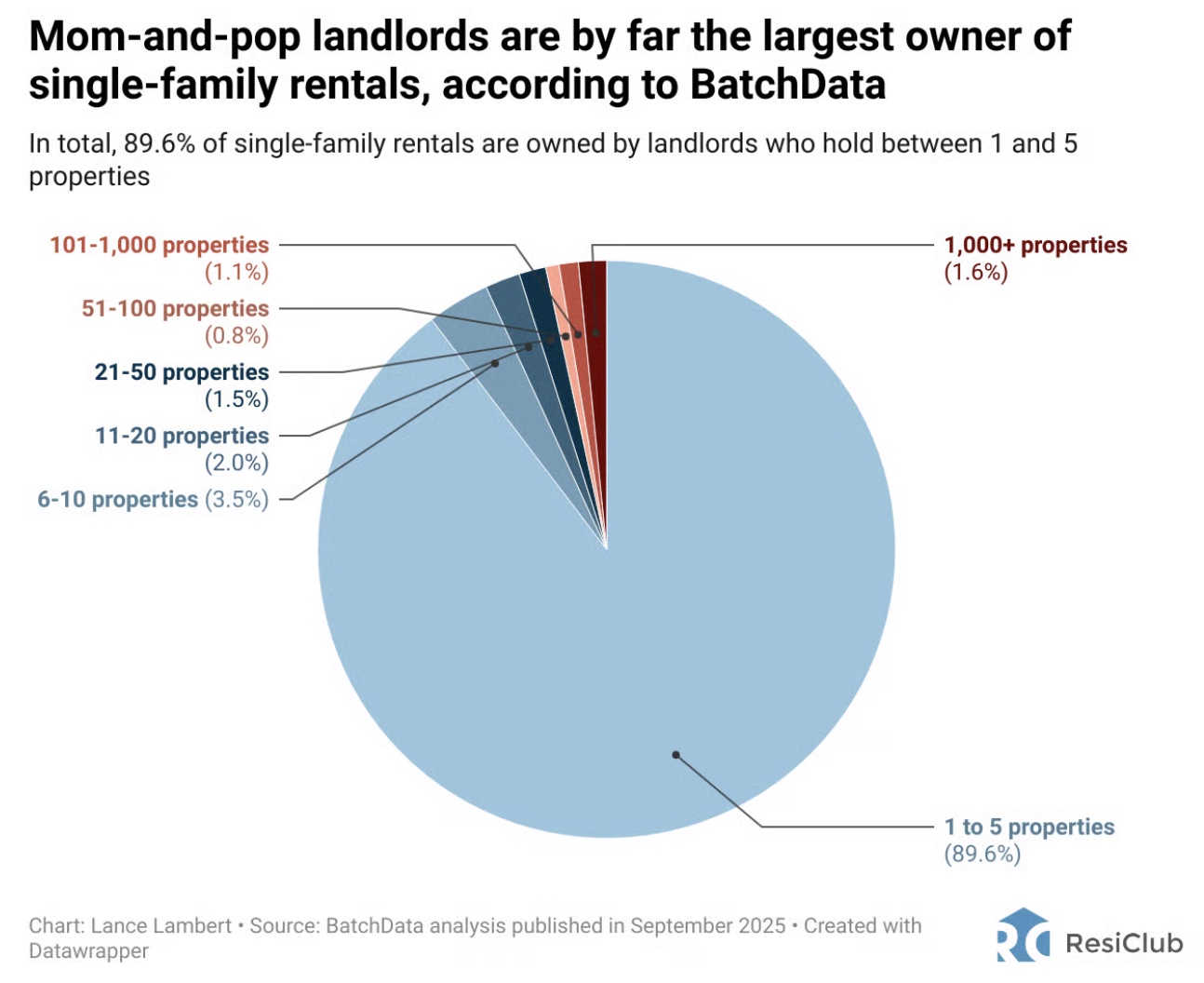

Despite the steady drumbeat of headlines about Wall Street landlords and institutional investors buying up homes, the single-family rental (SFR) market remains firmly in the hands of small-scale owners. A new analysis from BatchData on the Resiclub analytics site shows that 89.6 percent of SFR are owned by landlords holding between one and five properties. These “mom-and-pop” landlords continue to provide the backbone of the SFR market, even as build-to-rent (BTR) firms expand in certain metros and grow their BTR inventories.

