The Bureau of Labor Statistics (BLS) released its producer price index report for May 2019. It showed that overall prices for processed goods for intermediate demand fell by 0.2 percent in the month. The index was 1.1 percent higher than its year-ago level. This compares with a 1.8 percent rise in the all-items consumer price index (CPI-U) for the 12 months ending in May.

The BLS index of construction materials prices was up 0.1 percent from April 2019, after seasonal adjustment. It was 1.7 percent higher than its year-earlier level.

Multihousing Pro (PRO) compiled the BLS reported price changes for our standard list of construction commodities. These are commodities whose prices directly impact the cost of constructing an apartment building. The two right hand columns of the table provide the percent change in the price of the commodity from a year earlier (12 Mo PC Change) and the percent change in price from April 2019 (1 Mo PC Change). If no price data is available for a given commodity, the change is listed as N/A.

| Commodity | 12 Mo PC Change | 1 Mo PC Change |

| Softwood lumber | -18.0 | -0.4 |

| Hardwood lumber | -7.2 | -2.2 |

| General millworks | 2.7 | 0.5 |

| Soft plywood products | -17.8 | -0.5 |

| Waferboard and oriented strand-board (OSB) | N/A | N/A |

| Hot rolled steel bars, plates and structural shapes | 5.0 | -0.6 |

| Copper wire and cable | -1.8 | 2.9 |

| Power wire and cable | 4.1 | 1.9 |

| Builder’s hardware | 3.3 | 0.0 |

| Plumbing fixtures and fittings | 6.4 | 0.2 |

| Enameled iron and metal sanitary ware | 1.4 | 0.0 |

| Furnaces and heaters | 8.0 | 0.5 |

| Sheet metal AC ducts and stove pipe | N/A | N/A |

| Electrical Lighting fixtures | 5.5 | 0.9 |

| Nails | 4.2 | 0.0 |

| Major appliances | 4.5 | 0.8 |

| Flat glass | 1.7 | -0.2 |

| Ready mix concrete | 1.2 | 0.2 |

| Asphalt roofing and siding | 6.3 | 1.1 |

| Gypsum products | -6.3 | -2.6 |

| Mineral wool insulation | -2.6 | -7.9 |

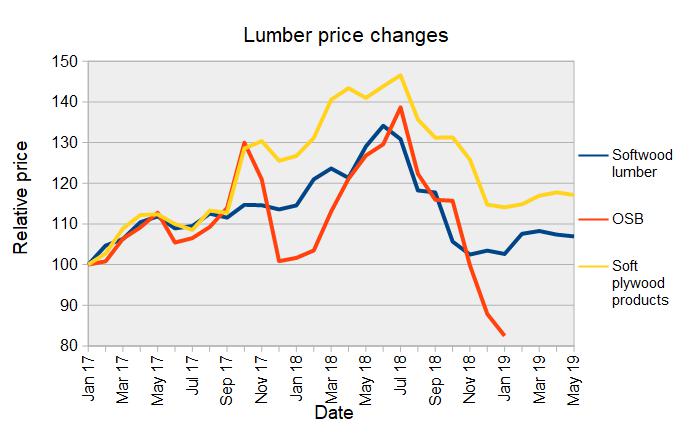

Lumber prices appear to have stabilized and have been holding in a relatively narrow range, particularly when compared to the rapid price swings seen in 2017 and 2018. Price changes for three important classes of lumber are illustrated in the first chart, below.

For the fourth month in a row, the BLS has not reported on the price of waferboard and OSB. However, a lumber industry trade publication, Random Lengths, reports that their structural panel composite price index, which is a mix of pricing of sheathing plywood and OSB, is down 40 percent over the last 12 months. Random Lengths also calculates a composite price index for framing lumber. That index is down 45 percent in the last 12 months so it would appear that they see more pricing volatility than does the BLS.

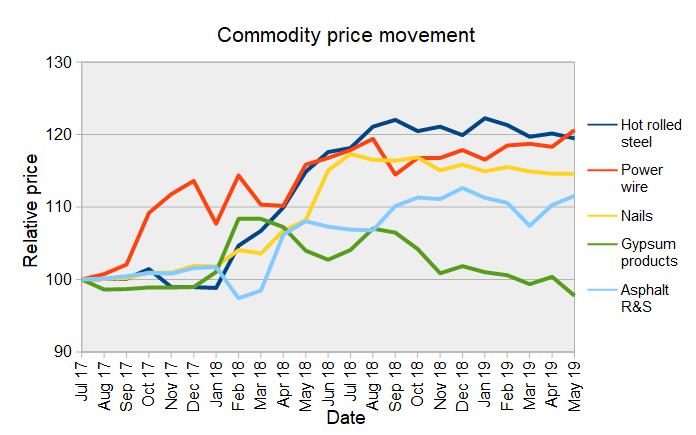

While many construction materials prices increased rapidly in 2017 and 2018, most commodities have seen less severe price increases this year. Over the last 12 months, furnaces and heaters have seen the biggest price jump at 8 percent. Other more finished goods such as electrical lighting fixtures and plumbing fixtures and fittings have also seen significant price increases lately, possibly due to higher metals prices working their way through the system. While the prices for these commodities are increasing significantly faster than the general rate of inflation, the gains are a far cry from the 30 percent increases seen in lumber products in the recent past.

Several construction materials prices which surged last year are illustrated in the next chart, below. It shows that they have largely stabilized since last fall.

The full BLS report can be found here.