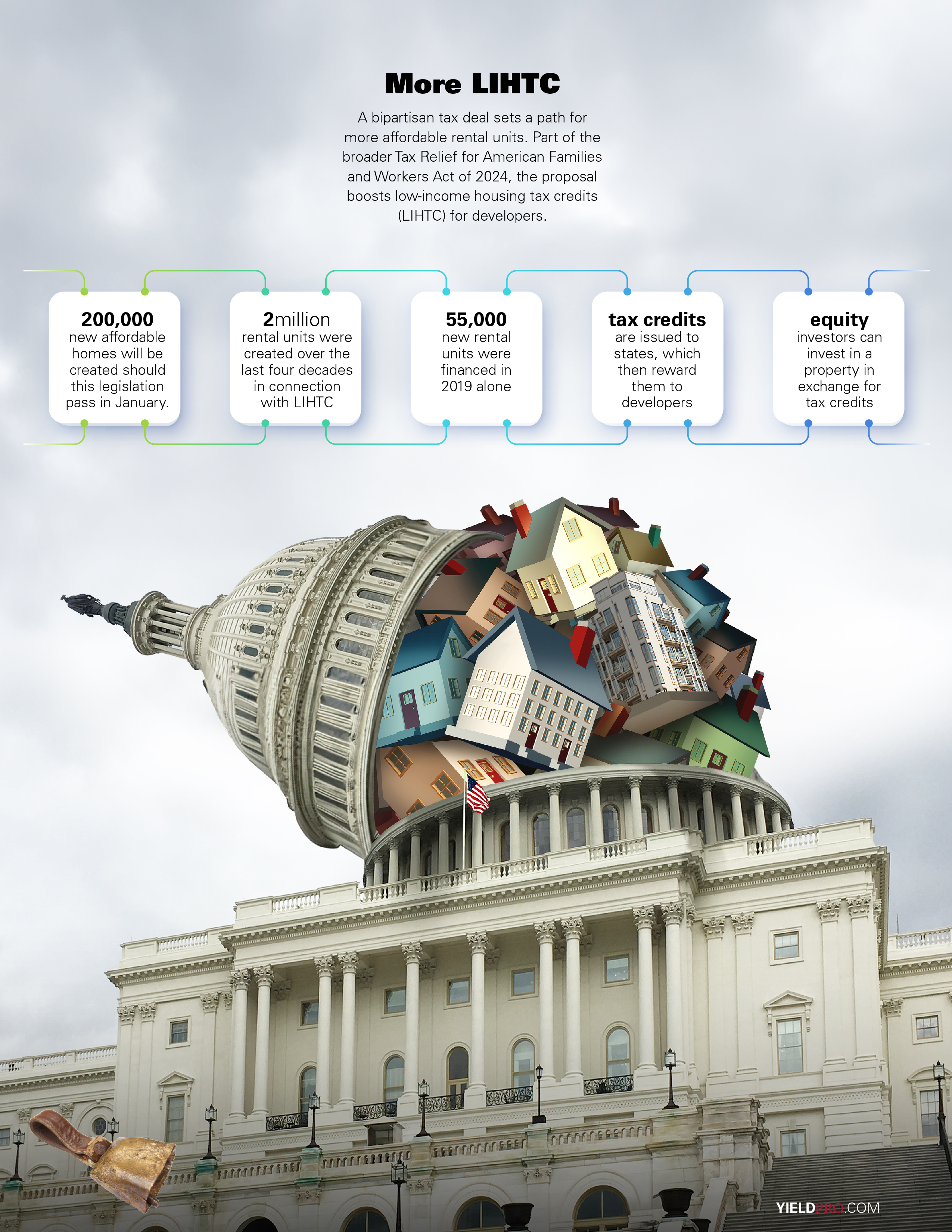

A bipartisan tax deal sets a path for more affordable rental units. Part of the broader Tax Relief for American Families and Workers Act of 2024, the proposal boosts low-income housing tax credits (LIHTC) for developers.

200,000 new affordable homes will be created should this legislation pass in January.

2million rental units were created over the last four decades in connection with LIHTC

