CoreLogic reported that their single-family rent index (SFRI) for August rose 2.4 percent from its year-earlier level. This is down 0.4 percentage points from last month’s reported year-over-year rent growth rate and is down from the 3.1 percent annual rent growth rate reported in August 2023.

Adjusted vs. nominal

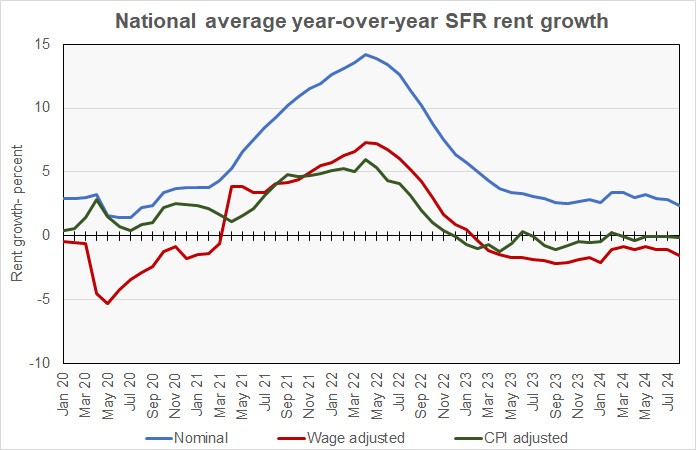

The history of the overall SFRI growth rate since January 2020 is shown in the first chart, below. The chart shows both the nominal year-over-year single-family rent growth rate and also the wage-adjusted and CPI-adjusted rates. The wage-adjusted rate is the year-over-year nominal rate less the year-over-year rate of wage growth as measured by the seasonally-adjusted average hourly earnings of production and non-supervisory employees. The CPI-adjusted rate is the year-over-year nominal rate less the year-over-year rate of growth in the consumer price index (CPI-U).

The chart shows that nominal SFR rent growth rate has recently been running at nearly the same level as in early 2020. However, the inflation rate was lower at that time than it has been lately, so the real rent growth rate is currently lower than it was then.

While wage growth seemingly jumped early in the pandemic, this was because relatively more low-wage workers lost their jobs than did higher-wage workers. This drove up the average wage rate. The economy is now in a more “normal” employment state so the trend of wage growth outpacing SFR rent growth is not just a statistical anomaly.

For reference, Yardi Matrix found that single-family rent growth in August was 0.7 percent year-over-year as rents fell $7 for the month. However, Yardi Matrix focuses on properties of 50 or more units while CoreLogic takes a broader look at the single-family rental market, since small holdings represent a majority of the market.

Ranking the metros

CoreLogic reports the year-over-year rate of growth in the SFRI for a select group of 20 metropolitan areas. Seattle moved up two places to take the title of rent growth leader this month with year-over-year SFR rent growth of 5.8 percent. New York City returned to the top five, occupying second place this month with rent growth of 5.5 percent. Last month’s leader, Washington D.C., fell to third place with rent growth also coming in at 5.5 percent. Detroit and Boston swapped the 4 and 5 spots with rent growth rates of 5.4 percent and 4.8 percent respectively. Chicago fell out of the top five in this month’s report.

Austin saw rents decline again year-over-year in August with a fall of 2.3 percent. Rents in Phoenix broke their slide as they were unchanged for the year. Orlando (+0.2 percent) and Dallas (+0.7 percent) occupied the 3 and 4 spots just as they did the last three months. Atlanta (+0.7 percent) completed the bottom 5 for slowest rent growth.

CoreLogic is a data and analytics company. It calculates the SFRI using “a repeat pairing methodology to single-family rental listing data in the Multiple Listing Service.” The CoreLogic report is available here.