Multifamily oversupply conditions are improving, but not out of the woods yet. The good news is that some relief is expected by 2025, but Sunbelt markets may take 12 to 18 months longer to balance supply and demand, according to Jay Levick, National Director of Multifamily Analytics for CoStar.

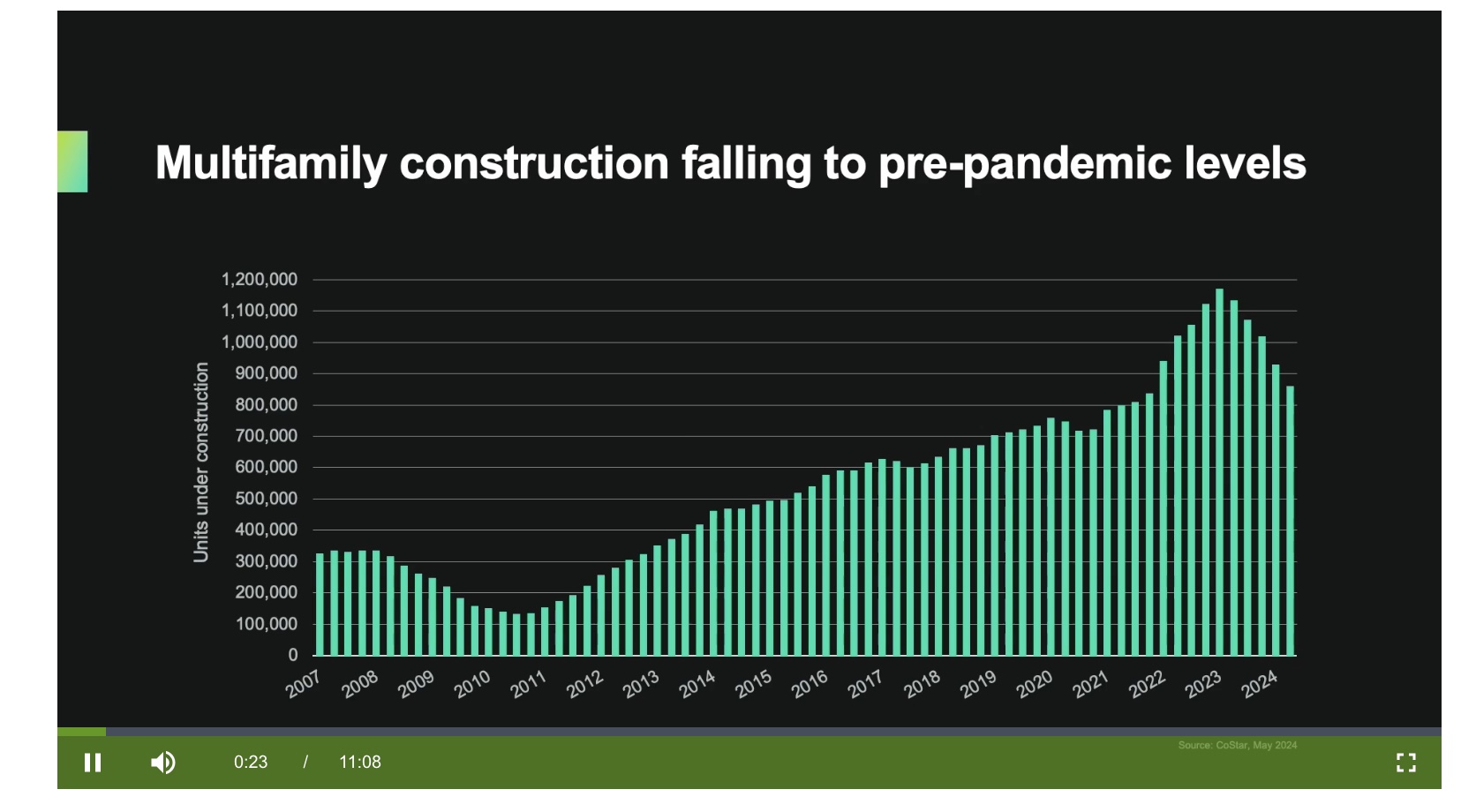

Levick discussed current oversupply conditions in the multifamily market during a presentation on Apartmentology.com, noting that the nation’s supply peak was reached in the first quarter of 2023 with 1.1 million units under construction, dropping 26 percent to 860,000 units at the end of May.

