Middle Street Partners (“MSP”) has completed a recapitalization with Inceptiv Management that will allow the multifamily investment and development firm to target $1 billion of early cycle developments and acquisitions over the next two-to-three years.

The recapitalization also includes a significant capital commitment from a partnership of high-net-worth individuals operating as Cannery Woods, LLC. Part of a very unique niche strategy, the transaction strengthens MSP’s ability to acquire new assets, recapitalizes GP investments across MSP’s existing portfolio of assets, buys out its previous minority GP owner, and increases the firm’s guarantee capacity for future growth of its development business throughout the Sunbelt, according to co-founders Adam Monroe and Ryan Knapp.

“This transaction facilitates our goal of continued early-cycle investment volume and marks the continued long-time partnership between MSP and the Principals of Inceptiv and Cannery Woods,” said Monroe. “Their knowledge of our business and a track record of success between our respective firms create an ideal fit as we look towards the continued growth of MSP,” Knapp added.

Inceptiv, a private equity firm based in Culver City, California, specializes in providing specialty GP capital solutions to both fund managers and independent sponsors. Inceptiv’s investment highlights its focus on empowering growth-oriented platforms that exhibit strong leadership and a well-defined strategy through creative GP capital structures. By providing bespoke capital, Inceptiv enables partners such as MSP to seize market opportunities and continue meaningful growth.

“We’ve known the Middle Street team for many years, have been impressed with their growth, extraordinary investment discipline, and deep bench of senior professionals,” said Inceptiv partners Hezy Shalev and Ulin Vijaya. “We are very excited to continue being a part of their growth story.”

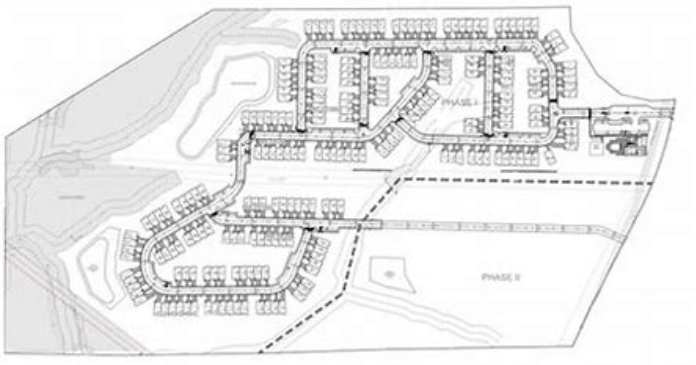

Middle Street Partners is a vertically-integrated real estate investment and development company focused on multifamily investments in the Sunbelt. Since its founding in 2009, Middle Street Partners has sponsored in excess of $2 billion in multifamily acquisitions and development located primarily in Georgia, Tennessee, Florida, North Carolina, South Carolina and Texas.

Inceptiv is a private equity firm based in Culver City, California, specializing in providing specialty GP capital solutions to real estate and private equity sponsors. With a focus on bespoke capital structures, Inceptiv partners with sponsors to support strategic growth, enabling its partners to scale operations, capitalize on market opportunities, and deliver exceptional outcomes for stakeholders.