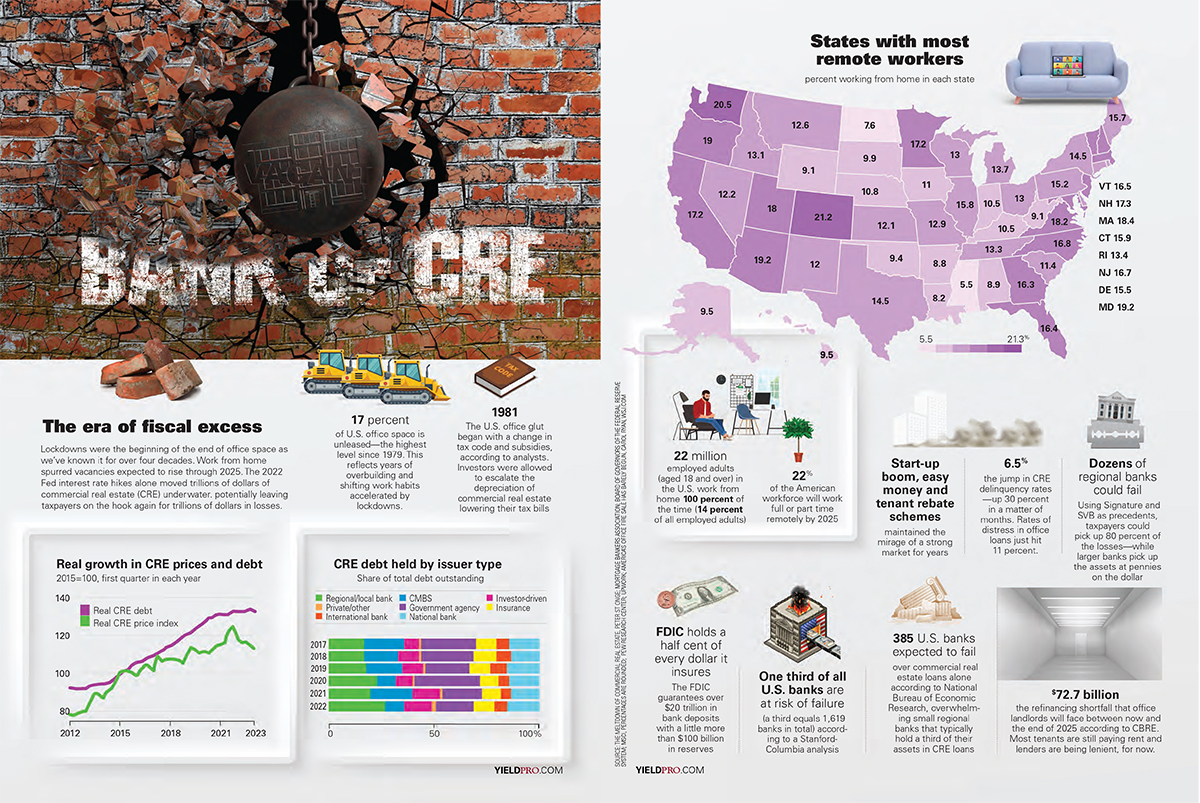

Lockdowns were the beginning of the end of office space as we’ve known it for over four decades. Work from home spurred vacancies expected to rise through 2025. The 2022 Fed interest rate hikes alone moved trillions of dollars of commercial real estate (CRE) underwater. potentially leaving taxpayers on the hook again for trillions of dollars in losses.

17 percent of U.S. office space is unleased—the highest level since 1979. This reflects years of overbuilding and shifting work habits accelerated by lockdowns.

1981 The U.S. office glut began with a change in tax code and subsidies, according to analysts. Investors were allowed to escalate the depreciation of commercial real estate lowering their tax bills

22 million employed adults (aged 18 and over) in the U.S. work from home 100 percent of the time (14 percent of all employed adults)

22% of the American workforce will work full or part time remotely by 2025

Start-up boom, easy money and tenant rebate schemes maintained the mirage of a strong market for years

Dozens of regional banks could fail. Using Signature and SVB as precedents, taxpayers could pick up 80 percent of the losses—while larger banks pick up the assets at pennies on the dollar

FDIC holds a half cent of every dollar it insures The FDIC guarantees over $20 trillion in bank deposits with a little more than $100 billion in reserves

One third of all U.S. banks are at risk of failure (a third equals 1,619 banks in total) according to a Stanford-Columbia analysis

385 U.S. banks expected to fail over commercial real estate loans alone according to National Bureau of Economic Research, overwhelming small regional banks that typically hold a third of their assets in CRE loans

$72.7 billion the refinancing shortfall that office landlords will face between now and the end of 2025 according to CBRE. Most tenants are still paying rent and lenders are being lenient, for now.

Source: The meltdown of commercial real estate, Peter St Onge; Mortgage Bankers Association; Board of Governors of the Federal Reserve System; MSCI, percentages are rounded; Pew Research Center; Upwork; America’s office fire sale has barely begun, Carol Ryan, wsj.com