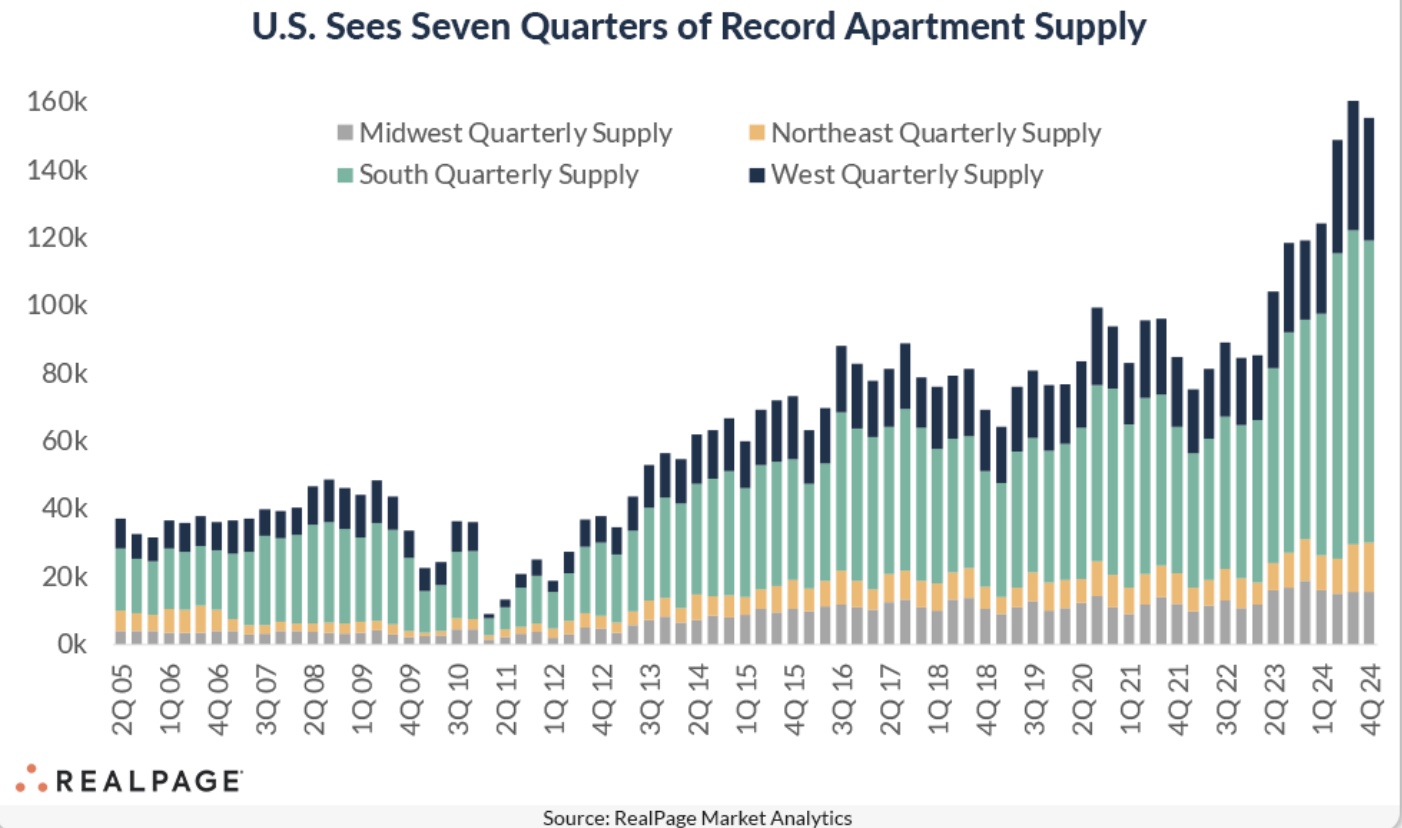

Apartment occupancy has increased across all three asset classes lead by Class B, despite a 50-year-high wave of new apartment deliveries, according to RealPage Analytics. Seven consecutive quarters of record new apartment supply caused occupancy to dip slightly in 2024, but the year ended with a rebound in demand that pushed occupancy close to historical levels. Chart below shows quarterly apartment supply across four national regions.

According to the National Multifamily Housing Council, the surge in new supply put downward pressure on rent growth and occupancy, especially in Sunbelt markets.

