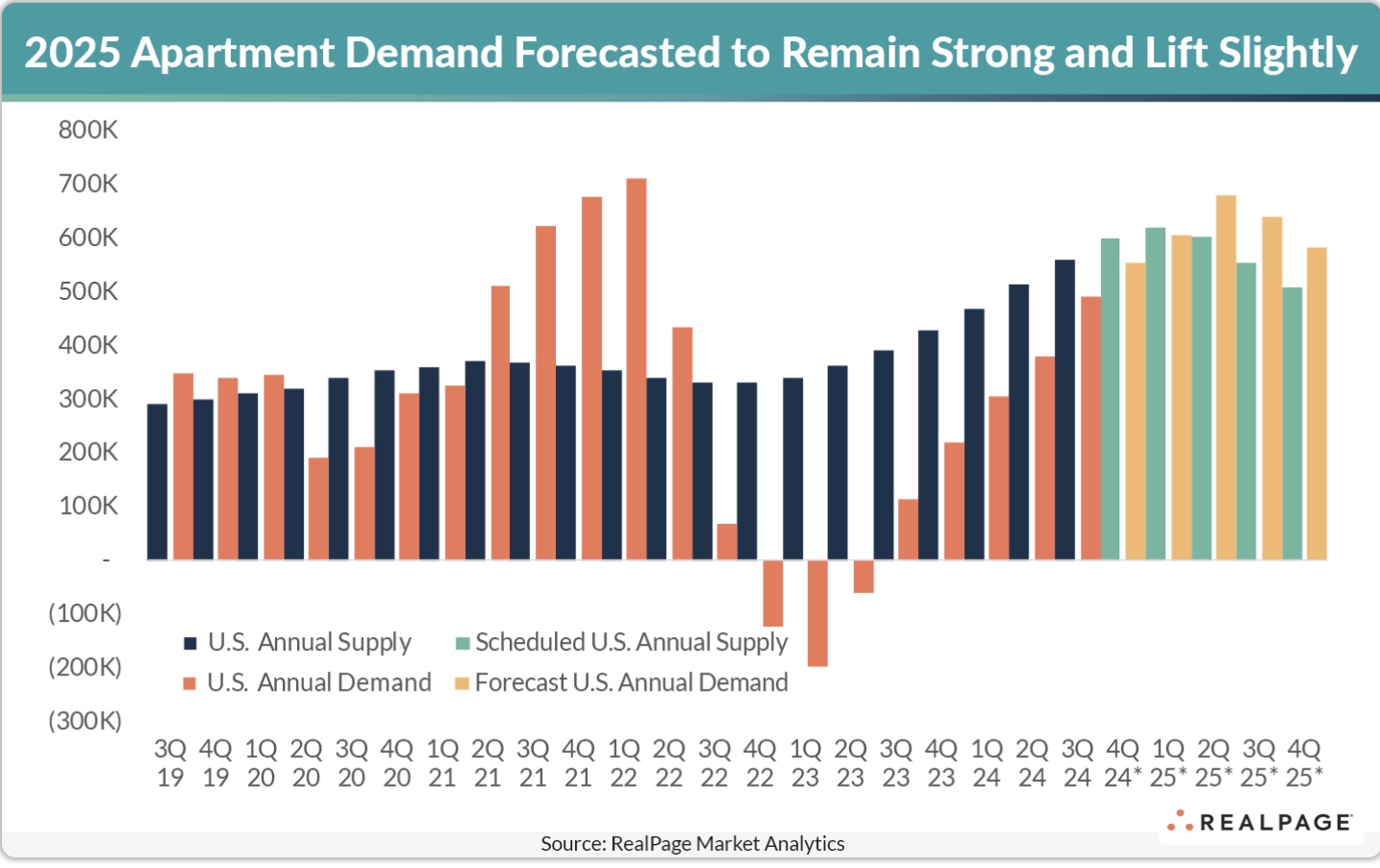

More than 558,000 apartment units have delivered over the past 12 months, hitting what RealPage Analytics calls a 50-year supply peak. But booming demand for rental housing has been a bright spot during the highest influx of new supply since 1974. Demand in 2024 is as strong as any other year on record, said RealPage, with 490,000 apartment units absorbed across the country. Some high-supply markets are even beating national norms with all-time-high demand records.

There are a number of factors driving apartment demand, explained RealPage chief economist Carl Whittaker during a Q4 national outlook podcast this week.

The US labor market surpassed expectations in September with an increase of nearly 254,000 jobs, while the unemployment rate fell for two consecutive months from August to September. Job growth helps spur new household formation and drives multifamily demand.

In addition, wage growth has kept up with rent growth and is now outpacing inflation.

The pace of wage growth has exceeded that of the rent growth over the past year or so. As a result, the median rent-to-income figures have dropped and are at their lowest level since 2019. Another driver is the pace of the home price growth relative to rent growth figures. Discouraged homebuyers are contributing to the strong multifamily demand.