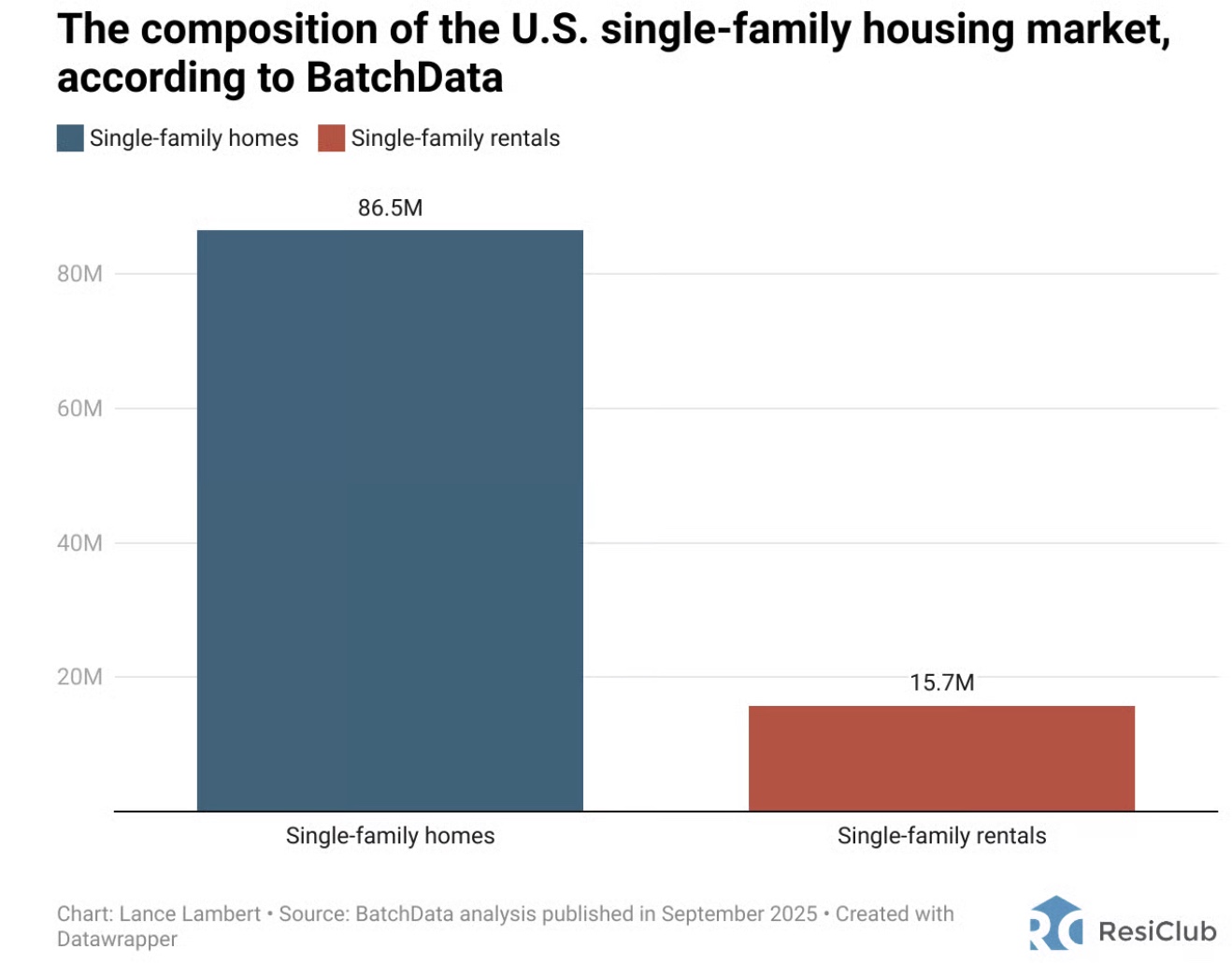

BatchData’s report calculates that the United States has 86.5 million single-family homes, of which 15.7 million are rentals. Nearly nine out of ten of those rentals belong to individuals or families who own no more than a handful of properties. That concentration underscores how decentralized the SFR market remains compared to the multifamily sector, where large institutional players dominate.

