Fannie Mae issued a multifamily market forecast this month predicting instability and cloudy skies in 2024.

“Our prediction of turbulence in the multifamily market last year was correct, and it appears that it is likely to continue into 2024,” states the report.

Below average rent growth, rising concessions. oversupplied metros and subdued demand are some of headwinds facing the multifamily market in the year ahead.

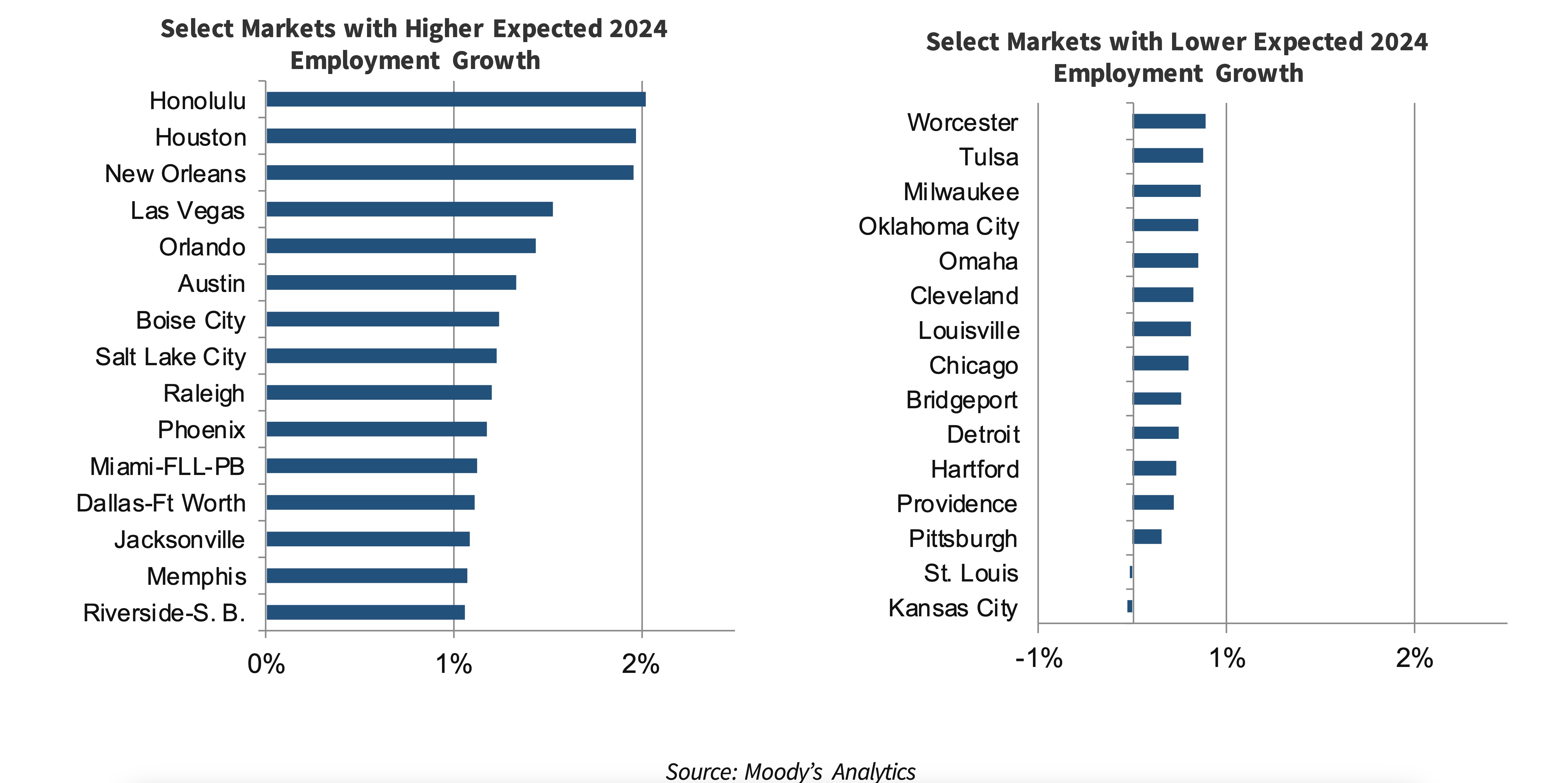

Further softening in rental demand and negative rent growth in Q1 2024 are expected as new supply enters the market, especially during the normally slow lease-up period, and again during Q4, due to the additional stressor of expected slower job growth.

Nationally for much of 2023, rental demand remained positive due to elevated interest rates, smaller-but-continued wage increases, stronger-than-expected job growth and an overall shortage of housing, especially for-sale housing, keeping many renters-by-choice renting.

Year-over-year job growth is again expected to be positive, but subdued by the end of 2024. The slight increase in the number of new jobs likely will keep new multifamily rental demand weak, just as the elevated pipeline of new units are expected to deliver, according to Fannie Mae’s latest economic forecast.

Last year, metros with higher numbers of new supply, like Austin, Phoenix, and Jacksonville, saw negative rent growth over the past six to 12 months, while supply-constrained metros, like Kansas City, Cincinnati and St. Louis, saw above average rent growth, according to RealPage.