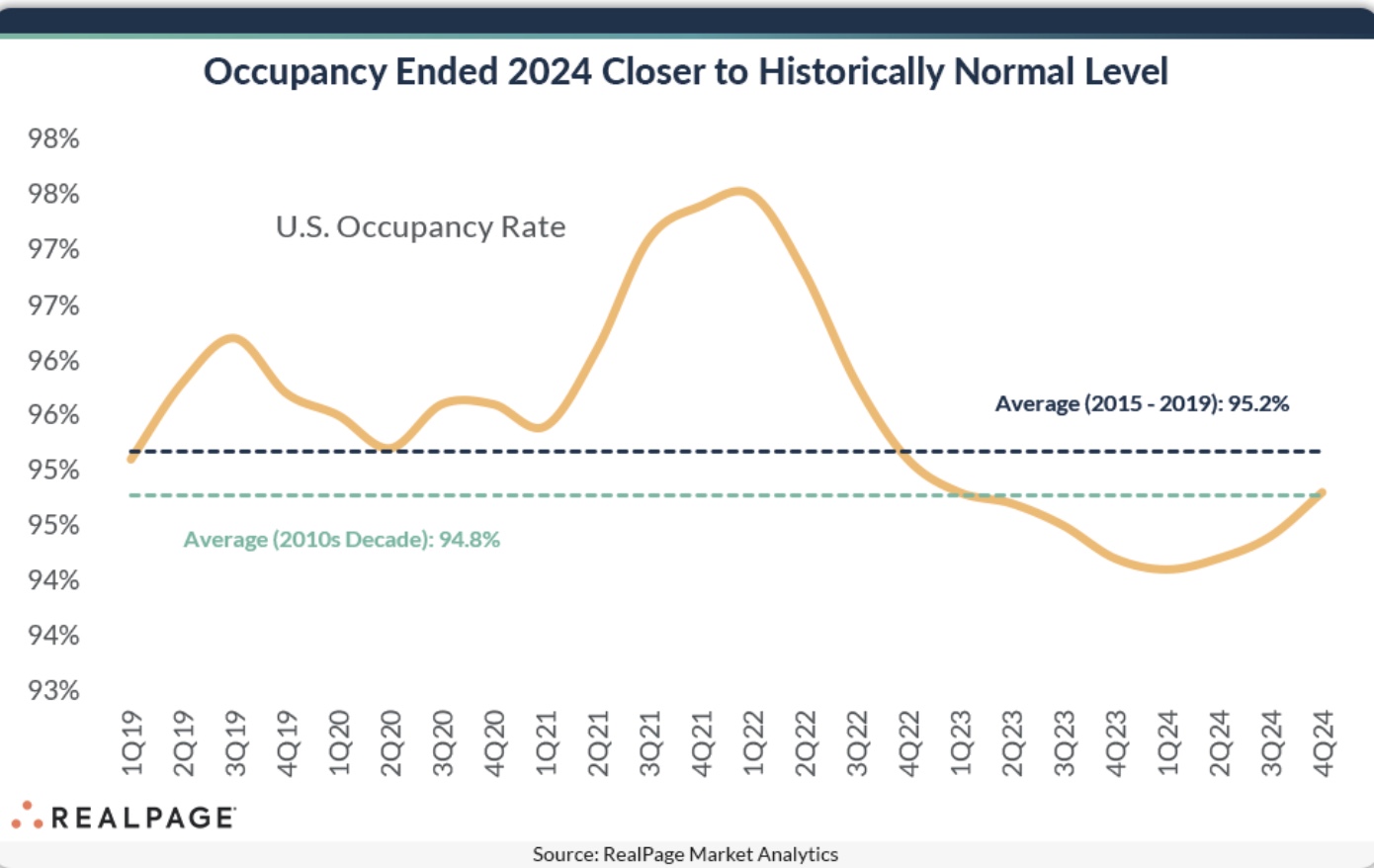

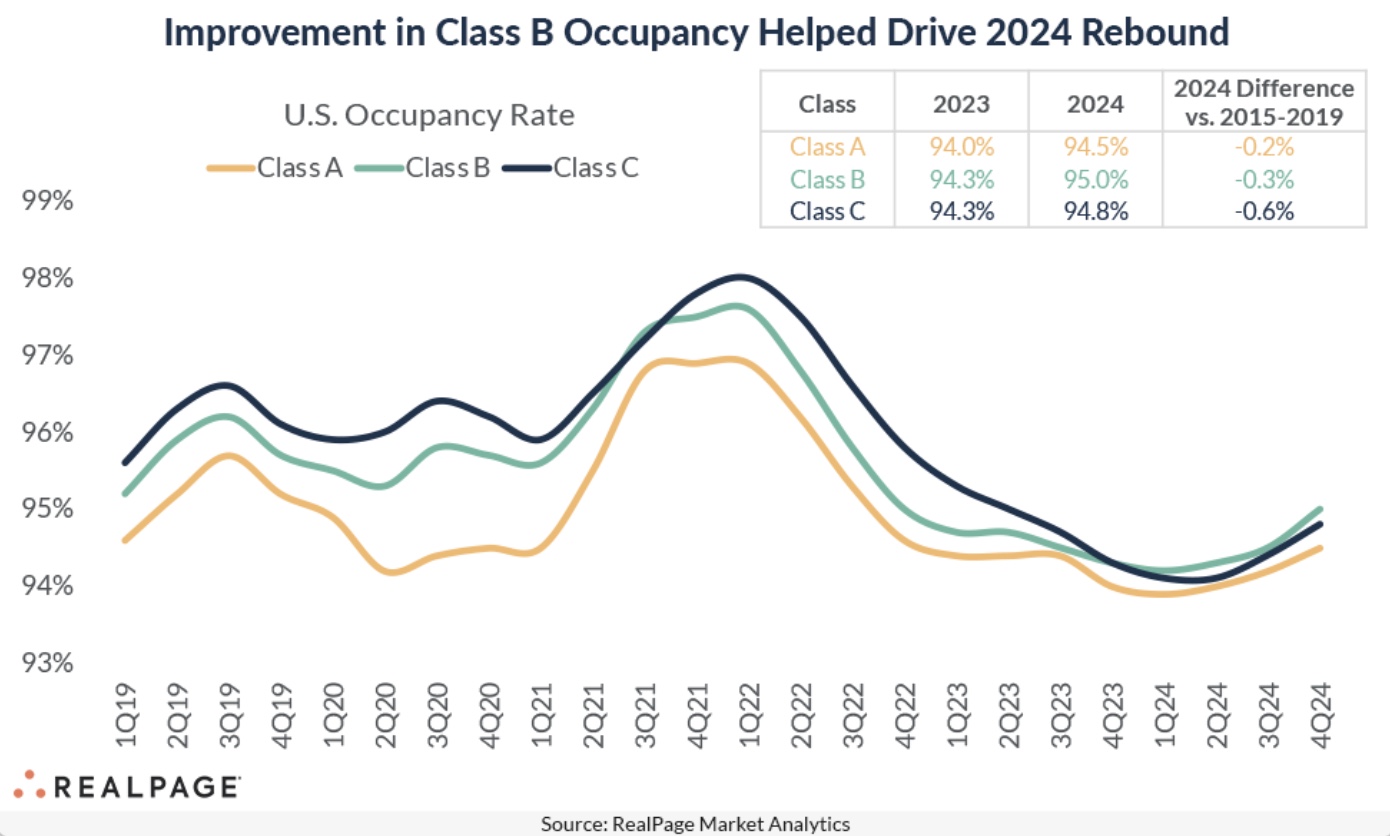

Early in 2024, occupancy hit a recent low of 94.1 percent but bounced to 94.8 percent by the end of the fourth quarter consistent with the U.S. apartment market’s long-term norm from the 2010’s decade and the more recent average from 2015 through 2019 of 95.2 percent, per data from RealPage.

