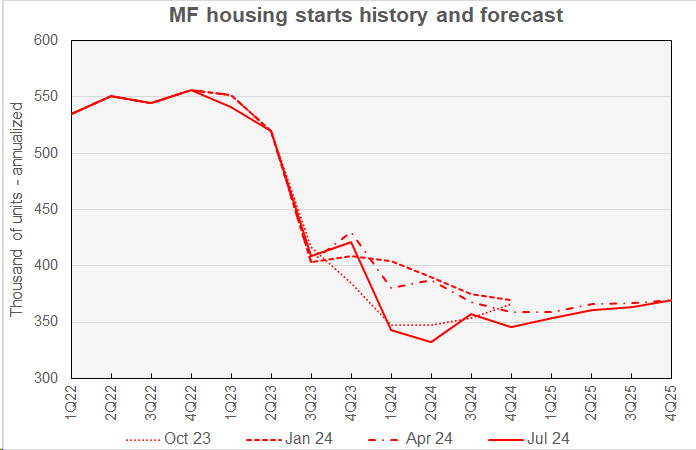

Fannie Mae’s July housing forecast calls for higher levels of multifamily housing starts in 2024 and 2025 than in their two most recent past forecasts.

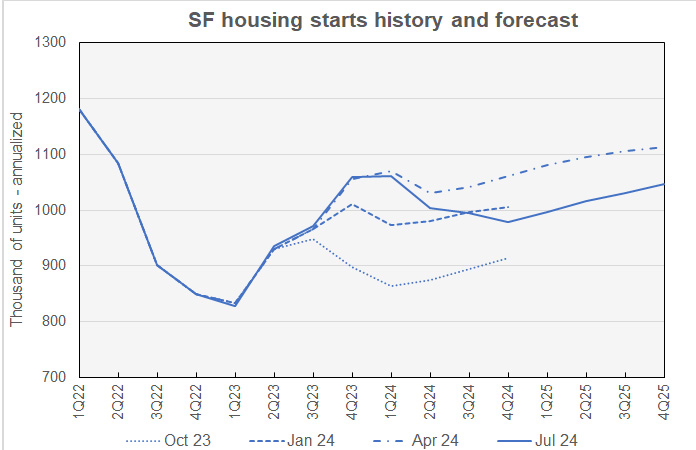

Single-family housing starts are expected to pull back slightly through Q3 2024 and then to resume their recent rise.

Fannie Mae’s forecasters believe that the Federal Reserve is likely to cut the Fed Funds rate in both September and December of this year. The Fed Funds rate is predicted to end the year at 5.0 percent. Forecasters are now expecting the Fed Funds rate to fall to 4.3 percent by the end of 2025. Last month’s forecast predicted that the rate would drop to only 4.5 percent by then, so they are now predicting 4 quarter-point rate cuts by the end of 2025.

The 10-year Treasury is reported to have risen to 4.4 percent in Q2 2024. It is predicted to drop slightly to 4.3 percent in Q3 2024 and to remain at that level through the end of 2025. These rates are marginally lower than those in last month’s outlook.

Higher multifamily starts expected

The current forecast for multifamily housing starts is shown in the first chart, below, along with three other recent forecasts. Fannie Mae considers any building containing more than one dwelling unit to be “multifamily”, including both condominiums and rental housing units.

While Fannie Mae’s forecasters have revised their multifamily housing starts forecasts for 2024 lower in each of their forecasts since February, revisions to the 2024 forecasts were generally higher this month. The low point for multifamily starts is still seen as being in Q2 2024, but the forecast number of starts for that quarter was raised by 26,000 annualized units to 332,000 annualized units.

For reference, the most recent new residential construction report from the Census Bureau has multifamily starts running at an annualized rate of 342,000 units in Q2 2024, although revisions to this data are possible.

Fannie Mae’s current forecast calls for multifamily starts to rise slowly from Q4 2024 through the end of 2025, finishing 2025 at a rate of 370,000 annualized units.

Looking at yearly forecasts, the predicted number of multifamily starts for 2024 was revised higher by 21,000 units to 344,000 units. The forecast for multifamily starts in 2025 was revised higher by 11,000 units to 362,000 units.

Single-family starts forecast revised lower

The current forecast for single-family housing starts is shown in the next chart, below, along with three other recent forecasts.

In the current forecast, each quarterly prediction for single-family starts from Q2 2024 through the end of 2025 was lower than in last month’s forecast. The Q2 2024 forecast was revised lower by 25,000 annualized units. The forecasts for the following quarters were revised lower by 17,000 to 51,000 annualized units.

The low point for single-family starts is now expected to be in Q4 2024, one quarter later than in last month’s forecast. The annualize number of single-family starts expected in that quarter is 979,000. Single-family starts are then forecast to rise gradually, reaching 1,046,000 annualized units in Q4 2025.

Looking at their full-year predictions, Fannie Mae now expects single-family starts to be 1,010,000 units in 2024, down 23,000 units from the level forecast last month. Single-family starts in 2025 are forecast to be 1,022,000 units, down 36,000 units from the level forecast last month.

