Federal Open Market Committee (FOMC) met this week and, in an unusual pre-election move, decided to lower their target interest rate by 0.5 percentage point. In addition, their projections now indicate that they will deliver another 0.25 point rate cut by the end of this year and four more 0.25 point rate cuts by the end of next year.

As recently as their June meeting, the Fed had only been predicting a single 0.25 point rate cut by the end of this year. However, a weak employment report and calls by a trio of prominent Senate Democrats for an immediate large rate cut seem to have changed the minds of the Fed’s board.

The FOMC meets 8 times per year but only releases an economic forecast at 4 of the meetings. The Fed forecast presents estimates for economic metrics for December of each year, now through 2027, and a “longer run” forecast which reflects their view of the output of the economy if operating at equilibrium. The consensus Fed forecast is developed by the combining the forecasts of 19 economists. Each of the economists assumes that the Fed will follow “appropriate” monetary policy during the term of the forecast, although their individual ideas of what that policy is may vary.

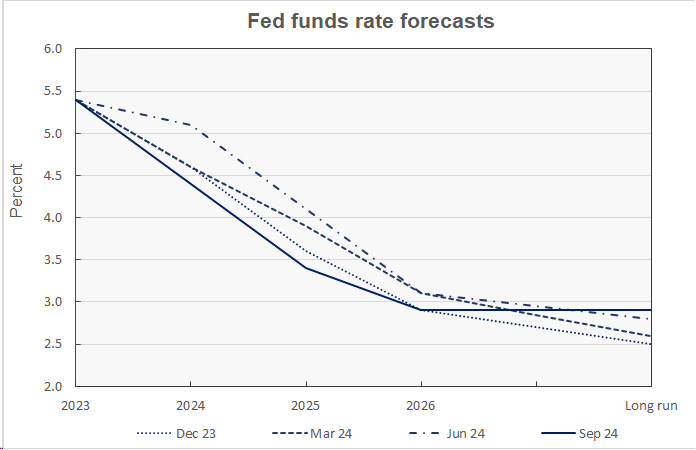

Interest rates to decline more quickly

The headline news coming out of the recent Fed meeting was their decision to provide an immediate large interest rate cut. In addition, their estimate of the appropriate Federal Funds interest rate for year-end 2025 has now been lowered from 4.1 percent to only 3.4 percent. The Fed’s prediction of the appropriate Federal Funds rate for 2026 is 2.9 percent, down from the 3.1 percent rate projected in the June forecast.

The projection for the long-run interest rate was raised again in the current forecast, rising 0.1 percentage point to 2.9 percent. As recently as last December, the long-run, or equilibrium, interest rate was pegged at 2.5 percent. The means that the Fed now believes that significantly higher interest rates will be necessary to maintain the balance between maximizing employment and keeping inflation under control, their dual mandates.

A history of the forecasts for the Federal Funds rate is given in the first chart, below.

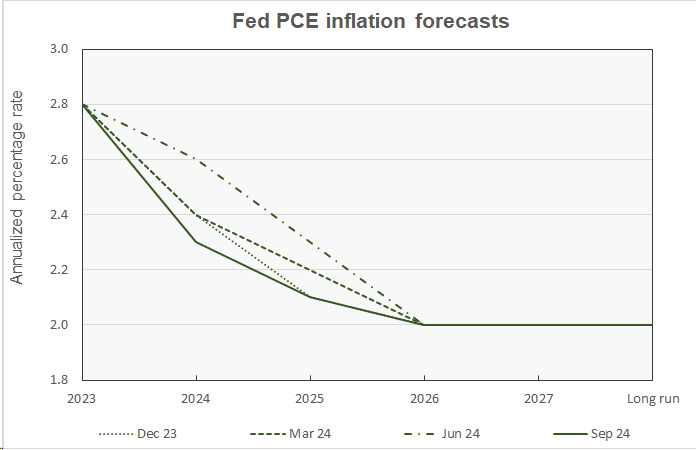

Inflation outlook lowered

The Federal Reserve’s preferred inflation measure is based on the Personal Consumption Expenditures (PCE) survey, rather than the more familiar Consumer Price Index (CPI). Compared to June’s forecast, the year-end reading for 2024 for PCE inflation was lowered 0.3 percentage points to 2.3 percent. The year-end reading for 2025 was lowered 0.2 percentage points to 2.1 percent. The projection for year-end inflation for 2026 remained at 2.0 percent, the Fed’s target.

The history of the Fed’s recent PCE inflation forecasts is shown in the next chart.

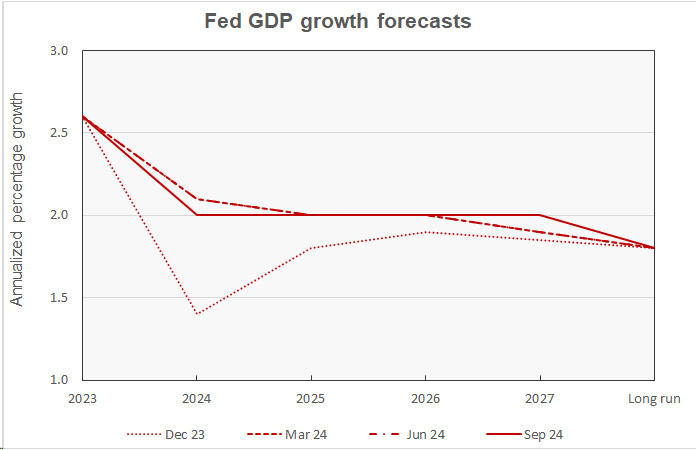

GDP growth projections down slightly

Fed’s current median forecast for 2024 GDP growth was lowered 0.1 percentage point to 2.0 percent. This is despite the Bureau of Economic Analysis’s second estimate of Q2 2024 GDP coming in at a reasonably strong 3.0 percent. The median GDP growth forecasts for 2025 and 2026 were unchanged at 2.0 percent, the long-run projection for the economy if running at equilibrium.

Recent Fed GDP forecasts are illustrated in the next chart, below.

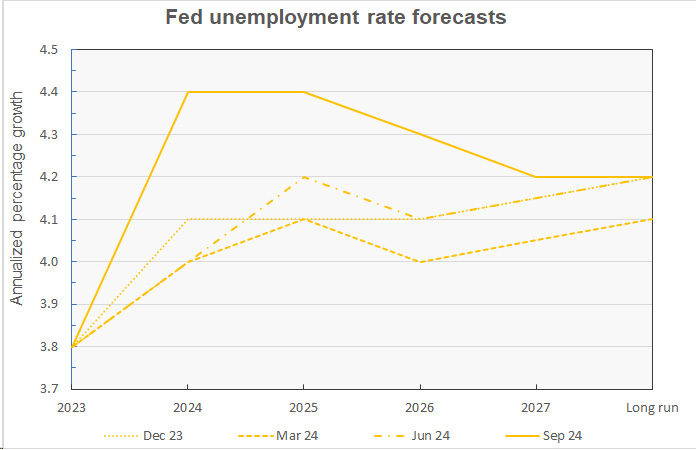

Unemployment higher across the board

The Fed forecasts that the year-end unemployment rate will be 4.4 percent in 2024, up 0.4 percentage points from June’s forecast. The unemployment rate forecast for year-end 2025 is up 0.2 percentage point from June’s forecast at 4.4 percent. The forecast for 2026 was also revised 0.2 percentage point higher to 4.3 percent.

The history of the Fed’s recent unemployment rate forecasts is shown in the next chart.

The next updates to the Federal Reserve’s forecasts for the economy will come after the December 2024 FOMC meeting which concludes on the 18th of that month.