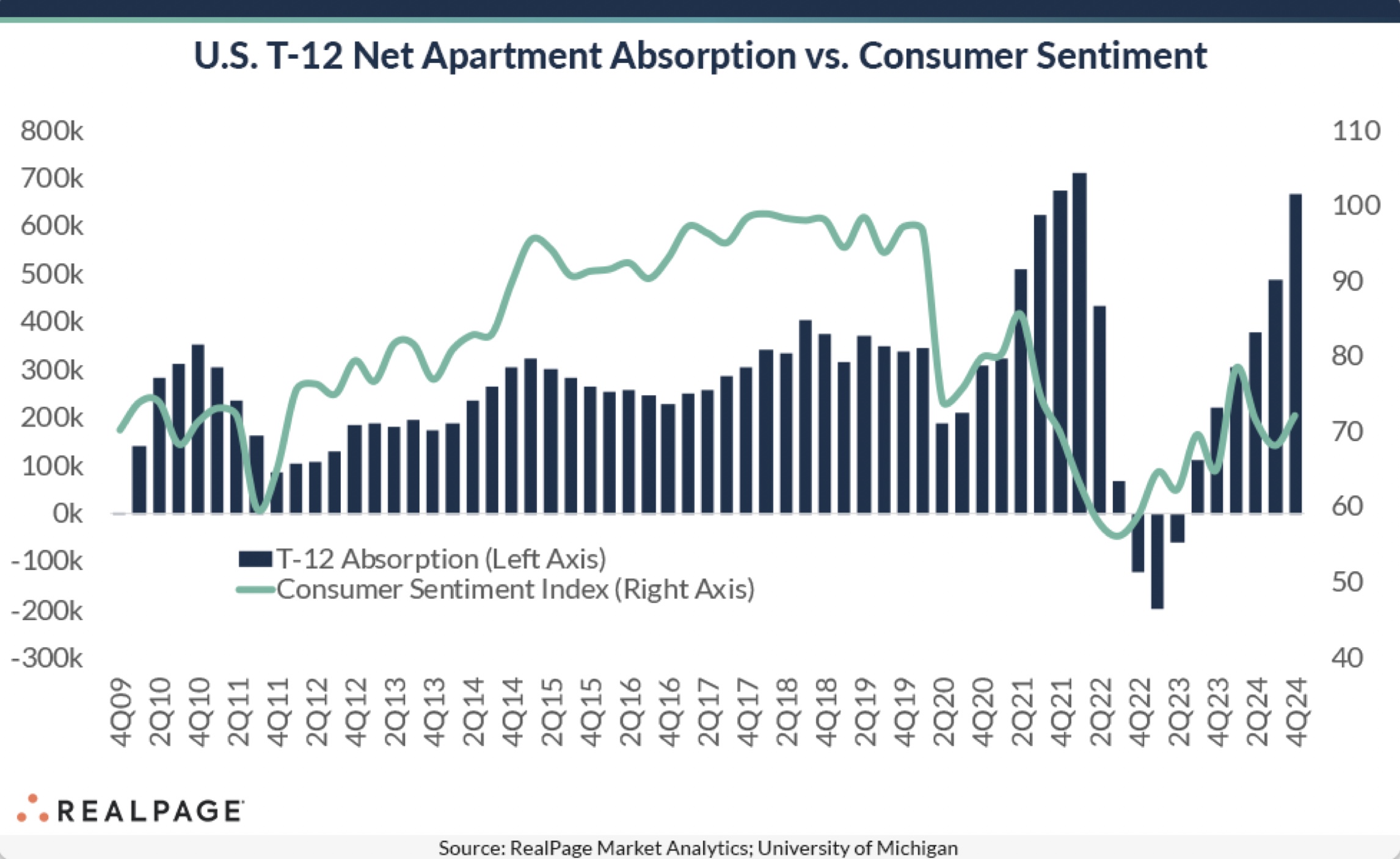

Last year’s surprising upside in apartment demand is expected to continue this year, even if the pace of absorption slows due to fewer new deliveries, said RealPage Chief Economist Carl Whittaker, who dives into factors driving apartment demand and consumer sentiment this year. Increasing demand for rental housing has coincided with steadily improving consumer sentiment and defied expectations last year in the face of moderating job growth. The chart below from RealPage shows the correlation between net apartment absorption and consumer sentiment.

