Class B apartment properties outperformed their luxury siblings in 2023, and most analysts expect they will continue outperforming in 2024. Berkadia concluded that data published in a December 2023 report entitled, “Is the trophy asset still winning” supports the adage that Class B is the place to be.

Class B apartments have outperformed for several years, but have become more desirable given recent economic uncertainty. A November 2023 survey conducted by CoStar’s Apartments.com found that 80 percent of renters have been impacted by inflation and nearly all expect to experience financial strain for least the next six months.

When combined with the flood of mostly Class A product deliveries last year, it isn’t surprising that luxury apartments saw rent prices decline, ending 2023 down 0.4 percent, according to Apartments.com.

Cushman and Wakefield lists Class B outperformance as one of the top trends across its 178,000-unit managed portfolio, attributing the resilience of the Class B sector to a few factors:

• Renters in this subset form the backbone of the U.S. economy: teachers, firefighters, policemen et. al, – jobs that are resilient during economic headwinds and offer a degree of recession resistance.

• Most new development is targeted toward Class A renters, given construction costs versus rents. Fewer than a third of the roughly 1 million units underway today will serve the Class B/workforce housing market.

• In a bear market/recession, job loss results in renters needing to save on costs. By trading down to a Class B apartment, renters stand to save an average 30 percent on rent. In recent quarters that premium has narrowed, but is still much wider than the historical average.

RealPage Analytics estimates that owners renting Class-A units would have to offer at least three-months free rent to price their units competitively with Class B.

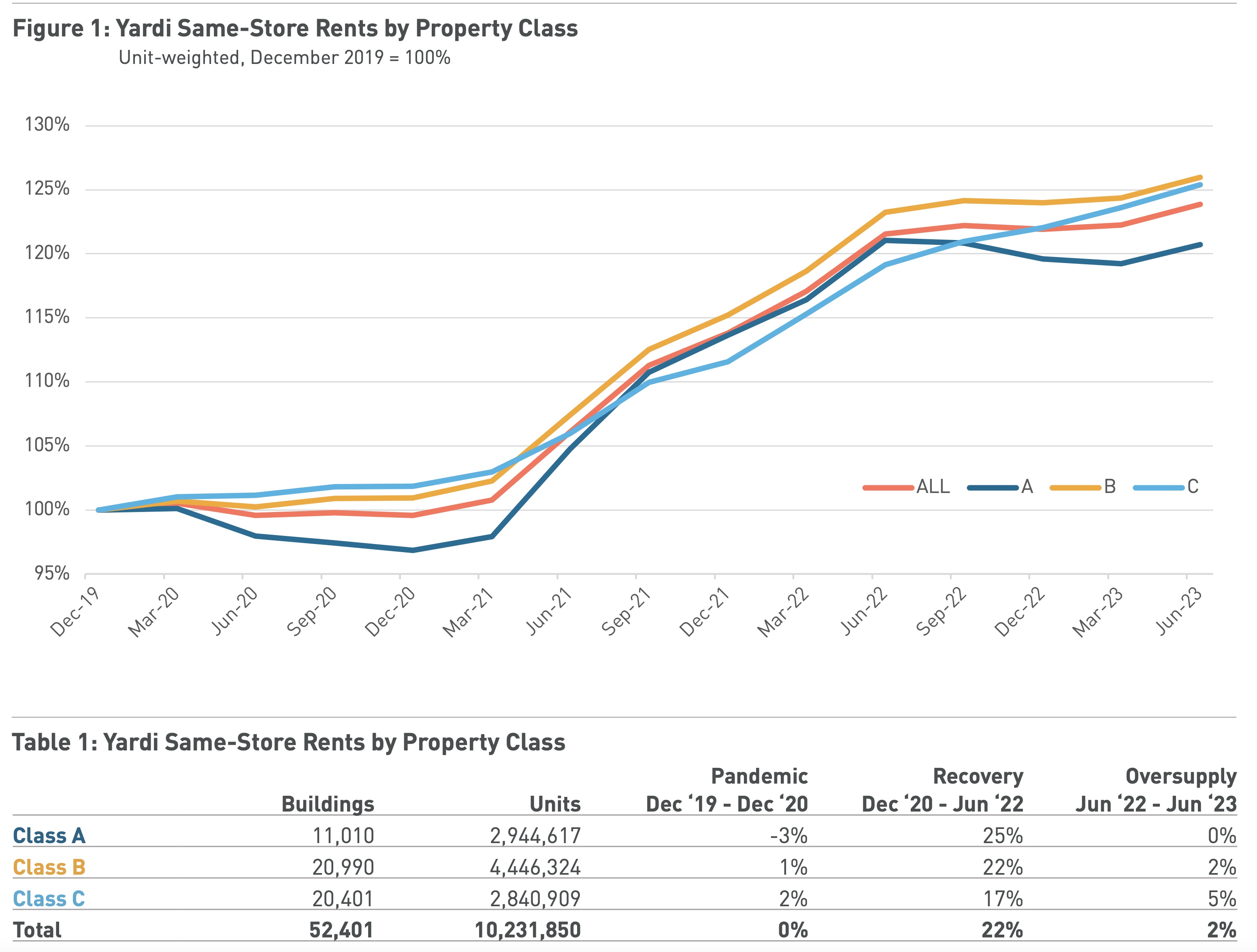

Berkadia conducted an evaluation of multifamily performance by property class through and after the COVID-19 pandemic, beginning with a look at same-store rents reported by Yardi. Using effective rents reported at the unit level for more than 52,000 properties and 10 million units, the data showed a clear pattern. In relatively weak periods like the height of lockdown and again since the middle of 2022, Class A was the weakest performer and Class C the strongest. When rents were accelerating, between year-end 2020 and the middle of 2022, Class A was best performer, while Class C posted more tepid if consistent gains and Class B was consistently in the middle.

