Increasing household debt and delinquencies signals challenges ahead for multifamily owners, operators, and renters. Rising credit card debt and high credit-card interest rates make it difficult for renters to make ends meet, especially those who lease market-rate and affordable properties.

Greg Willets keeps his finger on the pulse of the economy and how it affects the multifamily housing industry as part of his job. Willets is chief economist for LeaseLock, a rental security deposit insurance company.

He follows the Federal Reserve Bank of New York’s (FRBNY) quarterly report on household debt to determine how shifts in debt numbers might alter the ability of households to meet their housing payment obligations.

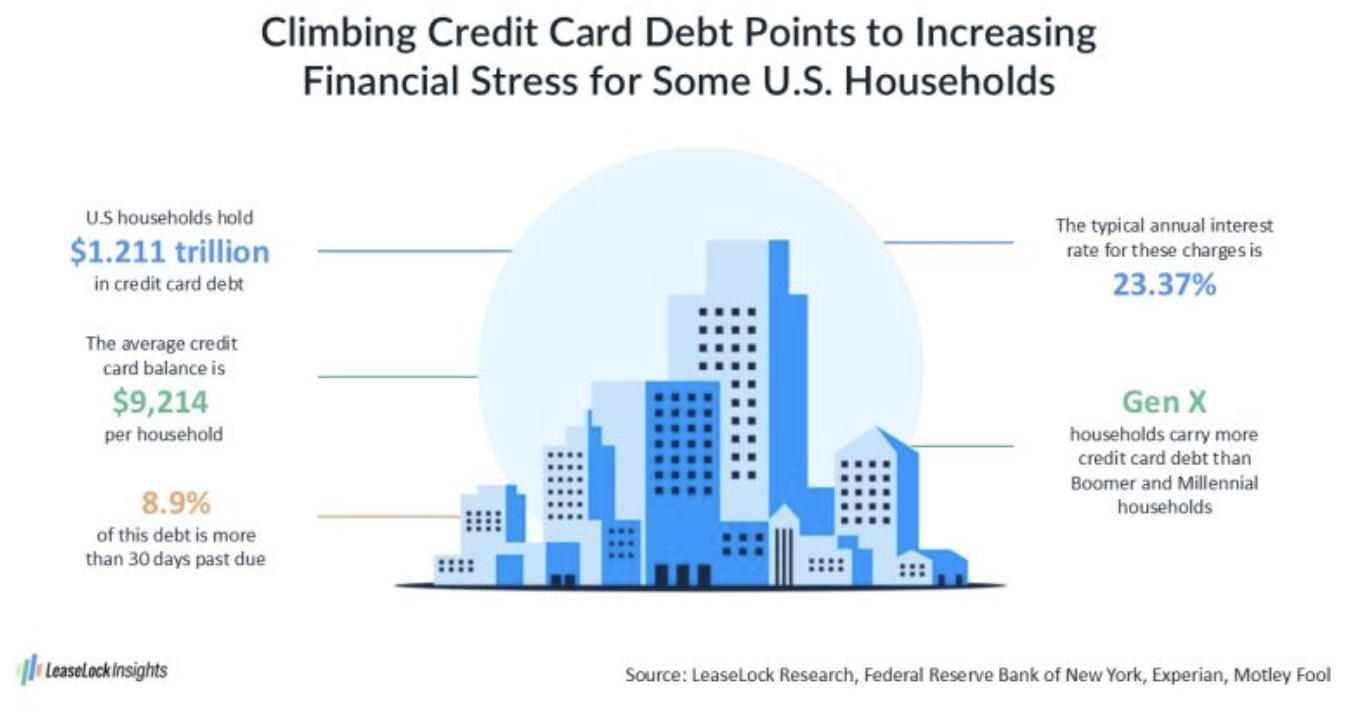

According to today’s FRBNY statistics, household credit card debt in the U.S. has risen significantly, now totaling $1.211 trillion. This is a seven percent increase year-over-year and a 57 percent jump since 2021, when COVID-related assistance checks temporarily lowered debt levels.

“While I wouldn’t put any of the current metrics into red flag territory, it’s worth noting how quickly some households are running up credit card debt at the same time that payment delinquencies are beginning to rise,” said Willets

The average household carries over $9,200 in credit card debt and delinquencies are rising, according to the Motley Fool.

Today, just under nine percent of credit card debt is more than 30 days past due and more than seven percent is more than 90 days past due, up from historic levels in 2021 to 2022, writes Willets on his LinkedIn page.

While delinquency rates remain well below levels during the Great Financial Crisis of 2009 through 2010, the real concern is credit card interest rates that have risen to what some may consider usury levels.

As of Q4 2024, the FRBNY calculates credit card interest rates at more than 23 percent, making this type of debt much more expensive than auto loans or mortgages. Morover, this week, the average APR for credit cards in Forbes Advisor’s database is 28.72 percent. This overall average calculation includes airline, hotel, flexible rewards, cash back, student, zero percent APR, balance transfer and business credit cards.

At these rates, carrying a balance on credit cards can be extremely costly and many consumers end up paying two to three times the original price of goods and services if they can only afford to make minimum payments.

Renters relying on credit cards risk falling into a vicious cycle of debt that makes it harder for them to meet monthly rent payments along with other debts, leading to missed rent payments, higher delinquencies and ultimately evictions. Rising delinquencies also result in stricter approval criteria for leases and potentially shrink the pool of qualified renters, especially in Class B and C properties.

Heavier debt loads also may prevent renters from moving to higher-quality housing or saving for homeownership, the latter of which increases demand for rental housing. Renewal rates may decline if renters need to downsize or move to lower-cost markets. And, renters-by-necessity who are unable to make their lease payments also limit the ability of landlords to raise rents and may necessitate operators use concessions to attract and retain tenants.

Gen Xers aged 45 to 60 carry the highest balances per household today, higher than younger and older cohorts. Willets says this is likely because Gen Xers are in their peak earning years.

Conclusion: The combination of rising debt, delinquencies, and high interest rates suggests greater financial stress for renters and higher risk of delinquency rates and evictions for multifamily owners and operators, particularly in middle-market and affordable housing segments.