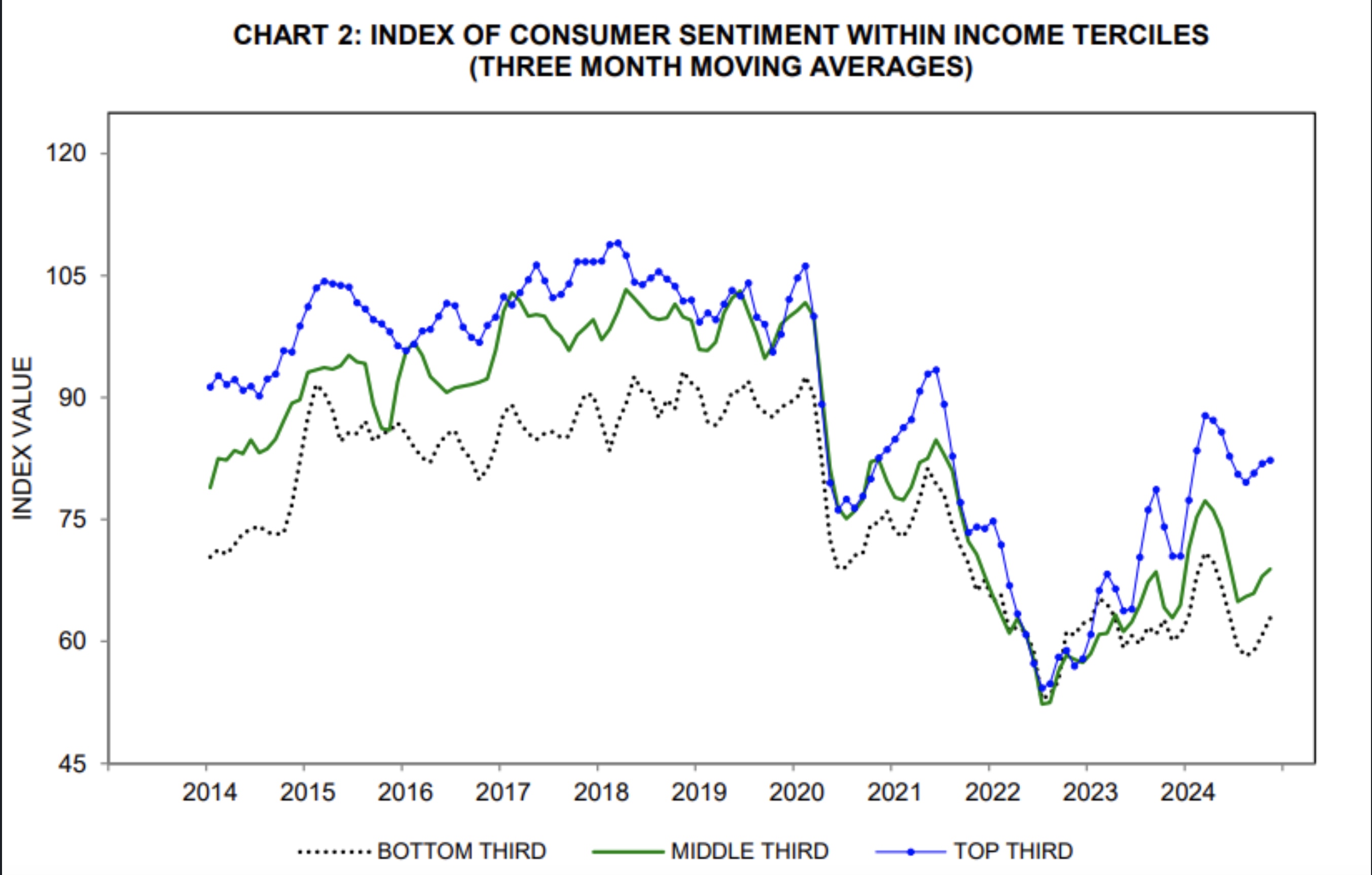

According to the University of Michigan’s Consumer Sentiment Index, consumer sentiment began trending upward from its low point in the summer of 2022, which also was the peak inflation point, and steadily improved as inflationary pressures eased.

