CoStar reported that its value-weighted index of multifamily property prices rose 1.3 percent month-over-month in September, reversing last month’s reported decline. This index was down 7.9 percent year-over-year.

Note that CoStar’s report indicates that prices moved in the opposite direction month-over-month as was reported by MSCI Real Capital Analytics. However, the less volatile year-over-year price change data for the two reports comes closer to telling the same story.

The value-weighted index of non-multifamily commercial property rose 1.4 percent month-over-month in September. This index is down 8.2 percent year-over-year. The other commercial property types tracked by CoStar are office, retail, industrial and hospitality.

For more information on the CoStar Commercial Repeat Sales Indexes (CCRSI’s), please see the description at the bottom of this report.

Multifamily property prices move sideways

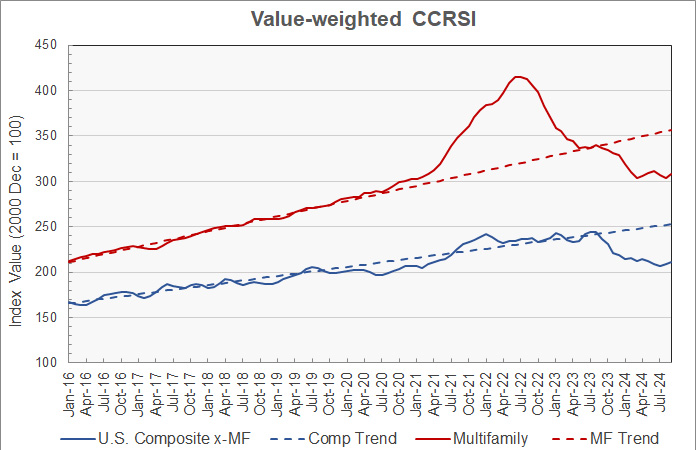

The first chart, below, shows the history of the value-weighted CCRSI’s since January 2016 for multifamily property and for all other commercial property considered as a single asset class. It also shows trend lines for the growth in the two CCRSI’s based on their growth in the period from January 2012 to January 2020. The indexes are normalized so that their values in December 2000 are set to 100.

The chart shows that multifamily property prices have been largely static since February. They are down only 0.8 percent since then. However, multifamily property prices are down 25.9 percent from the high they reached in July 2022. They are also 13.7 percent below their pre-pandemic trend.

Prices for other commercial property types rose again this month and are back to where they were in March. These prices are now 13.3 percent below their high point and 16.3 percent below their pre-pandemic trend.

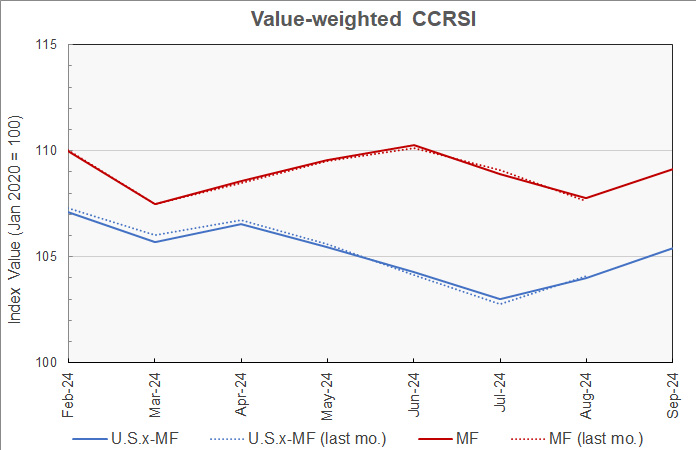

The second chart shows the recent history of multifamily property prices and other commercial property prices based on this month’s data along with the estimates from last month. For purposes of this chart, the price indexes for both property groupings were set to a value of 100 in January 2020 so that the indexes could be plotted together at a scale that would show the detailed price movements.

The chart shows that new transactions added to the data sets made only slight changes to last month’s index values. This is despite 112 new transactions (8.5 percent) being identified for August, 35 new transactions being identified for July and less than 10 new transactions being identified for each of the earlier months. This could indicate that the price appreciation rates for the new transactions matched those of the transactions CoStar had previously identified. It is also possible that few of the new transactions identified were for multifamily property.

Tracking regional differences

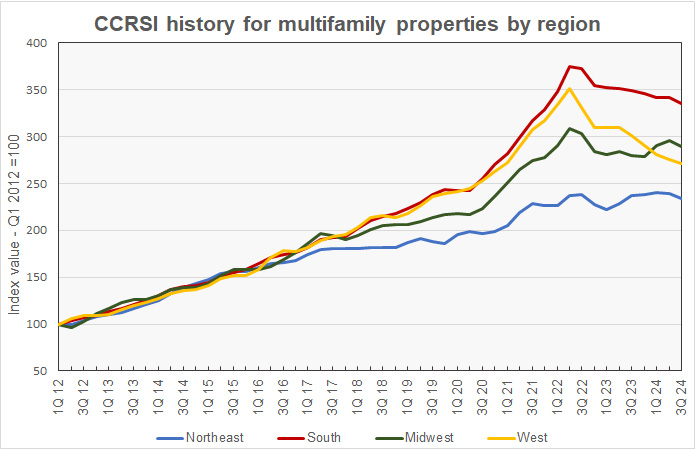

CoStar’s quarterly reports include information on changes in the equal-weighted CCRSI by property type and region. The history since Q1 2012 of these regional indexes for multifamily property is shown in the next chart, below. For purposes of this chart, the CCRSI’s for each of the four regions was normalized to a value of 100 in Q1 2012.