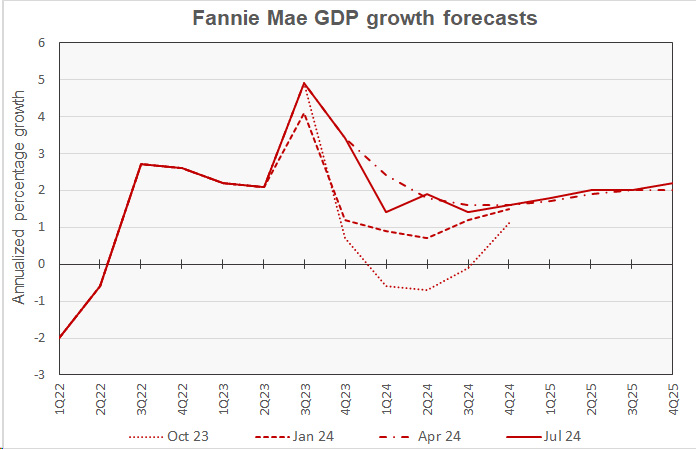

GDP growth outlook sees modest changes

The next chart, below, shows Fannie Mae’s current forecast for Gross Domestic Product (GDP) growth, along with other recent forecasts.

As is often the case for GDP forecasts, revisions made to GDP projections were small, with no revision greater than 0.1 percentage points. Fannie Mae’s forecasters revised their estimate for Q1 2024 GDP growth higher from 1.3 percent to 1.4 percent, matching the Bureau of Economic Analysis’ third estimate. Fannie Mae revised their forecasts for Q2 and Q3 2024 GDP lower by 0.1 percentage points. They now expect a GDP growth rate of 1.9 percent in Q2 and of 1.4 percent in Q3. The only other revisions to the GDP growth forecasts were 0.1 percentage point increases to the forecasts for Q2 and Q4 2025.

The full year forecast for GDP growth for 2024 was left unchanged at 1.6 percent while the full-year forecast for 2025 was raised to 2.0 percent.

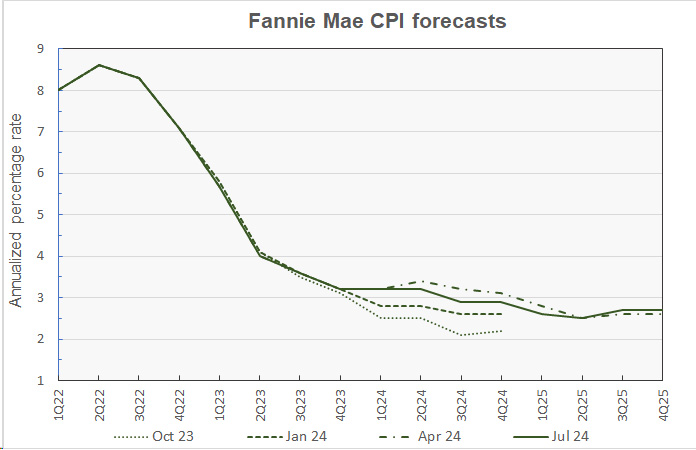

Lower CPI Inflation predicted

The next chart, below, shows Fannie Mae’s current forecast for the Consumer Price Index (CPI), along with three other recent forecasts.

This month, all revisions to Fannie Mae’s CPI inflation quarterly forecasts were to the downside, more than reversing last month’s changes. Inflation was predicted to be 0.1 percentage point lower in Q2 2024 and Q3 2025. It was predicted to be 0.2 percentage points lower in Q3 2024. It was predicted to be 0.3 percentage points lower in Q3 2024 and Q1 2025 and it was predicted to be 0.4 percentage points lower in Q4 2024.

Looking at whole-year forecasts, the forecast for year-over-year CPI inflation in Q4 2024 was lowered 0.3 percentage points to 2.9 percent. The Q4 2025 year-over-year inflation forecast was unchanged at 2.7 percent.

Employment growth forecast nearly unchanged

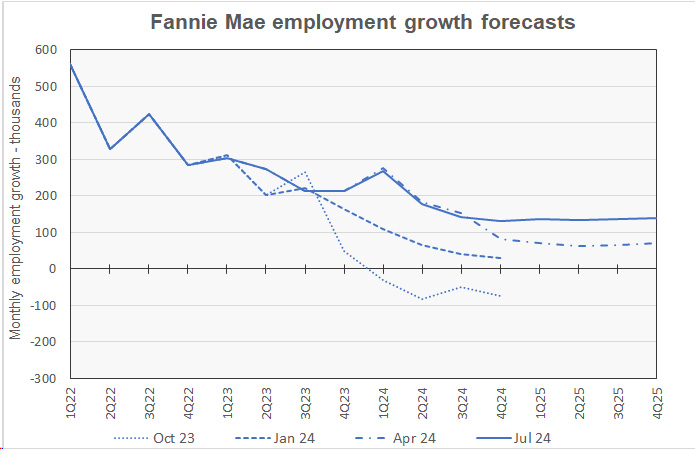

The next chart, below, shows Fannie Mae’s current forecast for the employment growth, along with three earlier forecasts. Employment growth is our preferred employment metric since job gains, along with productivity gains, drive economic growth. By contrast, the unemployment rate depends on employment but also on the labor force participation rate. Either rising employment or falling labor force participation can drive the unemployment rate lower, but only the former would contribute to economic growth.

Revisions to this month’s employment growth forecasts are all to the upside with the exception of that for Q2 2024, which now anticipates monthly job growth of 177,000 jobs, a decrease of 21,000 jobs from the last forecast. Monthly job growth is forecast to fall from Q2’s level, reaching 132,000 per month in Q4 2024. It is then forecast to rise slightly, reaching a level of 138,000 per month by Q4 2025.

For reference, the business survey in the Employment Situation Report from the Bureau of Labor Statistics indicates that the economy added an average of 177,000 jobs per month in Q2 2024.

Compared to last month’s forecast, the expected full year forecast for employment growth in 2024 was unchanged while employment growth for 2025 was revised marginally higher. Employment growth in 2024 is expected to be 2,200,000 jobs. Employment growth in 2025 is expected to be 1,600,000 jobs.

The Fannie Mae July forecast can be found here. There are links on that page to the detailed forecasts and to the monthly commentary.