The latest commercial property price report from MSCI Real Capital Analytics said that multifamily property prices fell 0.4 percent in September from their level of the month before. In addition, last month’s reported increase was revised to a loss in this month’s report. Prices were down 6.3 percent from their level of one year ago.

Defining CPPI

MSCI tracks an index called the Commercial Property Price Index (CPPI). The index is computed based on the resale prices of properties whose earlier sales prices and sales dates are known. The index represents the relative change in the price of property over time rather than its absolute price. Note that, as new property transactions are added to the MSCI dataset each month, they recalculate the CPPI for the months in which the transactions occurred, potentially all the way back to the beginning of the data series.

Multifamily property prices drop

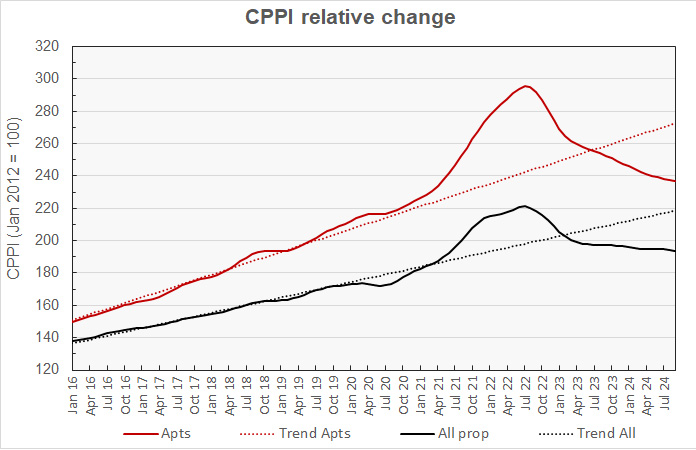

The first chart, below, shows how the CPPI’s for all commercial property as a single asset class and for apartments have changed since January 2016. To simplify the comparison, both CPPI’s have been normalized to values of 100 in January 2012. The chart also contains trend lines showing the straight-line average rates of price appreciation for the two asset classes based on their performances from January 2012 to December 2019.

The chart shows that both multifamily property prices and general commercial property prices continue to increase the gap between their current levels and the levels that would have been expected if they had continued to follow their pre-pandemic trends.

Multifamily property prices are now down 19.9 percent from their peak but are 11.7 percent above their level in January 2020. They are 13.2 percent below their pre-pandemic trend line.

Prices for all commercial property as a single asset class are down 12.5 percent from their peak but are 11.9 percent above their level in January 2020. They are 11.4 percent below their pre-pandemic trend.

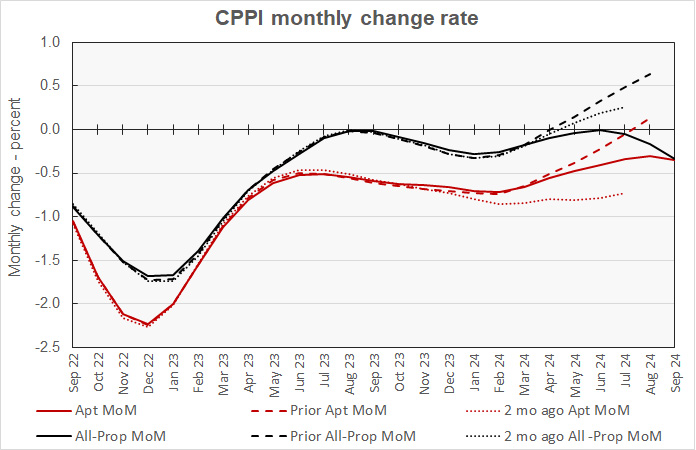

The next chart plots the month-over-month changes in the values of the CPPI over the last 25 months for all commercial property as a single asset class and for apartments. It also includes the same metrics based on the data included in last month’s report and the report from the month before that.

The chart shows a more pessimistic picture than that painted by last month’s data. Instead of showing a month of price gains for multifamily property and 4 months of price gains for commercial property, the latest data shows continuing, and accelerating, price declines for both classes of property.

The current month’s data shows that multifamily property prices had been declining at progressively lower rates but that trend was broken this month with the rate of month-over-month price decline exceeding that of last month. However, comparing the results with those of the prior two months shows that it may take several months for the data to settle out. The current month’s data has to be considered preliminary as the trends it indicates may be upended by additional transactions included in next month’s dataset.

