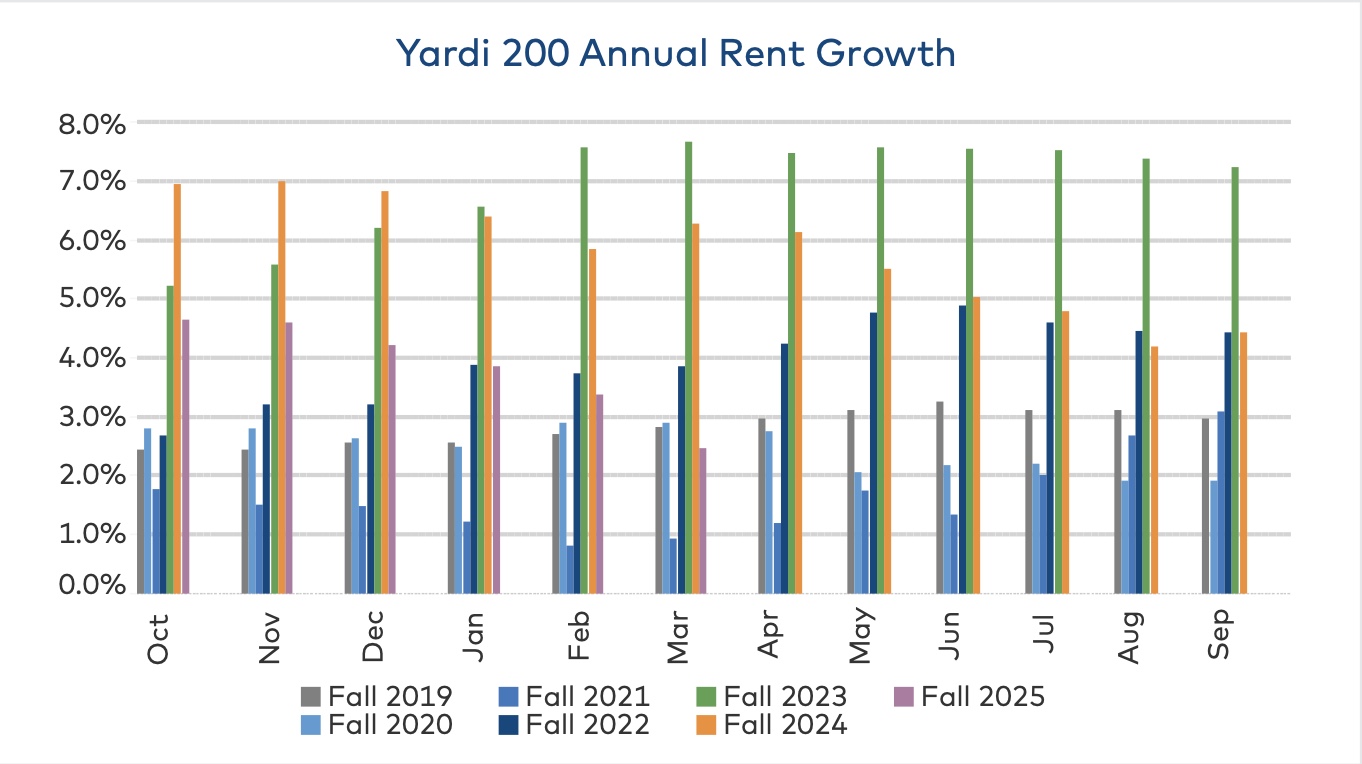

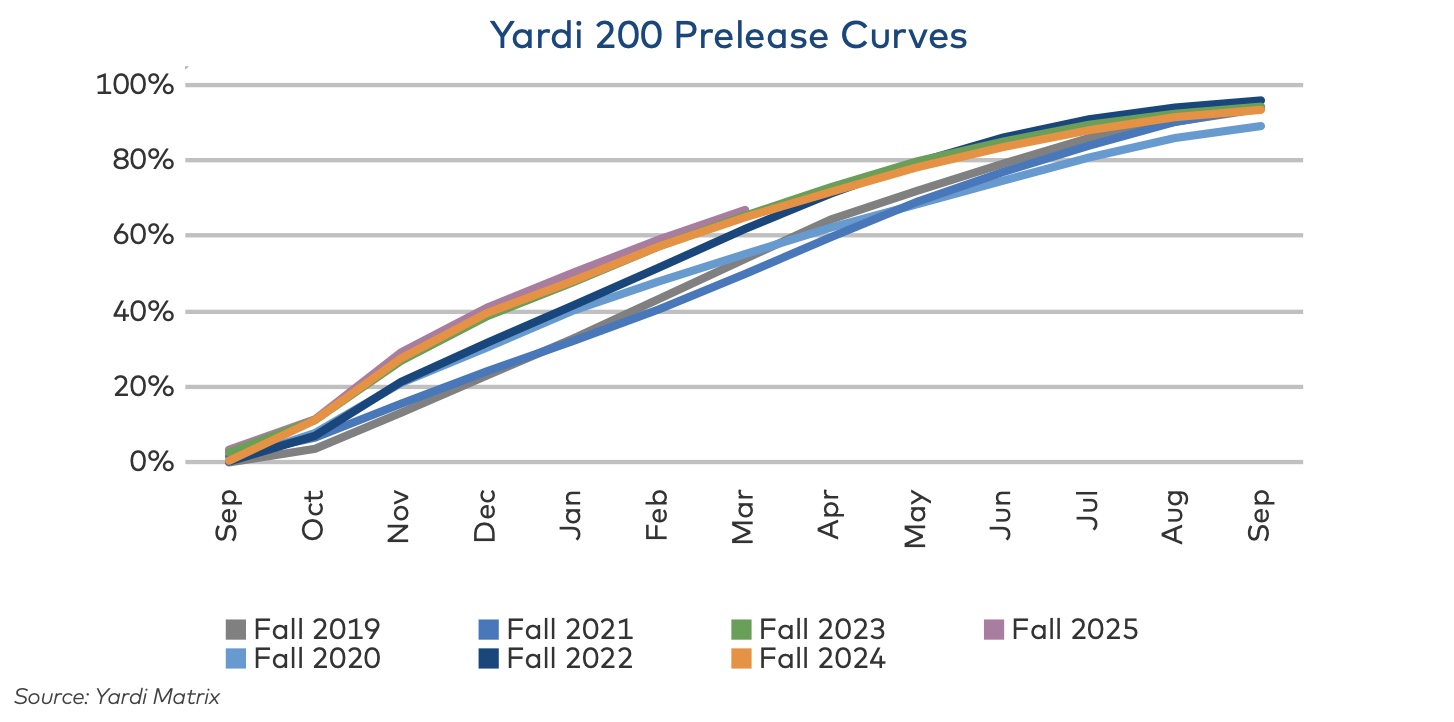

Student housing preleasing across Yardi 200-tracked universities held steady in March 2025 at 67.1 percent, slightly below the year-ago level of 67.4 percent, while enrollment has grown in primary state schools. However, rent growth slowed significantly, falling to 2.5 percent, down 90 basis points from February’s 3.4 percent, marking the steepest month-over-month rent decline in six years, according to the new Yardi Matrix Student Housing National Report for April 2025.

Despite this moderation, the average rent per bed reached a record of $918, increasing $1 from February. Still, this year’s leasing season has seen average rent growth of just 3.9 percent, compared to 5.8 percent in 2023–2024 and seven percent in 2022–2023.

A key driver behind the cooling rent growth trend is the slower pace of preleasing combined with a wave of new construction, especially concentrated at Power 5 universities. These top-tier markets are now grappling with supply-side pressure that is softening rent growth.

For instance, Tennessee, with 3,261 beds under construction, saw rents decline six percent in March, a stark reversal from 22.6 percent rent growth in March 2024. Similarly, Ohio State, Arizona State, and Minnesota each had over 2,000 beds under development and experienced rent declines of up to 11.5 percent year-over-year.

Still, not all large markets are seeing rent growth slow. A few standouts continue to outpace the national average despite new inventory. Auburn posted 10.8 percent rent growth with 1,227 beds under construction. Purdue recorded 10.1 percent growth alongside 1,139 beds in progress. Michigan saw 7.9 percent rent growth even as 857 new beds were being added.

Markets like Michigan State and LSU, both with thousands of beds in planning or construction, could be next to face pressure that could potentially impact their recent above-average performance.

Meanwhile, only 17 universities reported double-digit rent increases in March—mostly smaller markets—while 69 schools saw declines, further highlighting the shift toward more normalized conditions after years of aggressive growth.

But overall new supply of dedicated off-campus student housing fell 20 percent to 35,703 new beds last year from 44,746 in 2023, and the trend is expected to continue with Yardi projecting delivery of 33,995 new beds in 2026.

Meanwhile, preleasing and rent escalation appear to be entering a phase of measured correction, albeit with select opportunities remaining for outperformers. This is likely good news for students who have been grappling with the rising cost of housing. Per a February analysis from Moody’s, student housing rent growth has outpaced multifamily rent growth over the past two years.