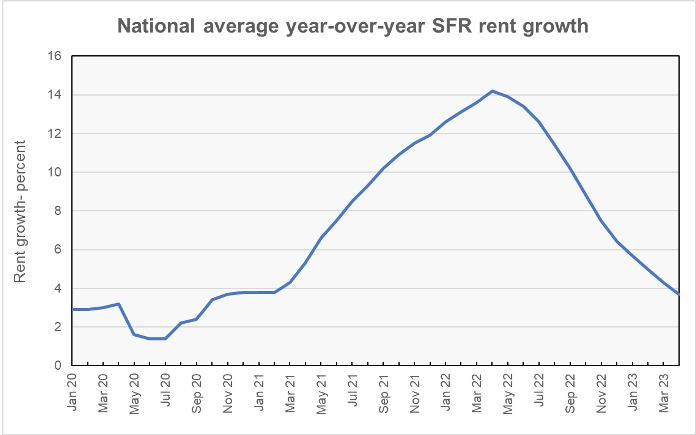

CoreLogic reported that their single-family rent index (SFRI) for April rose 3.7 percent from its year-earlier level. This is down from the 4.3 percent SFR rent growth reported last month. It also marks 12 straight months of decline since the recent rent growth rate peak of 14.2 percent in April 2022.

Viewing changes over time

The recent history of the overall SFRI is shown in the first chart, below.

The chart shows that the rate of growth in single-family rents has been falling steadily since peaking in April 2022. While the rate of SFR rent growth is still above the pre-pandemic rate of around 3 percent, it continues to fall rapidly. It may soon drop below the pre-pandemic level.

For comparison, Yardi Matrix found that single-family rent growth in April was 2.3 percent. However, Yardi Matrix focuses on properties of 50 or more units while CoreLogic takes a broader look at the single-family rental market.

Segmenting the market

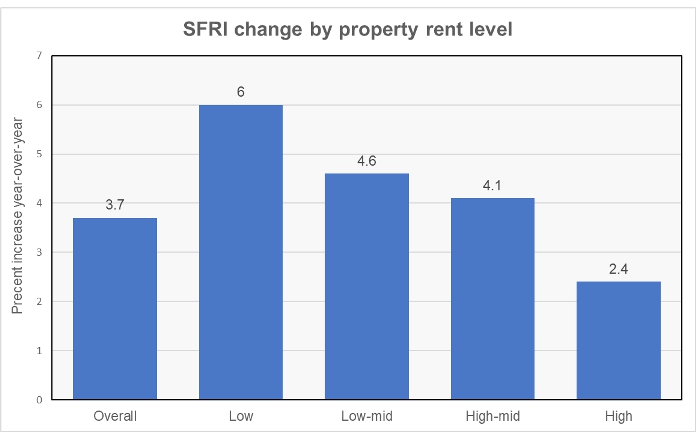

In addition to the overall SFRI, CoreLogic calculates rent growth by the relative asking rent for the property in its market. It divides properties into 4 groups: those prices at 75 percent or less than the regional median (Low), those priced at 75 to 100 percent of regional median (Low-mid), those price at 100 to 125 percent of regional median (High-mid) and those priced above 125 percent of regional median. The results for April 2023 are shown in the next chart, below.

The chart shows that rent growth is higher for lower priced properties with the rate of rent growth for the lowest-priced tier of properties being over twice that of the highest-priced tier.

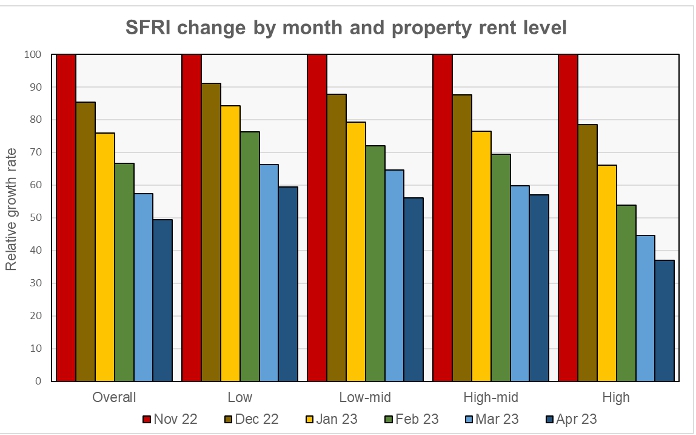

The last chart shows the relative rate of decline in rent growth over time by rent level. Each cluster of bars shows the ratio of the rates of rent growth measured for that property rent level for the last 6 months compared to its level 6 months ago. It shows that the 6-month decline in the rates of rent growth for the low, low-mid and high-mid property rent levels are all pretty similar. However, the relative decline in the rate of rent growth for the high rent level properties has been significantly greater.

Looking at metros

CoreLogic reports the year-over-year rate of growth in the SFRI for a select group of metropolitan areas. Charlotte leads the list again this month with SFR rent growth of 6.9 percent. Boston (6.2 percent), Orlando (6.0 percent), Chicago (5.9 percent) and New York (5.7 percent) round out the top 5 metros. At the other end of the scale are Las Vegas (0.1 percent) and Phoenix (-0.8 percent). Phoenix was the only one of the 20 listed metros to see single-family rents fall.

CoreLogic is a data and analytics company. It calculates the SFRI using “a repeat pairing methodology to single-family rental listing data in the Multiple Listing Service.” The CoreLogic report is available here.