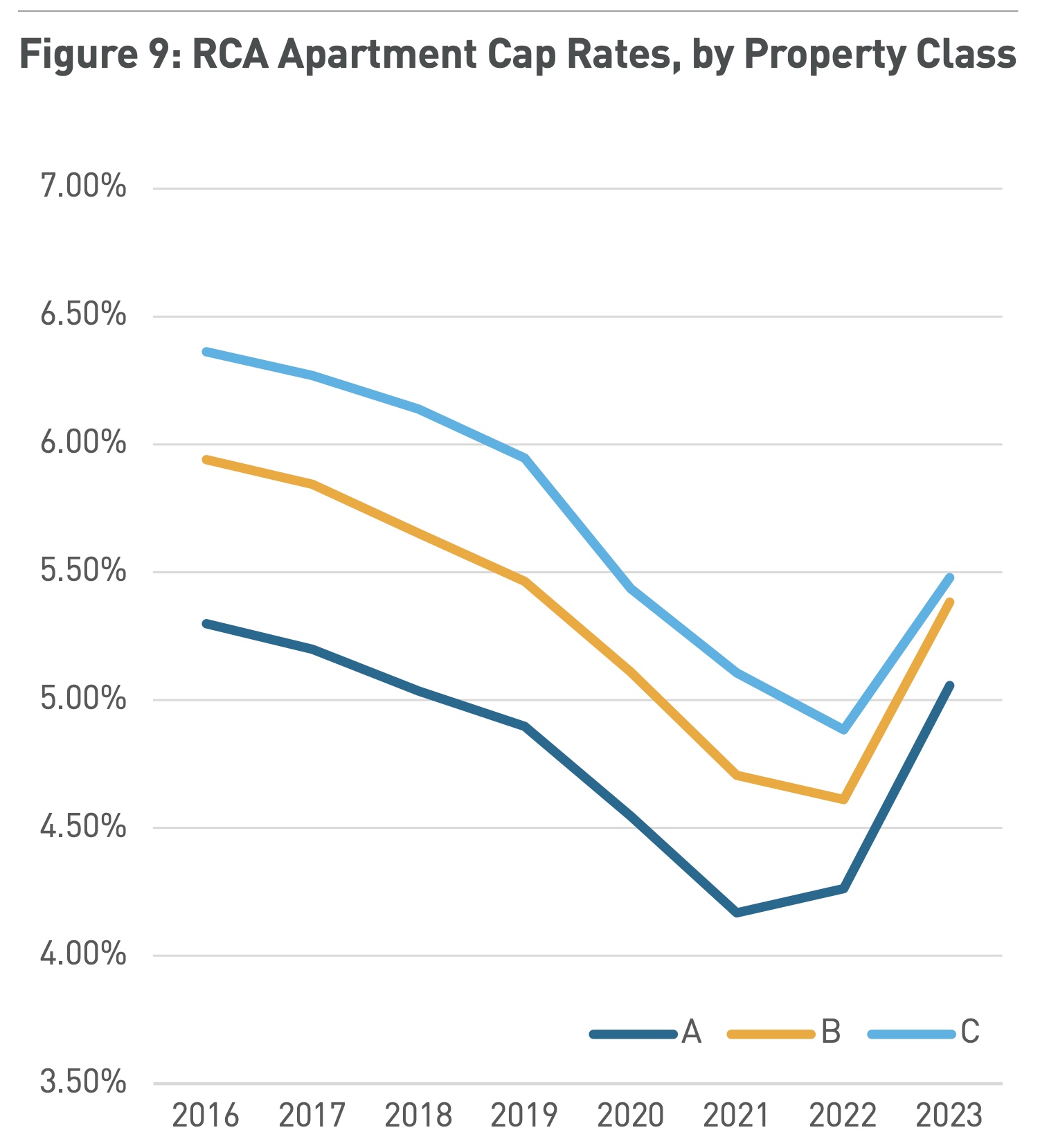

Berkadia also looked at cap rates as reported by RealPage analytics. The chart below shows that since the pandemic started, the basis between Class A and Class C cap rates shrank from 100 to 110 basis points to just 42 basis points by the end of 2023.

“We speculate that investors may question whether Class A deserves its trophy status after its lackluster results in both the early stages of the pandemic and again today. As that 42 bps premium for Class A product still translates to an additional cost equal to 1.5 years of earnings relative to Class C, its fair to ask whether buying trophy assets is still the winning investment strategy,” writes Berkadia’s analysts.

One way to protect a portfolio from the downside is by investing in Class B/C value-add assets, concludes Berkadia. “It’s a strategy that has proven to be highly resilient for a number of investors, even during the depths of previous recessions.”