Fannie Mae’s February housing forecast calls for multifamily starts to slow to start 2025 but to then rise through the end of 2026. The starts forecasts for every quarter in 2025 and 2026 were revised higher from the levels in last month’s forecast.

The forecast for single-family housing starts was revised marginally higher in Q1 and Q2 of 2025 but lower in every subsequent quarter through the end of 2026.

Even higher for longer

While President Trump has spoken of the possibility of making significant changes to tariff rates and to trade policy generally, the only potential change that was considered in developing Fannie Mae’s latest forecast was the 10 percent tariff on Chinese goods. The imposition of this tariff is expected to cause a slight decrease in GDP growth and a slight increase in inflation from what they would have otherwise been.

For the second straight month, Fannie Mae’s forecasters revised their predictions for the Fed Funds rate at year-end 2025 and 2026 higher. Fannie Mae’s forecasters now expect the Fed Funds rate to fall to an average of 4.1 percent in Q4 2025 and then to stay at that level through the end of 2026. Last month’s forecast had called for the rate to fall to 3.9 percent in Q4 2026 while the forecast from the month before that called for a Fed Funds rate of 3.4 percent in Q4 2026.

Despite the higher-for-longer forecast for the Fed Funds rate, predictions for the 10-year Treasury rate were left unchanged this month. It is still predicted to rise to a level of 4.6 percent in Q1 through Q3 2025 and rise again to 4.7 percent in Q4 2025. It is predicted to remain there through the end of 2026.

Multifamily starts forecast sharply higher

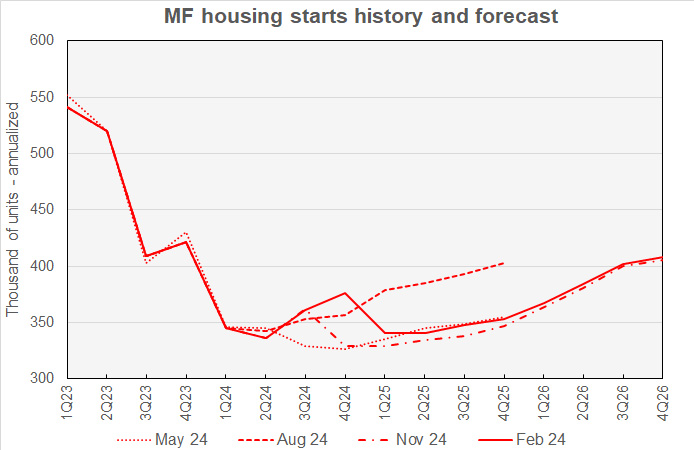

The current forecast for multifamily housing starts is shown in the first chart, below, along with three other recent forecasts. Fannie Mae considers any building containing more than one dwelling unit to be “multifamily”, including both condominiums and rental housing units.

Revisions to Fannie Mae’s multifamily housing starts forecasts were significant and all to the upside this month. The revisions to the quarterly forecasts for 2026 almost exactly reverse those made in last month’s report. The revisions to the quarterly forecasts for 2025 more than reverse those made last month.

The low point for multifamily starts is now seen as being in Q1 and Q2 2025 with 341,000 annualized starts in each quarter. The forecast calls for multifamily housing starts to rise from that point, ending with 408,000 annualized unit starts in Q4 2026. This is up from 363,000 annualized starts for Q4 predicted last month.

For reference, the most recent new residential construction report from the Census Bureau has multifamily starts running at a seasonally adjusted annualized rate of 372,000 units in Q4. The Census Bureau also reports that there were 473,000 starts in 2023 and 354,000 starts in 2024.

Looking at full-year forecasts, the predicted number of multifamily starts for 2025 was revised higher by 27,000 units to 346,000 units. The forecast for multifamily starts in 2026 was revised higher by 35,000 units to 390,000 units.

Single-family starts forecast slightly lower

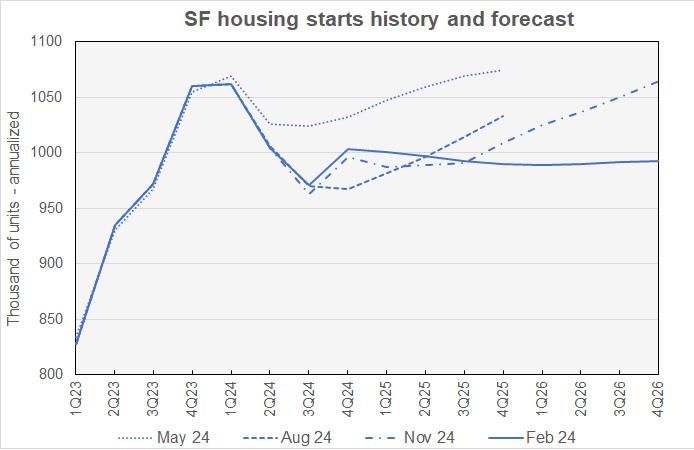

The current forecast for single-family housing starts is shown in the next chart, below, along with three other recent forecasts.

Revisions to the single-family starts quarterly forecasts called for higher starts in the near term and lower starts in the long term, resulting in a prediction of nearly flat starts over the forecast horizon. While the November forecast for single-family starts in Q4 2026 called for 1,065,000 units, the current forecast for that quarter only anticipates 993,000 starts. This is down slightly from the 1,001,000 single-family starts currently predicted for Q1 2025.

The low point for single-family starts going forward is now predicted to be Q1 2026 at 989,000 annualized units.

Looking at full-year predictions, Fannie Mae now expects 2,000 more single-family starts in 2025 than forecast last month at 995,000 units. The forecast for full-year single-family starts in 2026 is for 991,000 units, down 14,000 units from last month’s forecast.