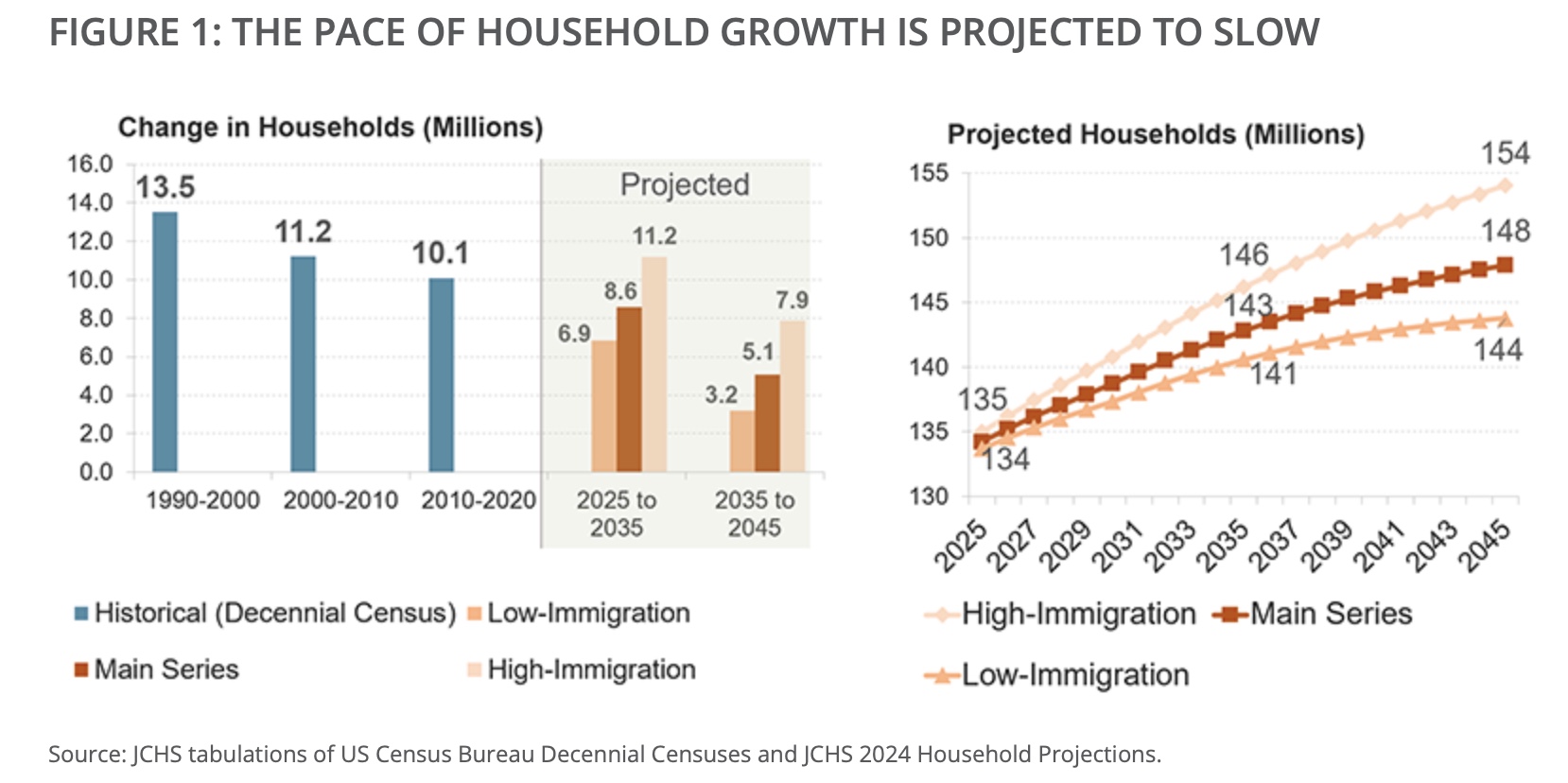

New projections from the Joint Center for Housing Studies (JCHS) anticipate a slowdown in household growth and housing demand. According to JCHS, household growth is the single largest source of demand for new housing, the need to replace older homes and accommodate a normal level of vacancies in a larger housing market. The projected slowdown in household growth will reduce demand for new housing construction from the current rate of 1.4 million units per year to an average of 1.1 million units in 2025 – 2035, says JCHS. The full paper is available here.

Yet multifamily pundits expect demand for apartments will remain strong this year driven by job growth, population growth and positive economic factors. Consumer sentiment in the 2020s cycle appears to be closely aligned with the Consumer Price Index (inflation), said Whitaker, explaining that as consumers feel better about their economic prospects, there is an accompanying improvement in household formation and consumer spending.

Consumer sentiment was at a three-year high at the end of 2024, which should help spur continued apartment absorption, said Whitaker.

This year, job growth is a potential demand concern. However, Whitaker expects slowing yet still-positive job growth to drive apartment demand. According to RealPage, U.S. annual job growth is forecast to total slightly more than one million additional jobs, or one percent growth in 2025, slightly below prior year outcomes. And, if job growth rebounds in some business sectors, economic growth will follow, said Whitaker.