The picture for all commercial property considered as a single asset class was changed even more profoundly in this month’s report than was that for multifamily property. Commercial property seemed to be solidly on an upward trend in price growth but that was reversed this month. We have to go back 5 months to find a point where the additional transactions added to the dataset had only an insignificant impact on the price growth picture. It may be a few months before the real price growth rate for September can be discerned.

Multifamily prices fall again

September’s data indicate that the month-over-month decline in multifamily property prices was only exceeded by that for offices within central business districts (CBDs). Those prices declined 1.5 percent for the month.

Suburban office property saw the largest monthly price gain in September with a rise of 0.5 percent. Industrial property continued to show steady growth, but only at a rate of 0.4 percent for the month. Prices for retail property rose 0.3 percent for the month.

Industrial property continued to be the best performing property type on a year-over-year basis, with prices rising 6.7 percent. Prices for offices within CBDs were down 22.4 percent while prices for suburban offices fell 3.3 percent. Prices for retail property fell 1.5 percent.

Major metro commercial property prices lead decline

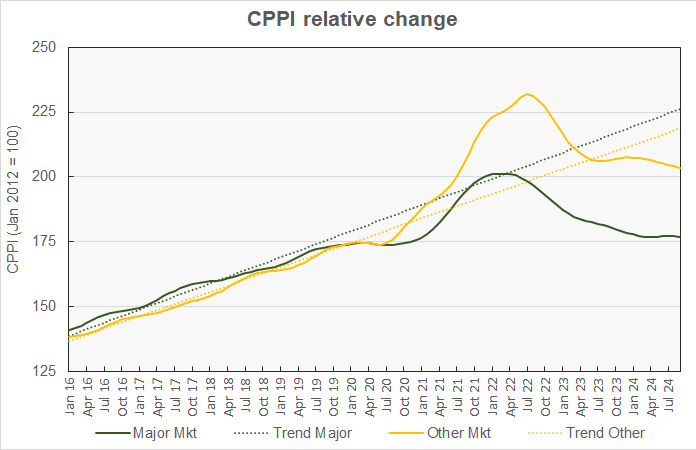

The MSCI report provides data comparing the price changes of commercial property in 6 major metro* areas against those in the rest of the country, although it does not separate out apartments from other commercial property types in this comparison. The next chart, below, plots the history of the relative price indexes since January 2016 for both market segments, along with trend lines based on straight-line fits to the changes in these indexes between January 2012 and December 2019. For purposes of this chart, both price indexes were set to values of 100 for January 2012.

The chart shows that the CPPI for major metro commercial property is down 0.1 percent month-over-month and 2.1 percent year-over-year. It has fallen 12.1 percent from its peak but is now 1.5 percent above its level in January 2020. It is 21.8 percent below its long-term trend.

The other markets CPPI is down 0.3 percent month-over-month and 1.4 percent year-over-year. It has now fallen 12.2 percent from its peak but is 16.6 percent above its level in January 2020. The non-major metro CPPI is 7.0 percent below its pre-pandemic trend.

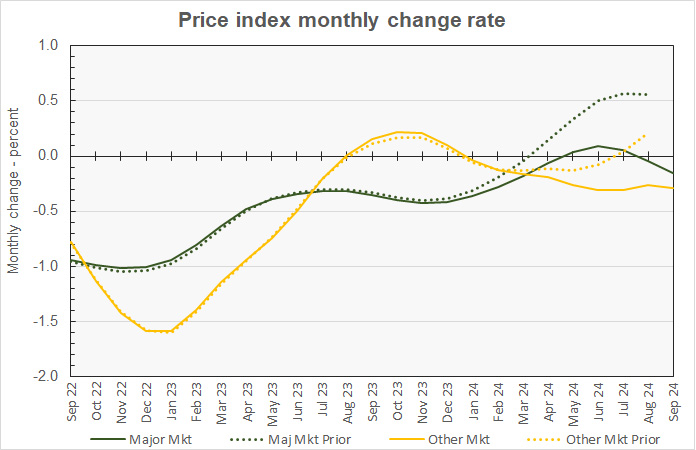

The final chart plots the history of the month-over-month changes in the price indexes for the two property markets over the last 25 months along with last month’s month-over-month price change data.

The chart shows that revisions to last month’s pricing data for both market segments were to the downside this month. The additional transactions identified for this month’s report made noticeable changes to the calculated month-over-month price growth data for at least the last 5 months.

The full report provides more detail on other commercial property types. Access to the MSCI Real Capital Analytics report can be obtained here.

*The major metros are Boston, Chicago, Los Angeles, New York, San Francisco and Washington DC.