One of ten unintended consequences of rent control, according to the National Apartment Association, is that it reduces developers’ incentives to build new rental housing.

Rent control has proven to backfire on the low-income renters it’s intended to protect, said RealPage Senior VP and Chief Economist Jay Parsons. “The one and only solution? “Build, build, build.”

And, while it may seem counterintuitive to some, Parsons makes the case that building lots of new luxury apartments helps lower rents at all price points—even in the lowest-priced Class C rentals.

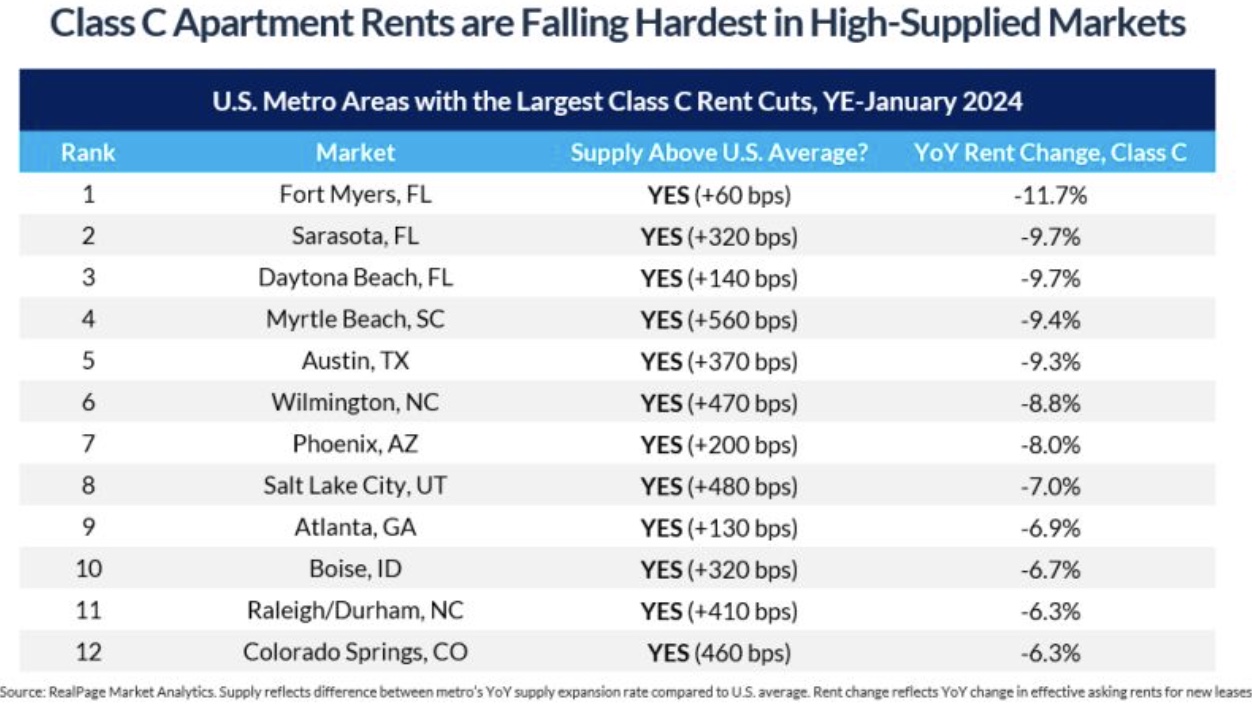

The chart below features twelve U.S. markets where, as of January, Class C rents have declined at least six percent year over year. Their common denominator is supply expansion rates above the U.S. average.

Three markets in the supply magnet state of Florida, which also boasts strong demand and a boost from a recent statewide workforce housing legislation, are seeing Class C rent cuts around 10 to 12 percent.

Not shown on the top twelve list, but seeing Class C rent cuts of four to five percent, are Orlando, Jacksonville and Tampa, all of which have a high number of new apartment deliveries.

Parsons points out that all of these markets, despite some moderation/normalization for in-migration and job growth, are ranked among the national leaders for net absorption.

Adding a lot of supply is doing exactly what it’s supposed to do, said Parsons.

“It’s a process academics call ‘filtering,’ which happens when higher-income renters in Class B apartments move up into higher-priced new Class A units, resulting in vacancy increases in Class B units, so Class B managers cut rents to lure Class C renters. And down the line it goes,” he said, adding that filtering works best when developers build lots of apartments.

“We didn’t see this phenomenon play out as clearly in past cycles, when supply was relatively limited, and failed to keep pace with demand,” he said.

Adding weight to Parson’s premise is the fact that Class C rents are increasing the most in markets with the least amount of new supply. In 18 of the nation’s 150 largest metro areas, nearly all of which are supply constrained, Class C rent growth topped five percent year over year.

Incentives versus control

Rent control remains front and center as a misguided solution to the nation’s lack of affordable housing and a rent control measure even made the 2024 election ballot in California, where the average median rent is $2941, according to Zillow.

Critics of Class A development push rent control, claiming the nation needs much more affordable housing than luxury. But, the only market-rate construction that pencils for developers is Class A, due to the high cost of land, labor, materials, insurance, taxes and impact fees. And, the only way to profitably build affordable workforce housing is by navigating complicated tax credit programs that can take years and offer no guarantees.

Parsons suggests that tax abatement programs, more commonly used for retail and office development, could provide developers with a needed financial incentive that will ultimately lead to a greater number of apartments being built.

“Construction math is broken right now given rising costs and slowing rents, but, if you can reduce the largest operational expense (taxes), many projects will suddenly pencil out, even with a portion of units set aside for low- and middle-income renters.

“Cities aggressively pushing property tax abatements will win an outsized share of apartment development in this cycle,” he said, adding that the strategy is working well in places like Texas, where PFC deals represent a growing share of multifamily starts.