55,000 new rental units were financed in 2019 alone

tax credits are issued to states, which then reward them to developers

equity investors can invest in a property in exchange for tax credits

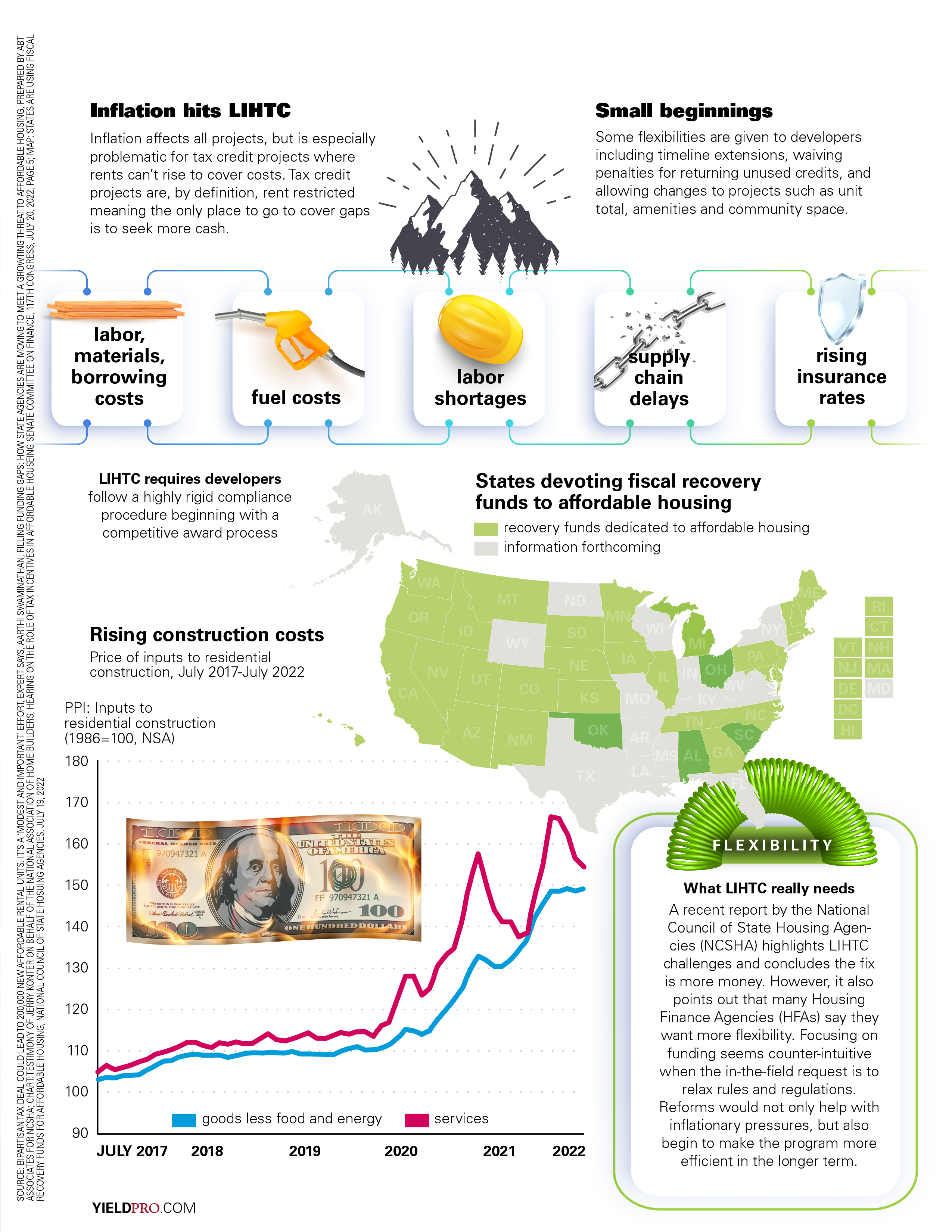

labor, materials, borrowing costs

fuel costs

supply chain delays

rising insurance rates

LIHTC requires developers follow a highly rigid compliance procedure beginning with a competitive award process

Rising construction costs Price of inputs to residential construction, July 2017-July 2022 (chart)

States Devoting Fiscal Recovery Funds to Affordable Housing (map)

Nearly 70 percent of the agencies responding (31 of 46 agencies) expect their states to devote fiscal recovery dollars to affordable housing activities, while 22 percent (10 of 46) do not. This decision has yet to be made in the remaining states.

STATE……………… FRF $ AMOUNT

California……………… $4.75 billion

Massachusetts……… $960 million

Nevada………………… $536 million

District of Columbia. $531 million

Pennsylvania………… $425 million

Colorado……………… $378 million

New Jersey…………… $345 million

Illinois………………….. $285 million

Rhode Island………… $250 million

North Carolina……… $205 million

Vermont………………. $159 million

Michigan……………… $130 million

Delaware…………… $114.2 million

Washington……….. $102.7 million

Utah……………….. $100.3 million

Georgia……………… $100 million

Iowa………………….. $100 million

New Hampshire….. $100 million

Maine…………………. $61.5 million

Arizona………………….. $50 million

Connecticut……………. $50 million

Idaho…………………….. $50 million

South Dakota…………. $50 million

Nebraska…………….. $39.5 million

Minnesota……………… $27 million

New Mexico…………… $25 million

Kansas…………………… $20 million

Hawaii………………… $16.3 million

Montana……………….. $15 million

Tennessee……………… $15 million

Oregon……………….. $13.9 million

Oklahoma, Ohio, Alabama, South Carolina more information to follow

Flexibility: What LIHTC really needs A recent report by the National Council of State Housing Agencies (NCSHA) highlights LIHTC challenges and concludes the fix is more money. However, it also points out that many Housing Finance Agencies (HFAs) say they want more flexibility. Focusing on funding seems counter-intuitive when the in-the-field request is to relax rules and regulations. Reforms would not only help with inflationary pressures, but also begin to make the program more efficient in the longer term.

SOURCE: BIPARTISAN TAX DEAL COULD LEAD TO 200,000 NEW AFFORDABLE RENTAL UNITS. IT’S A ‘MODEST AND IMPORTANT’ EFFORT, EXPERT SAYS, AARTHI SWAMINATHAN; FILLING FUNDING GAPS: HOW STATE AGENCIES ARE MOVING TO MEET A GROWTING THREAT TO AFFORDABLE HOUSING, PREPARED BY ABT ASSOCIATES FOR NCSHA; CHART: TESTIMONY OF JERRY KONTER ON BEHALF OF THE NATIONAL ASSOCIATION OF HOME BUILDERS, HEARING ON THE ROLE OF TAX INCENTIVES IN AFFORDABLE HOUSEING SENATE COMMITTEE ON FINANCE, 117TH CONGRESS, JULY 20, 2022, PAGE 5; MAP: STATES ARE USING FISCAL RECOVERY FUNDS FOR AFFORDABLE HOUSING, NATIONAL COUNCIL OF STATE HOSUING AGENCIES, JULY 19, 2022