In evaluating rent performance among major apartment markets, two key factors emerge: the timing of peak supply and the scale of new inventory at that peak. Data from RealPage Analytics suggests markets that reached supply summits earlier and at more modest levels are now seeing healthier rent growth, while those with later or more substantial peaks are still working through the impact.

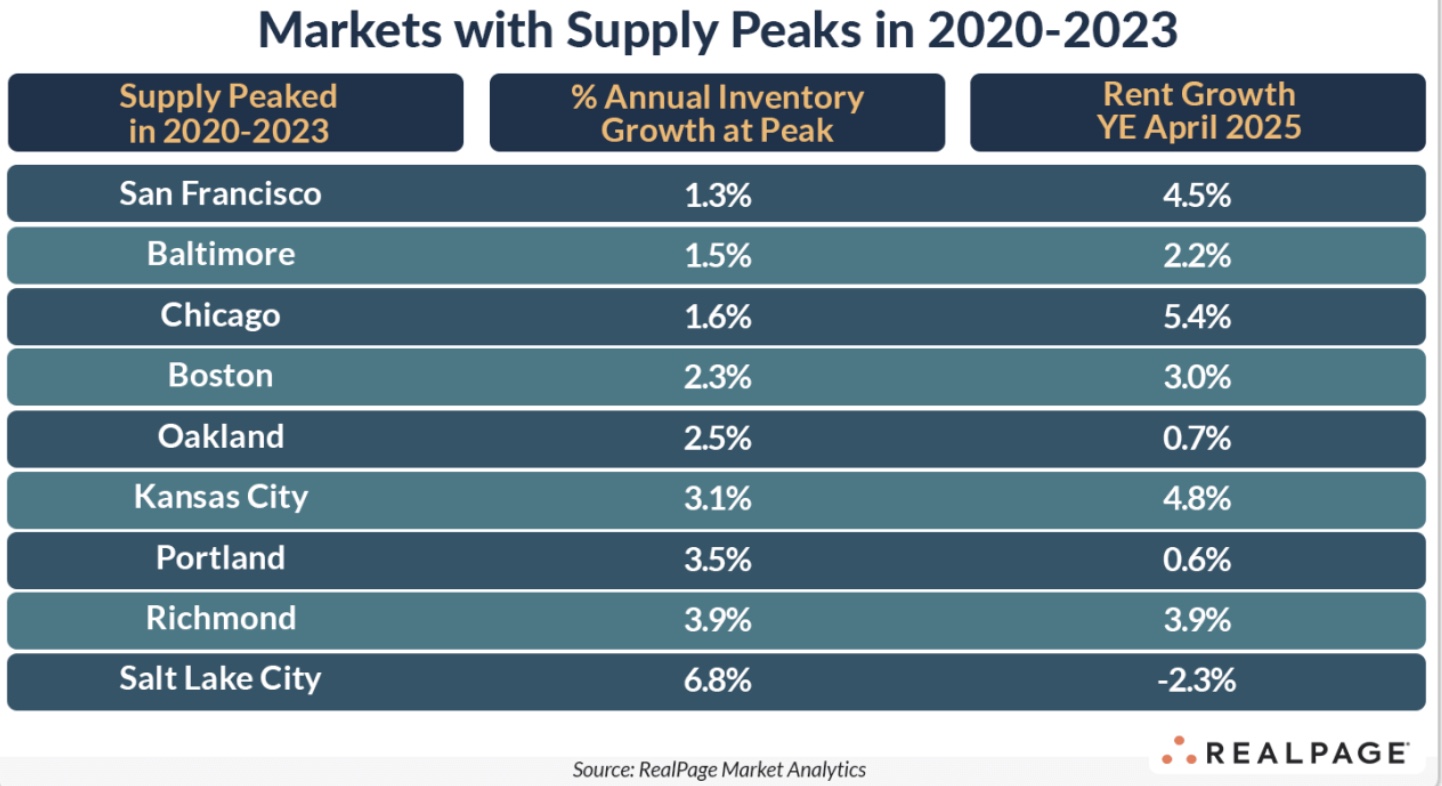

Among the 50 largest U.S. apartment markets, as reported by the US Census Bureau, nine hit annual supply peaks between 2020 and 2023, said RealPage. Of those, five experienced relatively modest inventory growth of 2.5 percent or less, including San Francisco, Baltimore, Chicago, Boston, and Oakland. These “early and soft” peak markets are mostly seeing rent growth outpace the national average of one percent as of April 2025.