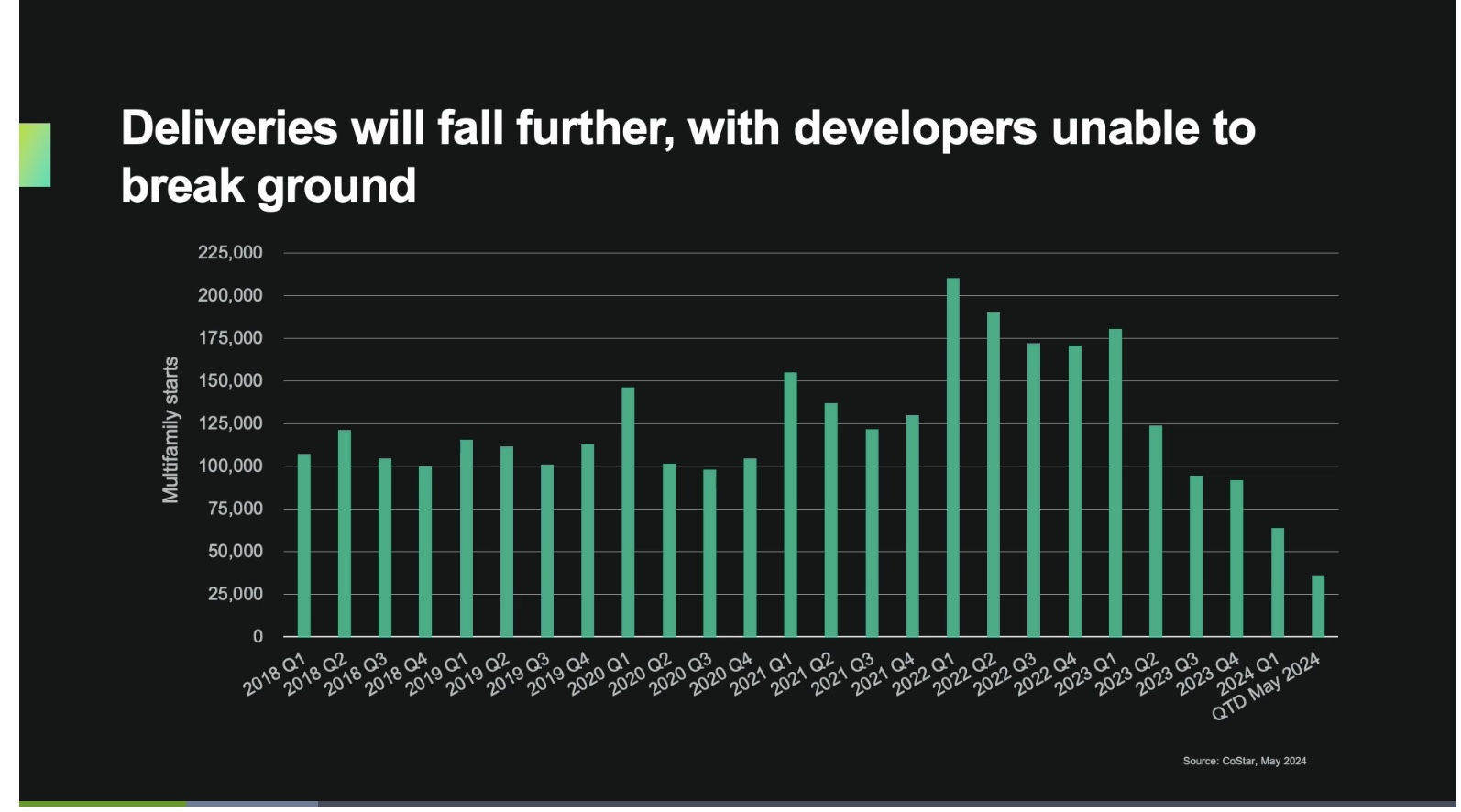

CoStar’s data also shows a significant decline in project starts, with 210,000 units started in the first quarter of 2022, dropping to 64,000 units at the end of the first quarter of 2023, and further to 36,000 units at the end of May.

Levick notes that developers are facing challenges in starting new projects due to difficulty in securing equity and high material costs, exacerbated by the current interest rate environment for construction loans, which will result in deliveries falling even further.

He explains that it takes around two years for a project to go from groundbreaking to tenant move-in. Annualizing the 64,000 units started in the first quarter of 2023, only 256,000 units would be delivered in 2026, a significant pullback from the 40-year construction high of 588,000 units in 2022.

CoStar forecasts a decline to 533,000 units in 2025, a 10 percent reduction from 2024, and 360,000 units in 2026, close to pre-pandemic averages.

