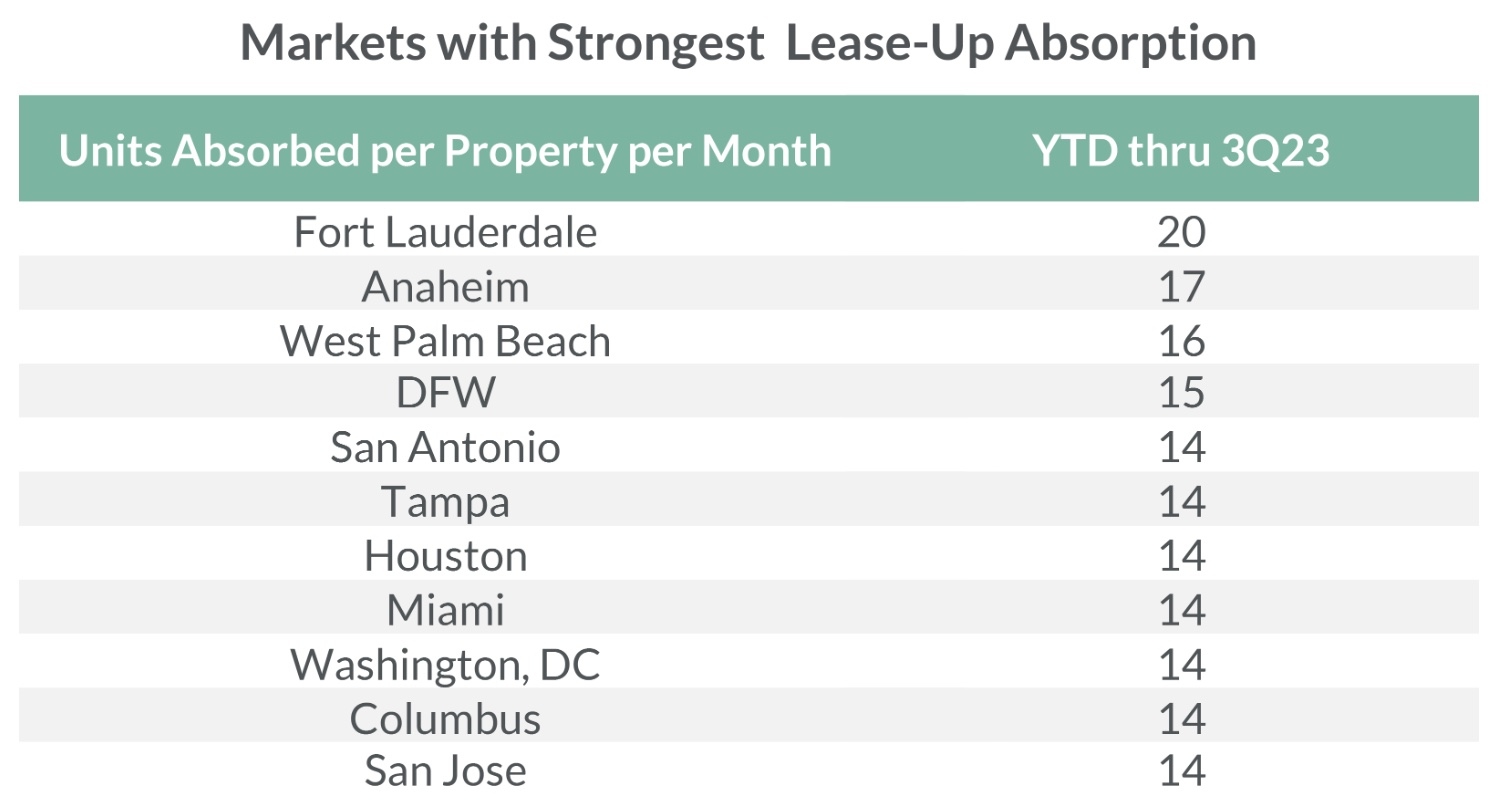

Comparing markets by strength of apartment lease-up absorption sheds light on market-adjusted demand.

Jay Parsons, RealPage SFV and chief economist, warned earlier this year that the glut of new apartment deliveries could result in a challenging 2023 leasing season. As apartment construction nears a 50-year high, RealPage compares the absorption strength of new apartment product in lease-up to provide a better picture of local market performance.

If new lease-ups take longer than expected to build up their initial base of renters, concessions among those assets may increase, writes Carl Whittaker, RealPage director of research and analysis.

Controlling for average property level absorption on a per month basis (or units absorbed per property per month) helps derive a baseline of lease-up demand in a market. This in turn makes it simpler to compare markets. For example, he said, the absolute number of units working through lease-up in a market like Columbus will never match that of larger metros like Los Angeles. Therefore, the per property per month measure helps provide a better market-adjusted demand snapshot.

Regionally, the South Florida markets of Fort Lauderdale, West Palm Beach and Miami make the top spots on RealPage’s demand leaderboard, according to RealPage Market Analytics data.

All the major Texas markets show strong demand for luxury product, except Austin, where the sheer volume of new supply is watering down the average number of units absorbed per property.

New product lease-up absorption in Baltimore, Greensboro, New York and San Jose increased this year compared to last. Meanwhile, Austin, Miami, Minneapolis, Newark and Orlando saw the sharpest slowdown in year-over-year lease-up absorption, declining more than 50 percent.

Most West Coast markets show up on the weak absorption list. But, lease-up demand in Orange County and San Jose has been stronger than their West Coast regional peers.

The Sunbelt, meanwhile, seems to be absorbing new supply fairly well, although absorption is outpaced by new product deliveries.

Considerable impact to existing assets is already being felt in high supply markets and submarkets, especially among Class B properties, writes Whittaker. He expects the increase in available apartments will lead to more competition for both existing and lease-up assets, as more construction projects reach the lease-up stage.