While big investors attract headlines, the actual numbers show their national footprint is modest relative to the millions of households who manage rentals locally.

BatchData’s findings suggest that small landlords are far from a monolithic group. Some are “accidental landlords,” holding on to a former primary residence instead of selling. Others see rental homes as a retirement strategy, treating properties as a supplement—or even a replacement—for a 401(k).

The short-term rental boom also drew in newcomers who saw Airbnb as a way to turn housing into a cash-flowing asset. Others hold properties in LLCs or trusts for estate planning, liability protection or inheritance purposes. Whatever the motivation, these households remain highly engaged in sustaining the rental housing supply.

Regional differences

Institutional ownership is more visible in select Sun Belt metros, where bulk acquisitions followed the 2008 housing crash. Atlanta, Phoenix, and Charlotte, for instance, have higher concentrations of corporate landlords than the national average.

The bigger institutional story today is the rise of BTR firms like Invitation Homes, AMH Homes, and Tricon Residential, which are adding thousands of purpose-built, single-family rental homes each year. With roughly 80,000 BTR units now delivered annually—around eight to ten percent of all single-family housing starts—this strategy has become the most scalable source of new SFR supply.

Mortgage market context

BatchData’s analysis comes alongside new mortgage market data that helps explain some of the SFR dynamics. According to the Federal Housing Finance Agency, 70.4 percent of homeowners with a mortgage carried an interest rate below 5.0 percent in the second quarter of 2025, down only slightly from 71.3 percent in the first quarter.

This “lock-in effect” has slowed overall housing turnover. Still, BatchData notes that life events, often described as the “three D’s” of real estate, which are death, divorce, and debt, continue to drive a baseline level of transactions. These moves ensure that some homes continue to enter rental supply even amid tight market conditions.

The investor definition debate

Adding to the confusion is how researchers define “investors.” Redfin estimated that investors purchased about 13 percent of all homes sold in the final quarter of last year. While that’s a notable share, the methodology matters. Redfin classified any buyer with corporate markers in their name, such as LLC or trust, as an investor.

That approach comingles small-scale buyers who use LLCs for liability protection or family trusts for estate planning with large institutional players. In other words, investor share often cited in headlines overstates the role of Wall Street relative to local owners.

The accidental landlord debate

A more recent wrinkle in the ownership landscape is the role of “accidental landlords,” those homeowners who rent their homes when they can’t sell at the desired price and wait for a stronger resale market.

But how much these accidental landlords matter is debated. Amherst Group LLC Chairman and CEO Sean Dobson told Jay Parsons on The Rent Roll podcast that accidental landlords are “not a meaningful contributor to supply” because of their typical shorter term hold before selling.

Tyler Perrotta of Rentvine, commenting on Parson’s LinkedIn page, agreed, calling accidental landlords “episodic and localized.” Meanwhile, data from Parcl Labs in 2024 shows spikes in homes flipping from “for sale” to “for rent” in Dallas, Houston, Phoenix, Tampa, and Atlanta. Spencer Gray of Gray Capital considers this “a contributing factor” but “immaterial” nationally.

Ryan Smith, an asset manager with Tri Arc Real Estate Partners, points out that many so-called accidental landlords locked in two to four percent interest rates and are sitting on a fair amount of equity. “They’re accidentional landlords,” he said, coining a new term. They accidentally got in at a great rate and basis, and they are intentionally choosing to rent because for now it makes sense.

In short, America’s SFR market remains firmly grounded in both deliberate local ownership and the growing BTR inventory.