A new report from CommercialEdge, a Yardi company, takes a standardized look at the characteristics of office properties to assess their potential for conversion to residential uses. It finds that 2.7 percent of existing office space nationally has excellent conversion potential while another 12.1 percent of existing stock has good conversion potential.

Defining the parameters

CommercialEdge defined a metric they call the Conversion Feasability Index (CFI). The index considers the characteristics of a building in order to assign it a score. Factors considered include “building age, location, total square footage, building depth, mid-block location, use type, number of stories, floor plate shape, ceiling height, green-building certifications, walkability and transit accessibility.“ The assessment then sorts the properties into one of 3 categories based on their suitability for office to residential conversion. Properties with excellent conversion potential are classed as Tier 1. Properties with good conversion potential but which might require modifications during conversion are classed as Tier 2. Properties that would be difficult to convert are classed as Tier 3.

Leading markets

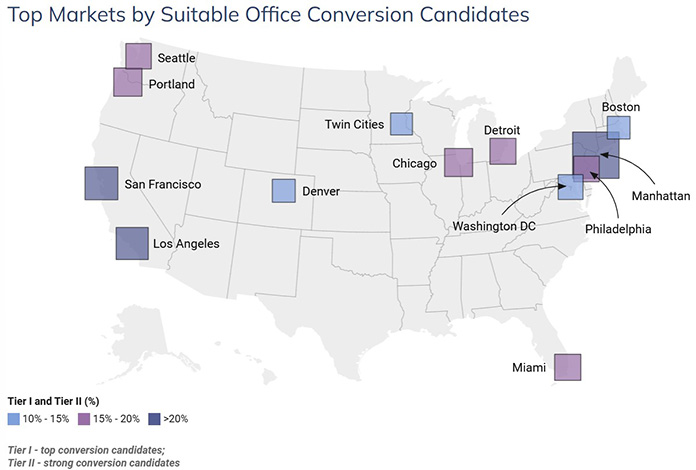

While 2.7 percent of office space is classified as having Tier 1 conversion potential for the country as-a-whole, conversion potential varies widely by market. CommercialEdge rates fully 16.8 percent of office space in Manhattan as having Tier 1 conversion potential. Other top cites for office properties with conversion potential are San Francisco (6.2 percent Tier 1), Los Angeles (4.4 percent Tier 1), Chicago (4.1 percent Tier 1) and Miami (3.7 percent Tier 1).

The report contains the following map highlighting other cities with high office to residential conversion potential.

Of buildings with Tier 1 office to residential conversion potential, CommercialEdge says that only 2.6 percent by square footage is located in suburban areas. The vast majority is in urban settings.

The report also lists statistics on office vacancy rates, rents and property values, but it does not break out these factors by the conversion potential rating.

Most of the full report is devoted to reporting on various facets of the commercial property market. It is available here.