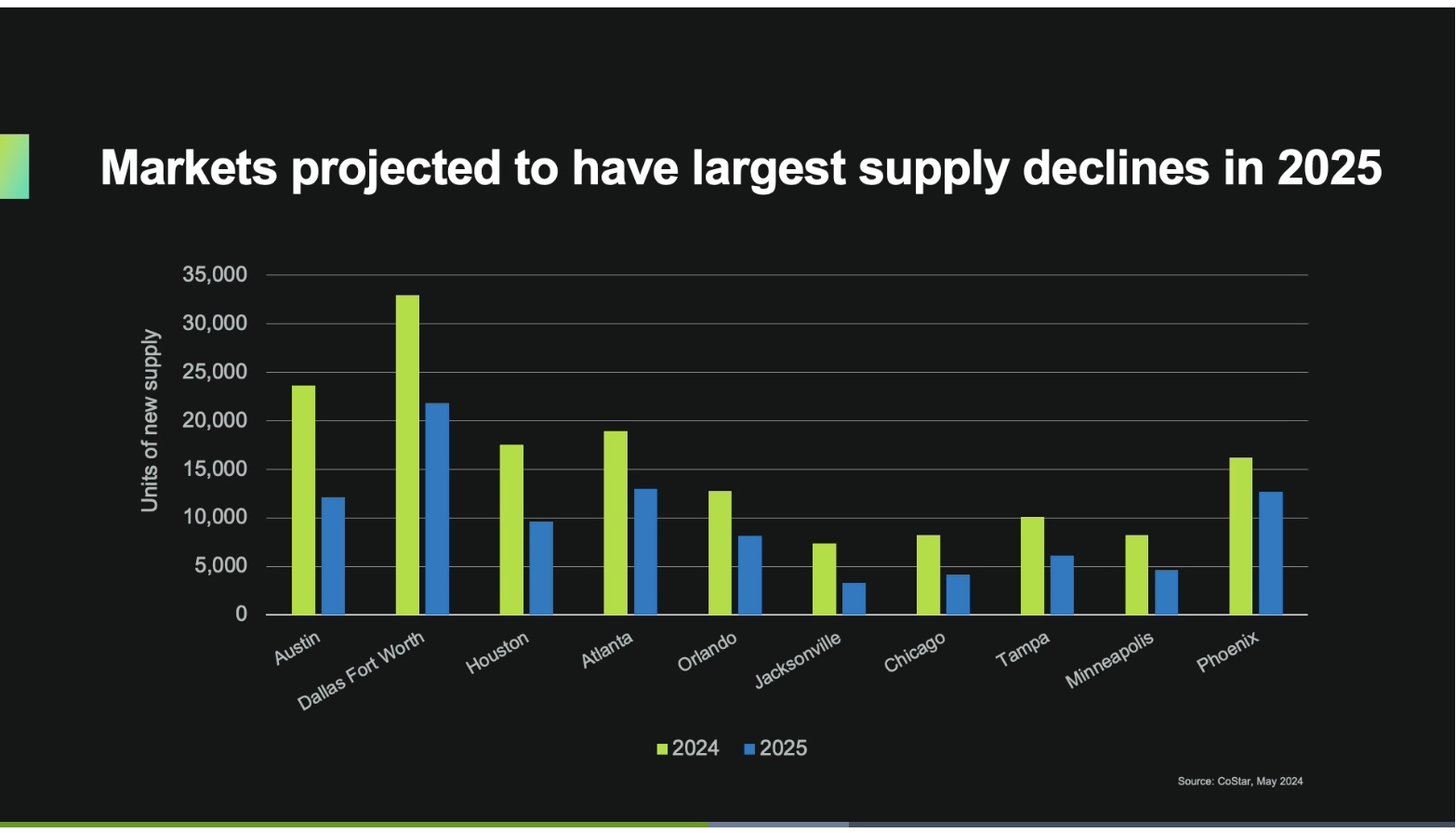

The national supply pullback does not apply to all metros, with 10 metros expected to see increased supply, which, when combined with demand, creates a more concerning situation. Markets forecast to have the largest supply declines are shown in the chart below.

Eight out of the ten metros with oversupply are in the Sunbelt, with Austin projected to deliver 23,000 units this year, but expecting demand of only 15,000 units, resulting in an oversupply of 7,000 units. Other metros, such as Dallas-Fort Worth, San Antonio, Tampa, and Atlanta, also face significant oversupply, with demand not expected to meet supply levels. Even so, some of these are finally seeing their pipelines pull back. Despite some pullback in 2025 projections, relief in supply and demand dynamics is expected to take until the second half or end of 2025.

