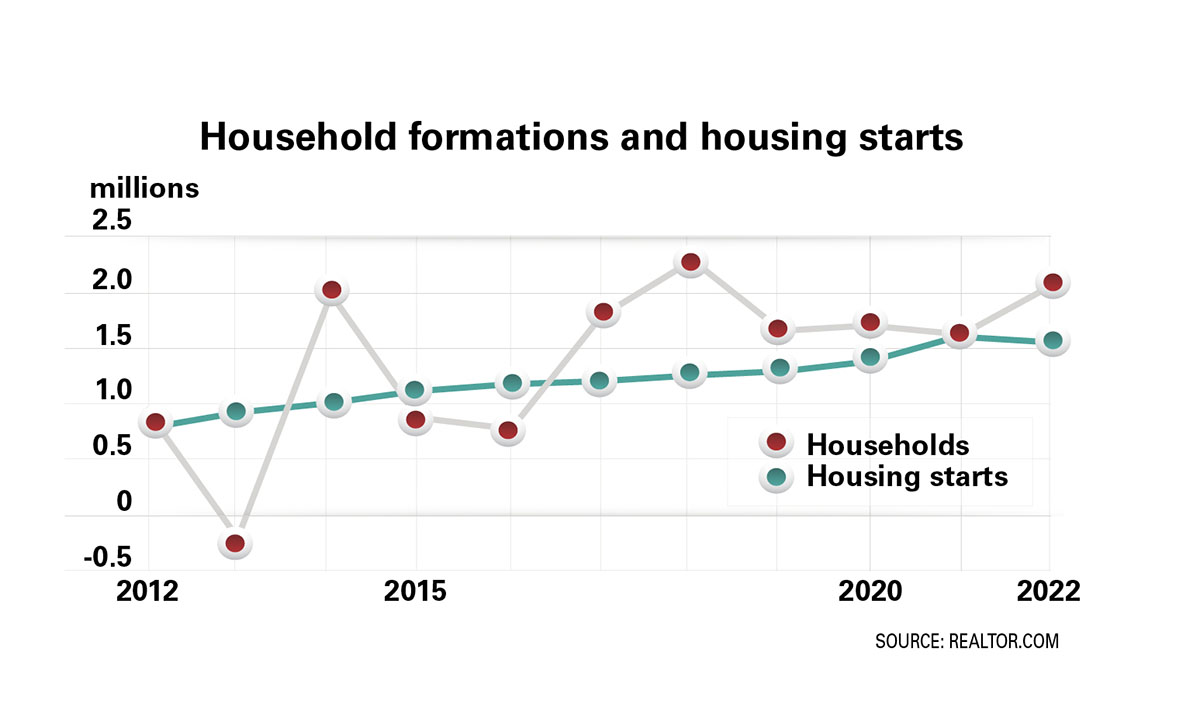

Rising costs shock affordable housing developers followed by high interest rates and volatile construction costs.

Developers are dizzy from volatile construction costs and rising interest rates.

These costs shocked developers struggling to finance plans to build and recapitalize affordable housing projects in 2022.

“Deals are tough to get done,” says Michelle Norris, senior vice president of business development and public policy for National Church Residences (NCR), based in Columbus, Ohio. “Recently, there are no deals that have come to our investment committee that have not had significant gaps in their budget.”

Affordable housing developers are committed to making deals work—filling budget gaps and finding new ways to finance mixed-income and workforce housing projects.

“We are using every creative resource we can to fill gaps,” says Norris.

Projects stalled by higher costs

As costs rose and then rose again, affordable housing developers struggled to finance and build affordable housing.

“I’ve been in the affordable multifamily business 15-plus years—and it’s been more challenging than it has ever been,” says Nick Cangelosi, senior vice president for Michaels Development, based in Camden, N.J. “Our overall tax credit affordable volume of activity is probably down 10 percent to 15 percent year-over-year, with many of our tax credit affordable starts slipping from 2022 into 2023.”

Most plans to build affordable housing are still moving forward—just much more slowly than expected. “We have our personnel and our teammates on jobs for six to eight months longer than usual given the construction delay and capital markets fluctuations,” says Cangelosi.

Federal official began to raise their benchmark “Fed Funds” interest rate in early 2022 to fight price inflation and cool an overheated U.S. economy. In February, the Fed’s target rate was 4.50 to 4.75. That’s up from almost zero the year before.

Interest rates for permanent loans climbed even more quickly as bond markets anticipated future rate hikes. The yield on 10-year Treasury bonds rose above 4.2 percent by October 2022, up from 1.5 percent at the start of the year. The yield on 10-year Treasury bonds moderated in recent months as the Fed slowed down its benchmark rate hikes.

