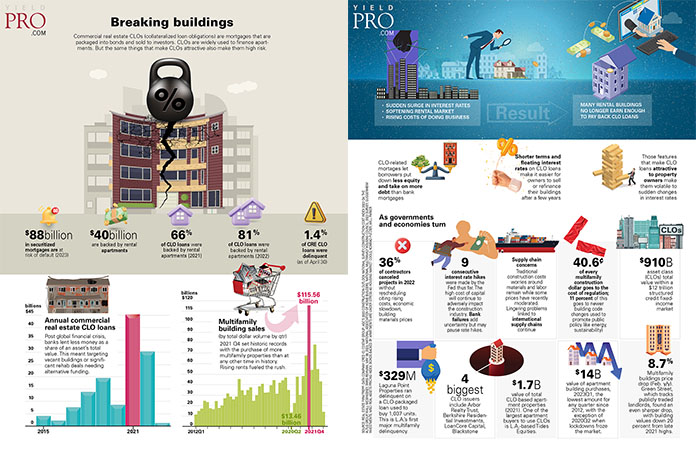

Breaking buildings Commercial real estate CLOs (collateralized loan obligations) are mortgages that are packaged into bonds and sold to investors. CLOs are widely used to finance apartments. But the same things that make CLOs attractive also make them high risk.

- $88 billion in securitized mortgages are at risk of default (2023)

- $40 billion are backed by rental apartments

- 66% of CLO loans were backed by rental apartments (2021)

- 81% of CLO loans were backed by rental apartments (2022)

- 1.4% of CRE CLO loans were delinquent (as of April 30)

Annual commercial real estate CLO loans

Post global financial crisis, banks lent less money as a share of an asset’s total value. This meant targeting vacant buildings or significant rehab deals needing alternative funding.

Multifamily building sales (by total dollar volume by qtr)

2021 Q4 set historic records with the purchase of more multifamily properties than at any other time in history. Rising rents fueled the rush.

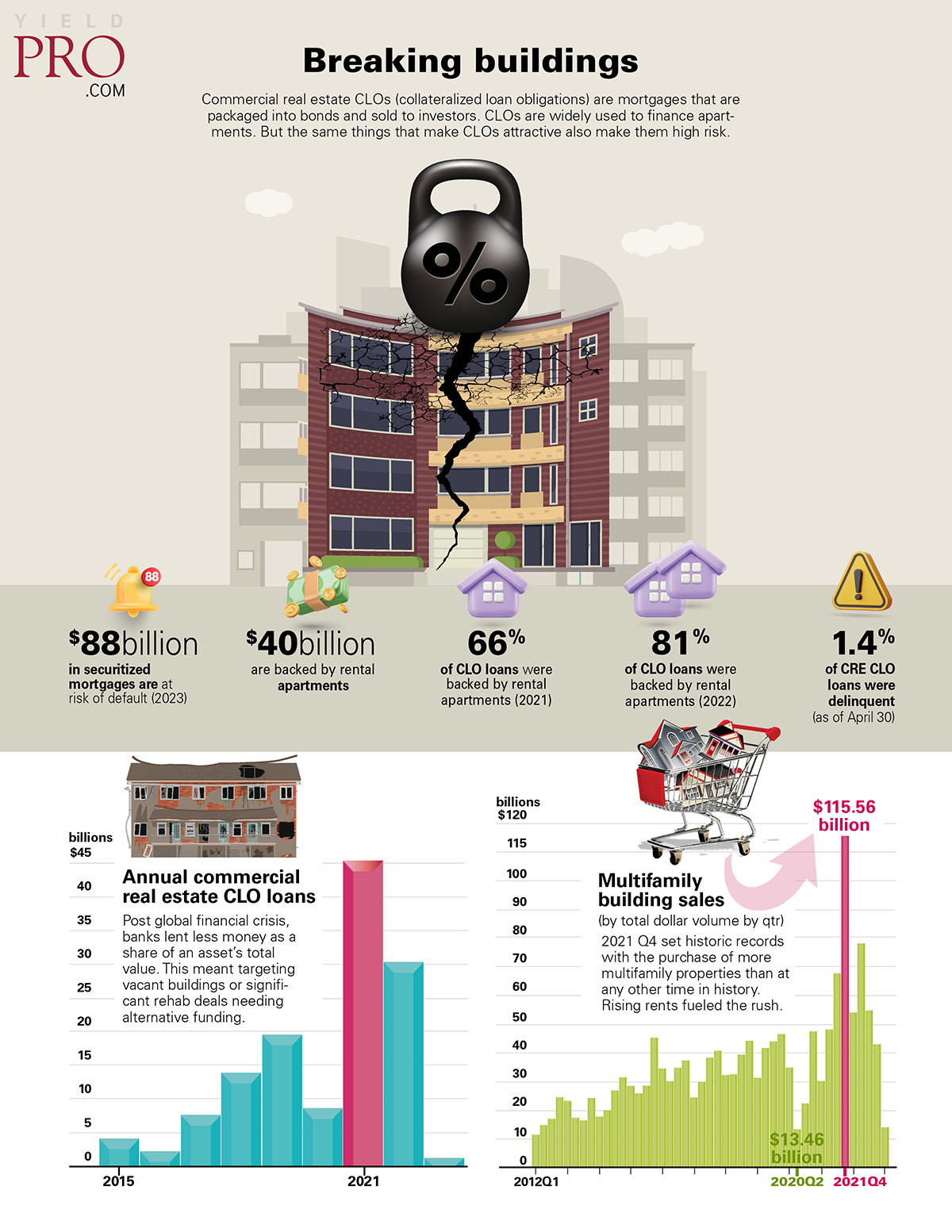

- Sudden surge in interest rates

- Softening rental market

- Rising costs of doing business

Results in:

- Many rental buildings no longer earn enough to pay back CLO loans

CLO-related mortgages let borrowers put down less equity and take on more debt than bank mortgages

Shorter terms and floating interest rates on CLO loans make it easier for owners to sell or refinance their buildings after a few years

Those features that make CLO loans attractive to property owners make them volatile to sudden changes in interest rates

As governments and economies turn

- 36% of contractors canceled projects in 2022 without rescheduling citing rising costs, economic slowdown, building materials prices

- 9 consecutive interest rate hikes were made by the Fed thus far. The high cost of capital will continue to adversely impact the construction industry. Bank failures add uncertainty but may pause rate hikes.

- Supply chain concerns Traditional construction costs worries around materials and labor remain while some prices have recently moderated. Lingering problems linked to international supply chains continue

- 40.6¢ of every multifamily construction dollar goes to the cost of regulation; 11 percent of this goes to newer building code changes used to promote public policy like energy, sustainability)

- $910B asset class (CLOs) total value within a $12 trillion structured credit fixed- income market

- $329M Laguna Point Properties ran delinquent on a CLO-packaged loan used to buy 1,037 units. This is L.A.’s first major multifamily delinquency.

- 4 biggest CLO issuers include Arbor Realty Trust, Berkshire Residential Investments, LoanCore Capital, Blackstone

- $1.7B value of total CLO-based apartment properties (2021). One of the largest apartment buyers to use CLOs is L.A.-based Tides Equities.

- $14B value of apartment building purchases, 2023Q1, the lowest amount for any quarter since 2012, with the exception of 2020Q2 when lockdowns froze the market.

- 8.7% Multifamily buildings price drop (Feb. y/y). Green Street, which tracks publicly traded landlords, found an even sharper drop, with building values down 20 percent from late 2021 highs.