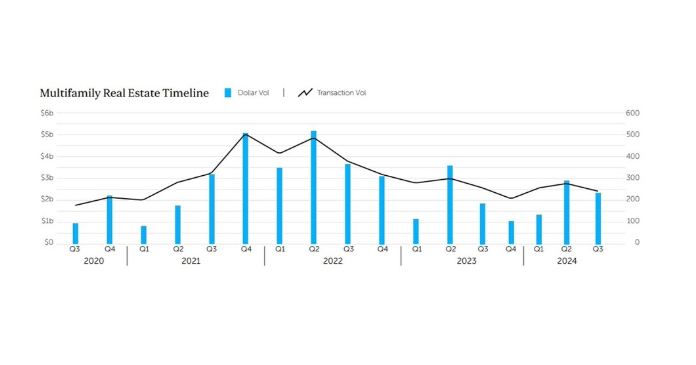

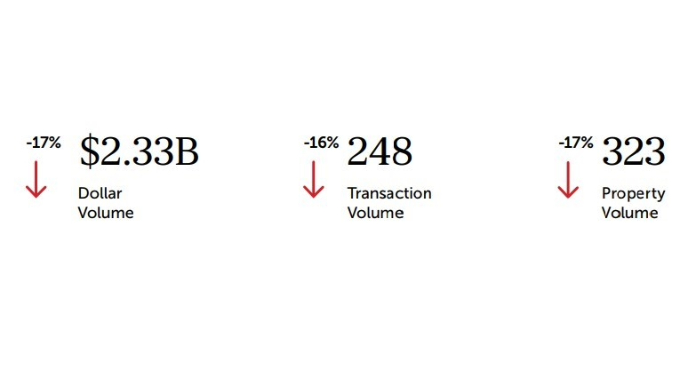

Following a robust second quarter, activity in New York City’s multifamily market slowed in the third quarter with dollar volume declining by 17% quarter-over-quarter to $2.33 billion and transactions falling by 16% to 248, according to Ariel Property Advisors’ Q3 2024 Multifamily Quarter in Review New York City.

Following a robust second quarter, activity in New York City’s multifamily market slowed in the third quarter with dollar volume declining by 17% quarter-over-quarter to $2.33 billion and transactions falling by 16% to 248, according to Ariel Property Advisors’ Q3 2024 Multifamily Quarter in Review New York City.

“Predominantly rent-stabilized buildings accounted for approximately 50% of both dollar and transaction volume in the third quarter,” said Shimon Shkury, President and Founder of Ariel Property Advisors. “These buildings are trading at an historically low basis because of regulations and high interest rates. However, private clients are becoming slightly more aggressive in their underwriting of these assets because they see lower interest rates on the horizon and the potential for regulatory changes.”

The largest transaction highlighted in the report was the multifamily sale of 20 Exchange Place from DTH Capital to The Dermot Company for $370 million, or $470 per square foot and $482,000 per unit. The property includes three bulk condo packages (two bulk residential packages with a total of 767 units and one retail condo) and was approximately 70% rent-stabilized at the time of multifamily sale.

Ariel’s report also noted a growing trend of real estate-owned (REO) properties, and deeds in lieu of foreclosure, indicating financial institutions are actively seeking ways to manage their distressed assets.

Manhattan below 96th Street multifamily dollar volume in Q3 2024 rose to $1.27 billion, a 40% jump from Q2 2024 and 21% increase from Q3 2023. Free market buildings dominated the market, accounting for 57% of the dollar volume and 83% of the transactions. As noted, the $370 million trade at 20 Exchange Place was the most significance in Manhattan followed by a $38 million transaction for 329-335 East 9th Street and 516-518 East 13th Street.

Dollar volume in Brooklyn dropped 60% to $528 million in Q3 2024 from Q2 2024 and transactions over this period declined by 12% to 115. 65% of the dollar volume and 61% of the transactions were for rent stabilized buildings with the remaining trades primarily concentrated in the free market sector. Significance included 275 Park Avenue, a 184,411-square-foot building that sold for $58.5 million, and the 478,214-square-foot Sentinel Brighten Beach and Flatbush Multifamily Portfolio that sold for $53.4 million.

Northern Manhattan submarket’s dollar volume rose to $244 million, which is a 40% increase quarter-over-quarter and 99% increase year-over-year. Predominantly rent stabilized buildings accounted for 56% of the dollar volume and 80% of the transactions, while buildings with regulatory agreements accounted for 44% of the dollar volume and 20% of the transactions. Significance included a 164,460-square-foot building at 107-145 West 135th Street, which sold for $64 million, and the 311,577-square-foot Sentinel Hamilton and Washington Heights Multifamily Portfolio, which traded for $55.8 million.

Queens’ multifamily dollar volume totaled $164 million in Q3 2024, a 43% drop quarter-over-quarter but 34% increase year-over-year, while transactions totaled 59, a 17% decline from Q2 2024 but 32% increase from Q3 2023. Predominantly rent stabilization accounted for most of the trades with 88% of the dollar volume and 78% of the transactions for the quarter. Featured transactions included 94-19 & 94-20 66th Avenue, a 97,920-square-foot building that sold for $18 million, and 30-58/30-64 34th Avenue, a 49,600-square-foot building that sold for $12.5 million.

The Bronx dollar volume was relatively flat at $124 million quarter-over-quarter and transactions fell 32% over this period to 19. Free market buildings accounted for 64% of the dollar volume and 62% of the transactions, while buildings with regulatory agreements accounted for 28% of the dollar volume and 13% of the transactions. Significance included a 44,620-square-foot property at 720 East 216th Street, which sold for $27 million, and a 44,200-square-foot building at 2732 Creston Avenue that sold for $26 million.