As interest rates rose, many developers found that their plans to build affordable housing could not support as much debt as their had planned.

“As interest rates ran up, many deals had gaps too large to fill,” says Angela Kelcher, senior managing director for JLL Capital Markets. “Many developers had to go back to the drawing board.”

Higher interest rates have also dragged down the price that many investors are willing to pay for low-income housing tax credits (LIHTCs). These tax credits are the most important capital resource developers have to raise money to build new affordable housing and preserve the existing affordable housing stock.

“In a lower interest rate market, a tax credit investor is typically satisfied with a 3.5 percent or 4 percent yield, plus or minus,” says Cangelosi. “But as the Fed rates start to creep higher, banks are better off buying short-term Treasury notes.”

LIHTC prices have dropped 5 to 10 percent in the markets where banks have been the most eager to invest to satisfy the requirements of the Community Reinvestment Act (CRA). “We’ve seen even more dramatic decreases in less CRA centric markets,” says Cangelosi.

Developers stretch for solutions

Of course, affordable housing developers are used to filling holes in the budgets of their projects because of rising costs.

“The solutions are always pretty much the same,” says Norris. “You try to negotiate a better equity price. You look for soft money. You adjust the scope of the project.”

When developers plan future projects, they are working to add enough room in their budgets to handle whatever the capital markets do.

“We’re having early conversations about where their interest reserves are and where they’re headed,” says Maria Barry, national executive of community development banking for Bank of America. “They are coming up with solutions to ensure they’ve got enough money to get their projects completed.”

However, in the last year, the rising interest rates combined with rising construction costs to make financing affordable housing even more difficult.

“Rising interest rates—it is the dance,” says Norris. “By the time you get it solved there is a new gap caused by construction costs increasing.”

The price of lumber has finally moderated after rising through the roof earlier in the recovery from the pandemic. Prices have also been volatile for sheetrock, windows and other key materials.

“We’re cautiously optimistic that we will see construction costs moderate or start to come down a little bit,” says Barry.

Other products have simply become unavailable when developers need them.

“I have heard of delays in appliances, elevators and switch gear to name a few,” says Barry. “Some developers are ordering products much earlier in the process than historically to ensure they have them on hand.”

Developers are punished when their construction projects miss deadlines for their completion.

“We have downward tax credit adjusters, so that if we are not delivering units based on a commitment that we made to our equity investor, they’re going to pay us less equity,” says Cangelosi.

A delayed project might also lose a commitment for permanent financing. “Renegotiating it would be in an entirely different universe almost with higher interest rates,” says Barry.

Soft financing rescues projects

Many state and local housing officials are also helping affordable housing developers with new commitments of soft financing to patch holes in project budgets.

“There is still an amazing amount of soft money available from all the bills that Congress passed since COVID,” says NCR’s Norris. “It’s a lot of money. It’s more money than any of us have seen in our lifetime.”

States from New Jersey to Florida are expanding their soft financing programs for affordable housing.

“We’re extremely optimistic,” says Michaels’ Cangelosi. “We’re already seeing it throughout the country.”

Affordable developers are also hoping that interest rates will stabilize in 2023.

“The general consensus is that the first half of this year is going to be tough and then we’re going to see it improve towards the latter half of the year as inflation is brought under control and the risk of recession hopefully diminishes,” says JLL’s Kelcher.

Interest rates don’t need to fall for developers to successfully close more deals. Interest rates simply need to become more predictable.

“People can deal with higher rates,” says Triloki Kaushal, managing director of affordable lending for Greystone. “What they can’t deal with is uncertainty.”

Fun with workforce housing

As developers struggle to finance and build traditional affordable housing with financing tools like LIHTCs, some developers are experimenting with new tools to build housing workforce housing.

“The Agency lenders are rolling out new programs to address the workforce segment,” says JLL’s Kelcher.

For example, owners who commit to keep apartments affordable to low- and moderate-income renters can receive lower interest rates from Fannie Mae lenders through Sponsor Initiated Affordability (SIA) program. Often these properties receive no other federal or state housing subsidies.

“Developers that have traditionally been pure market-rate developers are now looking at these mixed-income buildings, especially given the focus that Fannie Mae and Freddie Mac and other capital sources have on mission providing workforce housing,” says Greystone’s Kaushal.

Other partners are stepping forward to support workforce housing. Michaels Development recently partnered with Walt Disney World to build nearly 1,300 homes in Orlando, Fla.

“Employers or the city or the state are coming to the table,” says Michaels’ Cangelosi.

These partners can offer land well below market value, provide property tax abatements or relief on infrastructure or impact fees or permit fees—all to drive down the cost for the residents.

Author Bendix Anderson