The Bureau of Labor Statistics (BLS) released its producer price index report for July 2020. It showed that the BLS price index of materials and components for construction was up 0.5 percent from June, seasonally adjusted. It was 1.1 percent higher than its year-earlier level.

By contrast, overall prices for processed goods for intermediate demand rose by 1.5 percent. A 31 percent jump in the price of diesel fuel accounted for about half of the increase. Excluding food and energy, the price index for processed goods for intermediate demand was up by 0.5 percent for the month. The full index was 5.0 percent lower than its year-ago level.

For reference, the changes in these indices compare with a 1.0 percent rise in the all-items consumer price index (CPI-U) for the 12 months ending in July. The monthly increase in the index was 0.6 percent in July, matching last month’s rise.

Real average weekly earnings for all employees was down by 0.6 percent for the month of July but were still up by 4.3 percent over the last 12 months. The weekly earning statistics are being roiled by changes in the mix of job types in the economy due to COVID related shutdowns and re-openings.

Yield Pro (PRO) compiled the BLS reported price changes for our standard list of construction commodities. These are commodities whose prices directly impact the cost of constructing an apartment building. The two right hand columns of the table provide the percent change in the price of the commodity from a year earlier (12 Mo PC Change) and the percent change in price from June 2020 (1 Mo PC Change). If no price data is available for a given commodity, the change is listed as N/A.

| Commodity |

12 Mo PC Change |

1 Mo PC Change |

| Softwood lumber |

25.7 |

9.8 |

| Hardwood lumber |

-6.2 |

0.3 |

| General millworks |

1.6 |

0.3 |

| Soft plywood products |

19.2 |

20.2 |

| Hot rolled steel bars, plates and structural shapes |

-8.4 |

0.1 |

| Copper wire and cable |

-1.5 |

N/A |

| Power wire and cable |

-2.6 |

0.9 |

| Builder’s hardware |

2.0 |

-0.3 |

| Plumbing fixtures and fittings |

1.8 |

0.0 |

| Enameled iron and metal sanitary ware |

1.1 |

11.6 |

| Furnaces and heaters |

2.0 |

-1.0 |

| Sheet metal products |

-0.4 |

0.0 |

| Electrical Lighting fixtures |

-0.4 |

-4.6 |

| Nails |

-0.8 |

0.1 |

| Major appliances |

2.3 |

0.5 |

| Flat glass |

0.0 |

0.2 |

| Ready mix concrete |

2.0 |

0.1 |

| Asphalt roofing and siding |

4.1 |

2.3 |

| Gypsum products |

0.5 |

0.2 |

| Mineral wool insulation |

0.0 |

-2.6 |

Softwood lumber prices rose strongly again in July. Soft plywood product prices also jumped this month. Reports indicate that the price increases are due to lumber mills being shut down due to COVID concerns and not ramping production back up quickly enough to accommodate the increased demand caused by the resumption in construction activity. Reports that prices for raw timber have not increased support this view. If true, then the price increases currently being experienced may prove to be only temporary.

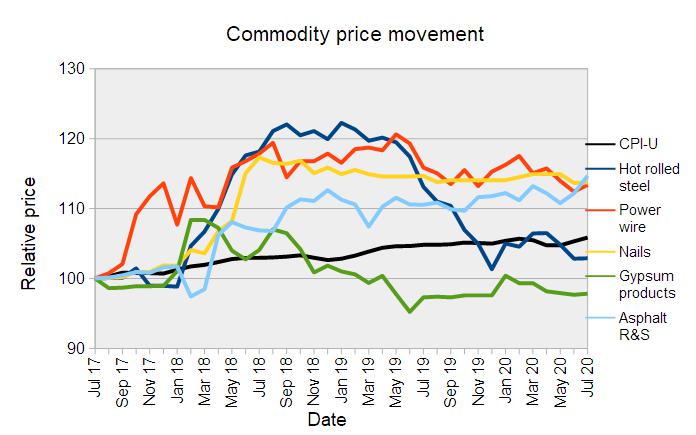

The second chart, below, shows the recent price history of several other construction materials. Unlike lumber, the prices of these construction materials have generally trended lower in recent months, although prices for asphalt roofing and siding have been edging upward. Price changes for several of the more finished goods from our sample are illustrated in the final chart, below. Last month’s plunge in the prices of enameled iron and metal sanitary ware was largely erased this month. This may indicate that the plunge was not real, but rather was due to data collection issues caused by COVID disruptions. This month, there is a similar plunge in the prices of electrical lighting fixtures, a category that has recently been exhibiting some of the highest rates of price increases. It will be interesting to see if next month’s report confirms this fall in prices or if it also proves to be anomalous.

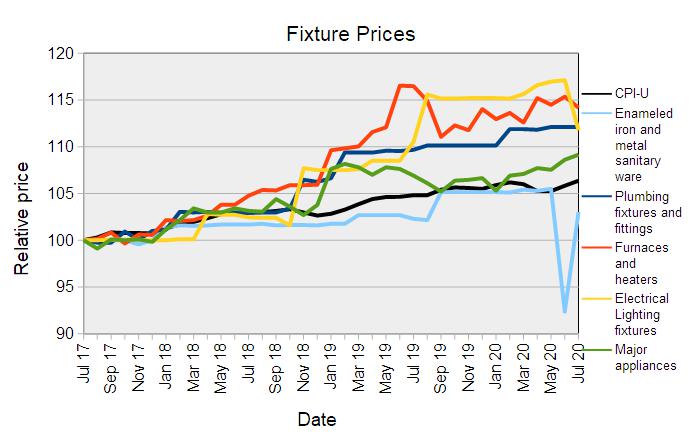

Price changes for several of the more finished goods from our sample are illustrated in the final chart, below. Last month’s plunge in the prices of enameled iron and metal sanitary ware was largely erased this month. This may indicate that the plunge was not real, but rather was due to data collection issues caused by COVID disruptions. This month, there is a similar plunge in the prices of electrical lighting fixtures, a category that has recently been exhibiting some of the highest rates of price increases. It will be interesting to see if next month’s report confirms this fall in prices or if it also proves to be anomalous.

The full BLS report can be found here.