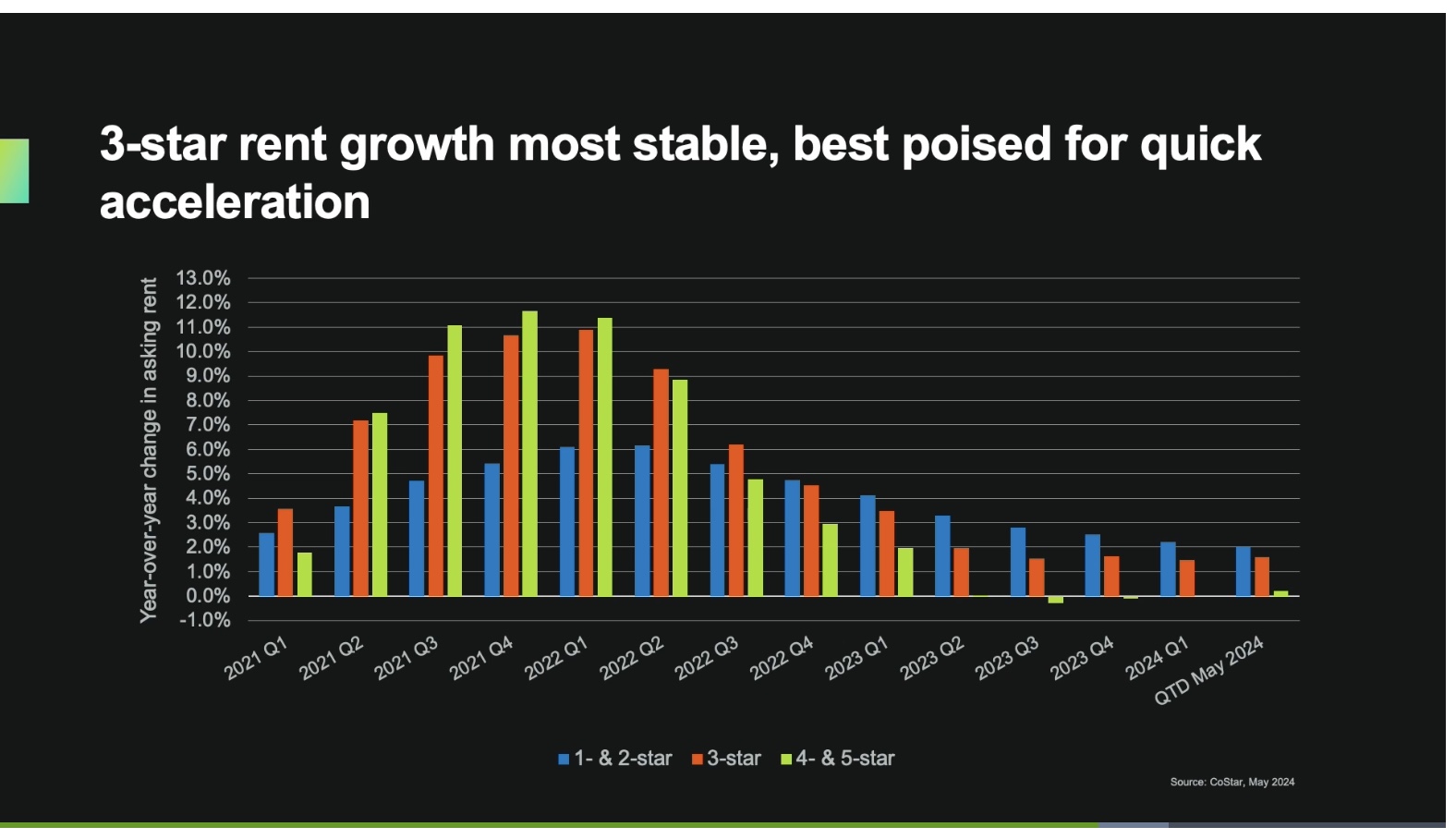

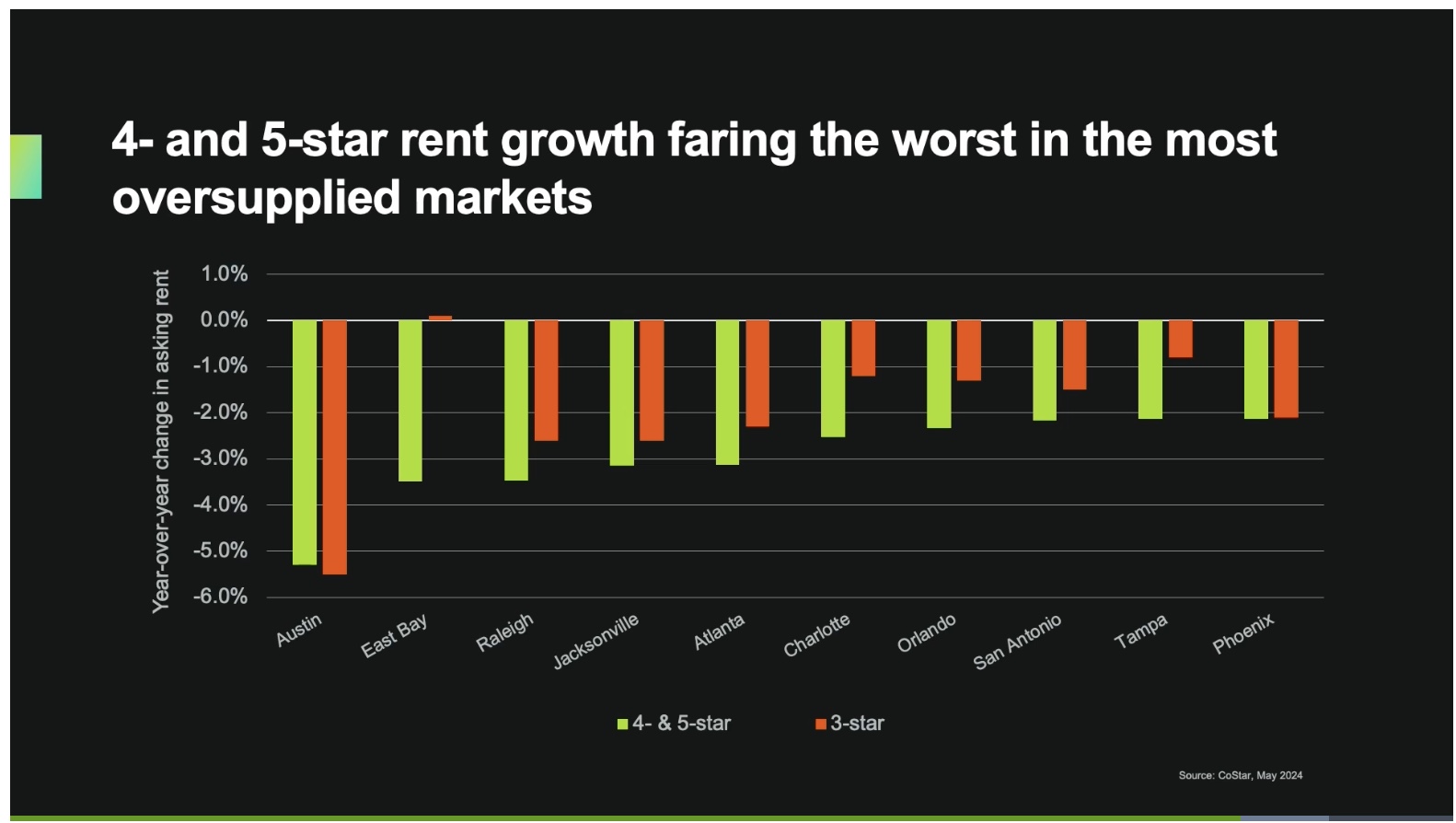

The vast majority of new supply is at the high end of the market, with 73 percent of units under construction being four and five-star, or Class A, properties, where oversupply conditions are being most impacted.

Rent growth at the top end of the market has been negatively impacted, with Class A experiencing a significant drop-off, while Class B rents have remained positive at about 1.5 percent over the last four quarters, except Austin which is experiencing pain in both Class A and B due to a smaller rent delta between the two.

A national rent delta of $571 exists between Class A and Class B properties, translating to nearly $7,000 more in annual housing costs and $20,000 to $25,000 more in income for residents just to qualify for that higher priced property.

The chart below reveals that Class A has suffered the most in terms of negative rent growth and the worst rents.

Despite national relief in oversupply conditions, many Sunbelt markets will continue to experience over supply well into 2025, with the top end of the market being the worst performer. The Midwest and Northeast markets are expected to recover more quickly, with relief coming sooner than in the Sunbelt.