Chicago, which peaked earliest in the first half of 2020 with just a 1.6 percent supply increase, leads the nation in annual rent growth at 5.4 percent, as does much of the Midwest. Its early and moderate peak allowed time to absorb new inventory and create conditions for a strong rebound. Baltimore and Boston, which peaked in late 2020, are seeing solid rent gains of two percent to three percent. The exception is Oakland, where rent growth remains sluggish at just 0.7 percent.

Early, large supply peak markets are yielding mixed results. Four other markets peaked early but with steeper inventory surges above three percent. They include Kansas City, Portland, Richmond, and Salt Lake City. But results vary by region. In the West, Portland and Salt Lake City are still digesting supply. Salt Lake City, which saw a peak of 6.8 percent in late 2023, was the only early-peaking market with rent cuts in April 2025.

In contrast, the Midwest and South fared better. Kansas City and Richmond, despite their sizable supply peaks, posted some of the nation’s strongest rent growth, both exceeding four percent annually.

Markets with supply peaks last year give mixed signals. Nineteen of the top 50 markets hit peak supply in 2024, aligning with the national apex. Six saw modest growth below 2.5 percent— Pittsburgh, Virginia Beach, Cincinnati, Sacramento, St. Louis, and Las Vegas. Most recorded rent growth above the national average in April 2025, except Sacramento (0.7 percent) and Las Vegas, where rents declined 1.7 percent.

By contrast, markets with 2024 peaks above three percent are largely struggling with rent cuts or stagnant pricing, reflecting the drag of elevated new supply.

Looking ahead: what to expect from future peaks

Markets still awaiting peak supply offer insight into future performance. Several, including Cleveland, Detroit, Memphis, New York, Washington, DC, and Milwaukee, are expected to peak this year with modest increases of one percent to two percent. Most were showing above-average rent gains in April, except for Memphis, where the 1.4 percent growth is unusually high for that market and may be contributing to weaker rent trends. On the other hand, high-growth markets like Austin, Charlotte, Phoenix, San Antonio, and Dallas are bracing for inventory spikes of five percent to 10 percent. These markets continue to post steep rent cuts, suggesting longer recovery periods ahead.

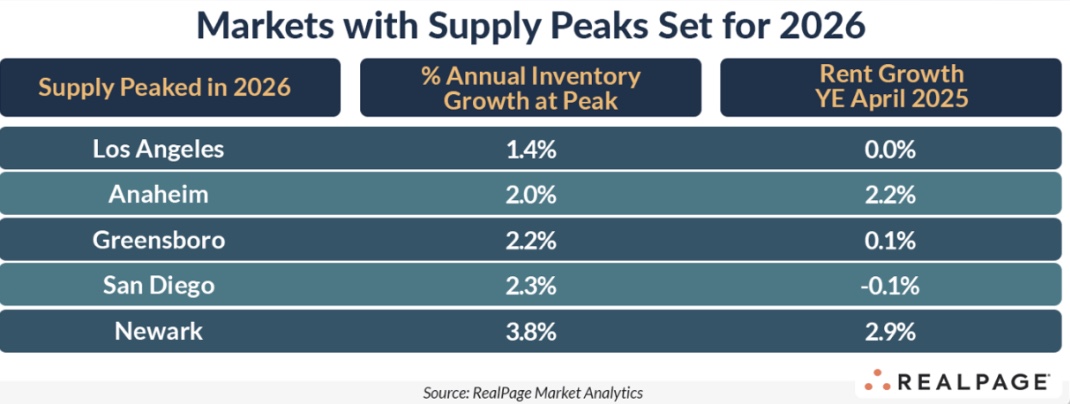

A few large markets won’t reach their peaks until after 2025. Los Angeles, Anaheim, San Diego, and Greensboro are expected to see peaks of one percent to two percent next year.

As of April, only Anaheim, Calif., was showing notable rent growth. Newark stands out as the only market slated for a major supply increase above three percent in 2026. It continues to post solid rent growth now, though that could shift as new inventory comes online.

The RealPage report is here: