With demand for rental housing surging and economic conditions shifting, 2025 could be a pivotal year for multifamily investors. Cautious optimism defines mid- and long-term industry sentiment, and analysts predict that deals will materialize before the year ends.

Yet, uncertainty was a dominant theme at both the National Multifamily Housing Council’s (NMHC) Strategies Conference and the National Association of Home Builders (NAHB) International Builder’s Show earlier this year.

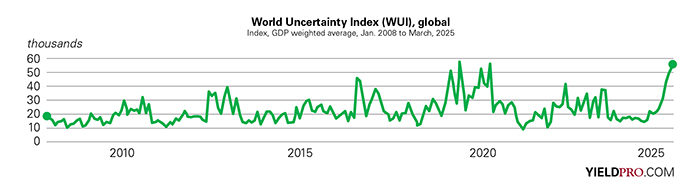

“The global uncertainty index is at levels we haven’t seen since the 2009-2010 European Sovereign Debt crisis and uncertainty in the U.S. has reverted to levels we haven’t seen since the pandemic, when the economy was turned off,” said Spencer Gray, president, co-founder, and CEO of Indianapolis-based Gray Capital, in March.

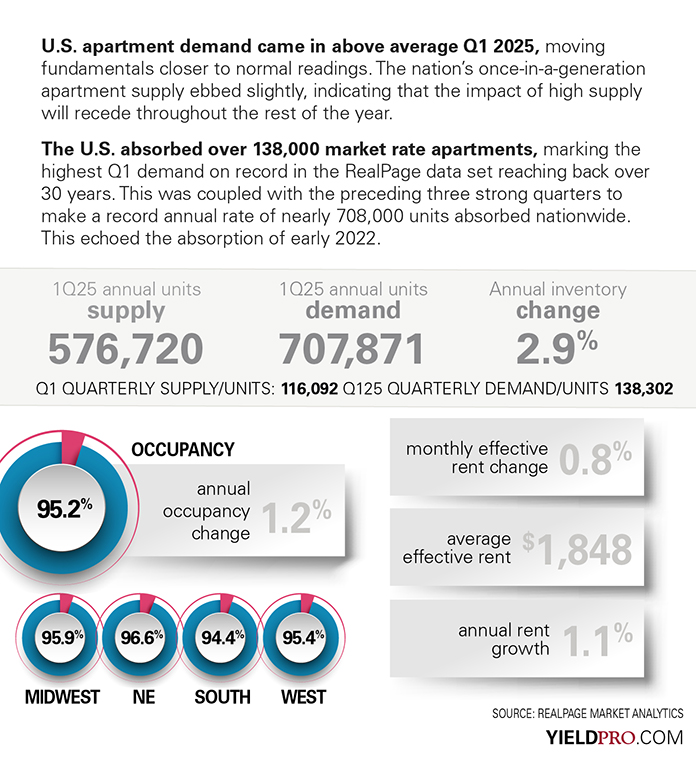

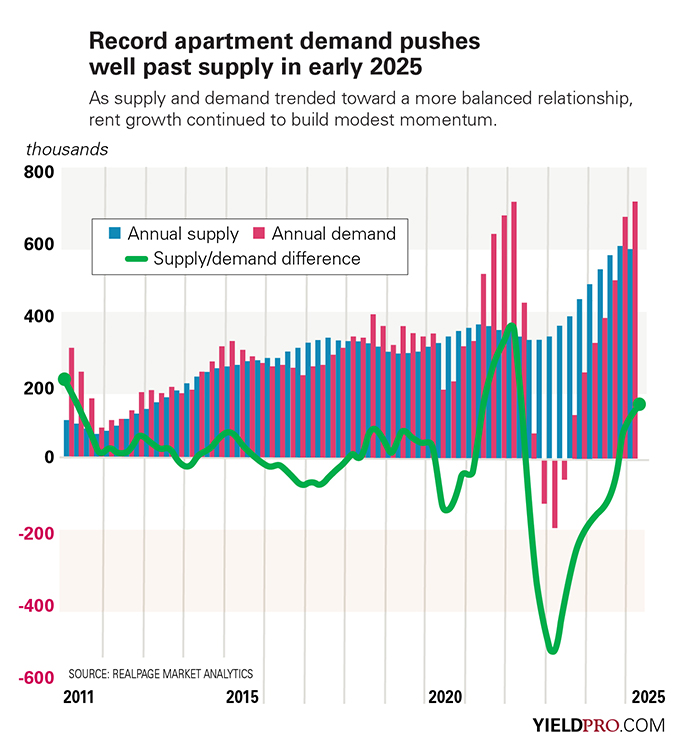

Despite these concerns, supply and demand fundamentals are moving toward equilibrium. The rapid influx of new apartment construction of recent years is waning, minimizing oversupply risks in many markets. Meanwhile, demand remains strong, particularly in the workforce and affordable housing segments.

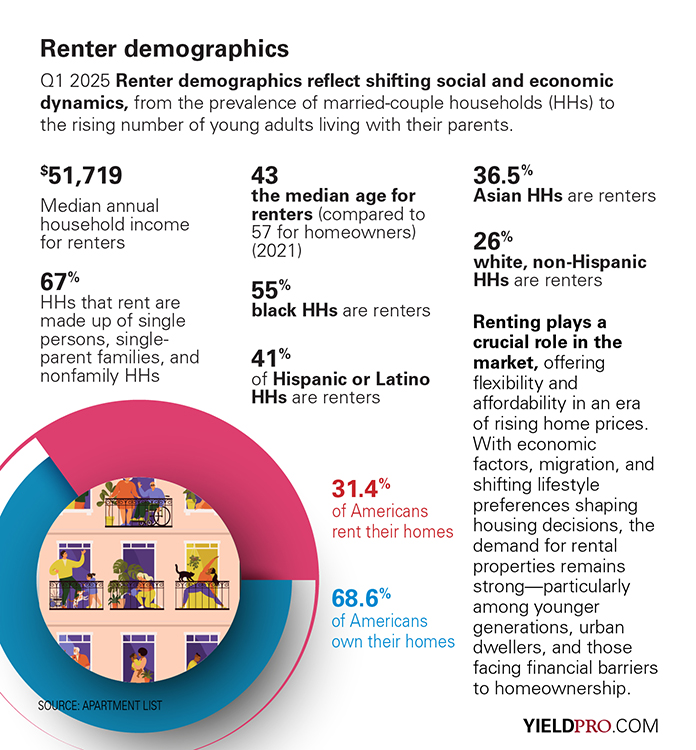

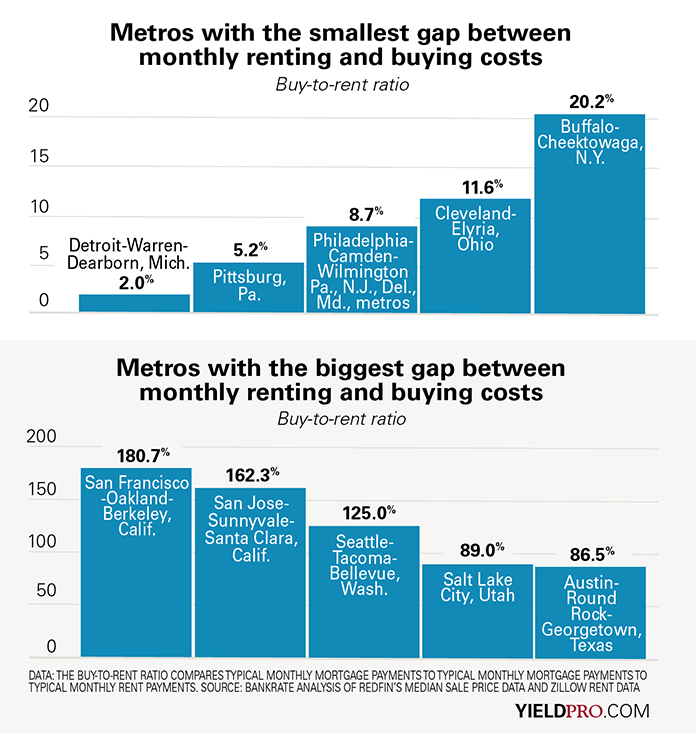

One thing is clear: renting has become more financially viable than buying, according to data from Gray Capital. With home values exceeding 7.2 times the average annual income, the cost of homeownership remains prohibitive for many Americans. Renting has become the more attractive and—in many cases—the only option.

According to RealPage Analytics, market-rate apartment rents increased by 0.41 percent in February. Though slightly below the long-term norm of 0.53 percent (measured from 2015 to 2024), this marks the strongest rent growth reading since 2022—signaling stability in the rental market despite broader economic uncertainty.

Supply wave reaches its peak

The supply wave of recent years is cresting. NAHB projects an 11 percent decline in multifamily housing starts this year, bringing the total to 317,000 units. However, a modest rebound is expected in 2026, with an anticipated six percent increase to 336,000 starts, said Danushka Nanayakkara, assistant VP of forecasting and analysis at NAHB.

The long-term supply outlook is tightening while absorption rates remain among the highest in over four decades. Analysts estimate the U.S. will need 4.3 million additional apartments over the next decade to meet projected demand.

This supply-demand imbalance presents opportunities for investors, but the key question remains: Is 2025 the right time to buy or build multifamily properties?

Some argue that inflation-driven construction costs and labor shortages are straining development, particularly with recent tariffs pushing up material prices. Gray suggests these policies haven’t yet altered overall market dynamics, but they could contribute to future supply shortages that may slow construction, while driving rents higher in the coming years.

At the same time, the new tariffs and policy shifts have triggered volatility in the stock market, raising concerns about a potential recession. Gray warns that a broader economic slowdown could send ripples through the multifamily sector, complicating investment decisions.

Despite the uncertainty, he believes apartment investment opportunities will emerge for those with a long-term perspective and strong operational strategies capable of navigating rising expenses—no small feat in today’s environment.

With market forces in flux, investors face a crucial decision—move now to capitalize on sustained rental demand or wait for financing conditions to stabilize. “Either way, 2025 is shaping up to be a defining year for multifamily real estate,” he said.

Short-term uncertainty centers on interest rates

Short-term uncertainty remains a primary concern, driven largely by interest rates, debt costs, property values, and return targets, not underlying real estate fundamentals, said Jay Parsons, a rental housing economist and consultant.

“The Federal Reserve has only one rate cut planned for this year, scheduled for the third quarter,” said Nanayakkara in early March. However, after President Donald Trump recently expressed his commitment to lowering interest rates, investors anticipate two additional cuts this year.

Nanayakkara emphasized that “economies are highly sensitive to uncertainty.”

Over the past two years, monetary policy—such as interest rate hikes and money supply adjustments—has dominated discussions. However, moving forward, fiscal policy, including government spending, tax incentives, and multifamily housing subsidies, are expected to play a more central role, she added.

This shift matters because fiscal policies take longer to implement than monetary adjustments. While interest rate changes can influence markets relatively quickly, government-led housing incentives and other housing policies roll out more slowly, potentially extending the uncertainty in the rental market.

Investors, developers, and operators may find themselves in a holding pattern, waiting to see what impact these policies will have on affordability, supply, and the possibility of a recession.

Gray outlined three possible recession scenarios based on interest rate cuts:

- If the Federal Reserve keeps rates unchanged, he estimates a 70 percent to 85 percent probability of recession in 2025.

- With gradual rate cuts, that probability drops 50 to 65 percent.

- Aggressive rate cuts would significantly reduce the risk of recession.

“There are so many factors at play, but this is the situation we’re facing as investors,” Gray said. “We must bear in mind that others are going to run to the sidelines—and that clears the field for us.”

Priming the buy side

Some investors are taking a wait-and-see approach, postponing acquisitions until market conditions improve. “It feels like everyone wants to be a net buyer, but at prices that don’t exist and for asset types that aren’t on the market at any scale,” said Parsons.

Rob Beardsley, founder and CEO of Texas-based multifamily syndicator Lone Star Capital, echoed this sentiment. “We don’t have a deal right now, but we’re actively raising capital for the right opportunity when it arises,” he said.

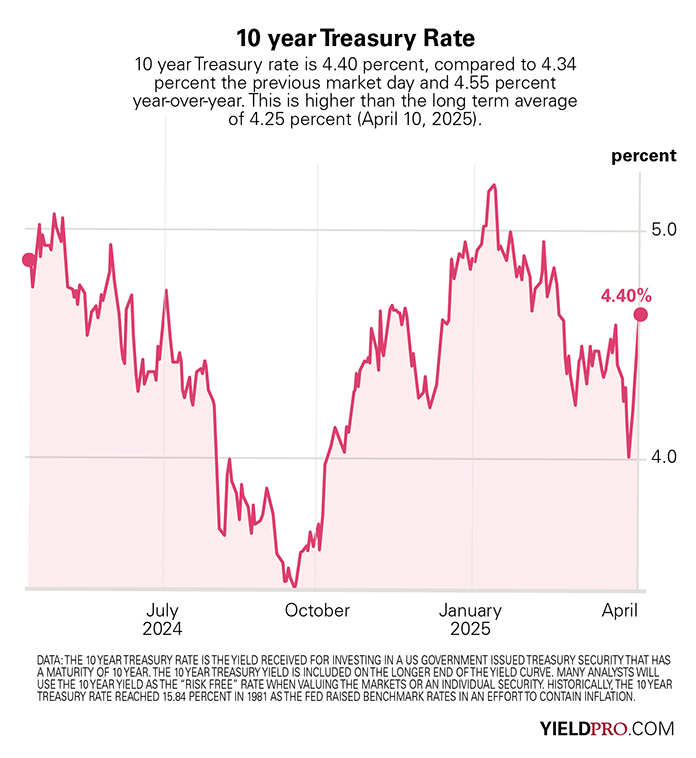

Lone Star has acquired $700 million in multifamily assets since 2018 and currently owns 5,000 units in Texas. Last year, the firm fell short of its $250 million acquisition goal, completing five deals totaling $190 million, attributing the shortfall to volatility in the Treasury markets.

Lone Star has acquired $700 million in multifamily assets since 2018 and currently owns 5,000 units in Texas. Last year, the firm fell short of its $250 million acquisition goal, completing five deals totaling $190 million, attributing the shortfall to volatility in the Treasury markets.

Lone Star focuses on value-add multifamily built between 1990 and 2010 in prime locations across the high-supply Dallas and San Antonio markets, and in Houston, which has seen stronger absorption and lower operating costs due to less competition. The firm is also looking to expand into Phoenix, where distressed deals were a significant topic at the NMHC Strategies Conference.

In February, the multifamily distress rate increased by 10 basis points to 13 percent following a 40-point rise in January, according to a report from data firm Cred iQ. Apartments are now the second most distressed asset type, just behind office buildings.

In February, the multifamily distress rate increased by 10 basis points to 13 percent following a 40-point rise in January, according to a report from data firm Cred iQ. Apartments are now the second most distressed asset type, just behind office buildings.

Beardsley noted that distressed deals may be harder to find than some investors expect, especially if lenders continue to restructure loans and provide borrowers with additional time to stabilize assets, preventing immediate losses from foreclosure.

“A major lender at NMHC mentioned that they’re willing to hold onto distressed assets for five to ten years until values recover, rather than selling at a loss. They are willing to operate these deals—something many would prefer to avoid—to protect their principal capital and ride the market recovery,” he said.

He further commented that if a property acquired in 2021 is now selling at its loan amount, buyers are likely overpaying. “When we analyze pricing on a deal, we compare the asking price against the loan amount and closing costs revealing that it’s usually not justified.”

He further commented that if a property acquired in 2021 is now selling at its loan amount, buyers are likely overpaying. “When we analyze pricing on a deal, we compare the asking price against the loan amount and closing costs revealing that it’s usually not justified.”

U.S. ten-year Treasury bond yields, which serve as a benchmark for debt pricing, will be a key factor influencing investor decision-making this year. But, the main obstacle for investors remains the high cost of debt, although capital is available, said Berkadia.

“I think floating rate debt is the greatest challenge,” said Marc Kulick, CEO of Vesta Capital, which specializes in acquiring and renovating multifamily communities across Arkansas, Kansas and Oklahoma.

“We’re all learning how important it is. There are deals we bought in 2021 and 2022 that are struggling for air because of floating rate debt, and there were deals we got lucky with in 2017 and 2018 that weren’t as strong but performed well because of the debt that was placed on them,” he said.

“We’re all learning how important it is. There are deals we bought in 2021 and 2022 that are struggling for air because of floating rate debt, and there were deals we got lucky with in 2017 and 2018 that weren’t as strong but performed well because of the debt that was placed on them,” he said.

“Excessive supply and inflated debt have created today’s challenges, but if you’re an investor eager to deploy capital, the right deals will come, but they will take time,” said Beardsley.

Development interest rebounds

High interest rates, limited capital availability and an uncertain economic climate helped to shrink construction pipelines over the past few years, with the end of 2024 marking the lowest number of starts in a decade.

Some developers are cautiously optimistic about renewing activity. Parsons doubts the U.S. will see a flurry of multifamily development starts this year, but said more institutions and REITs are kicking the tires looking for diamonds in the rough that can pencil out.

Some developers are cautiously optimistic about renewing activity. Parsons doubts the U.S. will see a flurry of multifamily development starts this year, but said more institutions and REITs are kicking the tires looking for diamonds in the rough that can pencil out.

“Developers have been having a hard time all across the country putting new shovels in the ground when interest rates are high and construction financing is not as attractive and valuations are down.

Then, when they actually build what they want to build, it’s worth less. There is less incentive because the numbers just don’t pencil out,” said Gray.

Gray Capital acquires core-plus and value-add apartments in the Midwest markets of Indiana, Ohio, Kentucky, and Michigan. The company has completed about $2 billion in transactions and has nearly $1 billion in properties under management across its portfolio.

Nanayakkara notes that restrictive regulations have slowed construction on the local level. “Zoning and permitting regulations account for 41 percent of the total cost of a multifamily project, compared to just 28 percent for a single-family home,” she said.

This disparity is particularly problematic for garden-style developments that target working-class renters and those who qualify for affordable rents.

This building type serves as a bridge between homeownership and renting. “But the good news is that the last third-quarter data we have for 2024 showed the highest level of this type of construction since 2008,” she said.

Looking ahead

The path forward for multifamily real estate in 2025 will be shaped by financing conditions, economic issues and evolving investment strategies. While uncertainty looms, seasoned investors see opportunity—especially for those willing to take a long-term approach.

“Multifamily real estate remains a strong investment opportunity,” Beardsley said. “If you can secure a good deal with solid fundamentals and demographics, don’t overlook it.”

As Gray put it: “A shocking percentage of investors who entered deals over the past couple of years are now facing capital calls. Some will navigate them, some will be forced into receivership, and others will have to sell at a loss. This could be an area of opportunity in 2025.”