GDP growth seen higher in 2026

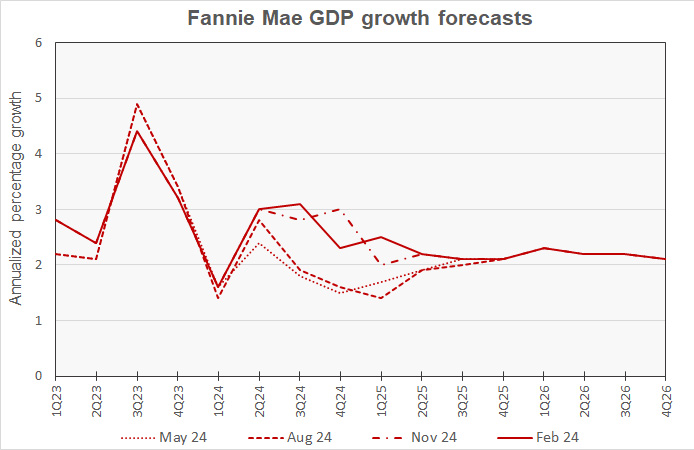

The next chart, below, shows Fannie Mae’s current forecast for Gross Domestic Product (GDP) growth, along with other recent forecasts.

Fannie Mae’s forecasters have repeatedly predicted that GDP growth would weaken soon, only to have to revise their forecasts higher for longer. That happened again this month when they revised their forecast for Q1 2025 GDP growth higher by 0.3 percentage points to 2.5 percent at a seasonally adjusted annualized rate. This adjustment is based on strong economic fundamentals at the end of 2024.

Upward revisions to GDP growth forecasts for 2026 put the quarterly growth rates right where they were in November’s forecast. Fannie Mae’s forecasters now expect year-over-year GDP growth to be 2.1 percent in both 2025 and 2026.

PCE Inflation forecast revisions generally higher

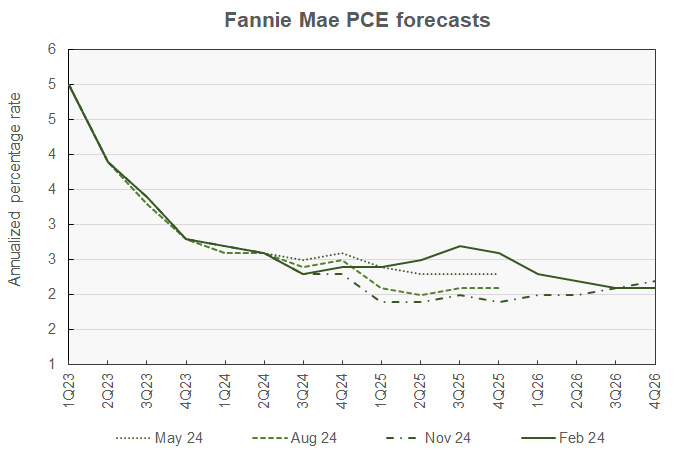

The next chart, below, shows Fannie Mae’s current forecast for the chained personal consumption expenditures (PCE) inflation rate, along with three other recent forecasts.

Fannie Mae’s forecasters raised their inflation forecasts for 2025 significantly higher. They now expect inflation to rise in the first part of the year, peaking at 2.7 percent in Q3. This is 0.4 percentage points higher than they predicted last month. They expect PCE inflation to fall from that point, ending 2026 at a rate of 2.1 percent. This is the same rate they predicted for Q4 2026 in last month’s forecast.

Forecasting declining employment growth

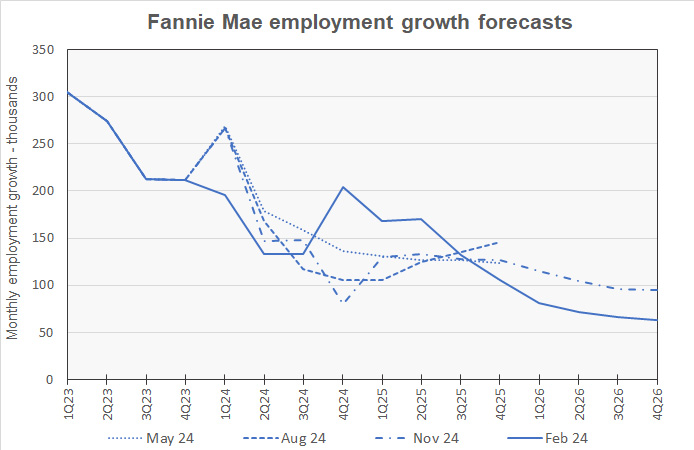

The next chart, below, shows Fannie Mae’s current forecast for employment growth, along with three earlier forecasts. Employment growth is our preferred employment metric since job gains, along with productivity gains, drive economic growth. By contrast, the unemployment rate depends on employment but also on the labor force participation rate. Either rising employment or falling labor force participation can drive the unemployment rate lower, but only the former would contribute to economic growth.

Note that the employment data quoted this month is based on revised population estimates from the Census Bureau, so the figures are not directly comparable to those given in earlier reports.

The forecasters called for monthly employment growth in Q4 2024 to be 204,000 jobs per month. Employment growth is then predicted to trend downward, reaching only 63,000 jobs per month in Q4 2026.

For reference, the business survey in the February Employment Situation Report from the Bureau of Labor Statistics indicates that the economy added an average of 204,000 jobs per month in Q4, although the actual monthly employment growth in the quarter varied from 44,000 jobs per month to 307,000 jobs per month.

Employment growth in 2025 is now expected to be 1,700,000 jobs. The employment growth forecast for 2026 calls for the economy to add 800,000 jobs.

The Fannie Mae January forecast can be found here. There are links on that page to the detailed forecasts and to the monthly commentary.