Here’s how.

1 Shoe leather

The resources and energy people use to convert deteriorating currency into stable assets are costly. Economists call this shoe leather costs, alluding to how people destroy their shoes in the metaphorical run to the bank.

2 Money and value are decoupled

Inflation disrupts money’s function of keeping track of the value of things. When prices are stable, we comprehend the relative value of goods. We know that dining out is 5X more expensive than eating at home. Yet, when prices increase rapidly, it’s difficult to keep track of the relative cost of things leading to wasteful decisions. Inflation makes accounting difficult.

3 Savings are destroyed

Rising prices mean savings buys fewer things. If you have $12,000 in savings and spend $1,000 on rent per month, you have a year’s worth of rent in savings. However, if inflation drives your rent up to $1,500 per month, your savings now affords you four fewer months of rent.

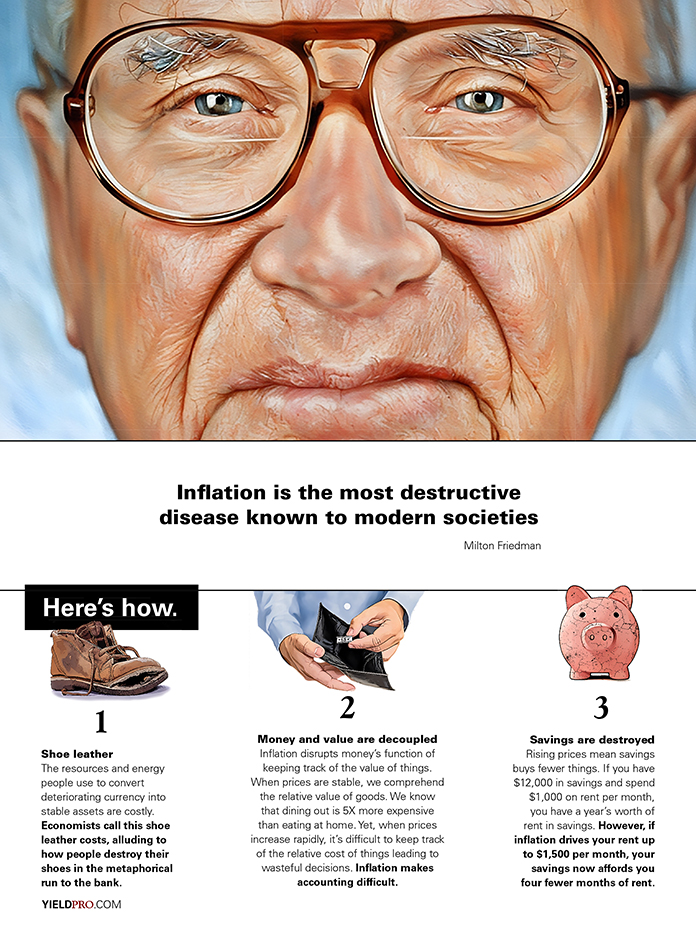

4 Inflation degrades citizens’ savings

Inflation frustrates people’s ability to plan causing chaos. A person who planned on having a year of savings must suddenly scramble in response to inflation eroding their account.

5 Savings is the foundation of modern society. In order to increase our future wealth, we save our funds and resources or borrow from the savings of another.

All large-scale, long-term projects require savings. When savings are disincentivized, wealth creation stops (or is even reversed as people begin to consume their savings). This makes people more short-sighted in practice, and long-term economic growth ceases to exist.

44M views of Elon Musk’s recent repost of Milton Friedman on inflation

Inflation is unparalleled in its ability to destroy a society

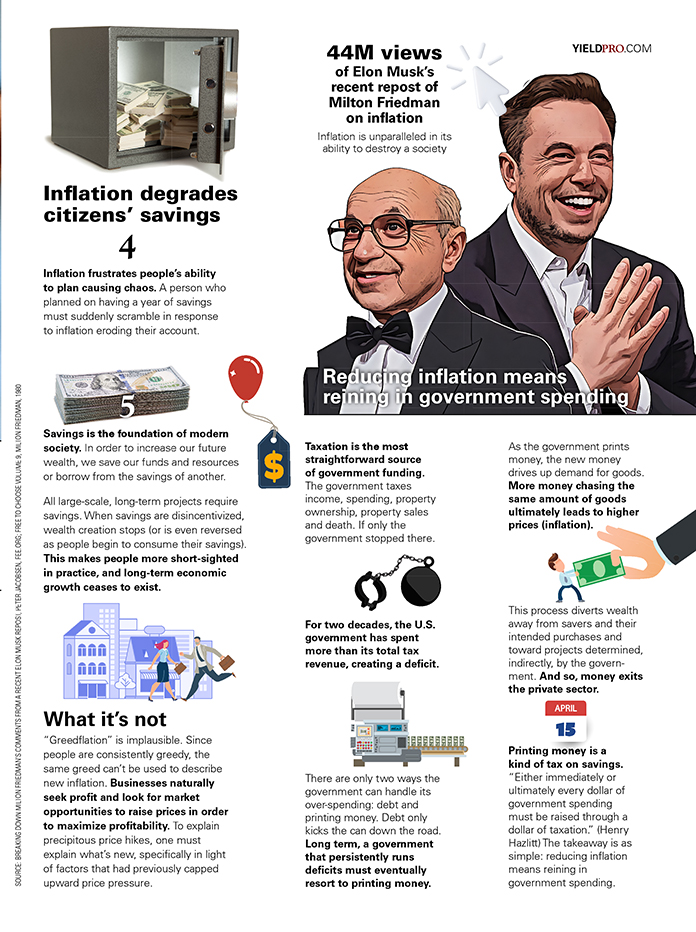

Reducing inflation means reining in government spending

Taxation is the most straightforward source of government funding. The government taxes income, spending, property ownership, property sales and death. If only the government stopped there.

For two decades, the U.S. government has spent more than its total tax revenue, creating a deficit.

There are only two ways the government can handle its over-spending: debt and printing money. Debt only kicks the can down the road. Long term, a government that persistently runs deficits must eventually resort to printing money.

As the government prints money, the new money drives up demand for goods. More money chasing the same amount of goods ultimately leads to higher prices (inflation).

This process diverts wealth away from savers and their intended purchases and toward projects determined, indirectly, by the government. And so, money exits the private sector.

Printing money is a kind of tax on savings. “Either immediately or ultimately every dollar of government spending must be raised through a dollar of taxation.” (Henry Hazlitt) The takeaway is as simple: reducing inflation means reining in government spending.

Source: Breaking down Milton Friedman’s comments from a recent Elon Musk repost, Peter Jacobsen, fee.org; free to choose volume 9, Milton Friedman, 1980