The Census Bureau’s new residential construction report for January showed rising level of multifamily construction completions. However, both multifamily permits and starts were down sharply for the month. If this trend continues, it would indicate that a significant slowdown in multifamily construction activity is coming.

The number of multifamily units under construction fell in January as completions outpaced starts. This decline continues the trend that has been in place since July 2023.

The report on single-family housing construction showed that, on a seasonally adjusted basis, single family permits rose 1.6 percent month-over-month and 35.7 percent year-over-year to 1,015,000 units. Starts fell 4.7 percent month-over-month while rising 22.0 percent year-over-year to 1,004,000 units. Completions fell 16.3 percent month-over-month and 15.8 percent year-over-year to 857,000 units. The reported number of single-family units under construction rose 5,000 from the revised level of the month before to 680,000 units.

Multifamily housing permits fall sharply

The number of permits issued for buildings with 5 or more units in January was reported to be 405,000 units on a seasonally adjusted, annualized basis. This is the lowest monthly issuance since April 2020, when the pandemic shutdowns impacted activity. Permit issuance was down 9.0 percent (40,000 units) from December’s revised (-4,000 units) figure. January permits were down 26.6 percent from the level recorded in January 2023 and were also down 20.1 percent from the trailing 12-month average.

In addition, 50,000 permits were issued in January for units in buildings with 2 to 4 units. This was up 1,000 units from the revised (-3,000 units) figure for December. January permits for units in buildings with 2 to 4 units were down 7.4 percent from the year-ago level and were down 2.8 percent from the trailing 12-month average.

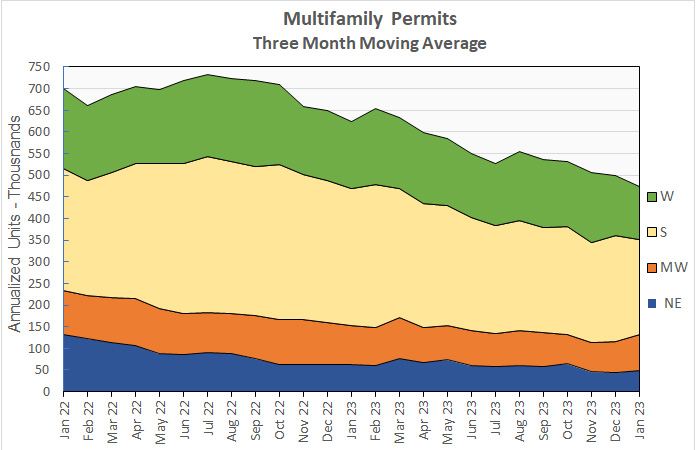

Regional data for multifamily housing is only reported for structures with two or more units. “Structures with 5 or more units” is not broken out as a separate category. Since the regional data is highly volatile and is frequently revised, it is examined here based on three-month weighted moving averages. This averaging helps smooth out the month-to-month variations in the data so that underlying trends are more visible.

Nationally, the three-month weighted moving average for permits issued for multifamily housing in January was down 4.9 percent from the level in December and was down 24.1 percent from the level of January 2023. The three-month weighted moving average for permits came it at 474,000 annualized units.

On a month-over-month basis, the three-month weighted moving average for multifamily permit issuance was up 15.5 percent in the Midwest and 12.5 percent in the Northeast. Permit issuance fell 10.1 percent in the South and 11.8 percent in the West.

When compared to year-earlier levels, the three-month weighted moving average of permits issued was again down in all regions of the country. Permits fell 8.5 percent in the Midwest, 19.7 percent in the Northeast, 21.2 percent in the West, and 30.8 percent in the South.

The following chart shows the three-month weighted moving averages of permits by region for the last 25 months.

Multifamily housing construction starts plunge

The preliminary January figure for multifamily housing starts in buildings with 5 or more units per building was 314,000 units on a seasonally adjusted, annualized basis. This was reported to be down 175,000 units from the revised (+72,000 units) figure for December.

Compared to the year-earlier level, multifamily housing starts in buildings with 5 or more units were down 37.9 percent. The reported starts figure was 32.2 percent lower than the trailing 12-month average.