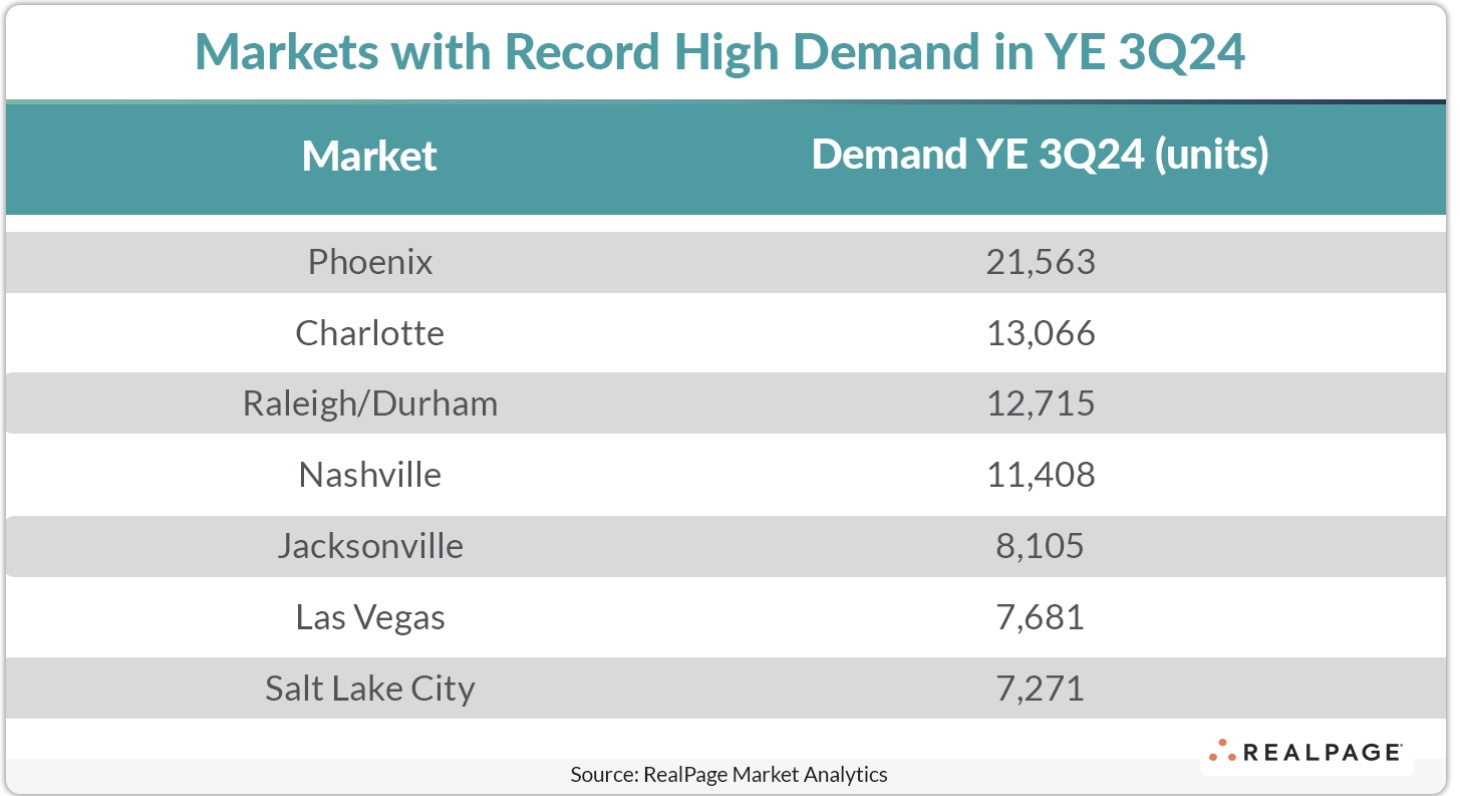

Seven of the nation’s 50 largest apartment markets recorded their largest demand volumes in the third quarter, including many fast growing SunBelt markets, reported RealPage.

Phoenix, Charlotte, Raleigh/Durham, Nashville, Jacksonville, Las Vegas and Salt Lake City reported all-time high demand bolstered by a few tailwinds that aided their demand performance. One of these tailwinds supporting housing demand is favorable demographics. According to the U.S. Census Bureau, population growth in all seven markets has at least doubled the national norm since 2017.

Total population in the Nashville, Raleigh and Jacksonvile has grown more than 10 percent in the five-year period ending 2022, according to the latest Census data available, while nationwide population growth during the same period grew only 3.1 percent.

These markets also beat national averages with higher job growth and lower unemployment numbers. Remarkably, they also experienced a supply boom, growing total apartment inventory above the national norm of 2.8 percent in the year ending Q3 2024, all except Las Vegas, which grew inventory a bit behind the average of 2.4 percent.

RealPage expects all these markets to continue receiving heavy supply in the coming year, which bodes well for continued apartment demand. Read the report here.

“We believe that strong demand will continue well into 2025, rising about five percent above the 2024 level,” said RealPage.