Forecasts from Fannie Mae and from the Federal Reserve foresee continued high inflation and rising interest rates.

Fannie Mae issues a monthly forecast for the economy and for housing production. The forecast provides both quarterly and annual estimates for standard economic metrics and currently runs through the end of 2023.

The forecast from the Federal Reserve (Fed) was released in conjunction with the recent meeting of the Federal Open Market Committee (FOMC). The FOMC meets 8 times per year but only releases an economic forecast at 4 of the meetings. The Fed forecast presents estimates for economic metrics by year through 2024 and a “longer run” forecast for the more distant future. The consensus Fed forecast is developed by the combining the forecasts of 18 economists. Each of the economists assumes that the Fed will follow “appropriate” monetary policy during the term of the forecast, although their individual ideas of what this policy is may vary.

Inflation persists

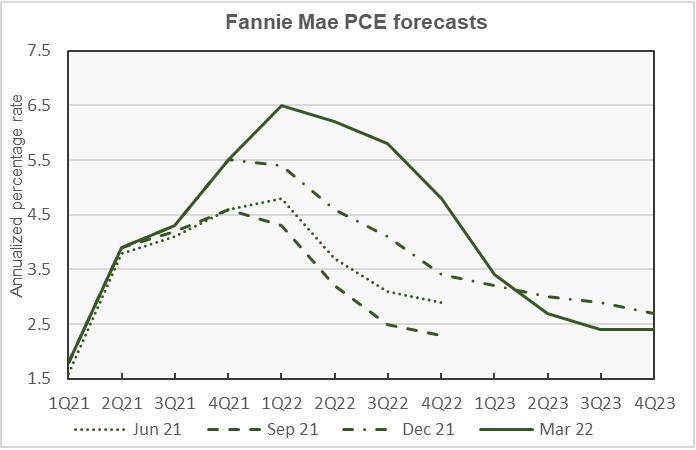

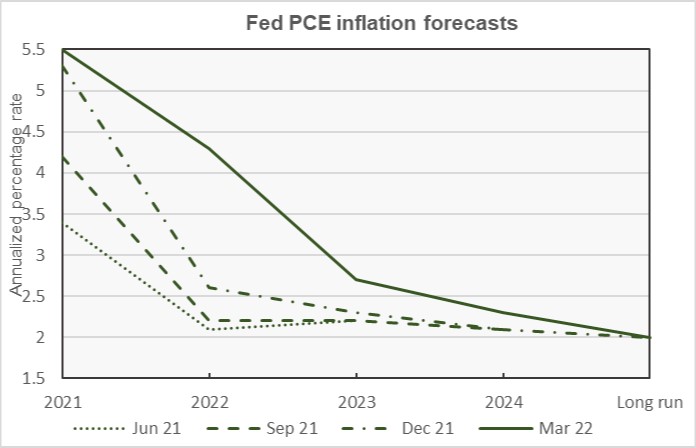

The Federal Reserve’s preferred inflation measure is based on the Personal Consumption Expenditures (PCE) survey, rather than the more familiar Consumer Price Index (CPI). Both the Fed and Fannie Mae provide forecasts for inflation as measured by the PCE, so that will be the index discussed here.

Several of Fannie Mae’s recent PCE inflation forecasts are shown in the next chart, below. The chart shows that Fannie has generally revised its forecast to call for higher inflation lasting longer as time goes by. Fannie Mae is currently calling for year-end inflation to come in at 4.8 percent in 2022 and 2.4 percent in 2023 as measured by the PCE.

The history of the Fed’s recent inflation forecasts is shown in the next chart. The current forecast predicts a much higher level of inflation in 2022 than did even the last forecast, which was released in December. The Fed now expects year-end inflation in 2022 to come in at 4.3 percent. It is expected to fall to 2.7 percent in 2023 and to 2.3 percent in 2024.

Interest rates on the way up

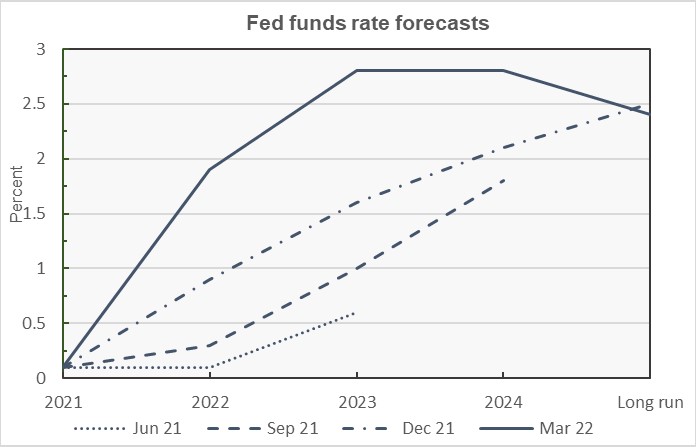

The big news coming out of the recent Fed meeting was their announcement of their first rate hike since 2018. Eight of the 9 voting members of the FOMC voted to increase the federal funds rate by 0.25 percent. The remaining governor voted for a 0.5 percentage point increase.

