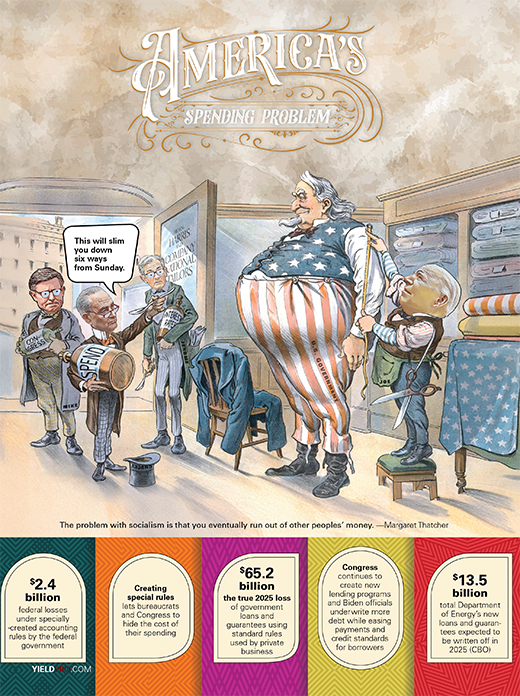

This will slim you down six ways from Sunday.

The problem with socialism is that you eventually run out of other peoples’ money. —Margaret Thatcher

$2.4 billion—federal losses under specially-created accounting rules by the federal government

Creating special rules lets bureaucrats and Congress to hide the cost of their spending

$65.2 billion—the true 2025 loss of government loans and guarantees using standard rules used by private business

Congress continues to create new lending programs and Biden officials underwrite more debt while easing payments and credit standards for borrowers

$13.5 billion—total Department of Energy’s new loans and guarantees expected to be written off in 2025 (CBO)

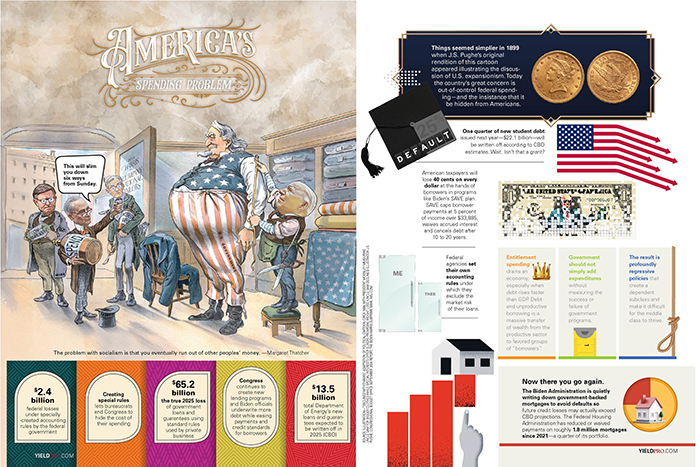

Things seemed simpler in 1899 when J.S. Pughe’s original rendition of this cartoon appeared illustrating the discussion of U.S. expansionism. Today the country’s great concern is out-of-control federal spending—and the insistence that it be hidden from Americans.

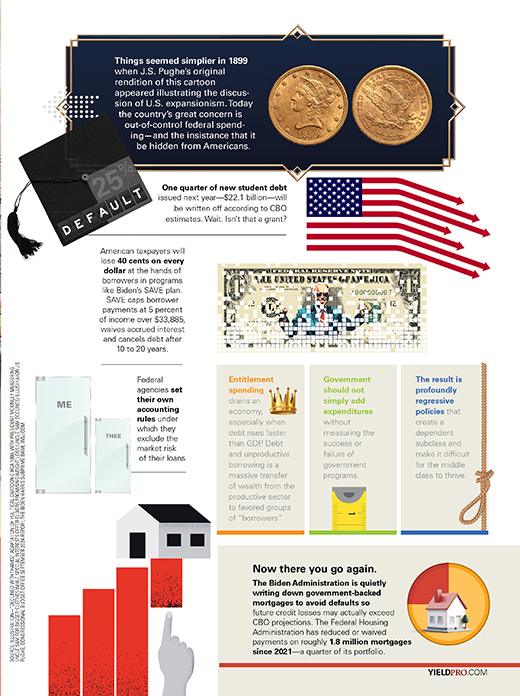

25% Default—One quarter of new student debt issued next year—$22.1 billion—will be written off according to CBO estimates. Wait. Isn’t that a grant?

American taxpayers will lose 40 cents on every dollar at the hands of borrowers in programs like Biden’s SAVE plan. SAVE caps borrower payments at 5 percent of income over $33,885, waives accrued interest and cancels debt after 10 to 20 years.

Federal agencies set their own accounting rules under which they exclude the market risk of their loans.

Entitlement spending drains an economy, especially when debt rises faster than GDP. Debt and unproductive borrowing is a massive transfer of wealth from the productive sector to favored groups of “borrowers.”

Government should not simply add expenditures without measuring the success or failure of government programs.

The result is profoundly regressive policies that create a dependent subclass and make it difficult for the middle class to thrive.

Now there you go again.

The Biden Administration is quietly writing down government-backed mortgages to avoid defaults so future credit losses may actually exceed CBO projections. The Federal Housing Administration has reduced or waived payments on roughly 1.8 million mortgages since 2021—a quarter of its portfolio.

Source: Illustration—”Declined with Thanks,” adaptation of political cartoon circa 1899, with President McKinley measuring Uncle Sam for bigger clothes while special interests offer elixirs promising weight loss (Uncle Sam declines) illustrator J.S. Pughe; congressional budget office September 2024 report; the Biden-Harris subprime bank, wsj.com