Fannie Mae expects supply and demand will again vary by metro this year. In high-supply markets, the GSE expects flat to negative rents, resulting in higher concession rates and more owners offering them at the localized submarket level. In other undersupplied metros, Fannie Mae expects positive rent growth, but not at levels sufficient enough to dramatically alter the overall national outlook.

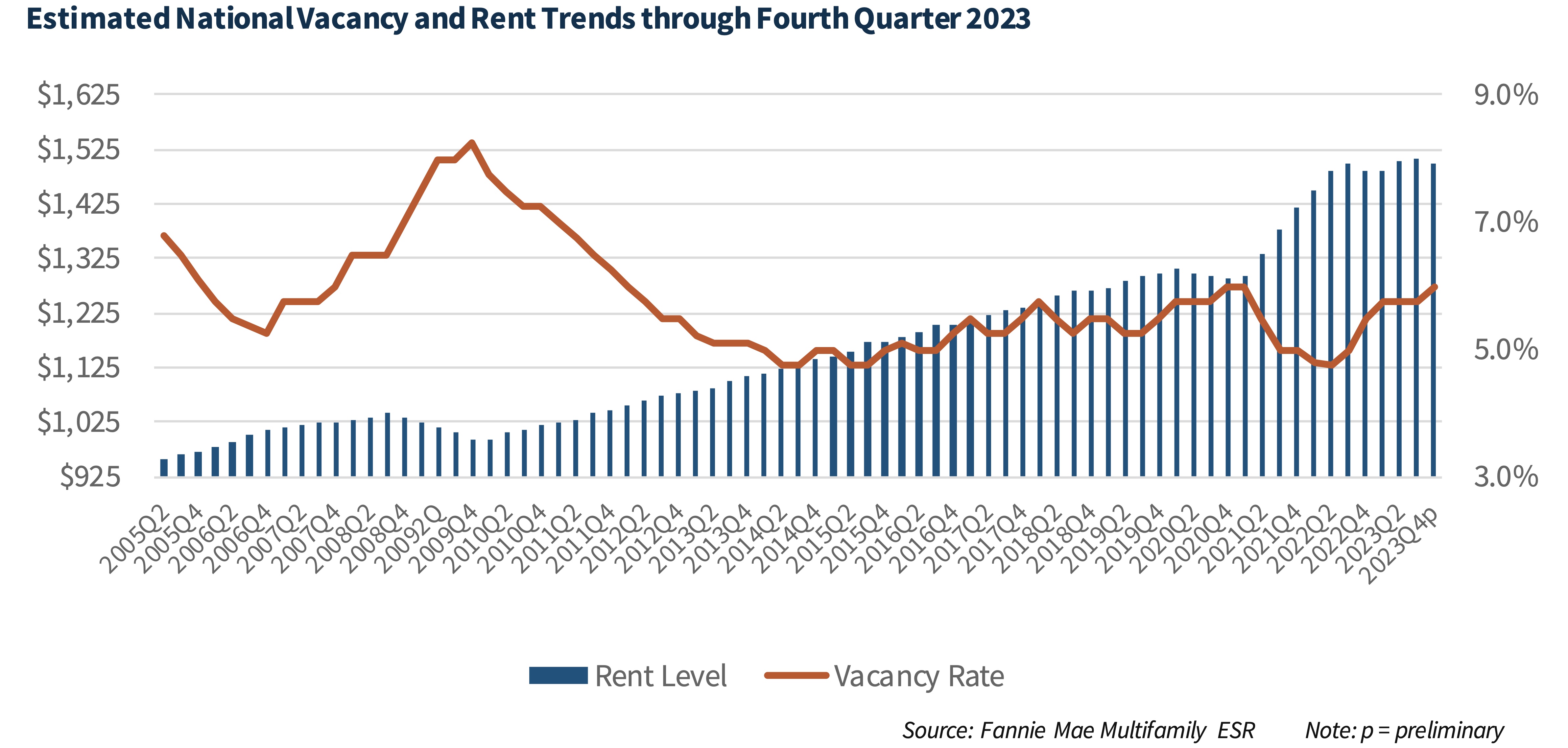

Supply also pushed the vacancy rate higher last year and vacancy is expected to rise again this year as new units deliver, adding to the more than 500,000 units already added in 2023.

As a result, Fannie Mae expects new supply completing over the next 12 months will push the national vacancy rate up to 6.25 precent. “It is important to note that this elevated level is expected to be short-lived and to drop back down to 6 percent by 2025,” states the report.

Additionally, a vacancy level of six percent to 6.25 percent is not that much higher than the long-term average of 5.75 percent from 2005 through 2022, said Fannie Mae.

Multifamily origination volume levels are expected to remain subdued. As of October 2023, the Mortgage Bankers Association estimates multifamily origination volume at $285 billion in 2023 and $339 billion in 2024, subject to change. But, based on current trends, Fannie Mae’s estimates of annual multifamily originations are slightly lower this year at $255 billion to $275 billion in 2023 and $295 to $325 billion in 2024.

In conclusion, Fannie Mae predicts continued softness in demand from both renters and investors, and doesn’t anticipate a return to more normalized trends until mid-2025.