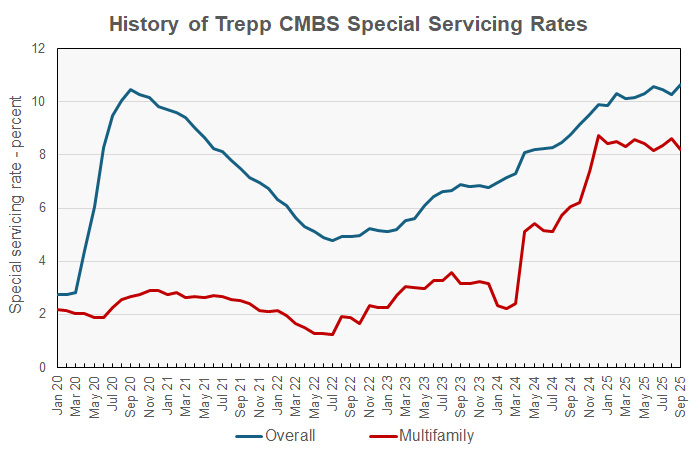

Trepp reported that the special servicing rate for multifamily commercial mortgage-backed securities (CMBS) loans fell in September. The rate has occupied a narrow range for all of 2025. By contrast, the overall CMBS special servicing rate on commercial property rose by 37 basis points in the month, reaching a multiyear high.

Multifamily CMBS special servicing rate plateaus

The special servicing rate on CMBS loans on multifamily property fell 41 basis points in September to 8.20 percent. Multifamily was the only property type to see its rate fall in the month. Since last December, the multifamily special servicing rate has occupied a narrow range with readings as high as 8.72 percent and as low as 8.18 percent. This relative stability is in marked contrast to the sharp rise in the rate that occurred in 2024 when it rose 555 basis points during the year. One year ago, the multifamily rate was 6.07 percent.

The report found that the overall CMBS special servicing rate rose to 10.65 percent, up from last month’s rate of 10.28 percent. The September rate is up 186 basis points from the level of the year before.

The recent history of multifamily and overall CMBS special servicing rates is shown in the chart, below.

The largest increase in special servicing rates this month was on that for mixed-use properties, which jumped 131 basis points to 11.95 percent. However, even this sharp rise did not fully reverse last month’s sharp fall, and it leaves the rate below its level in July. One year ago, it was 228 basis points lower at 9.67 percent.

The special servicing rate on lodging property CMBS rose 81 basis points to 9.91 percent. However, with last month’s drop, it is still below its level of 2 months ago. It is up 207 basis points year-over-year.

The special servicing rate for retail properties was up 45 basis points for the month, rising to 11.94 percent. It is up 72 basis points year-over-year.

The rate on CMBS loans on industrial properties was up 4 basis points this month, rising to 0.65 percent. One year ago, it was 0.50 percent.

The special servicing rate on office properties moved marginally higher this month rising 1 basis point. However, it remains by far the highest of the special servicing rates of the property types Trepp tracks at 16.91 percent. It is up 433 basis points year-over-year, also by far the highest gain of any of the property types.

The full Trepp special servicing rate report can be found here.