The chart shows that multifamily property prices in the Northeast and Midwest regions have been occupying a narrow range since 2022. By contrast, the prices for multifamily property in the South and West regions have been trending lower since reaching peaks in late 2021. Prices are off 22.7 percent in the West and 10.7 percent in the South since then.

On a quarter-over-quarter basis, multifamily property prices in Q2 2024 were down in all four regions of the country. Prices fell 1.9 percent in the Northeast, 1.9 percent in the Midwest, 1.8 percent in the South and 1.4 percent in the West.

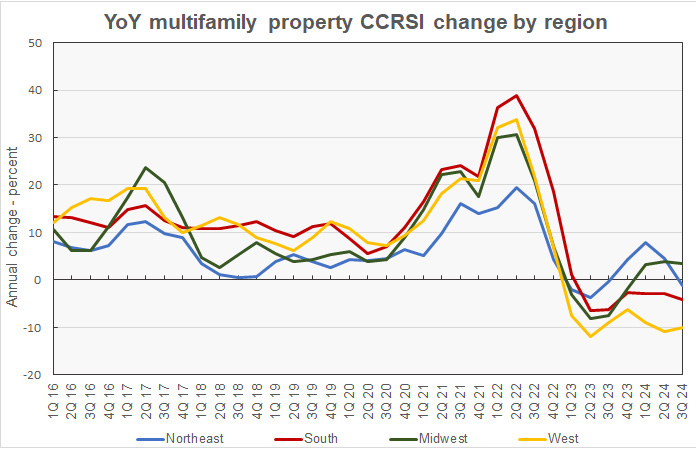

The next chart shows the history of the year-over-year regional multifamily property price changes by quarter since 2016. The chart shows that only the Midwest region saw a positive year-over-year price change in Q3.

Based on CoStar’s equal-weighted quarterly indexes and compared to year-earlier levels, prices in Q3 2024 were up by 3.5 percent in the Midwest. However, prices fell 1.2 percent in the Northeast, 4.1 percent in the South and 10.0 percent in the West.

Transaction volumes reported lower

An issue with monthly transaction volume reporting is that CoStar usually identifies additional transactions to tabulate over the next few months after the initial report, and these extra transactions tend to make initial reports of falling transaction volumes appear more negative than they will subsequently appear. For example, CoStar reported that the transaction volume in September was down 16.1 percent from the revised level of the month before, but it was only down 9.0 percent from the preliminary level for August reported last month.

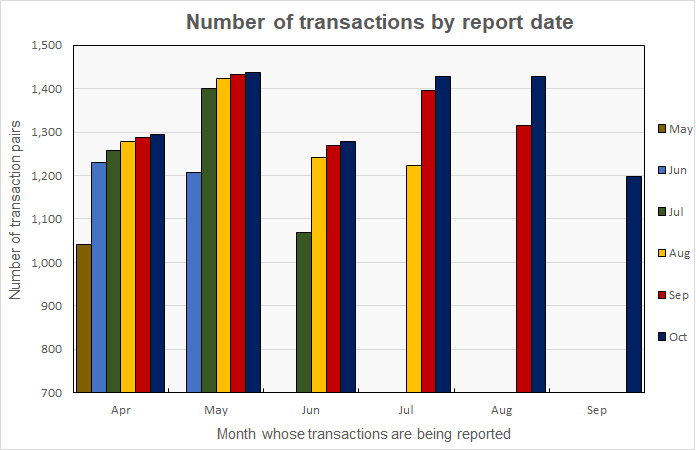

CoStar reported that their initial transaction count for September was 1,197 repeat sales pairs. This is down from the 1,315 transaction pairs identified for August in last month’s report and also down from the 1,427 transaction pairs identified for August in this month’s report.

The history of the revisions to the transaction counts for recent months is illustrated in the next chart. It shows that the number of transactions for April was initially given as 1,041 in the May report and has been revised in every subsequent report. While the size of the transaction count revision was largest in the next month’s report, additional transaction pairs for April continued to be identified in every subsequent report. The current report identifies 1,295 transactions for April. By contrast, transaction data for September only appears in the October report. We can expect it to be revised next month.

The preliminary dollar volume of transactions was reported to fall 2.6 percent from the revised level of the month before to $9.47 billion. However, the dollar volume of transactions increased 1.7 percent from the preliminary level reported last month.

The full report discusses all commercial property types. While the CoStar report provides information on transaction volumes, it does not break out multifamily transactions. The latest CoStar report can be found here.

CCRSI defined

The CoStar report focuses on a relative measure of property prices called the CoStar Commercial Repeat Sales Index (CCRSI). The index is computed based on the resale of properties whose earlier sales prices and sales dates are known. The index represents the relative change in the price of property over time rather than its absolute price. CoStar identified 1,197 repeat sale pairs in September for all property types. These sales pairs were used to calculate the results quoted here.

CoStar computes CCRSI’s for a variety of property groupings, combining them by cost, region, property type or other factors. The value-weighted index is more heavily influenced by transactions of expensive properties than is CoStar’s equal-weighted index. The value-weighted index is the focus of this report because it is an index whose value is reported monthly and for which CoStar breaks out multifamily property as a separate category.