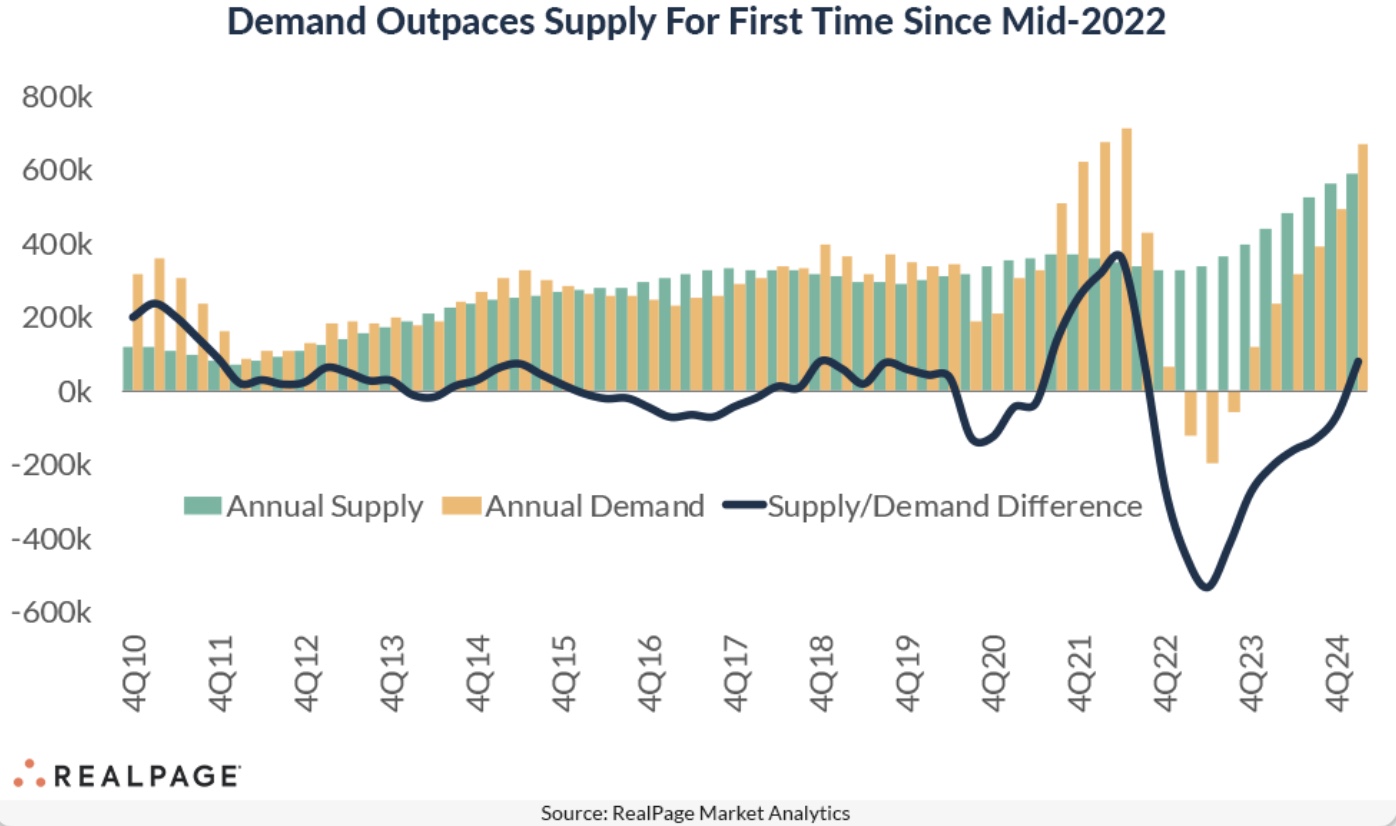

Also in the fourth quarter of 2024, demand for apartments reached its highest level in nearly three years, outpacing the decades-long high of new supply that reached a peak last year.

Class B multifamily units lead the occupancy recovery for the first time since 2010, reaching 95 percent occupancy by the end of 2024, ahead of Class C at 94.8 percent and Class A at 94.5 percent.

Because Class B stock comprises roughly half the existing nationwide apartment base compared to roughly a quarter each in Class A and Class C, it’s not surprising that Class B would post the tightest occupancy. But this reverses a historical trend from the 2010s through the early pandemic period when Class C was the most occupied product class in the nation.

Class B occupancy shot up 80 basis points by the end of the year, pulling ahead of the other asset classes and playing a pivotal role in boosting overall occupancy. Class A and Class C also improved but showed more subdued increases of 50 basis points each.

While all three asset classes showed occupancy gains, none returned to their pre-pandemic averages. But, combined with strengthening demand and moderating supply, improvement in all three classes casts a positive outlook for the apartment market in 2025.

The apartment sector’s improving fundamentals were matched by a 22 percent year-over-year increase in deal volume, reaching $146 billion. The surge in investor activity was driven by strong demand for income-producing assets, attractive apartment pricing and stabilizing cap rates, according to a report from CBRE that revealed 72 percent of commercial real estate investors ranked multifamily as their top asset class.

Apartment values fell just 4.2 percent year- over-year in Q4 2024 compared to 13.3 percent in Q3 2023, while cap rate increases slowed to just 10 basis points compared to 70 basis points over the same period.

Strong demand for rental units should continue to boost occupancy levels and accelerate rent growth next year, leading to increased investment activity. CBRE predicts that the average multifamily vacancy rate will reach 4.9 percent by 2025, and the average annual rent growth will be 2.6 percent. CBRE’s investor intention survey here.