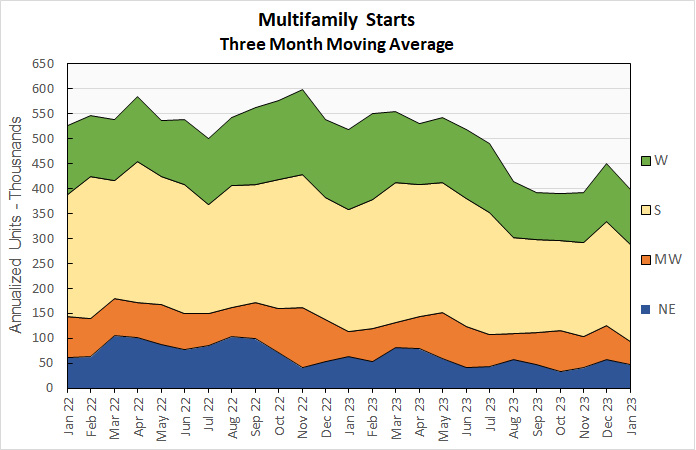

Multifamily housing construction starts (two or more units per building) in January were down 11.7 percent from their December level for the country as-a-whole, based on three-month weighted moving averages. Starts fell 6.0 percent in the South, 6.2 percent in the West, 18.2 percent in the Northeast and 32.7 percent in the Midwest.

The three-month weighted moving average of starts was down 23.5 percent for the country-as-a-whole on a year-over-year basis. Compared to January 2023, starts were down 9.2 percent in the Midwest, 20.1 percent in the South, 25.7 percent in the Northeast, and 32.2 percent in the West.

The following chart shows the three-month weighted moving average of starts by region for the last 25 months.

Multifamily housing completions continue climb

The preliminary January multifamily housing unit completions figure in buildings with 5 or more units per building was 538,000 units on a seasonally adjusted, annualized basis. This was reported to be up 6.3 percent (32,000 units) from December’s revised (-3,000 units) figure.

Compared to the year-earlier level, multifamily housing completions in buildings with 5 or more units per building were up 53.7 percent. Compared to the trailing 12-month average, completions were up 21.8 percent.

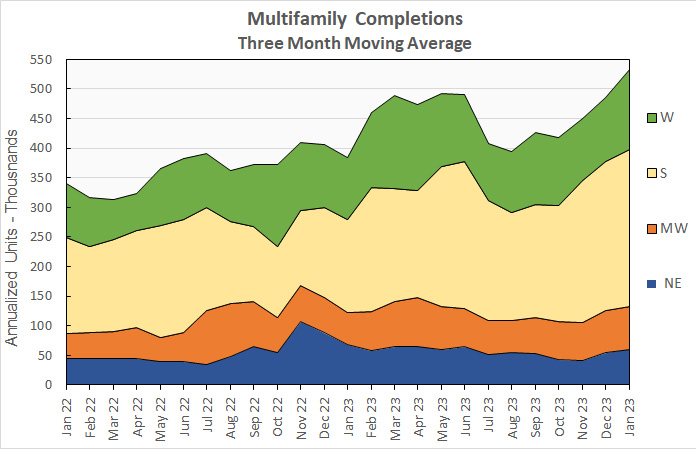

For the country as-a-whole, multifamily housing construction completions (two or more units per building) were up 9.9 percent month-over-month, comparing three-month weighted moving averages. The three-month weighted moving average of completions was up 26.3 percent in the West, 10.4 percent in the Northeast, 5.1 percent in the South and 1.7 percent in the Midwest.

On a year-over-year basis, the three-month weighted moving average of completions in buildings with 2 or more units per building was up 38.6 percent nationally. Completions were up 68.5 percent in the South, 32.7 percent in the Midwest and 28.9 percent in the West. Completions fell and 11.3 percent in the Northeast.

The three-month weighted moving average of completions by region for the past 25 months are shown in the chart below.

The number of multifamily units reported to be under construction fell in January. Census reported that there were 979,000 units under construction in buildings with 5 or more units per building on a seasonally adjusted annualized basis. This was reported to be down by 9,000 units from the revised (-2,000 units) level of the month before. It is 5.0 percent, or 47,000 units, higher than the number of units under construction one year earlier.

All data quoted are based on seasonally adjusted results and are subject to revision.