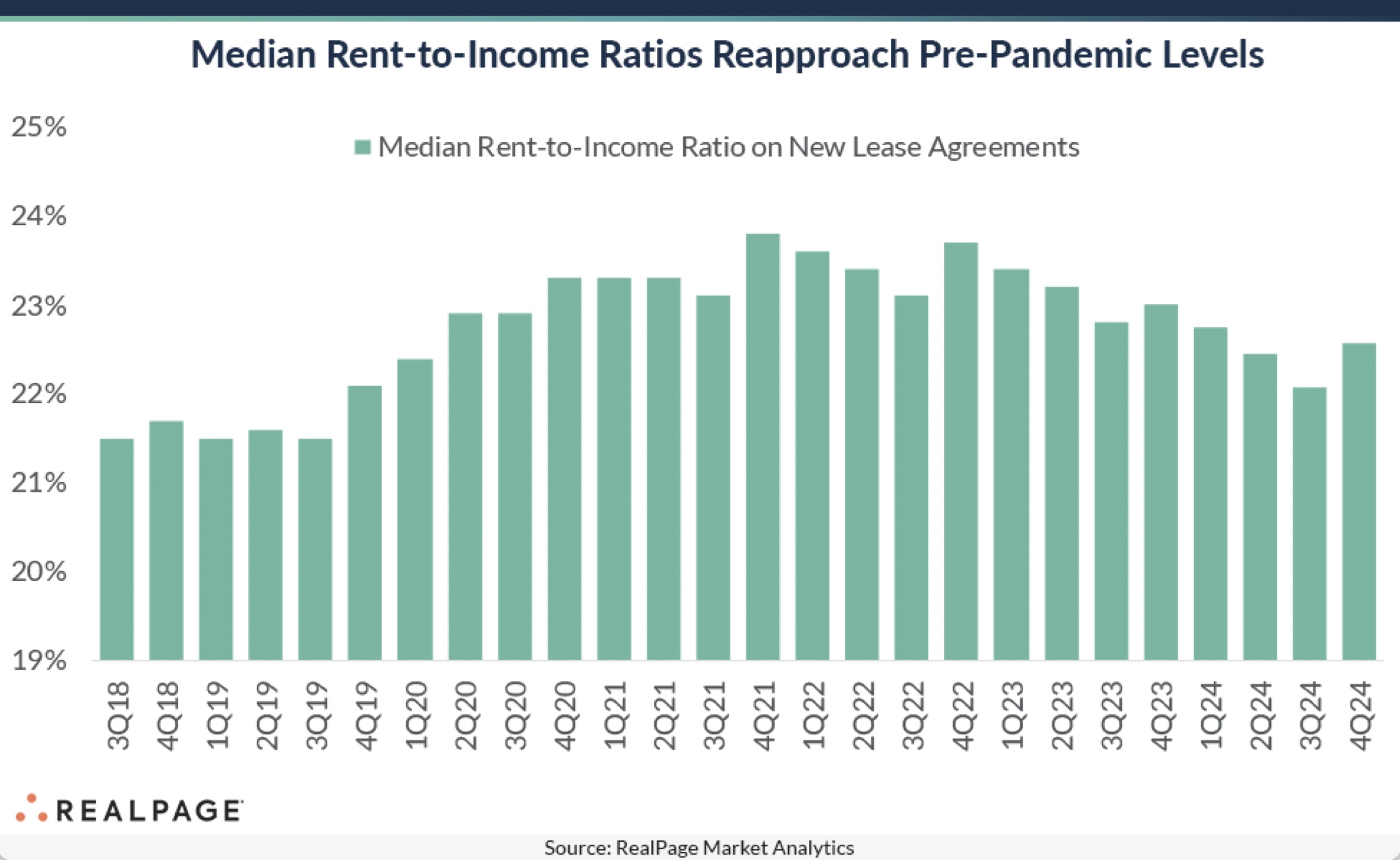

Improving affordability should be another demand driver this year, he said. According to RealPage Analytics, rent-to-income ratios trended down last year to pre-COVID levels of around 22 percent last seen in early 2020. See chart below.

Whitaker sees single-family market fundamentals as a multifamily tailwind. Quarterly apartment REIT earnings reports suggest move-outs to homeownership are down well below historical levels while single-family home prices have grown by almost 50 percent since the beginning of 2020, whereas rents are up 29 percent.

Finally, improved resident retention has resulted in fewer units needing to be backfilled, said Whitaker.

“Though demand is synonymous with absorption in a technical sense, it’s sometimes useful to think of absorption as a quantitative measure and demand as a more holistic summation of the state of the market. Demand, therefore, can be assessed in two ways: new leases and renewals,” he said.

Last year, renewals ticked up around two percent and more retention means fewer move-outs, said Whitaker. With fewer move-outs, any increase in new leases signed contributes to overall aggregate demand.

As a result of the demand drivers listed above and the increased use of concessions, new lease traffic increased. Concessions may be stimulating traffic to individual properties, said Whitaker.