The Fed now expects the federal funds rate to close 2022 at 1.9 percent, up from the 0.9 percent rate predicted in December. The forecast for the federal funds rate to close 2023 was raised from 1.6 percent to 2.8 percent for and from 2.1 percent to 2.8 percent for 2024. A history of the forecasts for the federal funds rate is given in the next chart, below.

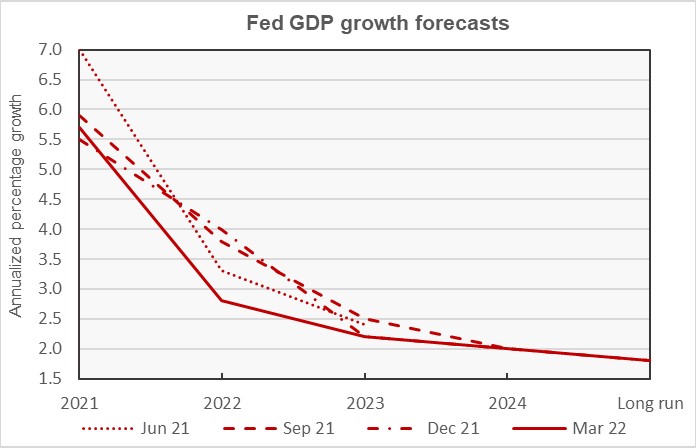

GDP: opinions vary

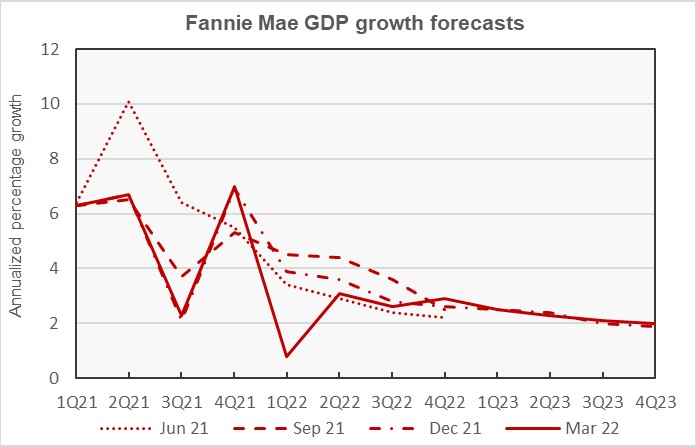

Fannie Mae’s recent forecasts for GDP growth have been impacted by the state of the pandemic. Q3 2021 growth was impacted by the Delta wave of the pandemic while Q1 2022 growth is being impacted by the Omicron wave. When the pandemic subsides, the economy bounces back. As the Omicron wave fades, Fannie Mae expects the growth trajectory of the economy to return to something akin to what they were predicting in earlier forecasts. This is shown in the next chart, below.

On a whole-year basis, Fannie Mae is now predicting GDP growth of 5.6 percent in 2021, 2.3 percent in 2022 and 2.2 percent in 2023. A recent series of Fannie Mae’s GDP forecasts is illustrated in the first chart, below.

The Fed does not release quarterly projections, instead focusing on each year as-a-whole. The Fed’s current forecast for GDP growth in 2022 is now 2.8 percent, down from the 4.0 percent they forecast in December, but higher than Fannie Mae’s prediction. However, the Fed forecasts that GDP growth will fall to 2.2 percent in 2023, marginally lower than Fannie Mae’s prediction. Recent Fed GDP forecasts are illustrated in the next chart, below.

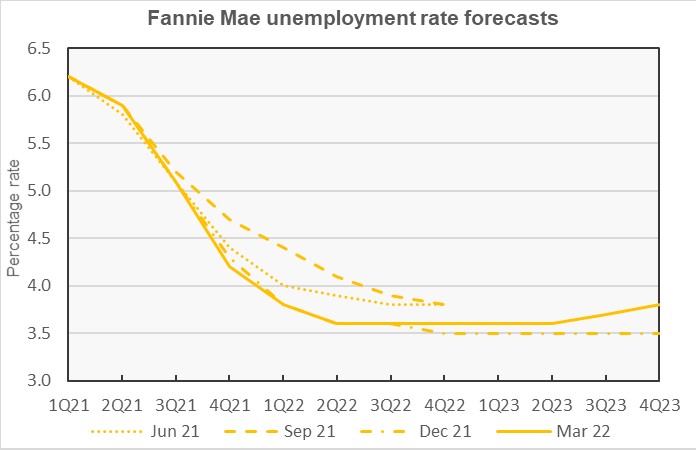

Unemployment forecasts nearly unchanged

The new forecast from Fannie Mae calls for the unemployment rate to fall in line with their recent predictions. This is shown in the next chart, below. The annual rates of unemployment predicted by the Fed are in line with Fannie Mae’s projections.

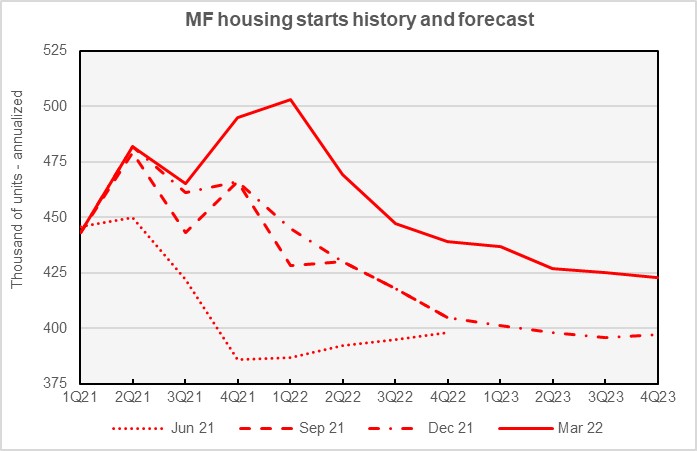

Positive outlook for multifamily housing

Fannie Mae’s forecasts for the multifamily housing construction market is shown in the next chart, along with other recent forecasts. The chart illustrates rising optimism for multifamily starts by Fannie Mae’s forecasters, although they still expect that 2021 will have a higher number of starts than either of the next two years. Fannie Mae now expects multifamily starts (2+ units per building) to be 465,000 units in 2022, up 23,000 units from the level forecast in December. The forecast for multifamily starts in 2023 was revised upward by 20,000 units to 428,000 units.

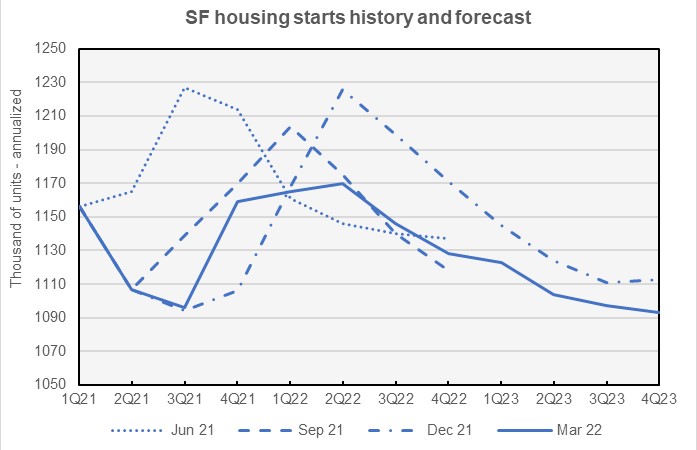

Fannie Mae’s forecasts for the single-family housing construction market is shown in the next chart below, along with older forecasts. The chart illustrates that, since the December forecast, the expectation for the number of starts in 2021 was revised up slightly but the forecasts for single-family starts in 2022 and 2023 were revised downward.

By the numbers, the forecast for single-family starts in 2022 was for 1,152,000 units. This was down by 40,000 units from the level forecast in December but was up by 13,000 units from the level in last month’s forecast. The forecast for single-family starts in 2023 was 1,104,000 units. This was down by 20,000 units from the level called for in December’s forecast and was down by 6,000 units from the level forecast last month.

This month’s Fannie Mae Multifamily Market Commentary focused on the senior housing market. It discussed the recovery of that market in the wake of the pandemic and its prospects going forward.

The Fannie Mae forecast summary can be found here. There are links on that page to the detailed economic and housing forecasts.